If AT&T, Verizon and T-Mobile USA are actively working to explore how to share spectrum now used by the U.S. Department of Defense, that is a signal that the carriers believer there is a serious chance spectrum sharing could happen, even if the carriers typically prefer to use only licensed spectrum.

The immediate focus is a proposed sharing of 95 MHz of spectrum currently used by DoD and other federal agencies, in the 1755 to 1850 MHz spectrum band.

Spectrum sharing, releasing more unlicensed spectrum and new spectrum auctions, plus reassignment of frequencies originally awarded for mobile satellite service are key ways regulators now are trying to make more spectrum available as a way of promoting mobile and wireless competition and innovation.

Since their introduction in 1994, the United States has conducted more than 70 spectrum auctions to assign thousands of wireless licenses.

But regulators also are working to increase the amount and ease of using unlicensed spectrum as well. The "white spaces" spectrum, and a new proposed sharing of 5-GHz spectrum are examples of some of the ways additional spectrum could be made available to existing and new service providers.

If three of the four largest U.S. mobile service providers are working in public on spectrum sharing in the 1755 MHz to 1850 MHz spectrum, it indicates they believe the spectrum will be made available.

Thursday, January 31, 2013

Spectrum Policy Innovations are Coming

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

What is the "Value" of the Fixed Access Network

Studies of smart phone user behavior confirm what most of us might have concluded, namely that Wi-Fi has become a key access method for smart phone users, and provides the answer to a question some might now be asking about the respective roles of mobile and fixed access networks.

That there are synergies between mobile and fixed networks is incontestable. All forms of access, whether fixed, untethered or mobile, are essentially “tail circuits” that connect users to core networks.

What is harder to determine is precisely where those synergies exist, and how big the synergy might be, when considering the highest value provided by fixed access, as compared to mobile access.

That issue increasingly is important as most people, in virtually all markets, rely on smart phones, potentially raising the issue of mobile substitution for the fixed network, and as fast mobile networks using Long Term Evolution create, in a new way, a chance to substitute mobile networks for Internet access that formerly would really have made sense only on a fixed network.

In other words, the growing question is “what is the value of the fixed network.”

Support for video entertainment, and consumption of large amounts of bandwidth at low cost, to support multiple users, emerges as perhaps the defining “value” of a fixed access connection. The key issue is that, increasingly, most digital appliances used in the home or at work use Wi-Fi, which is a wireless tail for a fixed network.

Android smart phone users tracked for a year by NPD Connected Intelligence use between half a gigabyte a month to about 1 Gbyte a month of mobile network data. Apple iPhone users tend to use a bit more.

Though the data might reflect the smaller number of iPhone users in the sample, consumption tended to run between 0.75 Gbytes a month up to about two gigabytes a month. By December 2012, though, Apple iPhone users were consuming data at about the same rate as Android users.

U.K. Android users send and receive 78% of all their data over WiFi networks, according to Nielsen, which also tracked the data usage of about 1,500 Android users.

Nielsen’s analysis suggests as much as 78 percent of all data consumed by users is using a Wi-Fi connection of some sort.

Data collected by Mobidia shows that Wi-Fi usage is close to ubiquitous in developed markets, where more than 90 percent of smart phone users also use Wi-Fi as a means of data connectivity. In Hong Kong and the Netherlands, use of Wi-Fi by smart phone users is over 98 percent.

That there are synergies between mobile and fixed networks is incontestable. All forms of access, whether fixed, untethered or mobile, are essentially “tail circuits” that connect users to core networks.

What is harder to determine is precisely where those synergies exist, and how big the synergy might be, when considering the highest value provided by fixed access, as compared to mobile access.

That issue increasingly is important as most people, in virtually all markets, rely on smart phones, potentially raising the issue of mobile substitution for the fixed network, and as fast mobile networks using Long Term Evolution create, in a new way, a chance to substitute mobile networks for Internet access that formerly would really have made sense only on a fixed network.

In other words, the growing question is “what is the value of the fixed network.”

Support for video entertainment, and consumption of large amounts of bandwidth at low cost, to support multiple users, emerges as perhaps the defining “value” of a fixed access connection. The key issue is that, increasingly, most digital appliances used in the home or at work use Wi-Fi, which is a wireless tail for a fixed network.

Android smart phone users tracked for a year by NPD Connected Intelligence use between half a gigabyte a month to about 1 Gbyte a month of mobile network data. Apple iPhone users tend to use a bit more.

Though the data might reflect the smaller number of iPhone users in the sample, consumption tended to run between 0.75 Gbytes a month up to about two gigabytes a month. By December 2012, though, Apple iPhone users were consuming data at about the same rate as Android users.

U.K. Android users send and receive 78% of all their data over WiFi networks, according to Nielsen, which also tracked the data usage of about 1,500 Android users.

Nielsen’s analysis suggests as much as 78 percent of all data consumed by users is using a Wi-Fi connection of some sort.

Data collected by Mobidia shows that Wi-Fi usage is close to ubiquitous in developed markets, where more than 90 percent of smart phone users also use Wi-Fi as a means of data connectivity. In Hong Kong and the Netherlands, use of Wi-Fi by smart phone users is over 98 percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

A Few Tips for Increasing Your Influence at the FCC

Sharon Gillett, former chief of the FCC's Wireline Competition Bureau, talks about

- some of the FCC major activities affecting broadband that communities can participate in and/or influence;

- the typical process for moving from policy ideas to actual programs;

- how to work the public comment period; and

- ways in which communities and small or regional ISPs and telcos may partner to influence the FCC policy and programs.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Wednesday, January 30, 2013

Will U.K. Mobile Market Change after LTE Auctions?

It is of course axiomatic that without access to spectrum, no entity can be in the mobile service provider business. That access can be through owned or leased spectrum, but fundamentally, spectrum access is necessary. That naturally raises the question of whether “winning” fourth generation Long Term Evolution spectrum is “necessary” for a firm to be a market leader in mobile services, in the future.

Some might say so. “The importance of this spectrum auction in shaping the future of the U.K. wireless market cannot be understated,” said Daniel Gleeson, mobile analyst at IHS iSuppli. “Access to spectrum is the main barrier to entry for any company looking to build a new wireless network.”

It is true that seven companies are bidding for spectrum: the country’s four existing mobile operators along with three new players. With only three companies likely to win spectrum, at least one of the United Kingdom’s existing operators is likely to lose out,” said Gleeson.

The four existing players that have entered the auction are EE, O2, Vodafone and Three. The three new entrants are BT, PCCW and MLL Telecom.

