Extraplating from the results of a survey conducted by Harris Interactive on its behalf, Rebtel estimates that U.S. mobile users could be spending $38 billion a year on international calls on their smart phones, annually.

Rebtel estimates that 21 percent of U.S. adult smart phone owners make international calls and spend an average of $156 every month doing so, Rebtel says.

If, according to the 2010 U.S. Census, there are 234.6 million adults age 18 or older in the United States, with 41 percent of the population owning a smart phone, and 21 percent of these people making international calls on their smartphones, then roughly 20 million Americans are spending nearly $38 billion a year on international calls on their smart phones annually.

Some might find that estimate fanciful. Visiongain calculates that in 2012 the global mobile VoIP market will see revenues of $2.5 billion.

Also, if U.S. mobile voice overall is about $120 billion, the Rebtel estimate would have international long distance comprising about 32 percent of all U.S. mobile voice revenues overall, a figure that seems unlikely.

According to the Federal Communications Commission, retained international revenues, revenues billed by U.S. carriers, less settlement amounts owed to foreign carriers for U.S.-billed traffic, plus settlement amounts due to U.S. carriers for foreign-billed traffic, amounted to $4 billion in 2009.

It is hard to reconcile total retained international calling revenues, on all networks, of $4 billiion, as reported by the FCC in 2011, with an estimate of U.S. smart phone calling of $38 billion.

Granted, it is harder these days to tally actual revenue, as more activity shifts to over the top IP mechanisms.

At some point, the estimates might be even harder to make, as mobile service providers switch from 3G networks for voice services, over to voice over LTE (voLTE), which will operate fundamentally in the same way as over the top mobile voice, the difference being the ownership of the services.

Still, the Rebtel estimate seems inflated. One has to assume that the sample was not representative of the typical base of smart phone users, or that respondents somehow misunderstood or inaccurately recalled their international long distance spending.

Maybe I am misreading the FCC data. Or perhaps the FCC data isn't capturing mobile calling data. But the numbers do not add up.

Friday, August 17, 2012

Smart Phone Owners Spend $38 Billion a year on International Calls?

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

What's Value of Mobile Payments for Retailers?

For mobile payments and wallets to get wide retailer support, the value proposition has to be quite clear, since it is merchants, almost alone among ecosystem participants, for whom mobile payments means spending money (upgrading point of sale systems and software), not getting it (consumers might get rewards, processing networks and issuing banks protect transaction fee revenue).

Access to consumers' shopping habits is probably the biggest long term value, though some might expect lower transaction costs that will offset the costs of upgrading point of sale systems to accept mobile payments, in some cases.

"Who's buying, what the market segments are, where they are, what kind of things they're buying and how the information that's captured at the point of sale can be leveraged for things like offers, loyalty, rewards, and that kind of thing" is the value, according to Bill Maurer, who runs the Institute for Money, Technology and Financial Inclusion at U.C. Irvine, according to.Money Morning.

That would allow creating the sort of recommendation engines that Amazon and Netflix use to create context and shopping suggestions.

Access to consumers' shopping habits is probably the biggest long term value, though some might expect lower transaction costs that will offset the costs of upgrading point of sale systems to accept mobile payments, in some cases.

"Who's buying, what the market segments are, where they are, what kind of things they're buying and how the information that's captured at the point of sale can be leveraged for things like offers, loyalty, rewards, and that kind of thing" is the value, according to Bill Maurer, who runs the Institute for Money, Technology and Financial Inclusion at U.C. Irvine, according to.Money Morning.

