President Barack Obama is expected to soon nominate a former head of the largest U.S. cable TV and mobile trade organizations to be chairman of the Federal Communications Commission, WSJ.com reports.

Some policy advocates will decry Wheeler's nomination, but he is an acknowledged subject matter expert on both the cable and mobile industries. Others might say an FCC chairman intimately familiar with the funding of new entities should have views about innovation and regulation that could be helpful as the FCC grapples with how to adapt its regulation to a non-monopoly world where innovation can outrun regulatory understanding.

Tuesday, April 30, 2013

Obama to Name Tom Wheeler to Head FCC

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Mexico Telecom Deregulation is Coming

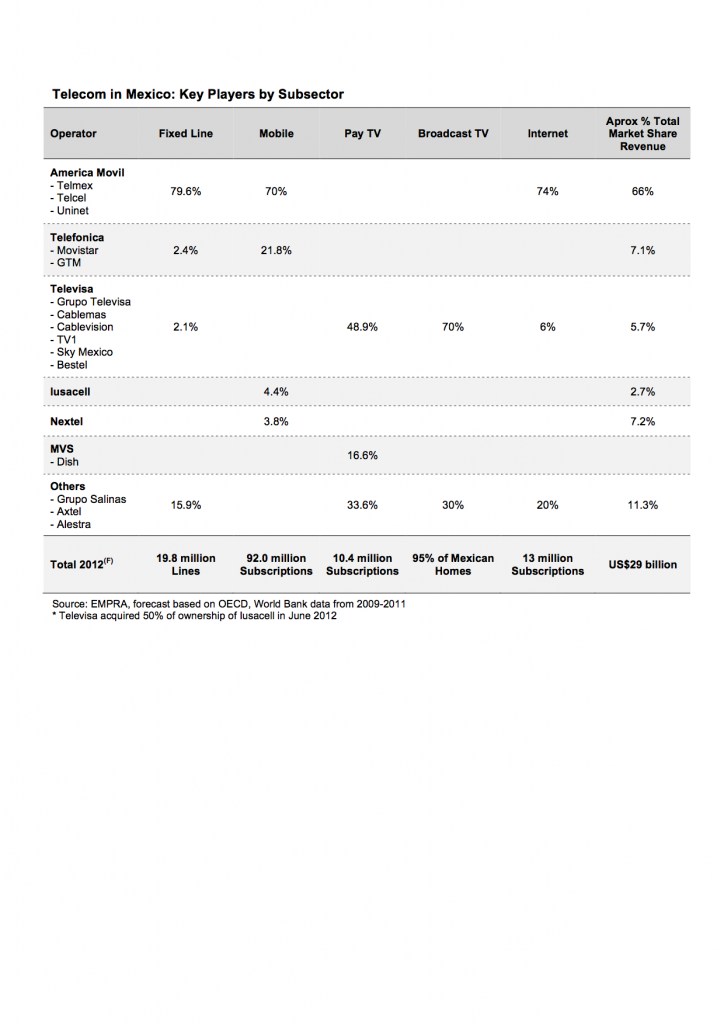

Mexico's telecom and TV markets are about to be disrupted, as the Mexican Senate has passed a bill to create a new communications and media regulator with the power to break up any firms with 50 percent or more market share in either the communications or TV broadcasting markets.

The legislation also ends the current limits on foreign investment in fixed network telephony and television. The law also creates a state-owned wholesale telecom network that would allow rival companies to bypass America Movil, which controls 75 percent of the country's fixed telephone lines and 70 percent of its mobile telephones and broadband accounts.

Televisa is the other target the new regulator will be looking at. Televisa, has around a 70 percent share of the TV market,

The new regulatory body, called the Federal Telecommunications Institute, is expected to be in operation by the end of 2013, with its first actions occurring in the first half of 2014.

