Global traffic once was driven by voice. Then it was driven by internet data. Increasingly, traffic is dominated by video entertainment. That has serious business model issues for access providers.

In the era of internet video, greater usage does not necessarily drive much incremental revenue.

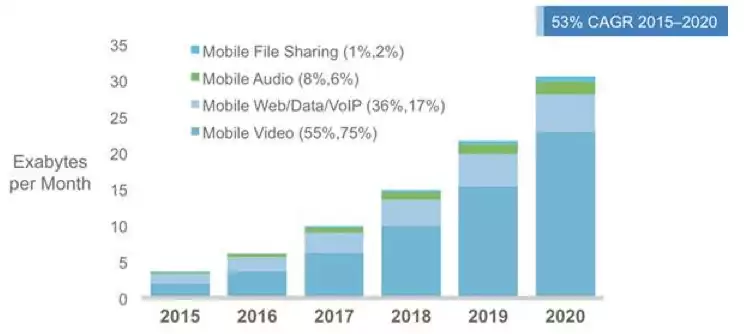

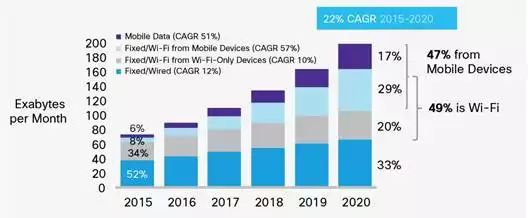

That video now drives global traffic is uncontestable. There will be nine-times more mobile video traffic by 2021, according to Jean-Luc Valente, Cisco VP. Fully 75 percent of mobile data traffic will be video by 2021. That is important, in part, since as much as half of all traffic is generated by mobile devices, while by 2020 perhaps 70 percent of all traffic will be related to mobile devices.

So here’s the problem: video consumes huge and growing amounts of bandwidth (first small screen, then standard definition video, now high definition video and more intense formats coming. But much of that video drives no direct revenue. And most video that does drive direct revenue (streaming video services) is not owned by the access providers.

At the same time, the revenue which can be driven by internet access services has an average revenue problem: prices per gigabyte keep dropping. In fact, some would argue such prices (at retail) must drop, to sustain the OTT video model.

New unlimited usage plans featured by the top-four U.S. mobile operators, or zero-rated video plans, provide concrete examples of how that process continues to unfold.

Some would note that bandwidth prices are plunging so much that overall network revenue per bit could even go negative within 10 years.

“Two decades ago, it would have cost almost $10,000 a month to get a data connection as fast as today's baseline internet wireline connections,” said Tom Nolle, CIMI Corp. principal. “Yet, the internet has pushed down revenue per bit transported so sharply that operators widely believe connection services will have a negative return on investment before the end of the decade.”

Indeed, revenue per gigabyte has been declining for some time, in the mobile and fixed realms.

The business model issue therefore has several key aspects. Revenue per gigabyte which can be earned by an access provider continues to drop. Up to some point, access providers can sell more units to offset declining prices, but only up to a point (unlimited usage or zero rating show the limits).

At the same time, the media type most desired by retail end users is video, which poses huge and growing capacity demands that require network upgrades, but without direct revenue increases to offset the investments.

Finally, consumers expect that subscription video or audio services will not require payment for consumed bandwidth. That pattern was set by broadcast radio, broadcast TV, then cable TV, satellite TV and telco TV. And though consumers understand they need to pay for internet access to watch Netflix or Amazon Prime, they likely would not pay for the incremental bandwidth correlated with their consumption, should that be proposed.

Video, in other words, has the potential to strain business models. Some think video could break the business model. The issue is simple. In the voice era, higher usage meant higher revenue.

In the era of internet video, greater usage does not necessarily drive much incremental revenue.

No comments:

Post a Comment