Technological determinism--the idea that technology shapes culture, society and history, independent of politics, economics, religion or other cultural forces--might mistakenly be applied in the connectivity and computing businesses.

In other words, some might think we have the internet because of personal computers, because of Moore’s Law, because of TCP/IP, digital media, smartphones and tablets. One might think we have e-commerce, affordable video conferencing or social media because of broadband internet access, cloud computing or fiber to the home.

That arguably gets it backwards, as we similarly contend that ubiquitous and high-quality broadband access creates economic growth. The causal relationship is likely the other way: wealth and high rates of economic growth create the demand for quality broadband access, use of smartphones, e-commerce and social media.

Telco network architectures have undergone significant changes since 1970, looking at the basic switching function. But technology change does not seem to explain the revenue and business model shifts that have transformed the industry. Architecture, for example, does not explain the shift to mobile revenues and the decline of fixed network revenue.

In 2023, in most countries, mobile service represents 70 percent to 80 percent of total service provider revenues. At Verizon, for example, mobility represents no less than 55 percent of total revenues while consumer revenues drive 77 percent of revenue.

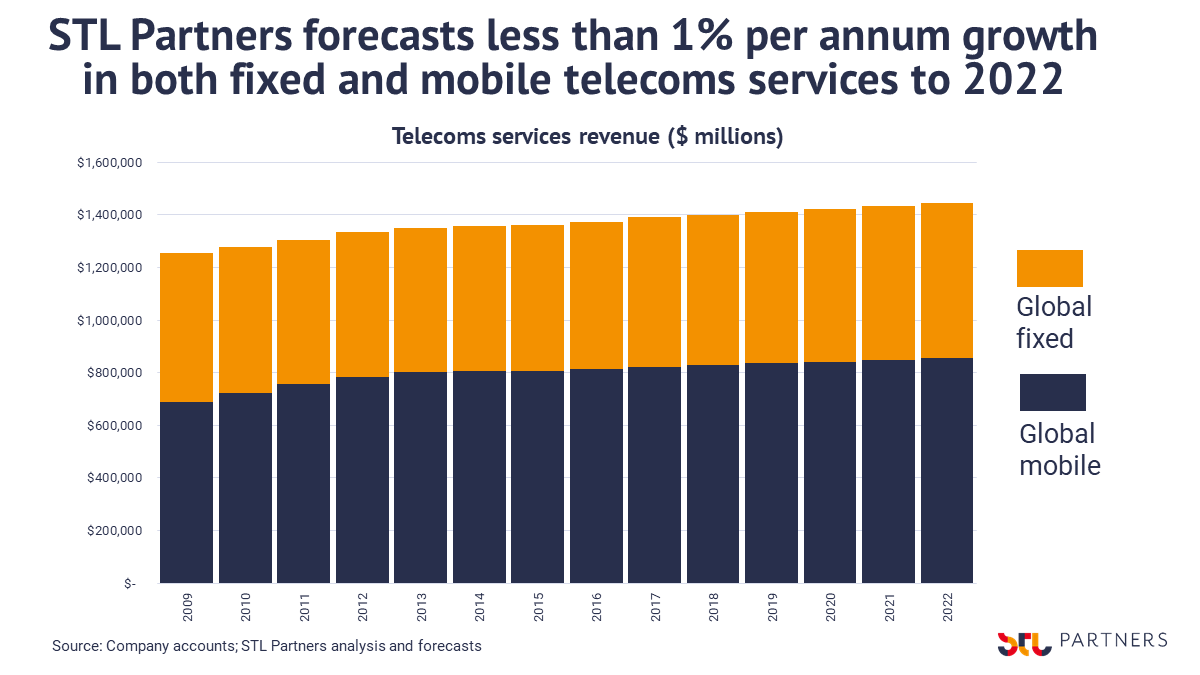

source: STL Partners

Fixed network revenue as reported to the U.S. Federal Communications Commission and based on revenues contributing to the universal service fund. It is skewed downward because mobile service revenues do not contribute to USF at the same rate as do fixed network services.

Instead, demand changes--accelerated by the introduction of competition; the value of mobility and the emergence of the internet--seem to explain the key business model changes. Architectural and physical media and switching evolutions seem less important drivers of business model change.

In the 1970s, for example, telco revenues were dominated by voice services, with the bulk of profit coming from international and long distance calling by business customers.

That began to change a bit in the 1980s, as the conversion to digital switching and Signaling System 7 enabled touch tone dialing, call waiting, call forwarding and voice mail. Some incremental revenues also were generated by business customers using Integrated Services Digital Network.

Business applications such as video conferencing, remote access, and digital phone systems generated new revenue based on use of ISDN.

But the bigger change was the shift of revenue from fixed network services to mobile services in the later 1990s and 2000s.

source: IDATE

The emergence of demand for internet apps and services also displaced voice as the key driver of fixed network revenues.

At least some connectivity providers also added significant revenues from entertainment video services. Cable TV companies always had done so, but added voice, then internet access and mobility services.

Telcos added video to their menus of voice and internet access. By the second decade of the 2000s, mobility and broadband internet access had become the number-one and number-two biggest revenue sources for most access service providers.

Demand changes explain more of the actual revenue shift in the access business since 1970 than the adoption of digital switching or optical fiber access media.

Mobile services substantially displaced the fixed network as the preferred way people make phone calls and use messaging or social media. That, of course, requires use of new mobile networks, but the networks did not drive demand. Demand requires the networks.

Likewise, one might argue that the emergence of the internet drives the demand for broadband access. It is worth noting that consumer demand drives both mobility and broadband access revenue.

Historically, technology innovations or demand for “advanced” services came from business users. That was true for long-distance calling, ISDN and business phone systems, for example.

That pattern held in the early days of mobility, but has reversed. Today, consumer users drive mobility revenue magnitudes. Also, internet access drivers were led, early on, by consumer demand.

The point is that technology changes more often reflect demand changes than cause them. Demand changes, in turn, have been increasingly driven by new value consumers perceive in mobile phones and the internet, with declining value seen in fixed network voice services.

Though one can document changes in network architectures, signaling methods or physical media changes, business model changes have happened for non-network reasons: competition, the value of the internet and mobility.