Just how much impact the new law will have in promoting competition is not immediately clear, though it is anticipated the new regulator will impose asymmetric rules on contestants that will favor all the smaller competitors and handicap America Movil and Televisa in some way.

The ending of the 49 percent investment cap on foreign firms might, or might not, have too much impact. Telefonica is a possible buyer of some of the smaller providers, as it already has about 22 percent mobile market share.

But international investors have been able to own more than 49 percent of mobile operations in Mexico for some time, and few have shown any appetite to buy into the market on a wider scale.

Possibly two new TV networks are expected to launch as a result of the changes. But there seems more uncertainty about market entry in the telecom business.

Observers might expect one of those new networks to be launched by Carlos Slim, who controls America Movil. Basically, Slim probably will use the new regulatory framework to diversify into television, even if America Movil

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

OTT App Traffic Now Higher than Text Messaging

Over the top messaging now is costing mobile service providers in Spain about €341 million annually. Text messaging revenues in Spain have declined from €1.1 billion (US$1.4 billion) in 2007 to €758.5 million in 2011 (US$991.8 million), says Pamela Clark-Dickson, Informa Telecoms analyst.

Significant losses also have occurred in other markets such as the Netherlands and South Korea.

Region

|

P2P Messaging Traffic (In Billion)

| ||||||||

2010

|

2011

|

2012

|

2013F

|

2014F

|

2015F

|

2016F

|

2017F

| ||

Worldwide

|

P2P SMS

|

5,812

|

6,546

|

6,623

|

6,687

|

6,654

|

6,522

|

6,304

|

5,931

|

OTT Messaging

|

1,494

|

3,840

|

6,774

|

10,452

|

14,970

|

20,437

|

26,359

|

32,141

| |

source:Portio Research

Daily OTT messaging traffic has already overtaken daily P2P SMS traffic in terms of volume, with an average of 19.1 billion OTT messages sent per day in 2012, compared with an average of 17.6 billion person-to-person SMS messages.

By the end of 2013, Informa estimates that 41 billion OTT messages will be sent every day, compared with an average of 19.5 billion P2P SMS messages.

Still, text messaging users vastly outnumber users of OTT apps. There were about 3.5 billion SMS users in 2012, compared with about 586.3 million users of OTT messaging.

Each OTT user sent an average of 32.6 OTT messages a day, compared with just five SMS messages per day per P2P SMS user, meaning that OTT-messaging users are sending more than six times as many messages as P2P SMS users do, says Clark-Dickson.

Still, Informa forecasts that global SMS revenues and traffic will continue to increase through 2016. Other analysts likewise predict the overall percentage of OTT messaging will continue to grow, compared to text messaging. Free is an attractive price point.  Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Monday, April 29, 2013

What Openreach Fiber to Home Prices Suggest About Infrastructure Cost

“Cost” is not “retail price,” but new fiber-on-demand retail prices from Openreach shed at least some light on the costs of a 330 Mbps fiber to premises network.

Openreach requires a fixed installation fee of £500. But most of the connection fee is variable, and is based on distance.

Openreach estimates more than half of premises (55 percent) will incur a distance based charge of between £200 and £1000. Virtually all other premises will face a charge of between £1,400 and £3,500.

It is hazardous to compare costs or retail prices between countries, but the Openreach retail prices translate to U.S. prices of $775 for the fixed install cost. Some 55 percent of locations also would have to pay between $310 and $1551 to get a fiber to home connection, which suggests a gigabit connection might cost somewhat more.

The other 45 percent of locations can expect to pay between $2171 and $5428 to get a fiber to home connection.

So for 55 percent of potential locations, costs might range from $1085 to $2326 to get a 300 Mbps fiber to home connection.

For 45 percent of connections, users might expect to pay between $2946 and $6203. Those are difficult numbers for a consumer connection.

Essentially, were “cost equal to price,” the standard monthly recurring cost of £38 a month ($59 a month) implies breakeven between 18 months to 39 months for 55 percent of locations.

