As always, the move would increase the odds of channel conflict for both Google and Microsoft.

Monday, November 26, 2012

Google Rumor: 13-inch Chrome OS Touch Notebook?

As always, the move would increase the odds of channel conflict for both Google and Microsoft.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

European Smart Phone Penetration Hits 54%

Out of this smart phone audience, 15.5 percent also own a tablet, compared to 9.3 percent last year.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Deutsche Telekom Faces Same Challenge as Many U.S. Service Providers

Most telecom executives, especially those facing growing competition from cable operators, have had to ask hard questions about their options for upgrading access networks. The simple fact is that a full replacement of the network to fiber to the home technology is expensive.

Japan's Bank Nomura estimated the cost of a digital subscriber line upgrade, in areas where Deutsche Telekom needs more speed to counter cable operator high speed access offering, at around 4 billion euros ($5.1 billion), while a full upgrade to fiber to the home, across Germany, could cost around EUR80 billion, or perhaps $102 billion.

So Deutsche Telekom plans to selectively upgrade, using a faster form of digital subscriber line technology, in those areas where competition is most fierce. The vectoring approach provides a dramatic boost in speeds.

Some would argue that Deutsche Telekom should simply rebuild its network using fiber to the home, essentially creating a "future proof" network.

The problem, some would say, is that the financial return from doing so is questionable, at some level. Mobile substitution is one issue. The bigger problem is that the basic business case, overall, is much tougher.

A shift of end user spending to mobile services means less potential revenue from a mix of services, ranging from voice to high speed access to video. Also, incumbent market share is far lower than it once was. In many cases, established operators have 30 percent to 40 percent market share, where they once had virtually 100-percent share.

That means a complete upgrade is bound to "strand" a significant portion of those assets, which will not have revenue attached to the lines.

Japan's Bank Nomura estimated the cost of a digital subscriber line upgrade, in areas where Deutsche Telekom needs more speed to counter cable operator high speed access offering, at around 4 billion euros ($5.1 billion), while a full upgrade to fiber to the home, across Germany, could cost around EUR80 billion, or perhaps $102 billion.

So Deutsche Telekom plans to selectively upgrade, using a faster form of digital subscriber line technology, in those areas where competition is most fierce. The vectoring approach provides a dramatic boost in speeds.

Some would argue that Deutsche Telekom should simply rebuild its network using fiber to the home, essentially creating a "future proof" network.

The problem, some would say, is that the financial return from doing so is questionable, at some level. Mobile substitution is one issue. The bigger problem is that the basic business case, overall, is much tougher.

A shift of end user spending to mobile services means less potential revenue from a mix of services, ranging from voice to high speed access to video. Also, incumbent market share is far lower than it once was. In many cases, established operators have 30 percent to 40 percent market share, where they once had virtually 100-percent share.

That means a complete upgrade is bound to "strand" a significant portion of those assets, which will not have revenue attached to the lines.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Sunday, November 25, 2012

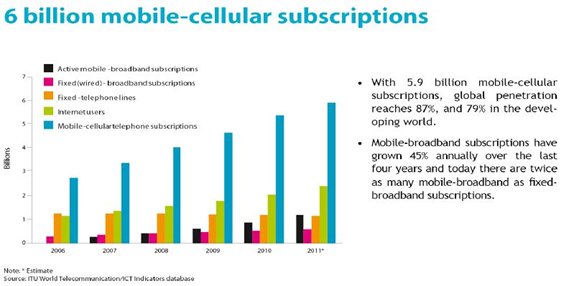

How Much Further Can Fixed Network Broadband Grow?

In the U.S. market, most potential consumers already buy broadband. Leichtman Research Group points out that the 17 largest cable and telephone providers, representing about 93 percent of the total market, acquired about 580,000 net additional high-speed Internet subscribers in the third quarter of 2012.

Collectively, these service providers now account for over 80.7 million subscribers. Cable companies have 46.2 million broadband subscribers, and telephone companies have 34.5 million subscribers.

The issue is how close the U.S. market is to full saturation. By some estimates, U.S. fixed network broadband penetration is near 80 percent of homes. You might argue that leaves room to grow, and there is, but not much.

The reason is that not every home requires broadband. Not every home owns computers. Not every home has users that want to use at-home Wi-Fi to support tablet and smart phone access, or game consoles or Internet-connected TVs.

Also, some households substitute mobile access for fixed connections. Perhaps six percent of U.S. homes using broadband already seem to rely exclusively on mobile connections.

When asked what device they normally use to access the internet, 25 percent of smart phone owners say that they mostly go online using their phone, rather than with a computer.

While many of these individuals have other sources of online access at home, roughly one third of these “cell mostly” internet users lack a high-speed home broadband connection, according to Pew Internet & American Life Project. That implies about an eight percent of households that only use mobile broadband.