That would allow creating the sort of recommendation engines that Amazon and Netflix use to create context and shopping suggestions.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

How the Internet Has Changed 2002 to 2012

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Thursday, August 16, 2012

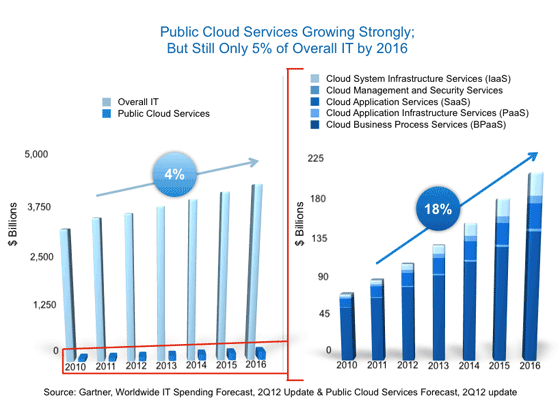

Which is the Bigger Cloud Opportunity, Business Process or Software "As a Service?"

It isn't clear whether software as a service or "business process as a service" is the biggest cloud computing opportunity. Gartner has in the past argued that SaaS is the biggest opportunity. But Gartner now seems to believe BPaaS is the single biggest opportunity.

"Major trends in client computing have shifted the market away from a focus on personal computers to a broader device perspective that includes smart phones, tablets and other consumer devices," says Steve Kleynhans, Gartner VP. "Emerging cloud services will become the glue that connects the web of devices that users choose to access during the different aspects of their daily life."

To be sure, there also are ramifications for enterprise users as well as consumers. And that explains the huge interest in cloud computing, on the part of service and application providers.

Still, most of the revenue upside appears likely to accrue to hardware and software suppliers, according to a Morgan Stanley analysis. In the telecom space, the analysts expect key winners to include Rackspace, Equinix and competitive local exchange carriers and metro bandwidth suppliers.

Also, pubic cloud computing is likely to reduce traditional telco enterprise service revenues. Morgan Stanley further suggests that among IT decision makers, the large telcos remain behind Amazon and others in terms of “cloud mindshare.”

How much overlap there is between hosting and cloud computing services is an important issue for service providers. At one level, hosting is about server real estate and amenities. But cloud computing is about some other things, namely rental of computing cycles and storage, rental of operating systems and platforms, and rental of actual business apps.

Though service providers have embraced the hosting business and content delivery networks as “valued added parts of the transport and business,” it remains unclear how far they might ultimately go in the core cloud computing business.

The increasing number of devices used by any single consumer to access and use cloud computing resources means more access revenue, to be sure.

Gartner predicts that, by 2014, the personal cloud will replace the personal computer at the center of users' digital lives. That implies heavy and growing need for broadband access.

What also is clear is that service providers now see content delivery networks and cloud computing as new business opportunities, with ramifications for enterprise users as well as consumers. And that explains the huge interest in cloud computing, on the part of service and application providers.

Still, most of the revenue upside appears likely to accrue to hardware and software suppliers, according to a Morgan Stanley analysis, even as enterprises start to shift workloads to cloud approaches.

According to the Morgan Stanley survey, 79 percent of information technology workloads are running at on-premise data centers today, but over the next few years, respondents expect that only 64 percent of workloads will run at in-house data centers.

What’s more, 51 percent of respondents are running their entire infrastructure on premises today, but in three years some 70 percent of companies will have moved at least some workloads to managed hosting or public cloud environments, including infrastructure as a service, (IaaS), platform as a service, (Paas) or software as a service (SaaS).

That does not mean each of those ways of “doing cloud computing” represents the same amount of potential revenue for suppliers of the services. In the relatively near term, software as a service probably will represent most of the actual revenue for suppliers of cloud computing apps and services.

In fact, one might ask whether, on a global basis, cloud computing will be a significant revenue driver for anything but software as a service. According to Forrester Research, for example, by 2020 SaaS might represent $133 billion in annual revenue, while the other forms of cloud computing will register only in single-digit billions or low double digits.

In a similar way, some will argue that hosting and CDN services are more of a “value add” for connectivity services, rather than big new revenue drivers for service providers, in their own right.

The issue is which cloud computing suppliers or even data centers will benefit, particularly since cloud computing services today are more logically provided by Amazon and other suppliers, not “data center” suppliers.