Breakeven might take 50 months to 105 months. But cost is not equal to price.

Assume a designed 40 percent profit margin, suggesting actual breakeven costs for 55 percent of locations might range between $651 in revenue (11 months) to $1396 in revenue (24 months).

In 45 percent of instances, breakeven might occur at revenue between $1768 (30 months) and $3722 (63 months).

Of course, those estimates only describe simple payback on invested capital, with no accouting for the costs of borrowed money, and no profit until after the breakeven point is reached.

But those figures might roughly be in line with what other fiber to home projects might cost in North America, if a $70 monthly recurring cost is assumed.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gigabit Networks Will Destabilize the ISP Market

There are times in the global communications business when stability is the main trend. The first 125 years of telecom history were such times of fundamental stability.

But there are other times when instability and change are the main trends. That might have been said to be the case when global privatization and deregulation happened in the 1980s and 1990s. And instability now is growing with the maturation of voice and the rise of Internet access and mobility as anchor services.

Some might argue growing instability is what we will see over the next decade. Consider only the impact of symmetrical gigabit Internet access service. Quantitative change is not the only issue. Qualitative competitive implications will exist for contestants using different network topologies and access media.

Consider cable operator frequency plans and use of hybrid fiber coax, for example. Executives typically argue that HFC can be upgraded incrementally to support future bandwidths of that sort.

To support gigabit networks, it is argued, fiber is simply extended deeper in the access network, decreasing serving area size by about an order of magnitude, creating the same sorts of advantages mobile operators gain by using a fixed amount of spectrum in a cellular configuration.

Though the least disruptive, such an upgrade might feature per-user peak bandwidth of 100 Mbps, still an order of magnitude slower than Google Fiber’s 1 Gbps, symmetrical. Some say only the high-split and new top-split frequency plans, all featuring more fiber, will support gigabit speeds.

But some might suggest it would be easier to overlay some sort of fiber to home capability than to dramatically change frequency plans now commonly used by U.S. cable operators to support symmetrical gigabit Internet access services. At least so far, most cable executives deem that too expensive an approach.

Though three different frequency plans (low split, mid-split, high split) have been available for decades, virtually all cable operators use the low split plan. Basically, that means frequencies up to 54 MHz are reserved for return signals, while all the rest of the bandwidth up to about 850 MHz is used to support downstream communications and services.

But even traditional “mid-split or high-split networks are not symmetrical. The mid-split frequency plan increases return bandwidth up to about 85 MegaHertz. The high-split network increases return bandwidth to about 200 MHz. The new top-split network offers support for gigabit speeds gigabit speeds.

For cable operators, as for others using radio frequency networks, the challenge symmetrical gigabit services pose is not simply quantitative (more) but qualitative (equal split networks are needed).

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Wi-Fi as Substitute for Mobile Networks: Internet Access is the Difference

Wireless networking is at an inflection point where it can completely replace wired networking everywhere but the data center," said Robert J. Pera, Ubiquiti Networks CEO.

Allowing for a bit of hyperbole, we are probably once again at a point where observers are going to speculate about whether Wi-Fi networks can compete with or displace mobile networks. That debate is not as robust as it once was.

It might not be too early to suggest that such displacement does not make as much sense for voice networking or messaging as for Internet access, where use of fixed access by mobile devices primarily for Internet access is a rather common occurrence.

In fact, Cisco has speculated about the growing relevance of Wi-Fi for several years, in particular because the ways people use the Internet on mobile devices makes Wi-Fi a preferred and normal access method, something that is not quite so true for voice and messaging communications.

Cisco has predicted that Wi-Fi IP traffic will represent 46 percent of all IP traffic in 2015, while mobile IP (using the mobile network) will account for about eight percent of total traffic.

As early as 2010, more than 55 percent of all global public Wi-Fi hotspots offered free access to users.

