Perhaps it is one more sign of growing disruption in the U.S. mobile service provider market, but there is some dispute about whether Verizon Wireless or AT&T now has the larger market share, based on subscriber accounts.

By virtually all accounts, Verizon Wireless has been the market leader. But there are at least some analysts who believe AT&T has moved ahead.

That was not the case in 2012. AT&T said it had 105.2 million wireless subscribers for the second quarter of 2012, at a time when Verizon Wireless reported some 111.3 million wireless customers.

But AT&T does not any longer report its wireless subscriber figures, emphasizing total accounts in service.

When a company doesn’t report a specific number, such as number of accounts in service, or number of subscribers, you have to assume there is a reason.

To be sure, a change in reporting probably is required, as more customers shift to shared or family plans, so an “account” is not equivalent to devices or users in service. Further changes will be required if and when service for sensors (machine to machine or Internet of Things) are added to “account” totals.

Then there is the matter of how to count wholesale accounts, not just retail accounts. A wholesale mobile virtual network operator (MVNO) generates revenue for the supplying carrier, though typically with lower average revenue per user or end user account.

All of that complicates efforts to calculate U.S.mobile service provider market share.

The recent spate of mobile service provider acquisitions, in particular on the part of AT&T (Leap Wireless) and T-Mobile US (MetroPCS), have rearranged U.S. service provider market share, to some extent, based on subscribers.

MetroPCS added about 9.5 million subscribers for T-Mobile US. The Leap Wireless acquisition by AT&T adds about five million subscribers.

What remains a bit cloudy is the actual market share held by Verizon Wireless and AT&T.

Some now think AT&T has surpassed Verizon Wireless in subscriber count. Others might not see the evidence for that claim. AT&T did not report an actual wireless subscriber figure In the second quarter of 2013.

Virtually all observers would have in 2012 agreed that Verizon Wireless had the largest number of U.S. mobile subscribers, with AT&T following. Sprint, by most estimates based on company reporting also had significantly more share than T-Mobile US.

But after the acquisitions, some think market share has shifted, with AT&T leading Verizon, and Sprint still ahead of T-Mobile US, but by a smaller margin.

What is odd is that analysts no longer seem to agree about U.S. mobile service provider market share.

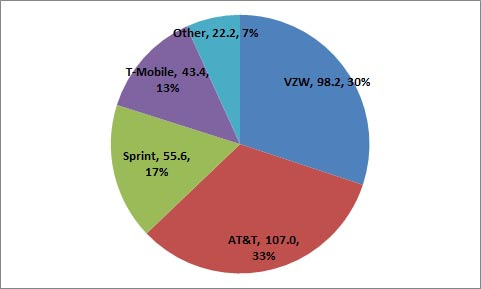

Many compilations of market share from 2012 had Verizon leading with about 34 percent share, followed by AT&T with about 32 percent, then Sprint with about 17 percent and T-Mobile US with 10 percent share. After a spate of acquisitions, the shares are rearranged.

AT&T now, by some accounts, seems to have passed Verizon, and T-Mobile US has gained market share, according to some accounts.

2013 mobile service provider market share

source: Blue Field Strategies