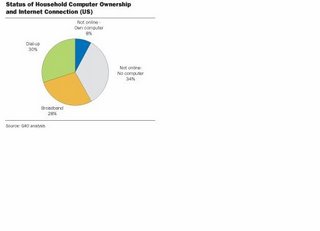

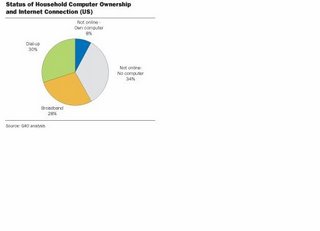

A commentator recently noted that "Some 62 million Americans are still using their telephone lines to dial into the Internet, according to recent figures from the Pew Internet and American Life Project. The direct implication is that U.S. consumers suffer from woeful broadband availability. Other figures from research firms like Forrester show that only about 40% of Americans have high-speed connections at home, 30% rely on dial-up and 25% don’t have any Internet connections at all.

"So how come the US is lagging behind most of the developed world in broadband access?," the commentator asks.

The problem with such thinking is that it likely is completely wrong. Sure, broadband bandwidths started out pretty low. But they are going up fast. And per-capita broadband consumption in the U.S. market does lag many other countries.

And sure, we'd have much higher penetration of just about anything if we are willing to subsidize it.

Where one starts doesn't matter. Where one ends is the issue. And there's ample historical evidence to suggest broadband adoption isn't an actual issue, from the perspective of where we will wind up. And one might point out that it is far easier to do something in a small country than across a whole continent, as a completely practical matter.

First of all, history actually suggests that innovations useful to consumers get adopted. Period. When people want something, they buy it. There's a demand element here, not simply a supply dimension.

What isn't useful doesn't get used. And many important communications innovations--including the Internet, cable TV, TV, radio, compact disk audio and DVD players, for example--have in fact propagated exceedingly rapdily with no much regulation besides spectrum allocation, RF emissions control and some amount of franchising, in some cases.

Things people don't find as useful, such as C-band satellite dishes, eight-track tape players, "videotext" and so forth, just don't make it because people don't find them useful enough, over time.

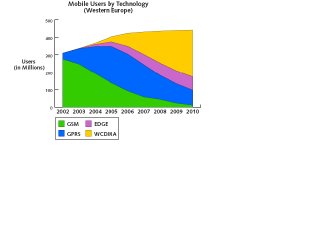

Then there are the examples of innovations such as mobile phone use, where U.S. consumers lagged far behind customers in other countries before penetration grew spectacularly. Something along the same lines appears to be happening with short message service: slow, under-par adoption followed by acceleration that ultimately closes the usage gap.

The point is that the same sort of alarmist fears were raised about mobile phone usage itself. And that doesn't seem to be any sort of problem at the moment. So maybe some perspective is in order. If "25 percent" of U.S. homes have no Internet access at all, that might be because 25 to 30 percent of U.S. homes have no personal computers in them.

And if telcos and cable companies keep adding customers at the furious pace they now are racing at, there won't be any homes with PCs left to convert to broadband in just several years.

It might be easy, convenient and satisfying to complain about broadband adoption. But it is wrong to ignore the evidence. And the evidence, both historical and current, suggests that broadband penetration is accelerating exceedingly sharply.

And, oh by the way, some people don't want to buy broadband yet. We'll fix that, in a bit. But just because people don't buy as much of any product as the producer would like does not mean there is market failure. It means people don't want a product, priced and packaged the way it currently is. There could be lots of good reasons for those decisions. And they are persuadable. But the problem isn't necessarily or primarily market structure and regulation.

Just like all those other communications-related services we now cannot live without, we will have virtually ubiquitous, high-quality broadband at affordable prices. It would be ahistorical to suggest anything else, and requires abandonment of any actual direct observation of current broadband adoption rates.

About 4 percent of American mobile phone owners aged 12 and older have downloaded full digital music songs over-the-air in the past 30 days, doubling proportions seen in 2005, says Ipsos North America. Males are twice as likely as females to have ever downloaded full songs. Teens are the most likely to have ever done so (11%), with younger adults 18 to 34 being the next most likely (8% among 18 to 24 year olds and 7% among those 25 to 34).

About 4 percent of American mobile phone owners aged 12 and older have downloaded full digital music songs over-the-air in the past 30 days, doubling proportions seen in 2005, says Ipsos North America. Males are twice as likely as females to have ever downloaded full songs. Teens are the most likely to have ever done so (11%), with younger adults 18 to 34 being the next most likely (8% among 18 to 24 year olds and 7% among those 25 to 34).