Also, mobile service providers are starting to embrace Wi-Fi as a meaningful part of their overall network access plans, shifting traffic to Wi-Fi to protect bandwidth needed for fully mobile activities.

In fact, Cisco estimates only 16 percent to 20 percent of mobile device Internet access operations actually happen when people are "on the go" or "out and about." Fully 80 percent of the time, mobile devices are used in the home, in the office or some other indoor location where Wi-Fi will suffice for Internet operations.

Perhaps oddly, mobile remains the foundation for "always connected" voice, messaging and apps, while Wi-Fi increasingly supports extended Internet sessions and media consumption.

Mobile's value remains its "always connected" feature, but Wi-Fi access increasingly handles most of the place-based "mostly connected" Internet requirements.

One feature of Ubiquiti's UniFi 3.0 software is "Zero Hand-Off Roaming." As the name implies, the feature allows users on UniFi networks to roam seamlessly from access point to access point, as is a key feature of mobile networks.

But some ISPs in the future might give much more attention to whether an Internet-access-optimized network is viable and sustainable, compared to full mobile networks. As mobile service providers provide their own Wi-Fi networks, or contract to use other big Wi-Fi networks, might the reverse happen?

Might big Wi-Fi network operators buy roaming on mobile networks, for the times when Wi-Fi users really want fully mobile Internet access? And, if so, does that make Wi-Fi a full substitute for "mobile networks?"

as early as 2010, hugely significant percentages of total device access used the fixed network (Wi-Fi) rather than the mobile network, Analysys Mason has argued.

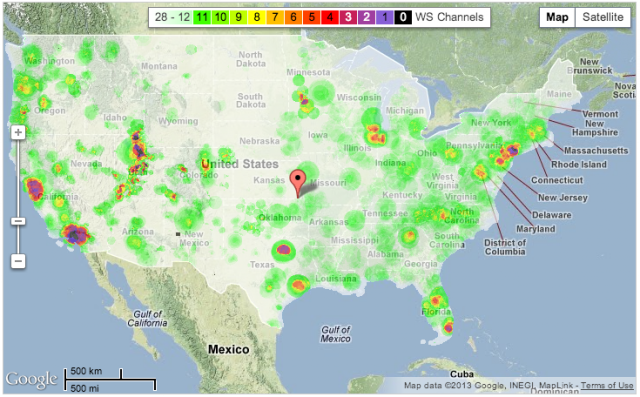

Proportion of mobile network traffic that is generated indoors, by region

Ironically, just as 4G is starting to narrow the gap between mobile broadband and fixed broadband, users--perhaps reacting to the higher cost of mobile broadband--have been using Wi-Fi as a substitute for mobile access.

That works because most “mobile device” Internet access happens at home, with a significant percentage at other locations where it is possible to default ot Wi-Fi access.

Allowing for a bit of hyperbole, we are probably once again at a point where observers are going to speculate about whether Wi-Fi networks can compete with or displace mobile networks. That debate is not as robust as it once was.

It might not be too early to suggest that such displacement does not make as much sense for voice networking or messaging as for Internet access, where use of fixed access by mobile devices primarily for Internet access is a rather common occurrence.

In fact, Cisco has speculated about the growing relevance of Wi-Fi for several years, in particular because the ways people use the Internet on mobile devices makes Wi-Fi a preferred and normal access method, something that is not quite so true for voice and messaging communications.

Cisco has predicted that Wi-Fi IP traffic will represent 46 percent of all IP traffic in 2015, while mobile IP (using the mobile network) will account for about eight percent of total traffic.

As early as 2010, more than 55 percent of all global public Wi-Fi hotspots offered free access to users.

Also, mobile service providers are starting to embrace Wi-Fi as a meaningful part of their overall network access plans, shifting traffic to Wi-Fi to protect bandwidth needed for fully mobile activities.

In fact, Cisco estimates only 16 percent to 20 percent of mobile device Internet access operations actually happen when people are "on the go" or "out and about." Fully 80 percent of the time, mobile devices are used in the home, in the office or some other indoor location where Wi-Fi will suffice for Internet operations.

