There can be no denying that connectivity providers would love to transform their business models in ways that represent more value and command higher market prices. It is natural that 5G would be seen as a tool in that process. But hopes often do not match reality.

“There is a strong consensus that 5G’s greatest commercial feature will shift away from acting purely as a connectivity pipe, says Telecoms.com. Such beliefs can be both reasonable and inconsequential at the time.

Ultra low latency performance might be both an important or key feature, and yet also have only slight impact on the ability of connectivity providers to escape their role.

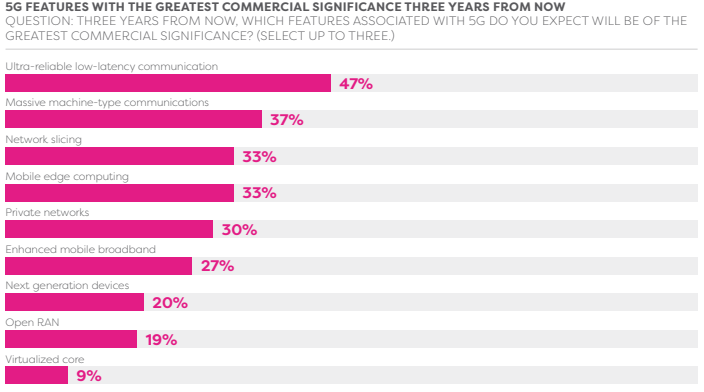

A survey of executives found industry insider belief that low-latency, sensor communications, network slicing and edge computing capabilities with most commercial significance. Again, that can be simultaneously true and yet very impactful in terms of revenue generation or ability to enhance value and role in the ecosystem.

source: Telecoms.com

As with most other features and capabilities, 5G can be a source of competitive differentiation when other competitors cannot match a particular feature as well. At the same time, the amount of differentiation is inherently limited, as all competitors have access to the same platforms.

Spectrum assets, on the other hand, provide a clearer case of differentiation, where ownership of licenses for various types of spectrum is disparate. T-Mobile, for example, has so far been able to leverage its greater mid-band spectrum resources against rivals whose positions still are developing.

As always, much hinges on how customers and users behave. The values of ultra-low latency performance, for example, can be obtained in various ways, not always to the revenue benefit of mobile operators. Network slicing value can be replicated in some instances by enterprise edge computing. The same is true of ultra-low latency and predictability, which can be created by private networks as well as 5G public networks; edge computing or private 5G.

It is understandable that industry executives hope for revenue and role outcomes that help service providers augment their connectivity role. Those hopes are likely to be hard to fulfill.

Even if network slicing, edge computing, private networks and sensor network support generate some incremental revenues, the volume of incremental revenue will not be as large as many hope to gain.

It is conceivable that mobile operators globally will make more money providing home broadband using fixed wireless than they will earn from the flashier, trendy new revenue sources such as private networks, edge computing and internet of things.

source: Ericsson

Wells Fargo telecom and media analysts Eric Luebchow and Steven Cahall predict fixed wireless access will grow from 7.1 million total subscribers at the end of 2021 to 17.6 million in 2027, growth that largely will come at the expense of cable operators.

source: Polaris Market Research

If 5G fixed wireless accounts and revenue grow as fast as some envision, $14 billion to $24 billion in fixed wireless home broadband revenue would be created in 2025.

5G Fixed Wireless Forecast |

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

Revenue $ M @99% growth rate | 389 | 774 | 1540 | 3066 | 6100 | 12140 | 24158 |

Revenue $ M @ 16% growth rate | 1.16 | 451 | 898 | 1787 | 3556 | 7077 | 14082 |

source: IP Carrier estimate |

Consider the U.S. market. By some estimates, U.S. home broadband generates $60 billion to more than $130 billion in annual revenues.

If the market is valued at $60 billion in 2021 and grows at four percent annually, then home broadband revenue could reach $73 billion by 2026. $24 billion would represent about 33 percent of total home broadband revenues.

|

| 2022 | 2023 | 2024 | 2025 | 2026 |

Home Broadband Revenue $B | 60 | 62 | 65 | 67 | 70 | 73 |

Growth Rate 4% |

|

|

|

|

|

|

Higher Revenue $B | 110 | 114 | 119 | 124 | 129 | 134 |

source: IP Carrier estimate |

If we use the higher revenue base and the lower growth rate, then 5G fixed wireless might represent about 10 percent of the installed base, which will seem more reasonable to many observers.

Assuming $50 per month in revenue, with no price increases at all to 2026, 5G fixed wireless still would amount to about $10.6 billion in annual revenue by 2026 or so. That would have 5G fixed wireless representing about 14 percent of home broadband revenue, assuming a total 2026 market of $73 billion.

If the home broadband market were $134 billion in 2026, then 5G fixed wireless would represent about eight percent of home broadband revenue.

Do you believe U.S. mobile operators will make more than $14 billion to $24 billion in revenues from edge computing, IoT or private networks?

Nor might private networks or edge computing revenues be especially important as components of total revenue. It is almost certain that global service provider revenues from multi-access edge computing, for example, will be in the single-digit billions ($ billion) range over the next few years.

The same is true of forecasts of service provider internet of things revenue. The service provider 4G or 5G private networks revenue stream is likely to be small as well.

All that implies that 5G fixed wireless might be the most-material--and largest--source of new service revenues for mobile operators.

Some estimates have total MEC revenues exceeding $25 billion by perhaps 2027 and close to $70 billion by 2032. Other estimates suggest annual revenue of close to $17 billion by 2027.

But those forecasts virtually always lump together revenues earned by hardware, software and services suppliers: infrastructure and platform plus computing as a service revenues. And computing as a service revenues will likely be dominated by hyperscalers, not mobile operators.

Connectivity providers will profit from real estate support and some increase in connectivity revenues, but relatively rarely from the actual “edge computing as a service” revenues.

For example, assume 2021 MEC revenues of $1.6 billion globally; a cumulative average growth rate of 33 percent per year; services share of 30 percent; telco share of service revenue at 10 percent.

Multi-access Edge Computing Forecast |

Year | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

Revenue $B | 1.6 | 2.1 | 2.8 | 3.8 | 5.0 | 6.7 | 8.9 | 11.8 |

Services Share | 0.3 | 0.6 | 0.8 | 1.1 | 1.5 | 2.0 | 2.7 | 3.5 |

Growth Rate | 0.33 |

|

|

|

|

|

|

|

Telco Share | 0.1 |

|

|

|

|

|

|

|

Telco Revenue | 0.2 | 0.2 | 0.3 | 0.4 | 0.5 | 0.7 | 0.9 | 1.2 |

source: IP Carrier |

The actual MEC revenue from MEC is quite small by 2028. In fact, too small to measure. Of course, all forecasts are about assumptions.

One can assume higher or lower growth rates; different amounts of connectivity provider participation in the services business; different telco shares of the actual “computing as a service” revenue stream; greater or lesser contributions from mobile connectivity revenue from MEC.

The point is that actual MEC revenues earned by mobile operators or other connectivity providers might actually be quite low. So value earned from all those infrastructure investments would have to come in other ways.

Higher subscription rates; higher profit margins; lower churn; higher average revenue per account are some of the ways MEC could provide a return on invested capital. Some service providers might actually provide the “computing as a service” function as well, in which case MEC revenues could be two to three times higher.

But many observers are likely to be disappointed by the actual direct revenue MEC creates for a connectivity provider.