Is it too late for mobile service providers, telcos and cable TV operators to gain a significant share in mobile advertising? Nobody knows yet.

It probably is not possible to get a leading share, so the point is whether it is possible to gain a significant share, across the payments, streaming and app fronts.

If it does not prove possible, Internet service providers are going to face increased pressure in their core access business, as advertising has enabled software and content businesses in the past.

But advertising increasingly could be the marginal contributor even for Internet access businesses, providing just the required amount of incremental revenue to enable widespread Internet access subscription models.

The other unresolved issue is whether ISPs can create significant new managed services revenues to offset pressure in the commoditized Internet access business.

Whether those new revenue sources come from streaming video, home security, health services or connected car apps does not matter so much. At the moment, nor does the relative revenue contribution matter so much.

What matters is discovering and creating the new managed services models to offset legacy service declines and commoditization of simple Internet access services.

Sunday, June 28, 2015

Is it Too Late for Mobile Operators to Gain Mobile Ad Share?

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Saturday, June 27, 2015

"Reliability" Isn't What it Used to Be, and Most of US Don't Really Mind

How to supply power to fixed network voice service phones is an acknowledged issue for fiber to home or cable TV voice services. They are, in fact, less reliable than legacy phone service when consumers do not buy optional battery power backup.

But few consumers seem to do so.

The problem of inability to use a service when the user device loses power is no longer unusual though. It applies to all Internet access services, mobile phones, cordless phones, televisions and all other consumer appliances generally.

In fact, it would be a fair generalization to say that most devices and apps using communication networks are “less reliable” than they used to be. And most users seem to adjust quite well.

There are understood protocols for services or apps that occasionally crash. One reboots. One “calls back.” One waits a few seconds or minutes. One switches to another app.

That is simply an adjustment to connectionless protocols that underpin modern apps and battery-powered end user devices.

Even in the restricted area of fixed network telephone service, most consumers long ago made decisions that ensured they would not have “telephone service” when local electrical power was disrupted.

The culprit is the cordless phone, which most consumers seem to use, when they have fixed network phone service at all. By definition, cordless phones require local electrical power to function.

So when there is a local power outage, even when the network is up and running, a customer cannot use a cordless phone.

So there is an easy solution for consumers who buy fixed network telephone service and want the ability to use their phones in the event of a local power outage: do not buy or use cordless phones.

That will be the case for some years to come. Eventually, however, battery backup is likely to be the only option for powering cordless phones or other consumer appliances in the event of local power outages.

One might argue the problem sort of goes away by itself, over time, as most consumers who care about network-powered phones tend to be in the higher age cohorts. Over time, most consumers, who do not especially worry about such things, will become 100 percent of the market.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

A Shakeout in India Mobile Market is Coming

The coming entry of Reliance Jio into India’s mobile market might well be the catalyst for industry consolidation many would argue is both inevitable and necessary.

In some areas, there are 13 different competitors. In most areas, there are eight contestants, though five firms have 10 percent share or greater.

Bharti Airtel in 2014 had about 23 percent share. Vodafone had about 19 percent subscriber share.

Idea in 2014 had about 15 percent share. Reliance Communications had about 12 percent share. BSNL had 10 percent share. In other words, the top five providers had nearly 79 percent market share.

That is a higher than typical degree of competition, and suggests eventual consolidation is necessary. Already, though, competition seemed in 2014 to be favoring Bharti, Vodafone and Idea, which were gaining net subscribers, while Reliance was losing net subscribers.

The entry by Reliance Jio will further complicate matters, as unless Reliance Jio fails, it has to take at least some market share from existing providers, even if it were to be successful at growing the market by creating net new subscribers.

Mobile adoption in mid-2014 was about 70 percent, so while there is some room for additional net subscriber growth, most of the potential Reliance Jio gains will have to come from other operators.

The reasons are simple enough. People with discretionary income who are within the typical coverage areas already are customers.

Many non-subscribers are in areas where mobile coverage is non-existent, so they cannot buy service, or face price constraints, when they are able to receive signals.

Given the Reliance Jio strategy of focusing on mobile Internet services, Reliance Jio inevitably will try to take market share from the ranks of consumers who value mobile Internet access and can afford to buy the service. Most of those people already buy service from an existing provider.