On the other hand, AT&T hopes to capitalize on its position as a “one-stop shop” for IT and connectivity needs. The company has said that it is already number two in hosting globally, with more than 2.5 million square feet of data center space (38 data centers, with 15 outside the US, primarily in Europe and Asia).

Verizon’s purchase of Terremark likewise is expected to boost Verizon’s connectivity sales, not simply “hosting” revenue, especially with small and mid-sized businesses. Verizon operates 220 data centers in 23 countries, as well.

Metro fiber providers and independent hosting firms also will benefit, it is reasonable to conclude. What isn’t so clear at the moment is how much share telcos might gain in the IaaS, PaaS and SaaS business segments, which are less “real estate” plays and more “computing services” offers.

Cloud computing gets lots of attention these days in the service provider business. But it might be helpful to keep in mind that the actual amount of new revenue data center hosting or cloud computing actually will generate is likely to be modest, from a service provider perspective.

The more important angle is the “value add” for the other core connectivity solutions. Essentially, data center hosting services and content delivery networks "make the bits more valuable." And value is the antidote to commodity pricing.

The point is that although there are good reasons for service providers to see cloud computing as a viable and interesting new revenue stream, it is important to be careful and rational about the huge numbers one tends to see thrown around, related to cloud computing.

Gartner, for example, now expects enterprise spending on public cloud services to grow from $91 billion worldwide in 2011 to $109 billion in 2012, while by 2016, enterprise public cloud services spending will reach $207 billion.

That’s a substantial market, but a market with distinct segments, not all of which are easily adaptable to telco provisioning. So among the issues is the question of which of these markets are most congruent with what telcos already do.

Looking only at the segment names, it might seem as though infrastructure as a service is most congruent, and there is logic to that thought.

The largest segment, though, is “business process as a service.” Gartner says that BPaaS will grow from $84.1 billion in 2012 to $144.7 billion in 2016, generating a global compound annual growth rate of 15 percent.

BPaaS includes cloud-based enterprise processes such as cloud payments, cloud advertising and “industry operations” such as e-commerce enablement.

In terms of revenue generated, cloud advertising is projected to grow from $43.1 billion in 2011 to $95 billion in 2016, generating 17.1 percent CAGR in revenue growth through 2016.

Cloud payments are forecast to grow from $4.7 billion in 2011 to $10.6 billion in 2016, generating a CAGR of 17.8 percent worldwide.

E-commerce enablement using BPaaS-based platforms is expected to grow from $4.7 billion in 2011 to $9 billion in 2016, generating a 13.6 percent CAGR in revenue globally.

One might argue that payments, advertising and e-commerce are not necessarily areas where telcos have natural present advantages.

Software as a service will be a $26.5 billion market in 2016. SaaS-based applications include such functions as customer relationship management, enterprise resource planning, web conferencing, teaming platforms and social software suites, for example. SaaS-based CRM will grow from $3.9 billion in 2011 to $7.9 billiion in 2016.

Web conferencing, teaming platforms and social software suites will grow from $2 billion in 2011 to $3.4 billion in 2016. SaaS-based ERP will grow from $1.9 billion in 2011 to $4.3 billion in 2016.

Supply chain management will grow from $1.2 billion in 2011 growing to $3.3 billion in 2016.

Platform as a service might be just a $2.9 billion business in 2016. PaaS generally includes development environments, and also generally is the smallest of the opportunities. PaaS includes application development, database management systems, business intelligence platforms and application infrastructure and middleware.

Infrastructure as a service is forecast to grow to $24.4 billion in 2016. Gartner argues, and has the most obvious fit with competencies service providers already possess.

(IaaS) is a highly automated offering where compute resources, complemented by storage and networking capabilities, are offered to the customer on-demand, Gartner says.

With a projected CAGR of 41.7 percent, IaaS is the fastest growing of the public cloud segments. From $4.2 billion in revenue generated in 2011, IaaS is forecast to hit $24.4 billion in 2016. That includes computing services, storage and print server functions.