Other European spectrum auctions have only seen a maximum of three operators win 800 MHz spectrum. The United Kingdom could follow this pattern, yielding three winners and four losers, IHS iSuppli says.

Among the existing mobile operators, the companies with the most to lose are O2 and Vodafone, which presently do not have 4G spectrum, IHS iSuppli said.

Not securing 800 MHz licenses would be a disaster for O2 or Vodafone, some might argue, even if both firms were to win spectrum at 2.6 GHz. The reason is that 800 MHz is viewed as essential for rural coverage, while the 2.6 GHz spectrum is seen as best suited to urban coverage.

Some might argue that the more likely outcome is that the fourth provider will wind up leasing spectrum from one of the other three providers, so the result might not be catastrophic. Still, owning spectrum arguably is safer than leasing spectrum.

But that analysis assumes the prices paid by the winners are reasonable, in light of the incremental revenue opportunities. Europe’s mobile service providers know well the dangers of overpaying for spectrum, as was the case when the 3G auctions were hold.

Operators overpaid for that spectrum, causing years of financial distress that also threatened bankruptcy for a few.

So it is possible the U.K. 4G auctions could rearrange business plans, perhaps in unexpected ways. Depending on the outcome, one or two of the leading four providers in the U.K. mobile market might find themselves more limited in terms of national coverage.

One or more of the “winners” might find themselves in more favorable positions, in terms of quality and quantity of spectrum. The auction, by itself, will not immediately change the market share situation. But it could begin a process that does change the market.

Some might say so. “The importance of this spectrum auction in shaping the future of the U.K. wireless market cannot be understated,” said Daniel Gleeson, mobile analyst at IHS iSuppli. “Access to spectrum is the main barrier to entry for any company looking to build a new wireless network.”

It is true that seven companies are bidding for spectrum: the country’s four existing mobile operators along with three new players. With only three companies likely to win spectrum, at least one of the United Kingdom’s existing operators is likely to lose out,” said Gleeson.

The four existing players that have entered the auction are EE, O2, Vodafone and Three. The three new entrants are BT, PCCW and MLL Telecom.

Other European spectrum auctions have only seen a maximum of three operators win 800 MHz spectrum. The United Kingdom could follow this pattern, yielding three winners and four losers, IHS iSuppli says.

Among the existing mobile operators, the companies with the most to lose are O2 and Vodafone, which presently do not have 4G spectrum, IHS iSuppli said.

Not securing 800 MHz licenses would be a disaster for O2 or Vodafone, some might argue, even if both firms were to win spectrum at 2.6 GHz. The reason is that 800 MHz is viewed as essential for rural coverage, while the 2.6 GHz spectrum is seen as best suited to urban coverage.

Some might argue that the more likely outcome is that the fourth provider will wind up leasing spectrum from one of the other three providers, so the result might not be catastrophic. Still, owning spectrum arguably is safer than leasing spectrum.

But that analysis assumes the prices paid by the winners are reasonable, in light of the incremental revenue opportunities. Europe’s mobile service providers know well the dangers of overpaying for spectrum, as was the case when the 3G auctions were hold.

Operators overpaid for that spectrum, causing years of financial distress that also threatened bankruptcy for a few.

So it is possible the U.K. 4G auctions could rearrange business plans, perhaps in unexpected ways. Depending on the outcome, one or two of the leading four providers in the U.K. mobile market might find themselves more limited in terms of national coverage.

One or more of the “winners” might find themselves in more favorable positions, in terms of quality and quantity of spectrum. The auction, by itself, will not immediately change the market share situation. But it could begin a process that does change the market.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

DT Delays joyn Launch

Deutsche Telekom apparently has delayed its launch of the “joyn ” messaging service. Joyn originally was scheduled to launch in December 2012 but DT apparently has run into implementation issues.

Joyn, the GSMA-backed effort to create a carrier over the top messaging service, will allow DT customers to chat and send files, free of charge, on all smart phone tariffs, at no incremental cost incurring data usage charges, for all customers who have a calling plan with flat-rate data usage or text messaging plans.

Some have questioned whether joyn really will be able to compete with WhatsApp and other over the top messaging services, but the retail packaging plan DT has chosen is intended to make joyn usage an amenity for users who already are paying what DT considers to be reasonable amounts of money for voice and messaging usage.

Smart phone adoption is driving mobile service provider mobile broadband revenue. But smart phones also are cannibalizing service provider voice and messaging revenue.

In 2012 the increase in smart phone penetration will cause voice and messaging revenue erosion of 3.9 percent in Western Europe and 1.6 percent erosion in Eastern Europe, according to Informa Telecoms & Media.

In fact, every increase of 10 percentage points in smart phone penetration in a given market costs Western European operators a 0.5 percent loss of voice and messaging revenue, according to Informa calculations.

Joyn is a service made possible by the “Rich Communication Suite,” essentially messaging applications built on IP Multimedia Subsystem (IMS) standards.

Joyn, the GSMA-backed effort to create a carrier over the top messaging service, will allow DT customers to chat and send files, free of charge, on all smart phone tariffs, at no incremental cost incurring data usage charges, for all customers who have a calling plan with flat-rate data usage or text messaging plans.

Some have questioned whether joyn really will be able to compete with WhatsApp and other over the top messaging services, but the retail packaging plan DT has chosen is intended to make joyn usage an amenity for users who already are paying what DT considers to be reasonable amounts of money for voice and messaging usage.

Smart phone adoption is driving mobile service provider mobile broadband revenue. But smart phones also are cannibalizing service provider voice and messaging revenue.

In 2012 the increase in smart phone penetration will cause voice and messaging revenue erosion of 3.9 percent in Western Europe and 1.6 percent erosion in Eastern Europe, according to Informa Telecoms & Media.

In fact, every increase of 10 percentage points in smart phone penetration in a given market costs Western European operators a 0.5 percent loss of voice and messaging revenue, according to Informa calculations.

Joyn is a service made possible by the “Rich Communication Suite,” essentially messaging applications built on IP Multimedia Subsystem (IMS) standards.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

France Telecom LTE Will Cost More than 3G Service

France Telecom will raise the prices of some of its mobile offers in France when it launches faster fourth-generation Long Term Evolution mobile networks later in 2013, according to Gervais Pellissier, France Telecom CFO.

France Telecom had done so in the U.K. market when it launched LTE services, boosting plan prices by about six to 10 pounds.

France Telecom plans to launch 4G LTE in France in April 2013.

France Telecom had done so in the U.K. market when it launched LTE services, boosting plan prices by about six to 10 pounds.