"We believe that the already-high competitive intensity in the sector that has diminished returns will only worsen with the entry of Rel Jio,” said Jefferies telecom analyst Vaibhav Dhasmana, said,

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Friday, June 26, 2015

AT&T Launches Gigabit Service in Chicago

AT&T is launching U-verse with AT&T GigaPower to residential and small business locations in parts of the City of Chicago during summer of 2015. Earlier, U-verse with AT&T GigaPower launched in parts of Elgin, Oswego, Plainfield, Skokie, Yorkville and surrounding communities.

AT&T is launching U-verse with AT&T GigaPower to residential and small business locations in parts of the City of Chicago during summer of 2015. Earlier, U-verse with AT&T GigaPower launched in parts of Elgin, Oswego, Plainfield, Skokie, Yorkville and surrounding communities.

AT&T says the network is the first Chicago residential service to feature speeds of up to 1 gigabit per second.

U-verse “High Speed Internet Premier” speeds up to 1Gbps start as low as $120 a month, or speeds at 100 Mbps start as low as $90 a month, with a one year price guarantee.

The services also can be bundled with other services such as entertainment video and voice.

AT&T plans to expand its 100 percent fiber network in up to 25 markets. U-verse with AT&T GigaPower has officially launched in parts of the Atlanta, Austin, Charlotte, Chicago, Cupertino, Dallas, Fort Worth, Houston, Kansas City, Nashville, Raleigh-Durham and Winston-Salem markets.

Plans have also been announced to launch AT&T GigaPower in parts of the Greensboro, Jacksonville, Miami, St. Louis and San Antonio markets.

Additionally, AT&T has committed that upon approval of its proposed acquisition of DIRECTV, the company will expand the AT&T GigaPower network to an additional 2 million customer locations. All of these 2 million locations are over and above what the company announced in 2014.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Bell Canada Goes Gigabit

Bell Canada President and CEO George Cope says Bell Canada is investing $1.14 billion to bring gigabit Internet access service to the Toronto area.

Bell Canada also will provide gigabit service to other cities in Ontario, Quebec and Atlantic Canada as part of a $20 billion investment.

Bell will launch “Gigabit Fibe” in other cities in Ontario, Québec and the Atlantic provinces as soon as the summer of 2015 in some locations.

Service initially will be available at a maximum 940 Megabits per second and rise to a full 1000 Megabits per second or faster in 2016 as modem equipment suppliers catch up to gigabit speeds, Bell Canada said.

The service will be available to 50,000 businesses and residences in the summer of 2015 and will then be expanded to another 1.1 million premises over the next 36 months.

The upgrade requires about 9,000 kilometres of new optical fiber in the city both underground from 10,000 manhole covers and above ground on 80,000 Bell and Toronto Hydro poles.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Mobile Video Will Drive Global Consumer Data Demand

There is a very simple reason why lots more mobile bandwidth is going to be needed in coming years. The number of discrete users and devices will grow; while the types of apps people use is changing.

Notably, consumption of video on mobile phones is exploding, mobile devices are the primary Internet access device globally, and therefore mobile video consumption will drive aggregate mobile bandwidth demand.

According to Ooyala, mobile video consumption grew 367 percent between the first quarter of 2013 and the first quarter of 2015.

In fact, mobile devices represented fully 42 percent of all video viewing in the first quarter of 2015.

Bandwidth intensity is the issue. Video, for example, simply requires an order of magnitude or two orders of magnitude bandwidth than most other apps. A one hour IP-based voice call might consume 28.8 Mbytes. An hour of mobile video consumption might consume 120 Mbytes. An hour of high definition TV consumption might consume 2.5 Gbytes.