The computing subsegment is expected to see the greatest revenue growth globally, growing from $3.3 billion in 2011 to $20.2 billion in 2016.

The point is simply that the cloud computing opportunity is large, but also consists of segments that might be harder or easier for service providers to compete within. Very few of the cloud segments, even when using bandwidth, access and data centers, rely at the retail level on expertise in those areas.

"Major trends in client computing have shifted the market away from a focus on personal computers to a broader device perspective that includes smart phones, tablets and other consumer devices," says Steve Kleynhans, Gartner VP. "Emerging cloud services will become the glue that connects the web of devices that users choose to access during the different aspects of their daily life."

To be sure, there also are ramifications for enterprise users as well as consumers. And that explains the huge interest in cloud computing, on the part of service and application providers.

Still, most of the revenue upside appears likely to accrue to hardware and software suppliers, according to a Morgan Stanley analysis. In the telecom space, the analysts expect key winners to include Rackspace, Equinix and competitive local exchange carriers and metro bandwidth suppliers.

Also, pubic cloud computing is likely to reduce traditional telco enterprise service revenues. Morgan Stanley further suggests that among IT decision makers, the large telcos remain behind Amazon and others in terms of “cloud mindshare.”

How much overlap there is between hosting and cloud computing services is an important issue for service providers. At one level, hosting is about server real estate and amenities. But cloud computing is about some other things, namely rental of computing cycles and storage, rental of operating systems and platforms, and rental of actual business apps.

Though service providers have embraced the hosting business and content delivery networks as “valued added parts of the transport and business,” it remains unclear how far they might ultimately go in the core cloud computing business.

The increasing number of devices used by any single consumer to access and use cloud computing resources means more access revenue, to be sure.

Gartner predicts that, by 2014, the personal cloud will replace the personal computer at the center of users' digital lives. That implies heavy and growing need for broadband access.

What also is clear is that service providers now see content delivery networks and cloud computing as new business opportunities, with ramifications for enterprise users as well as consumers. And that explains the huge interest in cloud computing, on the part of service and application providers.

Still, most of the revenue upside appears likely to accrue to hardware and software suppliers, according to a Morgan Stanley analysis, even as enterprises start to shift workloads to cloud approaches.

According to the Morgan Stanley survey, 79 percent of information technology workloads are running at on-premise data centers today, but over the next few years, respondents expect that only 64 percent of workloads will run at in-house data centers.

What’s more, 51 percent of respondents are running their entire infrastructure on premises today, but in three years some 70 percent of companies will have moved at least some workloads to managed hosting or public cloud environments, including infrastructure as a service, (IaaS), platform as a service, (Paas) or software as a service (SaaS).

That does not mean each of those ways of “doing cloud computing” represents the same amount of potential revenue for suppliers of the services. In the relatively near term, software as a service probably will represent most of the actual revenue for suppliers of cloud computing apps and services.

In fact, one might ask whether, on a global basis, cloud computing will be a significant revenue driver for anything but software as a service. According to Forrester Research, for example, by 2020 SaaS might represent $133 billion in annual revenue, while the other forms of cloud computing will register only in single-digit billions or low double digits.

In a similar way, some will argue that hosting and CDN services are more of a “value add” for connectivity services, rather than big new revenue drivers for service providers, in their own right.

The issue is which cloud computing suppliers or even data centers will benefit, particularly since cloud computing services today are more logically provided by Amazon and other suppliers, not “data center” suppliers.

On the other hand, AT&T hopes to capitalize on its position as a “one-stop shop” for IT and connectivity needs. The company has said that it is already number two in hosting globally, with more than 2.5 million square feet of data center space (38 data centers, with 15 outside the US, primarily in Europe and Asia).

Verizon’s purchase of Terremark likewise is expected to boost Verizon’s connectivity sales, not simply “hosting” revenue, especially with small and mid-sized businesses. Verizon operates 220 data centers in 23 countries, as well.