France Telecom plans to launch 4G LTE in France in April 2013.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Tuesday, January 29, 2013

Justice Department Asks FCC for Time to Review Softbank Acquisition of Sprint

The U.S. Justice Department has asked the Federal Communications Commission to to defer consideration of the Softbank acquisition of Sprint to give DoJ time to review the deal from a national security perspective, Bloomberg reports.

Separately, Dish Network Corp., which has submitted a bid of its own for parts of Clearwire, and also has asked for a careful review of the proposed Softbank acquisition of Sprint, said it won’t seek regulatory action to block the transaction. Dish still is pursuing its own deal to buy parts of Clearwire.

Some observers might argue that the Dish decision not to try and block the Softbank deal is a signal that what Dish really wants is a business deal with Sprint, not an actual takeover of Clearwire. By that line of thinking, Dish really is seeking leverage to convince Sprint to partner with Dish to help Dish build its own Long Term Evolution network.

Separately, Dish Network Corp., which has submitted a bid of its own for parts of Clearwire, and also has asked for a careful review of the proposed Softbank acquisition of Sprint, said it won’t seek regulatory action to block the transaction. Dish still is pursuing its own deal to buy parts of Clearwire.

Some observers might argue that the Dish decision not to try and block the Softbank deal is a signal that what Dish really wants is a business deal with Sprint, not an actual takeover of Clearwire. By that line of thinking, Dish really is seeking leverage to convince Sprint to partner with Dish to help Dish build its own Long Term Evolution network.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Tablets Outsell PCs 4:1 in 2012

Tablet sales for the full year of 2012 were 267 percent higher compared to 2011. December 2012 alone saw more tablets sold in GfK’s tracked retail channels than notebook sales in the whole of the fourth quarter of 2012, according to researchers at GfK. So you might roughly say that tablets outsold notebooks roughly four to one.

Lower average selling prices might have helped. ASPs declined 23 percent year over year from 2011 to 2012, GfK says.

Lower average selling prices might have helped. ASPs declined 23 percent year over year from 2011 to 2012, GfK says.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

YouTube to Introduce Paid Subscriptions

YouTube reportedly will launch paid subscriptions for individual channels, perhaps as early as the second quarter of 2013, according to Advertising Age. It appears that the first paid channels will cost somewhere between $1 and $5 a month, and likely will be created by programmers already producing original content successfully for YouTube.

YouTube is treating paid subscriptions as an experiment. much like video rentals when it began in 2010. The initial group of channels will be small, likely about 25 at the outset. The revenue split from subscriptions is expected to be similar to the 45-55 split that is common for ads on YouTube. Partners will also have the option to include ads in their pay channels, but its unclear what form those will take.

Machinima, Maker Studios and Fullscreen are likely among the programmers YouTube has asked to submit ideas for paid channels.

YouTube would initially launch around 25 paid channels.

In the past, observers have argued that YouTube could represent the "cable TV of the future." That might be stretching matters, at least for the moment. But if YouTube's new test proves successful, many smaller and niche programmers could find such YouTube distribution appealing.

With constantly climbing programming costs, distributors will be under pressure to pare back offerings to create lower-cost tiers of service. Those tiers will not include many niche or specialized channels.

That inability to obtain significant carriage on video subscription networks will force budding networks to look elsewhere for audiences, and YouTube might then prove appealing.

YouTube is treating paid subscriptions as an experiment. much like video rentals when it began in 2010. The initial group of channels will be small, likely about 25 at the outset. The revenue split from subscriptions is expected to be similar to the 45-55 split that is common for ads on YouTube. Partners will also have the option to include ads in their pay channels, but its unclear what form those will take.

Machinima, Maker Studios and Fullscreen are likely among the programmers YouTube has asked to submit ideas for paid channels.

YouTube would initially launch around 25 paid channels.

In the past, observers have argued that YouTube could represent the "cable TV of the future." That might be stretching matters, at least for the moment. But if YouTube's new test proves successful, many smaller and niche programmers could find such YouTube distribution appealing.

With constantly climbing programming costs, distributors will be under pressure to pare back offerings to create lower-cost tiers of service. Those tiers will not include many niche or specialized channels.

That inability to obtain significant carriage on video subscription networks will force budding networks to look elsewhere for audiences, and YouTube might then prove appealing.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Global Telecom Revenue Will Grow 3.8% Annually, to 2018

Forecasting is a hazardous business. Though one analysis shows European telecom service provider revenues have fallen for three straight years, other analysts continue to show steady growth, in ways that obscure the more granular trends.

Overall growth is undoubtedly a correct way to characterize the global business. It is just that growth will not be universal, for every service, in every country, for every provider, in every region.

Insight Research projects that global carrier revenue will grow from $2.2 trillion in 2013 to $2.7 trillion in 2018, at a compounded annual growth rate (CAGR) of 3.8 percent.

Insight Research, for example, lumps the “Middle East” region with “Europe” and “Africa.” It is a standard way of reporting the data, if increasingly inaccurate, given growth in Africa and Middle East, and shrinkage in Europe.

Since 2010, revenue has been declining in Europe, according to the European Telecommunications Network Operators Association. Declines continued in 2011 and 2012.

As you would guess, mobile service revenue will outpace revenue from fixed network services. From 2013 to 2018, wireline carrier revenue will grow from $1.0 trillion to $1.1 trillion

at a CAGR of 1.5 percent, while mobile carrier revenue will grow from $1.2 trillion to $1.6 trillion at a CAGR of 5.5 percent, Insight Research predicts.

North American carrier revenue will grow from $547 billion to $635 billion at a CAGR of three percent, Insight Research predicts. The EMEA region will do slightly better than North America, as the strength of growth in Africa and the Middle East. From 2013 to 2018 EMEA carrier revenue will grow from $661 billion to $772 billion at a CAGR of 3.2 percent.

Asia and the Pacific Rim (AP) and Latin America and the Caribbean (LA) are the

fastest-growing regions.

From 2013 to 2018 Asia Pacific carrier revenue will grow from $832 billion to $1,047 billion at a CAGR of 4.7 percent, while Latin American carrier revenue will grow from $175 billion to $214 billion at a CAGR of 4.1 percent.

Overall growth is undoubtedly a correct way to characterize the global business. It is just that growth will not be universal, for every service, in every country, for every provider, in every region.

Insight Research projects that global carrier revenue will grow from $2.2 trillion in 2013 to $2.7 trillion in 2018, at a compounded annual growth rate (CAGR) of 3.8 percent.