Sample Service and Application Bandwidth Comparisons

| ||

Segment

|

Application or Service Name

|

KB

|

Consumer mobile

|

SMS

|

0.13

|

Consumer mobile

|

MMS with video

|

100

|

Business

|

IP telephony (1-hour call)

|

28,800

|

Residential

|

Social networking (1 hour)

|

90,000

|

Residential

|

Online music streaming (1 hour)

|

72,000

|

Consumer mobile

|

Video and TV (1 hour)

|

120,000

|

Residential

|

Online video streaming (1 hour)

|

247,500

|

Business

|

Web conferencing with webcam (1 hour)

|

310,500

|

Residential

|

HD TV programming (1 hour, MPEG 4)

|

2,475,000

|

Business

|

Room-based videoconferencing (1 hour, multicodec telepresence)

|

5,850,000

|

Summary of Per-Device Usage Growth, MB per Month

| ||

Device Type

|

2014

|

2019

|

Non-smartphone

|

22 MB/month

|

105 MB/month

|

M2M Module

|

70 MB/month

|

366 MB/month

|

Wearable Device

|

141 MB/month

|

479 MB/month

|

Smartphone

|

819 MB/month

|

3,981 MB/month

|

4G Smartphone

|

2,000 MB/month

|

5,458 MB/month

|

Tablet

|

2,076 MB/month

|

10,767 MB/month

|

4G Tablet

|

2,913 MB/month

|

12,314 MB/month

|

Laptop

|

2,641 MB/month

|

5,589 MB/month

|

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

In Some Markets, Mobile Voice Represents Less than 15% of Total Device Usage

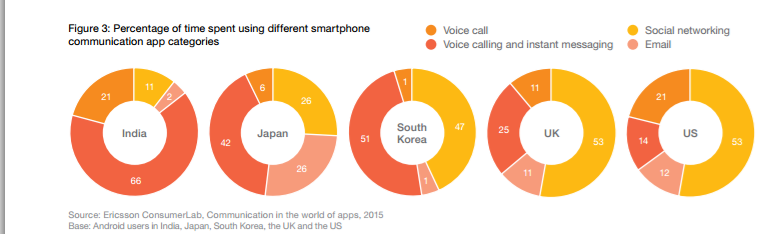

Once upon a time, mobile phones freed people from the need to be near a fixed network phone to make and receive calls. These days, communications, though still a key function, often represent less than a third of total smartphone activities.

In a significant development, social networking actually dominates even “communications” usage. In other words, voice is a fundamental capability for a smartphone, but often is not even the most-used communications mode.

Smartphones are multi-function devices, used 30 percent of the time for communications in the United States, United Kingdom, Japan and South Korea, and about 47 percent of the time in India.

Web browsing, games, entertainment and utility or productivity functions represent the other major categories of usage.

But which communication apps dominate varies widely as well. In the United States and United Kingdom, it is social networking which dominates communications. In the U.S. and U.K. markets, social networking represents 53 percent of total communications activity.

In other markets, such as India, voice represents 66 percent of communications activity, while in South Korea voice usage is 51 percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Bharti Airtel Plans Urban, Not Just Rural Deployment of OneWeb Terminals

Bharti Enterprise’s investment in OneWeb was substantial enough to earn it a seat on the board of directors. One might wonder why the investment was deemed important.

Aside from other considerations, likely includes favorable pricing terms for substantial deployments. And OneWeb might not be viewed simply as a way to reach rural areas affordably.

Bharti and Airbus are among the largest investors in the $500 million funding round.

Aside from other considerations, likely includes favorable pricing terms for substantial deployments. And OneWeb might not be viewed simply as a way to reach rural areas affordably.

But that should be the initial reaction most observers should have: OneWeb should help Bharti Airtel in its rural India, Sri Lanka, Bangladesh, sub-Saharan Africa markets.

“These areas will benefit, because this will feed into my mobile network, and wherever, we cannot reach today,” said Bharti Chairman Sunil Bharti Mittal.

As planned, Bharti can drop in a solar-powered earth station and create a small cell providing 3G and 4G mobile signals over an area about 300 meters (985 feet) to 400 meters (1312 feet) in radius.

That suggests a cell site with a diameter of up to 2600 feet, or about half a mile square.

What observers might not have expected is that the same network will help Bharti Airtel with dropped calls, something that has been a problem even in urban areas.

Even if the percentage of dropped calls seems not especially high (one to two percent), dropped calls apparently are a big customer irritant. Even in many developed markets, dropped call rates of two to four percent would not be terribly unusual.

So urban applications might be as important as rural solutions, as it turns out. It often will be the case that an area requires signal reinforcement but there is no available fiber backhaul, or zoning permission cannot be quickly obtained.

