Sometimes end user demand and supplier readiness are not the primary near-term issues that can accelerate or delay adoption of new technologies.

European privacy rules, multi-country business processes, a deep euro crisis and a lingering recession will conspire to delay cloud computing adoption in Europe by at least two years when compared to the U.S., according to Gartner analysts.

Gartner said that although interest in cloud is high in Europe, the diversity of Europe’s 44 different nations will result in slow cloud adoption in this region.

"The opportunities for cloud computing value are valid all over the world, and the same is true for some of the risks and costs," said Paolo Malinverno, vice president at Gartner. "However, some of cloud computing’s potential risks and costs — namely security, transparency and integration — which are generally applicable worldwide, take on a different meaning in Europe.”

The continuing economic crisis within the countries using the single European currency has deep IT implications, because increasing uncertainty about the euro is causing major investments to be put on hold.

This is slowing down decision making and will dampen spending.

Thursday, May 31, 2012

Cloud Adoption in Europe Will Slow Because of Euro Crisis, Other Issues

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Wednesday, May 30, 2012

How Big Will M2M, Connected Device Markets Be?

Some say tablets, though "connected devices," are not M2M connections, which should properly include only sensor applications where machines literally are talking to other machines.

The revenue per connection implications are fairly significant. Where a tablet connection could represent $10 to $60 worth of incremental revenue, a true M2M connection might represent $2 for each connection.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Revenue Impact of Multi-Device Data Plans is Not Yet Clear

“Multi-device” or family data plans, which allow numerous devices to share a single bucket of broadband access, are coming to the U.S. market. Precisely how consumers will react is not yet clear.

In the case of family voice plans, there was a net increase in users per account, so even if average revenue per user declined for the additional lines, service providers earned more revenue overall.

What will happen in the case of multi-phone households is not so clear, since there is a strong likelihood users will sign up for plans to support their tablets, especially single-user accounts.

What might happen in existing multi-device accounts is not so clear. Depending on how the plans are constructed, there could be some revenue losses if the subsidiary devices on an account were moved to a family data plan, instead of separate data plans for each device.

The big trade-offs will likely come in the multi-device family accounts, where the upside will come from additional new devices, especially tablets, being added to plans, with the risk of some diluted revenue from the older smart phone mobile data plans attached to each discrete phone.

The big upside is smart phone adoption. Though about half of U.S. mobile users already have smart phones, nearly half do not. Family data plans could convince more of those non-adopters to upgrade to smart phone service, meaning they also would likely want data access. The effective lower prices for new users could provide new incentive to upgrade sooner rather than later.

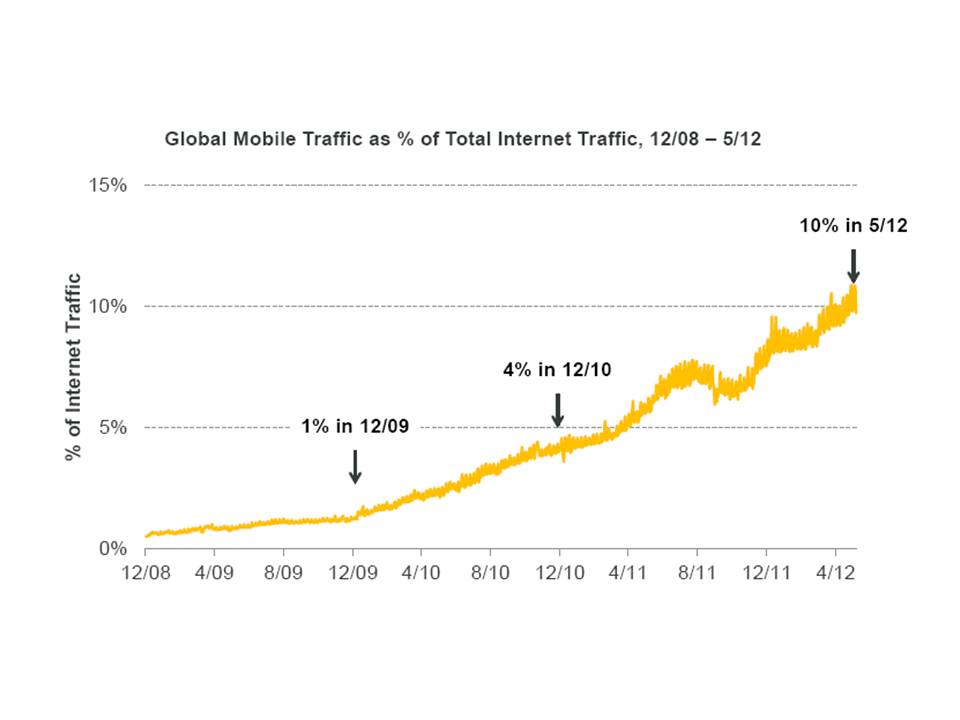

KPCB Internet Trends - 2012

In the case of family voice plans, there was a net increase in users per account, so even if average revenue per user declined for the additional lines, service providers earned more revenue overall.

What will happen in the case of multi-phone households is not so clear, since there is a strong likelihood users will sign up for plans to support their tablets, especially single-user accounts.

What might happen in existing multi-device accounts is not so clear. Depending on how the plans are constructed, there could be some revenue losses if the subsidiary devices on an account were moved to a family data plan, instead of separate data plans for each device.

The big trade-offs will likely come in the multi-device family accounts, where the upside will come from additional new devices, especially tablets, being added to plans, with the risk of some diluted revenue from the older smart phone mobile data plans attached to each discrete phone.

