Very frequently, some mobile or fixed network operators have greater or lesser revenue growth opportunities based on their existing market shares, asset and liability positions. A firm with zero to low exposure to a revenue opportunity often has a much-higher chance of fast growth, compared to legacy suppliers that lead a market.

Since many connectivity markets are essentially zero-sum games, a win by one contestant is a loss for another supplier. And leaders have the most to lose; attackers the most to gain.

In the U.S. market, for example, cable operators with zero exposure to fixed voice, mobility services and business internet access have been able to take market share from the incumbents. Conversely, telcos who historically have led those markets have lost share to the attackers.

T-Mobile and Verizon stand to take share from cable operators (who are the market leaders) using new fixed wireless platforms. T-Mobile historically has had zero share of the home broadband market, while Verizon has been limited by its geographic footprint, covering perhaps 20 percent or so of all U.S. home locations with its fixed network.

So the "SMB" segment is an opportunity for some competitors; less so for the leaders. What might be questionable are assertions that mobile operators are "neglecting" the SMB segment where it comes to 5G.

For as long as I can remember, calls have been issued that connectivity service providers are missing out on revenue opportunities from small and mid-sized businesses.

Looking at 5G revenues, for example, BearingPoint and Omdia point out that up to 99 percent of all businesses globally are SMEs, though connectivity providers focus on enterprises.

source: BearingPoint, Omdia

That is an “untapped” opportunity, they argue. That is misleading.

Omdia’s own data show that 63 percent of mobile operators believe large enterprises will generate the “most” 5G revenue.

Omdia’s own data also suggest that 54 percent of service providers believe SMEs will generate the “most” revenue. That is hardly neglect, as 32 percent of respondents believe consumers will generate the “most” revenue from 5G.

Keep in mind that mobility has, since the 2G era, been built on consumer revenues, not revenues from business.

source: Omdia, BearingPoint

But there are other reasons why smaller businesses are not specifically targeted. The cost of sales and buying behavior is virtually indistinguishable from the behavior of consumer customers.

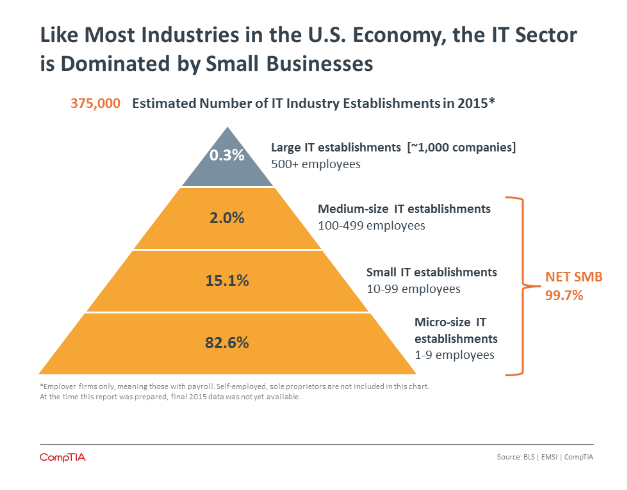

In the U.S. market, for example, 83 percent of all businesses are “micro” sized, having no more than nine employees.

“Small” firms with 10 to 99 employees represent 15 percent of all businesses, while “medium” organizations with 100 to 499 employees represent just two percent of entities.

If enterprise is targeted directly with field sales, then “micro” (83 percent of business entities) are marketed through the mass market channels. “Small and medium” organizations tend to be marketed to by partner and channel entities. Think of the role played by resellers and system integrators and distributors in the computing hardware business.

source: CompTIA

So some of us would argue that mobile operators are not neglecting SMEs. They sell using mass market techniques tot he 83 percent of customers that behave like consumers when evaluating and buying 5G services.

They use channel partners to sell to the mid-market. And they have dedicated field and inside sales teams to sell to enterprises.

One can argue that more internal resources should be devoted to direct sales efforts for SMEs. But cost of sales is an issue. In many cases, the financial return from higher sales and marketing cost expended on most “small or medium” customer accounts would generate a zero to negative financial return, compared to using channel partners.

All of us have to define our terms: what is “small;” what is “medium” and what does that mean for marketing, sales and requirements?

Also, are we talking about “new revenue sources” or “total revenue generated by segment?” It might, for example, prove to be the case that much “new use case” revenue is generated by enterprises, as they will be the entities deploying large internet of things and sensor networks.

Those are non-phone revenues. But phone revenues might still be led by consumer users, as historically has been the case.

The issue is “which are we talking about: new use case revenues or total or segment revenues?

Either way, though, it might be hard to make the argument that most of the return is going to come from SMBs, as compared to consumer or enterprise revenues.

Beyond that, some competitors do have an oportunity, especially if they have historically had zero to low exposure to SMB customer revenues. Cable operators have been in that position, as has T-Mobile.