Many studies show that income is directly correlated to PC ownership and broadband usage. Households with annual incomes of at least $75,000 buy broadband at at least an 87 percent rate. Homes with annual incomes of $30,000 to $49,999 buy broadband at a rate of about 64 percent.

The top cable companies added about 575,000 subscribers, while the top three telephone companies added about 5,000 subscribers, in large part because AT&T and Verizon actually lost customers.

AT&T and Verizon added 749,000 fiber subscribers (U-verse and FiOS) in the quarter, while having a net loss of 799,000 DSL subscribers.

The slow pace of net additions simply reflects a market that is nearly saturated. We will know when the market is completely saturated when net additions hit zero, or very close to it. .

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Global Telecom Business: No "One Size Fits All" Strategy Exists

Once upon a time, all communications service providers pretty much "looked alike" in terms of strategy. That is less true now, and will probably be much less true in the future, as service providers adapt to the realities of many different segments of the communications business.

These days, strategies are diverging. That might especially be true in developed markets, where actual practices have lead to more strategic diversity over the past couple of decades.

Those differences are driven, in large part, by a bifurcation of opportunity in the global telecommunications business, which is predicted by virtually all analysts to be growing, but unevenly.

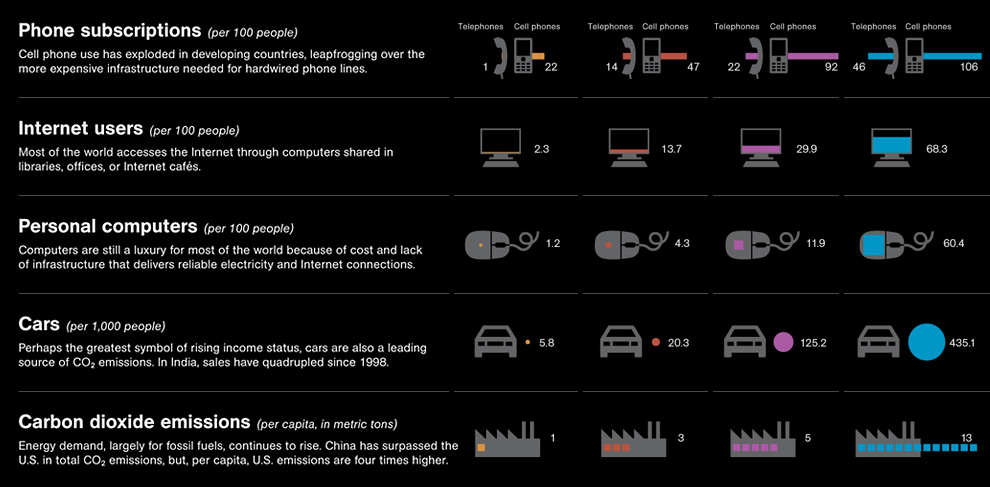

There are lots of places where phone penetration is 22 percent, for example, or where use of the Internet is about 23 percent, despite the fact that mobile penetration, in terms of “accounts,” now is as high as 79 percent, even in the “developing” countries.

Of course, usage even within a single country or region, and revenue prospects for service providers, are not distributed evenly. Generally speaking, growth opportunities are disproportionately found in the Asia-Pacific region, though Africa and Latin America are growth areas as well.

The obverse is true in much of of the developed world, where classic markets for voice and messaging are saturated, and even mobile broadband, the current growth driver, will face maturation not so long from now. That of course explains the serious and even furious pursuit of new growth drivers by executives in the mobile and fixed network service provider industries.