Perhaps oddly, mobile remains the foundation for "always connected" voice, messaging and apps, while Wi-Fi increasingly supports extended Internet sessions and media consumption.

Mobile's value remains its "always connected" feature, but Wi-Fi access increasingly handles most of the place-based "mostly connected" Internet requirements.

One feature of Ubiquiti's UniFi 3.0 software is "Zero Hand-Off Roaming." As the name implies, the feature allows users on UniFi networks to roam seamlessly from access point to access point, as is a key feature of mobile networks.

But some ISPs in the future might give much more attention to whether an Internet-access-optimized network is viable and sustainable, compared to full mobile networks. As mobile service providers provide their own Wi-Fi networks, or contract to use other big Wi-Fi networks, might the reverse happen?

Might big Wi-Fi network operators buy roaming on mobile networks, for the times when Wi-Fi users really want fully mobile Internet access? And, if so, does that make Wi-Fi a full substitute for "mobile networks?"

as early as 2010, hugely significant percentages of total device access used the fixed network (Wi-Fi) rather than the mobile network, Analysys Mason has argued.

Proportion of mobile network traffic that is generated indoors, by region

Ironically, just as 4G is starting to narrow the gap between mobile broadband and fixed broadband, users--perhaps reacting to the higher cost of mobile broadband--have been using Wi-Fi as a substitute for mobile access.

That works because most “mobile device” Internet access happens at home, with a significant percentage at other locations where it is possible to default ot Wi-Fi access.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Vermont Telephone Sells $35-A-Month Gigabit Internet Access

Though the offer does not have many implications for other Internet service providers not able to get $5371 per home in free money, Vermont Telephone has begun selling 1-Gbps Internet access for $35 a month.

Vermont Telephone serves 17,500 homes, and has gotten $94 million in "broadband stimulus" funds (about $5371 per home) to upgrade its network. It's interesting, but not an example of sustainable nationwide gigabit access precisely because it is built on huge subsidies.

The really important developments are any new ways ISPs can build networks delivering gigabit speeds, without subsidies, with clear and sustainable revenue models.

Vermont Telephone serves 17,500 homes, and has gotten $94 million in "broadband stimulus" funds (about $5371 per home) to upgrade its network. It's interesting, but not an example of sustainable nationwide gigabit access precisely because it is built on huge subsidies.

The really important developments are any new ways ISPs can build networks delivering gigabit speeds, without subsidies, with clear and sustainable revenue models.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Will LTE Reset Consumer Price Expectations?

The cost of mobile phone service in Europe has fallen by 15 percent since 2007, even as they have risen by 25 percent in the United States, at least as measured by “average” monthly phone bills. That is one reason why service providers in Europe hope Long Term Evolution will provide a chance to reset pricing expectations.

European users now spend an average of just 24 euros a month on their mobile phones, according to Sanford Bernstein. Americans spend about two thirds more. Some attribute the difference to the higher phone subsidies in the U.S. market, but at least some of the reason for lower European phone bills is greater erosion of voice revenues.

Voice represented more than 80 percent of revenue in 2007 and now accounts for 62.6 percent of revenue for European firms, according to Informa. And gross revenue is only part of the problem.

Profit margins on that earned revenue also is falling, in most markets, for most providers in Europe, North America and Japan. To be sure, one advantage of LTE is that it is more spectrally efficient, and should allow mobile service providers to offer service at lower costs per bit.

In fact, some might argue that is the primary advantage of LTE, not necessarily the platform for new services. Others would argue that vastly lower latency and much higher speeds so represent an application platform with huge advantages, compared to 3G networks.

The key early test will be whether LTE actually allows mobile service providers to reset consumer expectations about tariffs.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Does Bandwidth Once Again "Want to be Free?"