Insight Research, for example, lumps the “Middle East” region with “Europe” and “Africa.” It is a standard way of reporting the data, if increasingly inaccurate, given growth in Africa and Middle East, and shrinkage in Europe.

Since 2010, revenue has been declining in Europe, according to the European Telecommunications Network Operators Association. Declines continued in 2011 and 2012.

As you would guess, mobile service revenue will outpace revenue from fixed network services. From 2013 to 2018, wireline carrier revenue will grow from $1.0 trillion to $1.1 trillion

at a CAGR of 1.5 percent, while mobile carrier revenue will grow from $1.2 trillion to $1.6 trillion at a CAGR of 5.5 percent, Insight Research predicts.

North American carrier revenue will grow from $547 billion to $635 billion at a CAGR of three percent, Insight Research predicts. The EMEA region will do slightly better than North America, as the strength of growth in Africa and the Middle East. From 2013 to 2018 EMEA carrier revenue will grow from $661 billion to $772 billion at a CAGR of 3.2 percent.

Asia and the Pacific Rim (AP) and Latin America and the Caribbean (LA) are the

fastest-growing regions.

From 2013 to 2018 Asia Pacific carrier revenue will grow from $832 billion to $1,047 billion at a CAGR of 4.7 percent, while Latin American carrier revenue will grow from $175 billion to $214 billion at a CAGR of 4.1 percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Monday, January 28, 2013

What "Grow Internationally" Might Mean, for AT&T

Neither Verizon Wireless, nor AT&T Mobile, currently earns significant international revenue (aside from some roaming revenue or some enterprise accounts). But that could change in the future. AT&T has been talking more than Verizon about such potential developments.

The issue is what form such initiatives might take, or what the revenue drivers might be. Most observers would simply observe that "consolidation" has been a feature of nearly every segment of the communications business, for some decades.

There perhaps is a "negative" way to characterize consolidation, and a "positive" way. One would expect any executive at a public company to take the "positive" approach.

AT&T might see LTE as a significant enabling event. "There are probably some opportunities to create some unique roaming arrangements, roaming each other’s networks at different cost structures," said AT&T CEO Randall Stephenson, on AT&T's fourth quarter 2012 earnings call.

That is not necessarily the same thing as investing in the equity of another service provider, at least not in the sense of "controlling interest." On the other hand, roaming agreements would not be seen as global expansion, either, so AT&T has to be looking at something more substantial than "mere" roaming agreements.

Though it is helpful to create more "on-network" traffic at a global or regional level, for reasons of better operating cost, that is logically a different question than investing in asset growth overseas because domestic opportunities are growing constrained.

That might also be true for some "applications" such as AT&T's home security and home monitoring platforms. In fact, AT&T has licensed its U-Verse platform to Frontier Communications domestically. And AT&T, which provides the "Whispernet" service for Amazon's Kindle devices, might see similar business-to-business opportunities overseas, as well.

But should AT&T's board of directors be looking to authorize some equity-based acquisitions internationally, one factor would be the current state of European equity prices for telecom assets. Some would say some European telco assets are more affordable than in the past.

But the "negative" argument for global expansion also makes sense. The Federal Communications Commission essentially has said, by denying the T-Mobile USA acquisition, that AT&T cannot hope to grow larger by making big asset acquisitions in the United States.

If you believe opportunities for organic growth are going to contract, as smart phone penetration reaches saturation, and if you assume regulators will not allow domestic growth through acquisition, then a growing global footprint makes eminent sense.

The issue is what form such initiatives might take, or what the revenue drivers might be. Most observers would simply observe that "consolidation" has been a feature of nearly every segment of the communications business, for some decades.

There perhaps is a "negative" way to characterize consolidation, and a "positive" way. One would expect any executive at a public company to take the "positive" approach.

AT&T might see LTE as a significant enabling event. "There are probably some opportunities to create some unique roaming arrangements, roaming each other’s networks at different cost structures," said AT&T CEO Randall Stephenson, on AT&T's fourth quarter 2012 earnings call.

That is not necessarily the same thing as investing in the equity of another service provider, at least not in the sense of "controlling interest." On the other hand, roaming agreements would not be seen as global expansion, either, so AT&T has to be looking at something more substantial than "mere" roaming agreements.

Though it is helpful to create more "on-network" traffic at a global or regional level, for reasons of better operating cost, that is logically a different question than investing in asset growth overseas because domestic opportunities are growing constrained.

That might also be true for some "applications" such as AT&T's home security and home monitoring platforms. In fact, AT&T has licensed its U-Verse platform to Frontier Communications domestically. And AT&T, which provides the "Whispernet" service for Amazon's Kindle devices, might see similar business-to-business opportunities overseas, as well.

But should AT&T's board of directors be looking to authorize some equity-based acquisitions internationally, one factor would be the current state of European equity prices for telecom assets. Some would say some European telco assets are more affordable than in the past.

But the "negative" argument for global expansion also makes sense. The Federal Communications Commission essentially has said, by denying the T-Mobile USA acquisition, that AT&T cannot hope to grow larger by making big asset acquisitions in the United States.

If you believe opportunities for organic growth are going to contract, as smart phone penetration reaches saturation, and if you assume regulators will not allow domestic growth through acquisition, then a growing global footprint makes eminent sense.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Android, Apple Account for 92% of Global Smart Phone Shipments

You might say a business lead by two firms with 92 percent market share fits the notion of "market domination." And by that definition, the global smart phone market is dominated by Apple and Samsung.

According to the latest research from Strategy Analytics, global smart phone shipments grew 38 percent annually to reach 217 million units in the fourth quarter of 2012.

To the point, Android and Apple iOS together accounted for 92 percent share of all smart phones shipped worldwide, representing the largest market share the two firms ever have had.

Global shipment growth slowed from 64 percent in 2011 to 43 percent in 2012 as penetration of smart phones began to mature in developed regions such as North America and Western Europe,” says Neil Shah, Senior Analyst at Strategy Analytics.

Strategy Analytics estimates 152.1 million Android smart phones were shipped globally in the fourth quarter of 2012, nearly doubling from 80.6 million units in the fourth quarter of 2011.

Android’s share of the global smart phone market has surged from 51 percent to 70 percent over the past year.

Almost half-a-billion Android smartphones were shipped in total worldwide during 2012.

Apple grew 29 percent annually and shipped 47.8 million smart phones worldwide for 22 percent market share in the fourth quarter of 2012, dipping slightly from 24 percent a year earlier.

"The worldwide smart phone industry has effectively become a duopoly as consumer demand has polarized around mass-market Android models and premium Apple designs,” Strategy Analytics says.