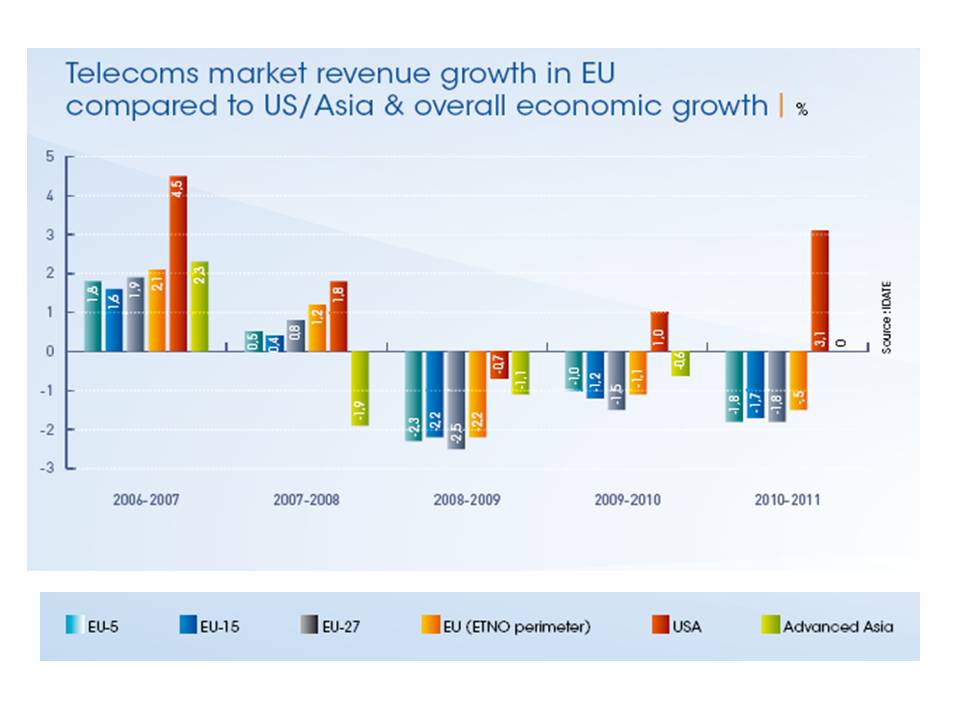

The European telecom service market decreased for the third year in a row, by 1.5 percent, the European Telecommunications Network Operators Association reports. You might blame a tough economy for the contraction, but ETNO points out that in the most-recent year, in a context of moderate economic recovery (+4.2 percent for current gross domestic product in the region), the lagging performance suggests structural changes, not just cyclical economic impact.

But some observers might argue that economic woes are having an impact.

The decline in fixed telephony revenues is accelerating (-8.3 percent in 2011 and –31 percent over the last five years), driven in part by a negative five percent growth of fixed lines in service. Since 2005, fixed line subscribership is down 22 percent. The bad news is that mobile revenues, long the driver of industry growth, also are declining (-0.6 percent)

Mobile voice revenues were down 4.7 percent in 2011 (–13.2 percent over the past three years), a decline driven by significant drops in some large countries: Spain (-8.3 percent),

France (-8.2 percent) and Germany (-7.1 percent).

Fixed network broadband revenue is the bright spot, as revenues were up 6.5 percent in 2011.

Mobile services, though, remain the bulk of telcos revenues, accounting for 52 percent of the total market (142.7 billion EUR in 2011).

The report also shows the divergence between European and the United States market, where it comes to revenue growth. Since 2006, U.S. service providers have done better than their European counterparts.

Precisely why that should be the case is not always so clear. One might argue that European markets are more competitive. One might argue European markets are more fragmented. One might argue that calling and texting tariffs have been higher, since there is more international roaming across Europe, compared to the continent-sized U.S. market.

Certainly, regulators have been squeezing revenue by mandating lower charges for cross-border roaming. Those lower tariffs of course will put pressure on gross revenue.

Moreover, Europe's share of the global telecoms market has been declining regularly over the recent years, from 31 percent in 2005 to just over 25 percent in 2011 as the gap between

global growth (+3.2 percent in 2011) and growth in Europe widens.

So different business strategies will make sense in different markets and parts of markets. Service providers in high-density markets with high per-capita income will be the first to find they must “outgrow” reliance on voice, messaging and even broadband access.

Service providers in low-density, high per-capita income areas will find they can rely on “basic” services for quite some time to come.

Service providers in high-density, low-income areas increasingly will be looking at ways to boost average revenue per user, while providers in low-density, low-income areas generally will be looking at ways to provide basic access services.

In telecom, there is no “one size fits all” strategy.

These days, strategies are diverging. That might especially be true in developed markets, where actual practices have lead to more strategic diversity over the past couple of decades.

Those differences are driven, in large part, by a bifurcation of opportunity in the global telecommunications business, which is predicted by virtually all analysts to be growing, but unevenly.

There are lots of places where phone penetration is 22 percent, for example, or where use of the Internet is about 23 percent, despite the fact that mobile penetration, in terms of “accounts,” now is as high as 79 percent, even in the “developing” countries.

Of course, usage even within a single country or region, and revenue prospects for service providers, are not distributed evenly. Generally speaking, growth opportunities are disproportionately found in the Asia-Pacific region, though Africa and Latin America are growth areas as well.

The obverse is true in much of of the developed world, where classic markets for voice and messaging are saturated, and even mobile broadband, the current growth driver, will face maturation not so long from now. That of course explains the serious and even furious pursuit of new growth drivers by executives in the mobile and fixed network service provider industries.

The European telecom service market decreased for the third year in a row, by 1.5 percent, the European Telecommunications Network Operators Association reports. You might blame a tough economy for the contraction, but ETNO points out that in the most-recent year, in a context of moderate economic recovery (+4.2 percent for current gross domestic product in the region), the lagging performance suggests structural changes, not just cyclical economic impact.

But some observers might argue that economic woes are having an impact.