The big upside is smart phone adoption. Though about half of U.S. mobile users already have smart phones, nearly half do not. Family data plans could convince more of those non-adopters to upgrade to smart phone service, meaning they also would likely want data access. The effective lower prices for new users could provide new incentive to upgrade sooner rather than later.

KPCB Internet Trends - 2012

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Globally, Mobile IS Telecom

Mary Meeker's "Internet Trends" presentation always contains interesting graphical nuggets.

Mary Meeker's "Internet Trends" presentation always contains interesting graphical nuggets. This one simply illustrates the extent to which mobility now has become "the telecom business."

Three years ago, there already were about 4.5 mobile lines in service for every fixed line, and that ratio no doubt has continued to tip in the favor of mobile in the intervening years.

Observers who casually chide fixed network operators for not investing more heavily in fiber to wherever those firms can make money are not paying attention to the fundamental realities that further investment in fixed network assets will be much more risky than it ever has been in the past, simply because "everybody" knows the revenue and growth are in the mobile networks.

"Stranded assets" are investments that aren't generating any revenue. These days, a good percentage of any further fixed network investment is going to be stranded. That makes companies nervous, and it should.

A rational executive would invest "mobile first."

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

S&P Wonders How Long U.S. Telecom Companies Can Maintain Current Dividends

Standard & Poors believes many U.S. telecommunications companies, traditional wireline

companies in particular, face industry trends that will ultimately hurt free operating cash flow generation and could make it challenging to maintain their aggressive financial policies.

"Returning cash to shareholders through dividends and share buybacks and the pressure to satisfy equity investors lessens their ability to pay back debt and maintain or reduce leverage," said Standard & Poor's credit analyst Allyn Arden.

"These companies may need to adopt more conservative financial policies and reduce leverage to be able to maintain their current ratings down the line," Arden warns.

companies in particular, face industry trends that will ultimately hurt free operating cash flow generation and could make it challenging to maintain their aggressive financial policies.

"Returning cash to shareholders through dividends and share buybacks and the pressure to satisfy equity investors lessens their ability to pay back debt and maintain or reduce leverage," said Standard & Poor's credit analyst Allyn Arden.

"These companies may need to adopt more conservative financial policies and reduce leverage to be able to maintain their current ratings down the line," Arden warns.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

An "uh oh" Moment for Online Advertising Proponents

The standard argument about online advertising volume, for decades, has been that, over time, "eyeballs" (audiences) lead to advertising. It's a reasonable argument. So the next challenge is that, if online audiences and proportional advertising to those audiences begin to hit a 1:1 relationship, it is hard to argue that lots more revenue growth is possible, in the near term.

To get more ad revenue, online sites would have to grow their audiences. According to Mary Meeker, online share of advertising spend now is very close to online's share of media audience.

That would suggest it is unreasonable to expect online advertising revenues to grow very fast, or much more beyond present levels, unless audience attention really shifts lots more.

The one place where there is a clear gap is the mobile venue, where advertising dramatically lags attention, by about an order of magnitude.

It takes no special insight to predict that attention now will be focused squarely on mobile advertising, as it remains the channel where revenues most lag attention. Conversely, print is the medium where spending is vastly overdone, in terms of audience attention.

The "bad" news is that we should be watching for signs that online advertising revenues begin to decelerate, in terms of growth.

KPCB Internet Trends - 2012

To get more ad revenue, online sites would have to grow their audiences. According to Mary Meeker, online share of advertising spend now is very close to online's share of media audience.

That would suggest it is unreasonable to expect online advertising revenues to grow very fast, or much more beyond present levels, unless audience attention really shifts lots more.

The one place where there is a clear gap is the mobile venue, where advertising dramatically lags attention, by about an order of magnitude.

It takes no special insight to predict that attention now will be focused squarely on mobile advertising, as it remains the channel where revenues most lag attention. Conversely, print is the medium where spending is vastly overdone, in terms of audience attention.

The "bad" news is that we should be watching for signs that online advertising revenues begin to decelerate, in terms of growth.

KPCB Internet Trends - 2012

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Internet Will Be Four Times as Large in Four Years, Cisco Says

.jpg) Annual global Internet traffic in 2016 will be four times the volume of 2011, Cisco says.

Annual global Internet traffic in 2016 will be four times the volume of 2011, Cisco says.The annual Cisco Visual Networking Index Forecast predicts annual global IP traffic of 1.3 zettabytes – (a zettabyte is equal to a sextillion bytes, or a trillion gigabytes).

The projected increase of global IP traffic between 2015 and 2016 alone is more than 330 exabytes, which is almost equal to the total amount of global IP traffic generated in 2011 (369 exabytes).

The growth will be driven by:

- An increasing number of devices: The proliferation of tablets, mobile phones, and other smart devices as well as machine-to-machine (M2M) connections are driving up the demand for connectivity. By 2016, the forecast projects there will be nearly 18.9 billion network connections―almost 2.5 connections for each person on earth, ― compared with 10.3 billion in 2011

- More Internet users: By 2016, there are expected to be 3.4 billion Internet users ― about 45 percent of the world's projected population according to United Nations estimates.

- Faster broadband speeds: The average fixed broadband speed is expected to increase nearly fourfold, from 9 megabits per second (Mbps) in 2011 to 34 Mbps in 2016.

- More video: By 2016, 1.2 million video minutes―the equivalent of 833 days (or over two years) ―would travel the Internet every second.

- Wi-Fi growth: By 2016, over half of the world's Internet traffic is expected to come from Wi-Fi connections.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Subscribe to:

Posts (Atom)

Agentic AI Should Change Computing Infrastructure: Issue is How Much

Agentic artificial intelligence, eventually featuring teams of autonomous agents working in concert, should have some obvious impact on comp...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...