That is not to say the smart phone market is immutable, either in terms of operating system share or device manufacturer share. In fact, one can already note that Samsung perhaps is the only profitable Android handset manufacturer.

Global Smartphone Operating System Shipments and Market Share in Q4 2012

| Global Smartphone OS Shipments (Millions of Units) | Q4 '11 | 2011 | Q4 '12 | 2012 | ||||

| Android | 80.6 | 238.9 | 152.1 | 479.0 | ||||

| Apple iOS | 37.0 | 93.0 | 47.8 | 135.8 | ||||

| Others | 39.4 | 158.6 | 17.1 | 85.3 | ||||

| Total | 157.0 | 490.5 | 217.0 | 700.1 | ||||

| Global Smartphone OS Marketshare % |

Q4 '11

| 2011 | Q4 '12 | 2012 | ||||

| Android | 51.3% | 48.7% | 70.1% | 68.4% | ||||

| Apple iOS | 23.6% | 19.0% | 22.0% | 19.4% | ||||

| Others | 25.1% | 32.3% | 7.9% | 12.2% | ||||

| Total | 100.0% | 100.0% | 100.0% | 100.0% | ||||

| Total Growth Year-over-Year % | 55.9% | 63.8% | 38.2% | 42.7% |

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

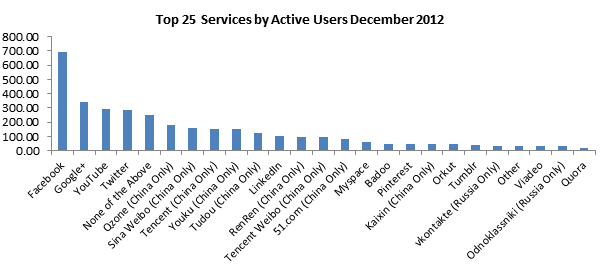

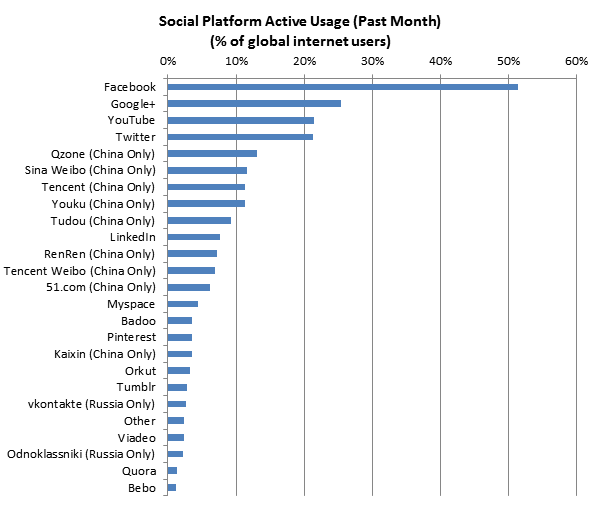

Google+ Now Second-Biggest Global Social Network?

Google+ now is the second-largest social network globally, behind Facebook, while YouTube is number three, according to Globalwebindex. Ignore for the moment whether Google+ is actually an identity service, or YouTube a video application.

Most would agree that Facebook users are more active than Google+ users, in all the ways that social network activity normally is measured.

Some will argue that Google+ "usage" is largely passive because Google is using Google+ as an identity mechanism, not a full-fledged social network, so the ranking does not necessarily mean too much.

On the other hand, it would not be hard to argue that the overall trend is that the largest networks, with scale effects, are winning share at the expense of small social networks with less scale.

Most would agree that Facebook users are more active than Google+ users, in all the ways that social network activity normally is measured.

Some will argue that Google+ "usage" is largely passive because Google is using Google+ as an identity mechanism, not a full-fledged social network, so the ranking does not necessarily mean too much.

On the other hand, it would not be hard to argue that the overall trend is that the largest networks, with scale effects, are winning share at the expense of small social networks with less scale.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

How Investment Rules Shape Canada's Communications Market

No set of government regulations, no matter the intent, always and everywhere have impact strictly confined to the problem the rules are meant to address. In fact, the unplanned and unexpected consequences can work to undermine the "solutions" the rules are supposed to achieve.

Like many other countries, Canada has foreign investment rules that prohibit non-Canadian firms from owning a majority of shares of leading communications service providers. In Canada's case the rule is that no foreign entity can own more than 33.3 percent of voting shares in a dominant Canadian telco.

On the other hand, foreign firms can own up to 100 percent of Canadian service providers with market share of 10 percent or less.

Some Canadian telcos now think the rules are unfair. The rules, for example, can allow much-larger foreign telcos to get a foothold in the Canadian market by investing in smaller firms. On the other hand, the foreign ownership rules also mean that the large Canadian providers are not able to attract the same level of investment as the smaller firms.

Rogers, Telus and BCE, for example, think the foreign ownership rules should be relaxed, so that every Canadian communications service provider operates under the same rules.

At least by implication, such regulatory relaxation might also mean that restrictions on the amount of spectrum an incumbent can own, or bid for, could change. Already, some might argue, smaller upstarts could bring huge resources to bear in spectrum auctions, when their foreign parents have deep pockets.

Oddly enough, rules designed to protect Canadian service providers might be having the opposite effect.

Like many other countries, Canada has foreign investment rules that prohibit non-Canadian firms from owning a majority of shares of leading communications service providers. In Canada's case the rule is that no foreign entity can own more than 33.3 percent of voting shares in a dominant Canadian telco.

On the other hand, foreign firms can own up to 100 percent of Canadian service providers with market share of 10 percent or less.

Some Canadian telcos now think the rules are unfair. The rules, for example, can allow much-larger foreign telcos to get a foothold in the Canadian market by investing in smaller firms. On the other hand, the foreign ownership rules also mean that the large Canadian providers are not able to attract the same level of investment as the smaller firms.

Rogers, Telus and BCE, for example, think the foreign ownership rules should be relaxed, so that every Canadian communications service provider operates under the same rules.

At least by implication, such regulatory relaxation might also mean that restrictions on the amount of spectrum an incumbent can own, or bid for, could change. Already, some might argue, smaller upstarts could bring huge resources to bear in spectrum auctions, when their foreign parents have deep pockets.

Oddly enough, rules designed to protect Canadian service providers might be having the opposite effect.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Friday, January 25, 2013

FCC Acts to Ease Deployment of Temporary and Small Cells

The Federal Communications Commission says it plans to streamline procedures related to deployment of temporary cell sites, and will this year also act to clear administrative barriers to building small cell sites and distributed antenna systems as well.

