Nobody yet knows whether artificial intelligence will mostly reinforce or disrupt advertising markets, much as nobody could have predicted huge shake ups in advance of Google or social media emerging. But it seems entirely possible that AI will assist some channels more than others in gaining or keeping their market share.

That already seems to be happening.

As use of third-party cookies dwindles, another shift in ad placement will follow, further boosting commitments to big retailers who possess actual first-party buyer data. And while internet app and content sites will continue to drive most of the spending, the biggest growth will be advertising on major retailer sites.

By 2030, forecasters expect major retailers to be scooping up as much as 28 percent of all U.S. advertising spend.

Channel/Venue | Estimated Spend (USD Billion) | Source |

Internet Apps & Content Sites | 520 | Statista, eMarketer, Interactive Advertising Bureau (IAB) |

Major Retailer Sites | 290 | Statista, eMarketer, Forrester |

TV Broadcast Networks | 35 | Statista, Nielsen |

Cable TV Networks | 25 | Statista, Nielsen |

Out-of-Home Advertising | 70 | Statista, Out of Home Advertising Association of America (OAAA) |

Radio & Podcast Advertising | 30 | Statista, IAB |

Print Media | 10 | Statista, Pew Research Center |

Other Channels | 45 | Industry reports, expert estimates |

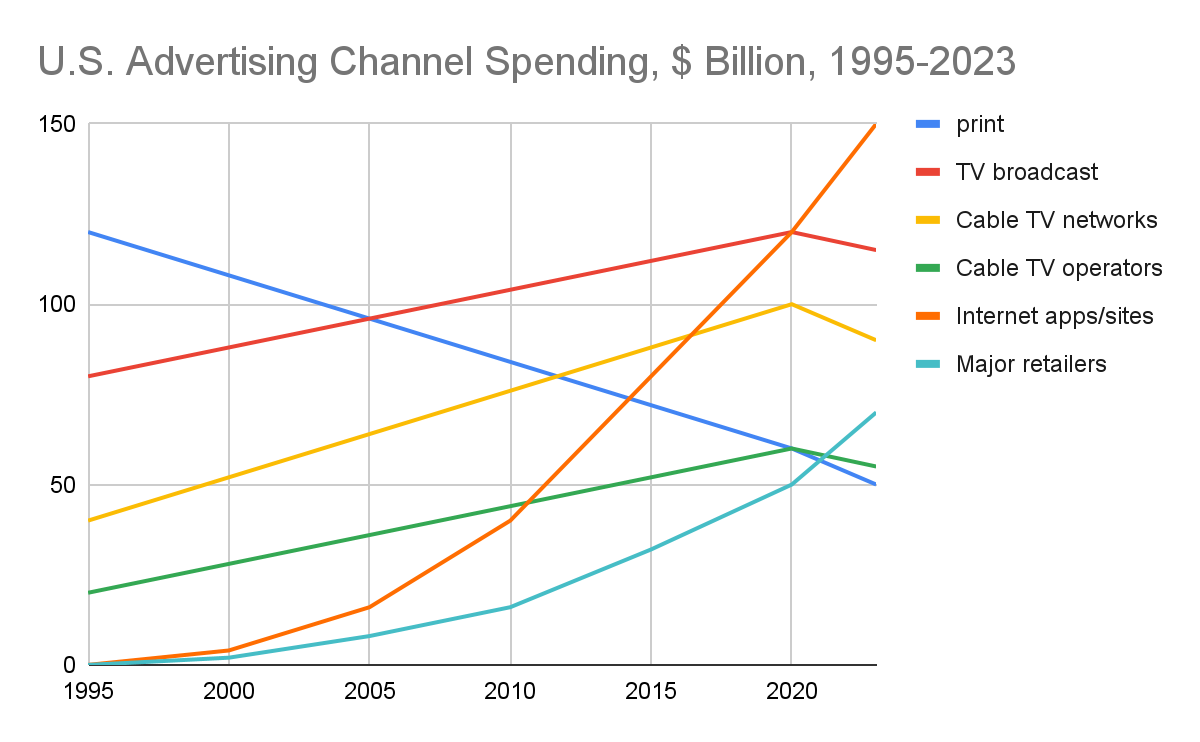

If one assumes ad revenue since 1995 was earned by different segments including print media, TV broadcasters, cable TV networks, cable TV operators, internet apps and content sites as well as major retailers, the general conclusions would be that print media commitments have shrunk, while revenues earned by the other (mostly electronic) segments have grown.

Ad volume is dominated now by internet apps and content sites, as well as major retailer channels, which is a big change for advertisers accustomed to using formal media channels. In fact, for some of us, the growth of retailer channels is the biggest surprise.

Media Channel | Annual Spending (USD Billion) | Percentage Share |

|---|

Internet Apps & Content Sites | 300 | 52.19% |

|---|

Major Retailer Sites | 120 | 21.04% |

TV Broadcast Networks | 49.2 | 8.55% |

Cable TV Networks | 32.5 | 5.65% |

Out-of-Home Advertising | 40 | 7.01% |

Radio & Podcast Advertising | 20 | 3.48% |

Print Media | 19.25 | 3.35% |

Advertising at one time underpinned media business models. Today it underpins technology and retailer business models. By 2030, as much as 78 percent of advertising will be going to technology and major retailer firms, while media claims only about 16 percent, including outdoor media such as billboards and displays.

All that assumes that artificial intelligence will only reinforce existing trends, and not disrupt them. In other words, if AI aids hyper-personalization, predictive targeting, dynamic content optimization or programmatic platforms, it might only reinforce existing trends.

Likewise, voice interfaces, immersive venues or context awareness should only reinforce existing trends.

Most observers likely see AI as driving more effectiveness for current methods (targeting, personalization, behavior-based inferences) than creating entirely new venues for placements.

There is one major caveat. If AI somehow creates new venues, channels or platforms, we could be looking at vastly-different spending patterns in a couple of decades, much as the internet created alternative platforms and venues.