Metro fiber providers and independent hosting firms also will benefit, it is reasonable to conclude. What isn’t so clear at the moment is how much share telcos might gain in the IaaS, PaaS and SaaS business segments, which are less “real estate” plays and more “computing services” offers.

Cloud computing gets lots of attention these days in the service provider business. But it might be helpful to keep in mind that the actual amount of new revenue data center hosting or cloud computing actually will generate is likely to be modest, from a service provider perspective.

The more important angle is the “value add” for the other core connectivity solutions. Essentially, data center hosting services and content delivery networks "make the bits more valuable." And value is the antidote to commodity pricing.

The point is that although there are good reasons for service providers to see cloud computing as a viable and interesting new revenue stream, it is important to be careful and rational about the huge numbers one tends to see thrown around, related to cloud computing.

Gartner, for example, now expects enterprise spending on public cloud services to grow from $91 billion worldwide in 2011 to $109 billion in 2012, while by 2016, enterprise public cloud services spending will reach $207 billion.

That’s a substantial market, but a market with distinct segments, not all of which are easily adaptable to telco provisioning. So among the issues is the question of which of these markets are most congruent with what telcos already do.

Looking only at the segment names, it might seem as though infrastructure as a service is most congruent, and there is logic to that thought.

The largest segment, though, is “business process as a service.” Gartner says that BPaaS will grow from $84.1 billion in 2012 to $144.7 billion in 2016, generating a global compound annual growth rate of 15 percent.

BPaaS includes cloud-based enterprise processes such as cloud payments, cloud advertising and “industry operations” such as e-commerce enablement.

In terms of revenue generated, cloud advertising is projected to grow from $43.1 billion in 2011 to $95 billion in 2016, generating 17.1 percent CAGR in revenue growth through 2016.

Cloud payments are forecast to grow from $4.7 billion in 2011 to $10.6 billion in 2016, generating a CAGR of 17.8 percent worldwide.

E-commerce enablement using BPaaS-based platforms is expected to grow from $4.7 billion in 2011 to $9 billion in 2016, generating a 13.6 percent CAGR in revenue globally.

One might argue that payments, advertising and e-commerce are not necessarily areas where telcos have natural present advantages.

Software as a service will be a $26.5 billion market in 2016. SaaS-based applications include such functions as customer relationship management, enterprise resource planning, web conferencing, teaming platforms and social software suites, for example. SaaS-based CRM will grow from $3.9 billion in 2011 to $7.9 billiion in 2016.

Web conferencing, teaming platforms and social software suites will grow from $2 billion in 2011 to $3.4 billion in 2016. SaaS-based ERP will grow from $1.9 billion in 2011 to $4.3 billion in 2016.

Supply chain management will grow from $1.2 billion in 2011 growing to $3.3 billion in 2016.

Platform as a service might be just a $2.9 billion business in 2016. PaaS generally includes development environments, and also generally is the smallest of the opportunities. PaaS includes application development, database management systems, business intelligence platforms and application infrastructure and middleware.

Infrastructure as a service is forecast to grow to $24.4 billion in 2016. Gartner argues, and has the most obvious fit with competencies service providers already possess.

(IaaS) is a highly automated offering where compute resources, complemented by storage and networking capabilities, are offered to the customer on-demand, Gartner says.

With a projected CAGR of 41.7 percent, IaaS is the fastest growing of the public cloud segments. From $4.2 billion in revenue generated in 2011, IaaS is forecast to hit $24.4 billion in 2016. That includes computing services, storage and print server functions.

The computing subsegment is expected to see the greatest revenue growth globally, growing from $3.3 billion in 2011 to $20.2 billion in 2016.