The FCC wants to expedite the placement of "temporary cell towers" such as "Cells on Wheels" (COWs) that can be used during special events, or possibly emergencies.

The FCC also says it will act to expedite the deployment of small cells and distributed antenna systems.

In the communications business, we sometimes forget that regulatory and legislative bodies enable, or can bar, creation of communications businesses. Financing, entrepreneurial skill and technology also are necessary, as well as clear value for end users. But it all begins with government permission to use spectrum, or to allow entities to enter a market.

Younger observers sometimes forget that it once was illegal for any company but one, in any area, to provide telecommunications services, for example. That barrier became more porous in the 1980s and then became virtually fully open to competition in 1996.

Still, lots of administrative procedures can raise the cost, and lengthen the time to bring new facilities or services to market, and the FCC wants to reduce some of those obstacles.

The FCC wants to expedite the placement of "temporary cell towers" such as "Cells on Wheels" (COWs) that can be used during special events, or possibly emergencies.

The FCC also says it will act to expedite the deployment of small cells and distributed antenna systems.

In the communications business, we sometimes forget that regulatory and legislative bodies enable, or can bar, creation of communications businesses. Financing, entrepreneurial skill and technology also are necessary, as well as clear value for end users. But it all begins with government permission to use spectrum, or to allow entities to enter a market.

Younger observers sometimes forget that it once was illegal for any company but one, in any area, to provide telecommunications services, for example. That barrier became more porous in the 1980s and then became virtually fully open to competition in 1996.

Still, lots of administrative procedures can raise the cost, and lengthen the time to bring new facilities or services to market, and the FCC wants to reduce some of those obstacles.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

U.K. LTE Auctions Begins

And observers expect a bifurcated strategy to emerge, with the leading national mobile service providers, including Vodafone, O2 , Three and EE, largely competing for the 800-MHz frequencies most suitable to national coverage, even in less dense areas.

On the other hand, three potential new providers, including BT, PCCW and MLL, are expected to bid for the higher frequencies more suitable for denser areas and cities.

The primary issue of coverage suggests the current national providers want to replicate their 3G coverage when adding LTE.

The new providers presumably will favor business plans that include wholesale, such as selling LTE capacity to other carriers in heavy-traffic areas, enterprise and business services. In other words, the 2.6-GHz frequencies will lead to building of networks whose primary value is "capacity," not "coverage."

The spectrum will almost double the frequencies available for U.K. mobile broadband services.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

"Broadband for Everyone" is Not Just a Slogan

Some might think the phrase “broadband for everyone” is only a slogan. On the contrary, over the next decade or so, we might find an extraordinary jump in the percentage of human beings in developing regions who have access to the Internet, can afford to buy access on a regular basis, and therefore create a big business opportunity for suppliers.

For example, if one assumes that in 2005 the middle class population of China was about eight percent, by 2030 it will be as high as 72 percent. In India, where the percentage of middle class people in 2005 was perhaps in the low single digits, by 2030 some 41 percent of India’s people will be middle class, defined as households with annual disposal income between 200,000 rupees up to one million rupees ($3,606 to $18,031 in annual disposable income).

Over the last decade, there has been a 50 percent jump in the number of people in the “middle class in Latin America and the Caribbean, The World Bank reports. Roughly speaking, about 30 percent of people in the Latin American and Caribbean region were middle class in 2009, using a definition of income between $10 a day and $50 a day.

The report on the Latin American middle class found that the middle class in the region grew to an estimated 152 million in 2009, compared to 103 million in 2003, an increase of 50 percent.

Among the highest achievers were Brazil, which comprised about 40 percent of the region’s middle class growth; Colombia, where 54 percent of people improved their economic status between 1992 and 2008; and Mexico, which had 17 percent of its population join the middle class between 2000 and 2010.

Today, the middle class and the poor in Latin America account for roughly the same share of the population, according to the report.

For suppliers of broadband services, the report is significant for several reasons. First, it shows dramatic growth of the base of consumers who logically will be buyers of Internet access services and products.

The study also suggests an important income threshold of about $10 a day income, the level at which enough economic security has been reached that the household is unlikely to fall back into poverty. That likely has key psychological implications for spending on products such as broadband access.

By a rough rule of thumb that suggests demand for broadband becomes significant once monthly cost falls to about three percent of household income, that $10 a day standard suggests a broadband service (terrestrial) will reach start to reach high levels of adoption at about $9 a month prices, and majority adoption at about $8 a month.

The point, as Canadian hockey star Wayne Gretzky once said, was to “skate to where the puck is going to be.” Even though the player with his stick on the puck mostly has to pay attention to where the puck is, right now, other defensive and offensive players will be thinking ahead to where the puck will be.

Suppliers of broadband access have the same challenge, namely building a business today, for today’s customer, while building towards a future where many billions of people will be able to become customers.

For example, if one assumes that in 2005 the middle class population of China was about eight percent, by 2030 it will be as high as 72 percent. In India, where the percentage of middle class people in 2005 was perhaps in the low single digits, by 2030 some 41 percent of India’s people will be middle class, defined as households with annual disposal income between 200,000 rupees up to one million rupees ($3,606 to $18,031 in annual disposable income).

Over the last decade, there has been a 50 percent jump in the number of people in the “middle class in Latin America and the Caribbean, The World Bank reports. Roughly speaking, about 30 percent of people in the Latin American and Caribbean region were middle class in 2009, using a definition of income between $10 a day and $50 a day.

The report on the Latin American middle class found that the middle class in the region grew to an estimated 152 million in 2009, compared to 103 million in 2003, an increase of 50 percent.

Among the highest achievers were Brazil, which comprised about 40 percent of the region’s middle class growth; Colombia, where 54 percent of people improved their economic status between 1992 and 2008; and Mexico, which had 17 percent of its population join the middle class between 2000 and 2010.

Today, the middle class and the poor in Latin America account for roughly the same share of the population, according to the report.

For suppliers of broadband services, the report is significant for several reasons. First, it shows dramatic growth of the base of consumers who logically will be buyers of Internet access services and products.

The study also suggests an important income threshold of about $10 a day income, the level at which enough economic security has been reached that the household is unlikely to fall back into poverty. That likely has key psychological implications for spending on products such as broadband access.

By a rough rule of thumb that suggests demand for broadband becomes significant once monthly cost falls to about three percent of household income, that $10 a day standard suggests a broadband service (terrestrial) will reach start to reach high levels of adoption at about $9 a month prices, and majority adoption at about $8 a month.