That allows Bharti to rectify signal coverage issues immediately, and then bridge the gap until more traditional solutions are possible (new towers and required backhaul).

Bharti and Airbus are among the largest investors in the $500 million funding round.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Thursday, June 25, 2015

What Happened to Tablet Market?

| source: Business Insider |

As recently as 2011, annual global tablet shipments growth surged 305 percent over a year’s time. By 2014, total tablet shipments growth had slowed to just eight percent annual growth.

The issue might be that tablets, which might once have been viewed as the successor to the personal computer, are in turn now being cannibalized by phablets (smartphones with bigger screens).

If so, the smartphone is the replacement for the PC in a great majority of cases, not the tablet.

Between 2015 and 2020, tablet growth rates might fall further, to about a 2.5 percent compound annual growth rate.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

LTE Still has Only 9% Adoption Globally

Long Term Evolution adoption has a long way to go, even as suppliers gear up efforts to create 5G standards. Globally, LTE has about nine percent adoption and three percent adoption in Latin America.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

When to Shut Down the PSTN Remains an Issue

The fixed network communications industry has yet to accomplish a key transition mobile service providers already have learned how to finesse, namely the challenge of decommissioning an out-of-date network with a next-generation replacement.

Among the chief problems are the “carrier of last resort” and universal service obligations imposed on some former monopoly providers. At some point, the legacy network must be completely shut off, and all customers migrated to the next-generation network.

But how to do so, and when to do so, remain contentious. Some policy advocates, for example, demand full legacy network coverage even as the next-generation network gradually is built.

But there is a fundamental economic problem. At some point, with dwindling numbers of customers on the legacy network, it becomes uneconomic to keep operating the legacy network.

At that point, economics matters: a network that cannot sustain itself cannot provide any service, to say nothing of universal service.

So the timing of any shutdown of the old public switched telephone network is one important issue. As any knowledgeable observer would attest, fixed network operators are anything but oblivious to the inevitability of the change.

That is one reason less capital, and fewer human resources, are allocated to maintaining the legacy network. But stranded assets are key. At some point, there will be so few remaining customers on the legacy network that it no longer makes sense to operate it.

In a sense, that is one reason why Sprint has asked the U.S. Federal Communications Commission to allow it to shutter the long distance voice network it operates.

It is likely that the cost of running and marketing services on that network exceed revenues. In other words, the Sprint long distance voice business is unsustainable.

That eventually is a problem to be faced by virtually all fixed network telcos.

The problem then are rules and timetables that allow complete decommissioning of the older network, and interim steps that encourage rapid investment in the replacement network, while allowing service providers to more rapidly do what they must do, namely shift customers to the sustainable networks.

So it is that BT is calling on Ofcom to let it scrap the traditional telephone network, while also loosening regulations in the interim.

“We believe obsolete regulation should be rolled back, rather than clinging on until the last user dies,” said Mark Shurmer, BT’s group director of regulatory affairs. That is hyperbole, but understated.

In fact, the breaking point will come much sooner, at the point where revenue earned from the legacy network does not support sustainable and profitable operations.

It’s a tough issue, with heavy political implications. But it is undeniable that sustainability matters. Before the point where the legacy network becomes literally unsustainable, regulators and service providers must have made clear plans to decommission the olde network, and move all customers to the replacement network.

It will not make economic sense to support both legacy and replacement networks simultaneously.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Google-Backed Sidewalk Labs Will Use Ad-Supported Revenue Model

Ad-supported communications is not a new idea in telecommunications. But it is getting much more attention these days as service providers experiment with new business models.

Decommissioned payphone booths will become public Wi-Fi hotspots in New York, as part of an initiative by Sidewalk Labs, a Google-backed urban innovation startup that will rely on advertising to support its menu of free Internet access to anyone in a 150-foot radius, free phone charging, phone calling, Internet browsing and access to local services and information.

Sidewalk Labs leads a group of investors acquiring Control Group and Titan, among the companies working on the LinkNYC network to blanket New York City with free Wi-Fi.

The intent is to extend the concept to other cities.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Subscribe to:

Comments (Atom)

Yes, Follow the Data. Even if it Does Not Fit Your Agenda

When people argue we need to “follow the science” that should be true in all cases, not only in cases where the data fits one’s political pr...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...