What is the key implication of Google Fiber selling 1-Gbps symmetrical access for $70 a month? Granted, such offers pose destabilizing and disruptive challenges to any ISPs competing in the markets where Google Fiber exists, or could exist. At the very least, Google Fiber will push other major ISPs to speed up the volume and tempo of their bandwidth upgrades.

But Google Fiber raises, in a new way, an older argument about the impact of Internet technology in a broad sense.

About a decade ago, Bill Gates irritated executives in the communications ecosystem by arguing that “bandwidth wants to be free? ” Others at the time quipped about whether “computing wants to be free?” Others might argue that data wants to be free. And some have been arguing that content wants to be free.

To be sure, Gates meant that bandwidth would not be a constraint to creating new services and apps, as computing cycles and storage had ceased to be a fundamental problem in the software business.

Nor, as it turns out, is it true that computing or information or content always “wants to be free.” But it still is worth considering “what would my business look like?” if communications, bandwidth, computing, storage or information were so available and low cost that those ceased to be constraints to a revenue model.

Such assumptions have immediate consequences for suppliers of those goods, of course. If communications, computing, storage or information wind up being so low in cost that they no longer constrain what can be done, what changes?

Google, Netflix, Amazon, Apple, Facebook, Square and many other examples illustrate what is possible when computing, communications, devices, transactions and information suddenly cease to be barriers.

But Gates was substantially correct. How many these days would argue against the notion that most public Wi-Fi access is substantially free?

“You can’t use today’s technology constraints to predict tomorrow’s developments,” says Amadeus Consulting CTO John Basso. That fundamental insight, based in large part on Moore’s Law, might once again be more important than often is believed.

You could argue whole businesses now are built on the assumption that technology (especially hardware) constraints disappear over time. All cloud-based apps are built on such assumptions.

In 2004, Gates argued that “10 years out, in terms of actual hardware costs you can almost think of hardware as being free — I’m not saying it will be absolutely free — but in terms of the power of the servers, the power of the network will not be a limiting factor,” Gates has argued.

You might argue that is a position Gates adopted recently. Others would argue that has been foundational in his thinking since Micro-soft was a tiny company based in Albuquerque, New Mexico in 1975.

Young Bill Gates reportedly asked himself what his business would look like if hardware were free, an astounding assumption at the time. In inflation-adjusted terms, an Apple II computer of 1977 would have cost $5,174, for example.

Though there are lots of entrepreneurs advocating or working on new ways to make bandwidth available to end users, both in consumer and business settings, Google Fiber arguably has the potential to radically remake expectations in the Internet access space, in part because of its high profile and assets. It sometimes might take a very well-heeled entity (such as Apple) to change or disrupt an industry, and Google is such a firm.

In the same way that Gates has argued that hardware will not be a limiting factor for what can be done with computing, you might argue that Google Fiber once again raises the same question for communications. Granted, $70 a month is not free. But $70 for a symmetrical gigabit access service, in a decade, might be the equivalent of “so affordable that access no longer is a constraint.”

That is what Google wants, and that is what Google Fiber seems to be encouraging, in a serious new way.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Friday, April 26, 2013

12% of Internet, App Activities Occur on Mobiles

As a result, 12 percent of total time spend consuming media, using apps and the Internet now happens on mobiles.

In 2012, the amount of time U.S. consumers spent using mobile devices excluding talk time, grew 52 percent to an average of 82 minutes per day, up from just 34 minutes in 2010, eMarketer says.

Time spent with "online" (non-mobile) apps and activities grew 3.6 percent to an average 173 minutes per day, compared to 7.7 percent growth in 2011 to 167 minutes per day.

Mobile will have the higher growth rates, in part because mobile usage starts from a low installed base, and in part because more mobile devices are being used for Internet and mobile app activities.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

U.K. to Test White Spaces in Third Quarter of 2013

Ofcom, the U.K. communications regulator, plans to test “white spaces” technology in the United Kingdom in the fall of 2013.

