End user demand for various connectivity services changes over time, but typically when some new need arises. But sometimes supplier push drives the change.

That might be the case for 5G, early on. Since 5G requires new devices, 5G device availability, especially for the most-popular brands, is a key requirement for higher 5G adoption. It is less clear that any immediate new use cases will be obvious.

Changes in demand have many drivers other than new needs, of course. At other times, revolutionary changes in supplier policy can shift demand quite radically.

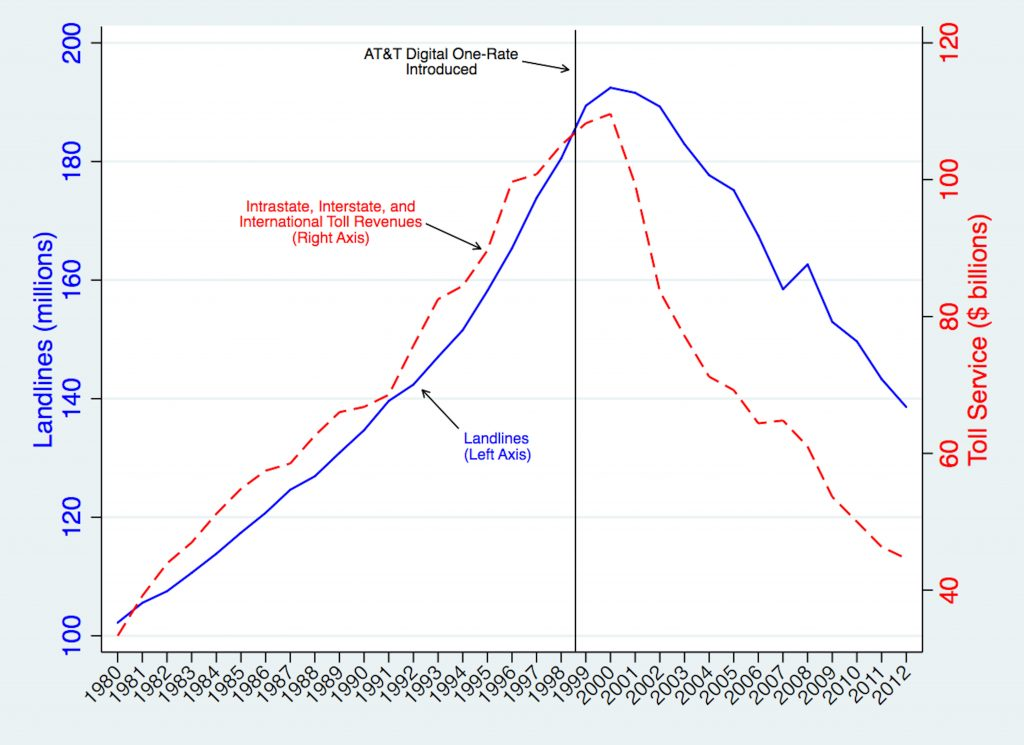

There was a time when a deliberate pricing strategy by AT&T mobility drove a huge amount of product substitution, literally leading to huge use of mobile calling as a direct substitute for long distance, and also leading to mobile substitution for local telephone service as well.

source: Telecom Policy Institute

Few now recall it, but AT&T Wireless once drove rapid mobile adoption by consumers by revolutionizing the way consumers paid for--and how much they paid for--long distance calling.

Back in 1998, AT&T unveiled a major new pricing plan for mobile users that priced all domestic calls for 10 cents a minute. That Digital One Rate plan effectively erased the distinction between local and long distance calling and provided a major incentive for consumers to buy mobile service.

Even many astute industry watchers did not appreciate the revolutionary nature of the plan. Technology pundit Walt Mossberg once called Digital One Rate “marketing hype.”

“It promises to make your cell phone as simple and affordable to use as a landline phone, so that you'll use it even for casual calls without a second thought,” said Mossberg. “The actual service behind the marketing isn't good enough to really allow that. I've been frustrated with it again and again.”

Digital One Rate was anything but hype. It really did revolutionize the way consumers and businesses made calls. It really did begin the mass adoption of mobile phones and the demise of landline service.

Beyond that, Digital One Rate changed the key profit drivers in telecom, from long distance revenue to mobile service. Within a decade, the industry profit driver changed from long distance to mobility. The shift from voice to data would follow.

In the ensuing years after Digital One Rate was introduced, long distance revenue plummeted, as did use of landline phone services. Digital One Rate was the driver, as the whole industry shifted pricing and packaging.

It is unclear how much 5G can shift end user demand. It is clear that at least some mobile service providers in the U.S. market are going to try and drive a substitution of mobile broadband for fixed network access. It is not clear whether end user demand shifts will mostly be driven by end users or suppliers.

Some of us can remember the new needs that caused us to upgrade to specific devices, and then to web-centric devices. I actually do not recall which 2G device I was using when the “need” for a Blackberry happened. Odd enough though it will seem now, “mobile email” was a huge draw, providing enough value to make it an easy choice.

I also remember when the Blackberry became a barrier. There was a time when smartphones did not routinely offer access to turn-by-turn directions, and for no subscription fee. That alone was the killer app that made the Blackberry suddenly less capable than I needed, and made the value of a 4G device much more attractive. It meant I did not need a discrete GPS device, with a required subscription.

I had used 3G dongles for wireless internet access when on business travel, as painful as it was, experience wise. The shift to a 4G dongle was a “no brainer” decision because the user experience was so much better.

The visual web made routine upgrades of my fixed network, to get higher speeds, a logical decision. It has been years since download speed actually has been an issue, though, as speeds and pricing have been more than adequate for all my use cases.

Work from home has not been a particular issue, as I have worked remotely, and out of my home, for most of the last 25 years. But what is new is the amount of time I spend on videoconferencing services. And since my connection is asymmetrical, with what now insufficient bandwidth for consistent user experience.

The new need is “more upstream bandwidth,” for the first time. At least so far, my 4G experience is not a pain point, as I tend not to do work videoconferencing on the mobile device.

In all those instances, a shift to different or new services, though anecdotal, was driven by a change in demand for features or services. 5G will be the same sort of thing for most people, and might initially be driven simply by the need for a new device that just happens to use the 5G network.