The point is simply that the cloud computing opportunity is large, but also consists of segments that might be harder or easier for service providers to compete within. Very few of the cloud segments, even when using bandwidth, access and data centers, rely at the retail level on expertise in those areas.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Square Offers Merchants a Flat Transaction Fees

With $250,000 in transactions, paying $275 per month works out to around 1.3 percent per transaction, which is significantly lower than the current rate of 2.75 percent.

If a business goes over $250,000 (and had opted into the monthly swipe fee) then the first dollar after will be charged the standard 2.75 percent rate.

One way or the other, the trend in transaction fees will keep dropping as the mobile payment business gets traction. Every newly competitive business has that impact on prevailing prices.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Over the Top Apps Pose Huge Risk for Some Mobile Service Providers

Over the top mobile voice and texting apps now affect traffic for almost 75 percent of mobile service providers operating in 68 countries surveyed by mobileSquared as part of a project sponsored by Tyntec.

But the potential danger will vary from country to country. Service providers in smaller countries, where lots of cross-border calling or messaging occurs, with high tariffs for cross-border traffic, will experience more danger than large countries with larger internal populations that can call quite some distance without crossing a border.

OTT apps and services also will cannibalize international calling revenues in any country with a large migrant population outside the home country. Think Filipinos working in the Middle East, or Indians living in the United States.

On the other hand, retail packaging can alleviate some of the potential risk, as Verizon Wireless is doing with its "Share Everything" plans.

About 52.1 percent of respondents estimate over the top mobile apps have displaced about one percent to 20 percent of traffic in 2012. That’s a clear issue since traffic lost means lost revenue as well.

Almost 33 percent of respondents expect one percent to 10 percent of their customers will

be using OTT services by the end of 2012, with 57 percent of respondents believe 11 percent to 40 percent of their customers will be using OTT services in 2012.

But 10.5 percent of service providers anticipate more than 40 percent of the user base will be using OTT services by the end of 2012.

In 2016, 100 percent of respondents believe at least 11 percent of their customers will be using OTT services. In fact, 42 percent of operators believe that over 40 percent of their customer base will be using OTT services in 2016.

The issue is what to do about the threat. In some countries, it might be legal for mobile operators to block use of OTT apps, as some carriers blocked use of VoIP. You can make your own judgment about whether that is a long-term possibility.

There are direct and indirect ways to respond, though. It is at least conceivable that some mobile service providers can legally create separate fees for consumer use of over the top voice and messaging apps. In other cases service providers will have to recapture some of the lost revenue by increasing mobile data charges in some way.

Verizon Wireless protects its voice and texting revenue streams by essentially changing voice and texting services into the equivalent of a connection fee to use the network. Verizon charges a flat monthly fee for unlimited domestic voice and texting.

The harder questions revolve around whether any service provider should create its own OTT voice and messaging apps, even if those apps compete with carrier services. Aside from potentially cannibalizing carrier voice and data services, this approach arguably does take some share from rival OTT providers.

On the other hand, it is a defensive approach that essentially concedes declining revenue, with some amount of ability to capture revenue in the “OTT voice and messaging” space.

Some larger service providers might find they are able to consider a partnering strategy with leading OTT players. To some extent, this also is a defensive move aimed at recouping some lost voice and messaging revenues. In other words, if a customer is determined to switch to OTT voice and data, the revenue from such usage ought to flow to the mobile service provider, if possible.

But there is a notable difference to the branded carrier OTT app approach. In principle, such OTT apps can be a way of extending a brand’s service footprint outside its historic licensed areas, into countries where it is not currently licensed.

Instead of functioning as a defensive tactic that recoups some share of OTT revenue in territory, OTT voice and messaging can be viewed as an offensive way of providing voice and messaging services out of region, says Thorsten Trapp, Tyntec CTO.

Over the longer term, it might also be possible for mobile service providers to replicate the network effect that makes today’s voice and messaging so appealing, namely the ability to contact anybody with a phone, anywhere, without having to worry about whether the contacted party is “on the network” or “in the community” or not. The RCS-e/Joyn effort is an example of that approach.