The point, as Canadian hockey star Wayne Gretzky once said, was to “skate to where the puck is going to be.” Even though the player with his stick on the puck mostly has to pay attention to where the puck is, right now, other defensive and offensive players will be thinking ahead to where the puck will be.

Suppliers of broadband access have the same challenge, namely building a business today, for today’s customer, while building towards a future where many billions of people will be able to become customers.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Will U.K. LTE Auctions “Pick Winners and Losers?”

It is of course axiomatic that without access to spectrum, no entity can be in the mobile service provider business. That access can be through owned or leased spectrum, but fundamentally, spectrum access is necessary. That naturally raises the question of whether “winning” fourth generation Long Term Evolution spectrum is “necessary” for a firm to be a market leader in mobile services, in the future.

Some might say so. “The importance of this spectrum auction in shaping the future of the U.K. wireless market cannot be understated,” said Daniel Gleeson, mobile analyst at IHS iSuppli. “Access to spectrum is the main barrier to entry for any company looking to build a new wireless network.”

It is true that seven companies are bidding for spectrum: the country’s four existing mobile operators along with three new players. With only three companies likely to win spectrum, at least one of the United Kingdom’s existing operators is likely to lose out,” said Gleeson.

The four existing players that have entered the auction are EE, O2, Vodafone and Three. The three new entrants are BT, PCCW and MLL Telecom.

Other European spectrum auctions have only seen a maximum of three operators win 800 MHz spectrum. The United Kingdom could follow this pattern, yielding three winners and four losers, IHS iSuppli says.

Among the existing mobile operators, the companies with the most to lose are O2 and Vodafone, which presently do not have 4G spectrum, IHS iSuppli said.

Not securing 800 MHz licenses would be a disaster for O2 or Vodafone, some might argue, even if both firms were to win spectrum at 2.6 GHz. The reason is that 800 MHz is viewed as essential for rural coverage, while the 2.6 GHz spectrum is seen as best suited to urban coverage.

Some might argue that the more likely outcome is that the fourth provider will wind up leasing spectrum from one of the other three providers, so the result might not be catastrophic. Still, owning spectrum arguably is safer than leasing spectrum.

But that analysis assumes the prices paid by the winners are reasonable, in light of the incremental revenue opportunities. Europe’s mobile service providers know well the dangers of overpaying for spectrum, as was the case when the 3G auctions were hold.

Operators overpaid for that spectrum, causing years of financial distress that also threatened bankruptcy for a few.

So it is possible the U.K. 4G auctions could rearrange business plans, perhaps in unexpected ways. Depending on the outcome, one or two of the leading four providers in the U.K. mobile market might find themselves more limited in terms of national coverage.

One or more of the “winners” might find themselves in more favorable positions, in terms of quality and quantity of spectrum. The auction, by itself, will not immediately change the market share situation. But it could begin a process that does change the market.

Some might say so. “The importance of this spectrum auction in shaping the future of the U.K. wireless market cannot be understated,” said Daniel Gleeson, mobile analyst at IHS iSuppli. “Access to spectrum is the main barrier to entry for any company looking to build a new wireless network.”

It is true that seven companies are bidding for spectrum: the country’s four existing mobile operators along with three new players. With only three companies likely to win spectrum, at least one of the United Kingdom’s existing operators is likely to lose out,” said Gleeson.

The four existing players that have entered the auction are EE, O2, Vodafone and Three. The three new entrants are BT, PCCW and MLL Telecom.

Other European spectrum auctions have only seen a maximum of three operators win 800 MHz spectrum. The United Kingdom could follow this pattern, yielding three winners and four losers, IHS iSuppli says.

Among the existing mobile operators, the companies with the most to lose are O2 and Vodafone, which presently do not have 4G spectrum, IHS iSuppli said.

Not securing 800 MHz licenses would be a disaster for O2 or Vodafone, some might argue, even if both firms were to win spectrum at 2.6 GHz. The reason is that 800 MHz is viewed as essential for rural coverage, while the 2.6 GHz spectrum is seen as best suited to urban coverage.

Some might argue that the more likely outcome is that the fourth provider will wind up leasing spectrum from one of the other three providers, so the result might not be catastrophic. Still, owning spectrum arguably is safer than leasing spectrum.

But that analysis assumes the prices paid by the winners are reasonable, in light of the incremental revenue opportunities. Europe’s mobile service providers know well the dangers of overpaying for spectrum, as was the case when the 3G auctions were hold.

Operators overpaid for that spectrum, causing years of financial distress that also threatened bankruptcy for a few.

So it is possible the U.K. 4G auctions could rearrange business plans, perhaps in unexpected ways. Depending on the outcome, one or two of the leading four providers in the U.K. mobile market might find themselves more limited in terms of national coverage.

One or more of the “winners” might find themselves in more favorable positions, in terms of quality and quantity of spectrum. The auction, by itself, will not immediately change the market share situation. But it could begin a process that does change the market.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Safaricom, Intel Introduce Yolo, Smart Phone for Cost Conscious Kenya Consumers

The Yolo is the third model with Intel branding .

Yolo is powered by the Intel Atom Z2420 processor (1.2GHz. It also comes with a 3.5-inch touch screen, a 5-megapixel camera with full HD video capture support, FM radio and HSPA+ support.

"We're redefining what cost-conscious Kenyans can expect from a smartphone," said Peter Arina, general manager, Safaricom' s Consumer Business Unit.

The device is aimed at the growing number of cost-conscious and first-time buyers in Kenya who do not want to sacrifice device performance or user experience for cost, Intel says.

The Yolo smartphone will be sold in Safaricom shops countrywide at the entry price of Kshs. 10,999 (about US $125) and comes bundled with a free 500 MBytes of data.

In some ways, the surprise here is the Intel brand being associated with a smart phone, in something other than an "Intel Inside" sense. That might not be so unusual in the future, as any number of mobile service providers might want their own branded phones, in some cases to better integrate with a carrier's own software and applications.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Smart Phone Market Shifting to Developing Nations, says Samsung

That might be important, as Apple and Samsung represent the two profitable suppliers of smart phones. By most reckoning, all the other smart phone suppliers earn only a little, or lose money.

"The furious growth spurt seen in the global smart phone market last year is expected to be pacified by intensifying price competition compounded by a slew of new products," Samsung said. In other words, expect slower growth in 2013. To be sure, one might argue that Samsung is talking here about its own prospects.

Growth in the overall market might continue. In fact, that is what Samsung seems to expect.

