Each of the top four global UCaaS providers by market share hold the same position in North America. North America accounted for 87 percent of UCaaS subscribers in the first quarter of 2013, followed by the EMEA(Europe, Middle East, and Africa) region, which had 10 percent of worldwide UCaaS subscribers.

One would be very hard pressed to name another communications service that is so concentrated in terms of buyers (by region). One would therefore be tempted to say that cloud-based UC has not yet gotten much traction anywhere outside North America.

Whether that means there is huge unmet potential (undoubtedly true) or huge indifference, is hard to say. If the cloud trend is real, and most would agree that it is, then most of the eventual sales have yet to be made.

Cloud computing is important, some might argue, because cloud computing represents the next wave of computing architecture, as there were earlier waves of mainframe, minicomputer and PC-based computing.

IDC predicts that the collaborative applications segment of the U.S. SaaS applications market grew 10.6 percent year over year in 2012 to over $2.6 billion in revenue.

Current market research indicates that Web conferencing and videoconferencing and UC are at or near the top of the list of applications most likely to move to the cloud, IDC says.

IDC estimates that collaborative applications (including instant communications,

enterprise social software, conferencing, team collaboration, and email) account for 14 percent of the total U.S. cloud applications market and 51 percent of the total U.S. collaborative applications segment revenue in 2012.

Synergy Research Group suggests a handful of leading U.S. cloud UC services suppliers, representing about half the U.S. market, earned about $84 million a quarter in the second quarter of 2013, suggesting those firms represent an annual market north of $340 million. If one assumes that is half the U.S. cloud UC market, then annual revenues would be in the $680 million range.

New data from Synergy Research Group show that between the first quarter of 2010 and the first quarter of 2013, unified communications as a service (UCaaS) subscribers nearly tripled to reach 1.6 million, and now account for 24 percent of total cloud UC subscribers. This is up from 21 percent three years earlier, Synergy Research estimates.

Together, four providers account for nearly half of UCaaS subscribers. 8×8 is the market leader, with 19 percent of subscribers. RingCentral, Vocalocity, and ShoreTel follow, with 10 percent, nine percent, and eight percent, respectively.

While the cloud UCaaS market as a whole grew 22 percent year over year in the second quarter of 2013, Vocalocity grew 45 percent while ShoreTel grew 37 percent.

Suppliers iCore, RingCentral and 8x8 all saw year-on-year revenue growth in the 18 percent to 22 percent range. In aggregate the six market leaders accounted for 54 percent of total quarterly UCaaS revenues, with 8x8 maintaining its overall market share lead at 15 percent.

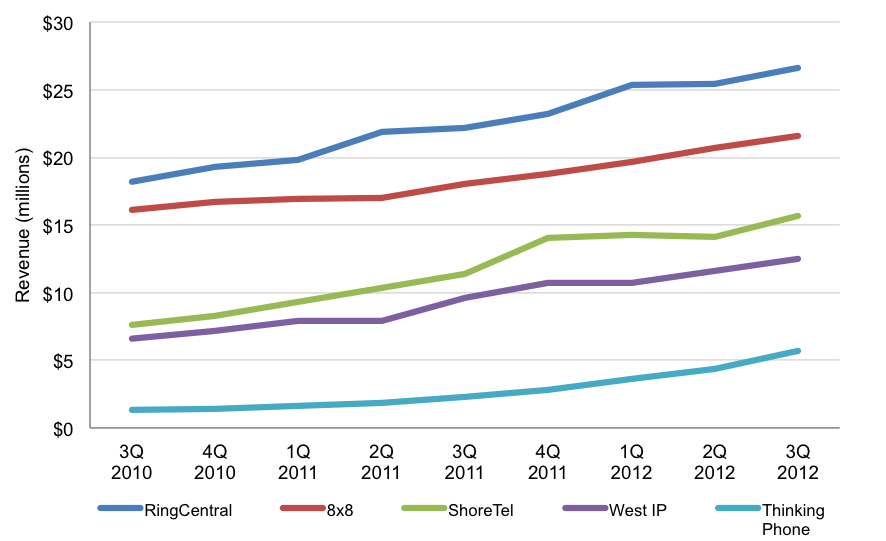

UCAAS BUSINESS SUITE WORLDWIDE REVENUES, Q3 2010-Q3 2012

source: Synergy Research

For some of us, the big question is why cloud-based UC resonates in the U.S. and North American market so well, and yet appears to lag so much in most other world markets.

No comments:

Post a Comment