Likewise, mobile service providers might be able to create a mediating role that bridges a closed OTT community by enabling third party access to some other third party community using the mobile phone number.

A version of this story originally appeared at Metaswitch Networks Carrier Evolution.

But the potential danger will vary from country to country. Service providers in smaller countries, where lots of cross-border calling or messaging occurs, with high tariffs for cross-border traffic, will experience more danger than large countries with larger internal populations that can call quite some distance without crossing a border.

OTT apps and services also will cannibalize international calling revenues in any country with a large migrant population outside the home country. Think Filipinos working in the Middle East, or Indians living in the United States.

On the other hand, retail packaging can alleviate some of the potential risk, as Verizon Wireless is doing with its "Share Everything" plans.

About 52.1 percent of respondents estimate over the top mobile apps have displaced about one percent to 20 percent of traffic in 2012. That’s a clear issue since traffic lost means lost revenue as well.

Almost 33 percent of respondents expect one percent to 10 percent of their customers will

be using OTT services by the end of 2012, with 57 percent of respondents believe 11 percent to 40 percent of their customers will be using OTT services in 2012.

But 10.5 percent of service providers anticipate more than 40 percent of the user base will be using OTT services by the end of 2012.

In 2016, 100 percent of respondents believe at least 11 percent of their customers will be using OTT services. In fact, 42 percent of operators believe that over 40 percent of their customer base will be using OTT services in 2016.

The issue is what to do about the threat. In some countries, it might be legal for mobile operators to block use of OTT apps, as some carriers blocked use of VoIP. You can make your own judgment about whether that is a long-term possibility.

There are direct and indirect ways to respond, though. It is at least conceivable that some mobile service providers can legally create separate fees for consumer use of over the top voice and messaging apps. In other cases service providers will have to recapture some of the lost revenue by increasing mobile data charges in some way.

Verizon Wireless protects its voice and texting revenue streams by essentially changing voice and texting services into the equivalent of a connection fee to use the network. Verizon charges a flat monthly fee for unlimited domestic voice and texting.

The harder questions revolve around whether any service provider should create its own OTT voice and messaging apps, even if those apps compete with carrier services. Aside from potentially cannibalizing carrier voice and data services, this approach arguably does take some share from rival OTT providers.

On the other hand, it is a defensive approach that essentially concedes declining revenue, with some amount of ability to capture revenue in the “OTT voice and messaging” space.

Some larger service providers might find they are able to consider a partnering strategy with leading OTT players. To some extent, this also is a defensive move aimed at recouping some lost voice and messaging revenues. In other words, if a customer is determined to switch to OTT voice and data, the revenue from such usage ought to flow to the mobile service provider, if possible.

But there is a notable difference to the branded carrier OTT app approach. In principle, such OTT apps can be a way of extending a brand’s service footprint outside its historic licensed areas, into countries where it is not currently licensed.

Instead of functioning as a defensive tactic that recoups some share of OTT revenue in territory, OTT voice and messaging can be viewed as an offensive way of providing voice and messaging services out of region, says Thorsten Trapp, Tyntec CTO.

Over the longer term, it might also be possible for mobile service providers to replicate the network effect that makes today’s voice and messaging so appealing, namely the ability to contact anybody with a phone, anywhere, without having to worry about whether the contacted party is “on the network” or “in the community” or not. The RCS-e/Joyn effort is an example of that approach.

Likewise, mobile service providers might be able to create a mediating role that bridges a closed OTT community by enabling third party access to some other third party community using the mobile phone number.

A version of this story originally appeared at Metaswitch Networks Carrier Evolution.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Top U.K. Texting Moments of the London Olympics

The infographic shows the biggest jump in message volume in the U.K. market began with the parade of nations.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Subscribe to:

Comments (Atom)

Quick Fixes and Fixations

“One pill makes you larger, and one pill makes you small,” sang Jefferson Airplane lead singer Grace Slick . Some might say that was just a...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...