White spaces are frequencies otherwise used for digital terrestrial TV broadcasting and wireless microphones, but which for reasons of frequency planning are not actually used in particular areas. Think of the way a cellular network is built, reusing frequencies by spatially dividing them.

The actual amount of available spectrum will be available in rural areas, if U.S. experience holds. In urban markets, it is possible that only a few 6-MHz channels will be available. Perhaps perversely, it also is possible that tens to scores of 6-MHz channels will be available in isolated or rural areas.

But progress probably will be relatively slow, as a full ecosystems of end user devices and infrastructure has to be built, meaning relatively high prices for devices and infrastructure in the near term.

White spaces takes advantage of similar interference protection schemes where the same frequencies are not used in adjacent areas.

Among expected applications for white spaces are broadband access for rural communities, Wi-Fi services or new “machine-to-machine” networks.

Ofcom anticipates that the technology could be fully rolled out during 2014.

Ofcom separately is planning to free up more spectrum in the future for fifth generation mobile networks (5G).

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

AT&T Digital Life Launches in 15 Cities

AT&T Digital Life puts AT&T into the home security and energy and water management businesses in a big way, launching in 15 U.S. cities, with a plan to serve 50 cities by the end of 2013.

Presumably the service will work anywhere AT&T's wireless network reaches, and also uses any broadband connection as well.

It's a big test of market demand for machine-to-machine services, especially with Comcast and Time Warner Cable offerings slated for commercial launch as well.

Presumably the service will work anywhere AT&T's wireless network reaches, and also uses any broadband connection as well.

It's a big test of market demand for machine-to-machine services, especially with Comcast and Time Warner Cable offerings slated for commercial launch as well.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

8% of Canadian Households Have Cut Video Cord

As other analysts have noted, perhaps the bigger problem is people and households that simply never sign up for a video service when they set up their households. Such households might not own a TV. But even some households that own a TV do not use it, Nielsen estimates.

In fact, perhaps 75 percent of homes that no longer watch over the air or video subscription services actually own at least one TV.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Global Smart Phone Sales Top Feature Phones for First Time

In the first quarter of 2013, global sales of smart phones outpaced feature phones for the first time, according to International Data Corp.

In the worldwide smart phone market, suppliers shipped 216.2 million units in the first quarter of 2013, representing 51.6 percent of the total phone shipments the quarter.

In fact, some might say smart phones now are simply a device that should be tracked with other computing devices. "Phone users want computers in their pockets,” said Kevin Restivo, IDC senior research analyst.

The days where phones are used primarily to make phone calls and send text messages are quickly fading away," he said. "As a result, the balance of smart phone power has shifted to phone makers that are most dependent on smart phones."

Top Five Total Mobile Phone Vendors, Shipments, and Market Share, 2013 Q1 (Units in Millions)

Vendor

|

Shipments

|

Market Share

|

1Q12 Shipments

|

1Q12 Share

|

Change

|

Samsung

|

115.0

|

27.5%

|

93.6

|

23.3%

|

22.9%

|

Nokia

|

61.9

|

14.8%

|

82.7

|

20.6%

|

-25.1%

|

Apple

|

37.4

|

8.9%

|

35.1

|

8.7%

|

6.6%

|

LG

|

15.4

|

3.7%

|

13.7

|

3.4%

|

12.4%

|

ZTE

|

13.5

|

3.2%

|

16.2

|

4.0%

|

-16.5%

|

Others

|

175.4

|

41.9%

|

161.1

|

40.0%

|

8.9%

|

Total

|

418.6

|

100.0%

|

402.4

|

100.0%

|

4.0%

|

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Subscribe to:

Posts (Atom)

Some Problems Just Cannot be Fixed: Lumen Technologies, for Example

Some problems are nearly impossible to fix. Consider Lumen Technologies, a mashup of the former Level 3 Communications capacity business and...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...