Does the U.S and French mobile business have “too many” or “too few” contestants? And no matter which view is taken, on what basis are informed judgments made?

Consider the rival bids being made by Altice, owner of French cable concern Numericable, and Bouygues, a leading French mobile operator, for the assets of Vivendi’s SFR mobile business.

In the wake of a decision by SFR to negotiate exclusively with Altice, Bouygues had been expected to pursue a merger with Iliad, which owns France's fourth mobile operator, Free Mobile.

Observers say regulatory risk is an important element of SFR thinking. A Bouygues purchase of SFR would reduce the number of national mobile providers from four to three, while French regulators prefer a minimum of four providers.

In that view, a purchase of SFR by a cable company would be preferable to reducing the number of mobile service providers. Of course, some would argue the mobile segment currently has too many contestants for a stable, healthy, longer term market that remains competitive.

In the U.S. market, Sprint has been sounding out regulators about a potential bid by Sprint to acquire T-Mobile US. By all accounts, U.S. Federal Communications Commission and antitrust authorities at the Department of Justice are skeptical about such a potential merger.

The reasons fundamentally are the same as in France: regulators have more confidence in a four-player market than a three-provider market, in terms of maintaining robust competition.

The problem is that there is no way to know, in advance, which position--the market is too concentrated, or the opposite market is not concentrated enough--is correct, in terms of maintaining both robust competition and also incentives for continual investment.

In fact, globally, a “rule of three” already seems manifest. That is to say, in any mature industry, three suppliers dominate the market. Of 40 major markets studied by mobile analyst Chetan Sharma, the top three mobile operators controlled 93 percent of their respective markets.

In some “hyper-competitive markets” like the United Kingdom and the United States, “which had more than four to five large players” are moving towards the consolidation phase where the top three control more than 80 percent of the market, Sharma has said.

Opponents of a Sprint acquisition of T-Mobile US argue that consumer retail prices likely will rise, in the event of a merger. Indeed, that is one reason why most equity analysts think only such a merger will end the current price war in the U.S. mobile market.

Economists and analysts at the Phoenix Center for Advanced Legal and Economic Policy Studies agree that retail prices likely would rise in the wake of a Sprint acquisition of T-Mobile US, but also argue that isn’t the point. Even higher retail prices do not tell the long-term story about sustainable levels of robust competition and sustainable incentives for continued investment.

Though it sometimes seems counter-intuitive, retail prices that are too low necessarily drive weaker competitors out of the market, leading to more market concentration. Prices that are too low also dissuade contestants from investing aggressively, as there is little to no profit for doing so.

But the issue is whether any regulatory bodies, anywhere, are smart enough to know, in advance, whether consumer welfare outcomes are better with three or four national providers.

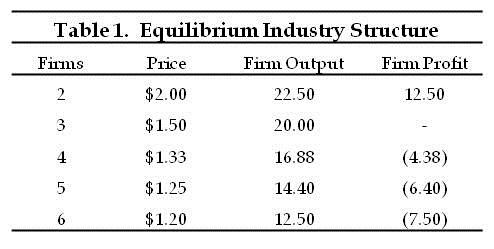

Economic theory suggests “excessive competition” can lead to negative profits, and therefore death, of all contestants in a market with too many competitors. Consolidation is the inevitable result.

And, one might well argue,, such consolidation provides a better outcome for consumers.

No comments:

Post a Comment