Many observers thought AT&T should not have purchased DirecTV. Others oppose the Time Warner acquisition. Some might be skeptical about whether Verizon and AT&T can create digital advertising platforms built on their content assets.

There are a range of objections. These include arguments that it was the wrong acquisition. Others might say it was a reasonable acquisition, but came at too high a price. The former argument is that there were other places to invest capital; the latter argument is that debt burdens were too high, relative to the value obtained.

But it is possible to argue that DirecTV is having positive impact on AT&T’s mobile business, while throwing off needed cash flow, and setting the stage for a bigger role in the video business “up the stack.”

And though some might criticize the DirecTV move as allowing AT&T to become the biggest video subscription provider in the United States without upgrading all of its fixed network lines to handle video, others would say that makes sense, if the fixed network business is itself dwindling, and therefore cannot justify expensive upgrades.

That is not to say upgrades are unnecessary; simply that more-affordable ways must be found to supply higher-speed internet access.

In that regard, much hinges on whether the decline of the linear video business is a “hard or soft landing.” If the decline is gradual, then AT&T has time to create a new streaming-based business to replace the legacy revenue stream. A rapid collapse would be much harder to stomach.

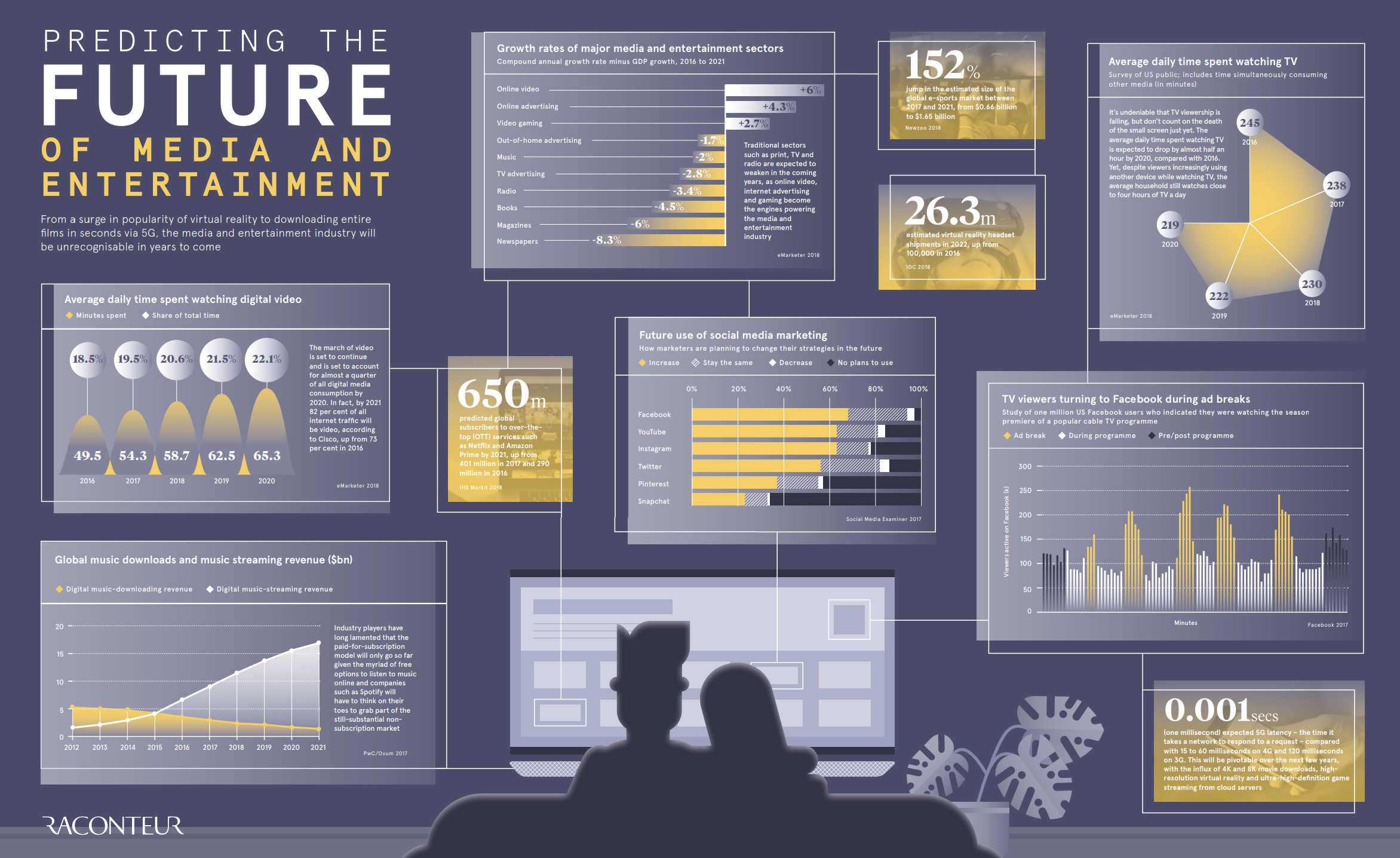

Some data suggests a softer than expected landing is quite possible.

Daily Minutes Watching TV vs. Digital Video

| ||

Year

|

TV (Minutes watched)

|

Digital Video (Minutes Watched)

|

2016

|

245

|

49.5

|

2017

|

238

|

54.3

|

2018

|

230

|

58.7

|

2019

|

222

|

62.5

|

2020

|

219

|

65.3

|

Courtesy of: Visual Capitalist