The decline in fixed telephony revenues is accelerating (-8.3 percent in 2011 and –31 percent over the last five years), driven in part by a negative five percent growth of fixed lines in service. Since 2005, fixed line subscribership is down 22 percent. The bad news is that mobile revenues, long the driver of industry growth, also are declining (-0.6 percent)

Mobile voice revenues were down 4.7 percent in 2011 (–13.2 percent over the past three years), a decline driven by significant drops in some large countries: Spain (-8.3 percent),

France (-8.2 percent) and Germany (-7.1 percent).

Fixed network broadband revenue is the bright spot, as revenues were up 6.5 percent in 2011.

Mobile services, though, remain the bulk of telcos revenues, accounting for 52 percent of the total market (142.7 billion EUR in 2011).

The report also shows the divergence between European and the United States market, where it comes to revenue growth. Since 2006, U.S. service providers have done better than their European counterparts.

Precisely why that should be the case is not always so clear. One might argue that European markets are more competitive. One might argue European markets are more fragmented. One might argue that calling and texting tariffs have been higher, since there is more international roaming across Europe, compared to the continent-sized U.S. market.

Certainly, regulators have been squeezing revenue by mandating lower charges for cross-border roaming. Those lower tariffs of course will put pressure on gross revenue.

Moreover, Europe's share of the global telecoms market has been declining regularly over the recent years, from 31 percent in 2005 to just over 25 percent in 2011 as the gap between

global growth (+3.2 percent in 2011) and growth in Europe widens.

So different business strategies will make sense in different markets and parts of markets. Service providers in high-density markets with high per-capita income will be the first to find they must “outgrow” reliance on voice, messaging and even broadband access.

Service providers in low-density, high per-capita income areas will find they can rely on “basic” services for quite some time to come.

Service providers in high-density, low-income areas increasingly will be looking at ways to boost average revenue per user, while providers in low-density, low-income areas generally will be looking at ways to provide basic access services.

In telecom, there is no “one size fits all” strategy.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Does Movie Piracy Actually Increase Movie Revenues?

Does illegal file sharing of movie content actually increase movie box office revenues? One study suggests that might actually be true, though the magnitude of the revenue lift might be tough to determine.

Researchers say the illegal file-sharing spreads information about content that encourages some users to pay, when they might not otherwise have done so. Content owners won't be impressed, as the self evident fact is that piracy does drive significant revenue loss.

Researchers say the illegal file-sharing spreads information about content that encourages some users to pay, when they might not otherwise have done so. Content owners won't be impressed, as the self evident fact is that piracy does drive significant revenue loss.

In fact, piracy affects many industries. In this one example, the revenues in red represent estimated losses because of piracy.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Why Technology Companies Should Not Pay Taxes

Though it is counter intuitive, consumers actually are better off when corporations do not pay any taxes at all.

They collect taxes on behalf of the taxing authority, but that's it. Taxes are a cost of doing business, like any other, so some other stakeholder winds up paying. The only issue is which stakeholders those are.

A tax requires that the wallet of some human being gets lighter; the study of exactly whose purse it will be is the study of tax incidence.

With respect to the incidence of corporation tax, we have known since 1899 (when Seligman first pointed it out) that the company itself does not ultimately carry that burden. In theory it's some mixture of the customers (who end up with higher prices), the workers (who get lower wages) or the shareholders (who see lower returns).

But there is an argument to be made that it is the workers and the shareholders who, in the end, take the hit.

So to the extent that a person actually cares about economic growth, this matters. To be sure, some people do not apparently actually care about growth, but economic growth is what allows people to earn a living, and supports all government spending. So economic growth really does matter.

A some level, taxes are necessary. But some taxes are harmful because they depress the growth that supports all jobs. Corporate taxation is one of those harmful taxes.

They collect taxes on behalf of the taxing authority, but that's it. Taxes are a cost of doing business, like any other, so some other stakeholder winds up paying. The only issue is which stakeholders those are.

A tax requires that the wallet of some human being gets lighter; the study of exactly whose purse it will be is the study of tax incidence.

With respect to the incidence of corporation tax, we have known since 1899 (when Seligman first pointed it out) that the company itself does not ultimately carry that burden. In theory it's some mixture of the customers (who end up with higher prices), the workers (who get lower wages) or the shareholders (who see lower returns).

But there is an argument to be made that it is the workers and the shareholders who, in the end, take the hit.

So to the extent that a person actually cares about economic growth, this matters. To be sure, some people do not apparently actually care about growth, but economic growth is what allows people to earn a living, and supports all government spending. So economic growth really does matter.

A some level, taxes are necessary. But some taxes are harmful because they depress the growth that supports all jobs. Corporate taxation is one of those harmful taxes.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Subscribe to:

Comments (Atom)

At Alphabet, AI Correlates with Higher Revenue

Though many of the revenue-lifting impacts of artificial intelligence arguably are indirect, as AI fuels the performance of products using ...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...