"In the first quarter, demand for smart phones in developed countries is expected to decelerate, while their emerging counterparts will see their markets escalate with the introduction of more affordable smart phones and a bigger appetite for tablet PCs throughout the year," Samsung says.

In other words, the smart phone market is approaching saturation in the developed markets, lower-cost devices will be needed to drive growth in emerging markets, while consumer spending might shift from smart phones to tablets.

Aside from what a slowing smart phone market might mean for suppliers of smart phones, the big strategic issue for mobile service providers is replacement revenue sources, once smart phone driven data plan sales level off.

Growth drivers have shifted, over the last couple of decades. For cable operators, it was video, then shifted to broadband access, then to voice, and now to business customer revenues. For fixed network operators growth shifted from voice to broadband to video entertainment.

For mobile operators, growth shifted from "more customers" (subscriber units) to messaging plans, to data revenues for Internet access. The coming saturation of the data plan growth driver is the looming strategic issue for mobile service providers.

With U.S. smart phone penetration above 55 percent, saturation effects will start to show every step of the way to about 80 percent, when growth will really become difficult. That is one reason why some are skeptical about whether Microsoft, Research in Motion and Nokia can hold or establish a sustainable foothold in the market.

By some reckoning, we are getting late in the game for major market share changes.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Why Record Sales are a Problem for Apple, Samsung, AT&T and Verizon

The fourth quarter of 2012 was significant for the smart phone business. Apple, Samsung, AT&T and Verizon all had record quarters, where it comes to smart phones.

Samsung earned record profits in the fourth quarter of 2012, lead by smart phones sales.

Apple reported record financial results in the fourth quarter of 2012, driven by sales of iPhones.

Separately, AT&T sold a record number of smart phones in the fourth quarter.

Verizon reported record smart phone sales as well, in the fourth quarter of 2012.

So you see the pattern: smart phone sales have grown dramatically in the U.S. market, a pattern one can see in other markets as well. But good news can the precursor for bad news down the road, as paradoxical as that sounds.

Virtually all observers will concur that revenue growth in the communications business now is lead by the shift to use of smart phones, which drives mobile data plan revenues. But all observers would also agree that growth will saturate, eventually.

And record sales only bring that saturation point closer. And the crucial question is what comes next, as the industry revenue driver? But there are more immediate questions, as well.

How much more time do rival suppliers really have to establish market share, when Apple and Samsung, which already earn most of the profit in the smart phone business, are possibly widening their already substantial lead in the market? The question probably is most salient for Research in Motion and Nokia.

There are profit margin issues as well. Both AT&T and Verizon reported that subsidies for smart phones, notably the Apple iPhone, were a drag on earnings. So the carriers have a mixed business interest, where it comes to the iPhone. The device drives consumer data plan adoption, but also carries the highest subsidy costs, and therefore hits earnings the hardest.

The service providers would, in one sense, welcome a hit phone that did not cost so much, in the way of subsidies. The Galaxy is the closest example of that. On the other hand, neither do the service providers want to give one more supplier greater power in the ecosystem, either.

While welcoming Android for providing choice and competition for Apple, service providers likely also want to ensure that Android, in turn, has competition.

And despite the record profits, Samsung also warned that profit margins would be an issue, as marketing expenses are climbing. Apple’s earnings growth and profit margin also emerged as issues in the fourth quarter of 2012.

The strong smart phone sales trend also means saturation will be reached “faster” in developed markets. And though forecast rates of growth also are high in developing markets, there will be retail price issues to be confronted by both Apple and Samsung.

That would suggest there is reason for the warnings about profit margin. One has to expect that, as the smart phone sales battle shifts to the developing regions, unit prices will have to fall. Typically, as sales of devices shift from developed markets to developing markets, gross revenue growth slows, and profit margins contract.

So, oddly enough, record smart phone sales are hastening the day when "what do we do next?" becomes a very-practical question for executives trying to drive the next quarter's revenue and profit margin numbers.

Samsung earned record profits in the fourth quarter of 2012, lead by smart phones sales.

Apple reported record financial results in the fourth quarter of 2012, driven by sales of iPhones.

Separately, AT&T sold a record number of smart phones in the fourth quarter.

Verizon reported record smart phone sales as well, in the fourth quarter of 2012.

So you see the pattern: smart phone sales have grown dramatically in the U.S. market, a pattern one can see in other markets as well. But good news can the precursor for bad news down the road, as paradoxical as that sounds.

Virtually all observers will concur that revenue growth in the communications business now is lead by the shift to use of smart phones, which drives mobile data plan revenues. But all observers would also agree that growth will saturate, eventually.

And record sales only bring that saturation point closer. And the crucial question is what comes next, as the industry revenue driver? But there are more immediate questions, as well.

How much more time do rival suppliers really have to establish market share, when Apple and Samsung, which already earn most of the profit in the smart phone business, are possibly widening their already substantial lead in the market? The question probably is most salient for Research in Motion and Nokia.

There are profit margin issues as well. Both AT&T and Verizon reported that subsidies for smart phones, notably the Apple iPhone, were a drag on earnings. So the carriers have a mixed business interest, where it comes to the iPhone. The device drives consumer data plan adoption, but also carries the highest subsidy costs, and therefore hits earnings the hardest.

The service providers would, in one sense, welcome a hit phone that did not cost so much, in the way of subsidies. The Galaxy is the closest example of that. On the other hand, neither do the service providers want to give one more supplier greater power in the ecosystem, either.

While welcoming Android for providing choice and competition for Apple, service providers likely also want to ensure that Android, in turn, has competition.

And despite the record profits, Samsung also warned that profit margins would be an issue, as marketing expenses are climbing. Apple’s earnings growth and profit margin also emerged as issues in the fourth quarter of 2012.

The strong smart phone sales trend also means saturation will be reached “faster” in developed markets. And though forecast rates of growth also are high in developing markets, there will be retail price issues to be confronted by both Apple and Samsung.

That would suggest there is reason for the warnings about profit margin. One has to expect that, as the smart phone sales battle shifts to the developing regions, unit prices will have to fall. Typically, as sales of devices shift from developed markets to developing markets, gross revenue growth slows, and profit margins contract.

So, oddly enough, record smart phone sales are hastening the day when "what do we do next?" becomes a very-practical question for executives trying to drive the next quarter's revenue and profit margin numbers.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Subscribe to:

Comments (Atom)

Yes, Follow the Data. Even if it Does Not Fit Your Agenda

When people argue we need to “follow the science” that should be true in all cases, not only in cases where the data fits one’s political pr...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...