Google Now is a natural language query app inevitably to be compared to Apple's "Siri." It was first included in Android 4.1 ("Jelly Bean") and was first supported on the Galaxy Nexus.

Monday, February 11, 2013

"Google Now" is Google's "Siri"

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Sunday, February 10, 2013

One Way Device Share Creates Revenue Share

Between them, Apple and Samsung earn nearly all the profits in the global smart phone device industry. Because other major vendors lost money in smart phones last quarter, the combined profits from Apple and Samsung in the category were greater than the total industry's Q4 profits.

Because other suppliers lost money, Apple and Samsung captured 101 percent of smart phone profits in the fourth quarter of 2012 and 103 percent for the full year, according to Canaccord Genuity analyst Michael Walkley.

Because other suppliers lost money, Apple and Samsung captured 101 percent of smart phone profits in the fourth quarter of 2012 and 103 percent for the full year, according to Canaccord Genuity analyst Michael Walkley.

Apple and Samsung's share of smartphone industry profits was greater than 100 percent every quarter of 2012.

That sort of share also creates other revenue opportunities, though. Application providers, such as Google, often will pay a device supplier for placement as the default app on all shipped devices.

That might represent $700 million to $900 million in current annual revenue for Apple.

Morgan Stanle

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Has "Peak SMS" Been Reached?

Spain is in many ways an exemplar of what is happening to text messaging revenues in the European and some other markets.

After peaking at the end of 2008 at about €450/quarter, Spanish text messaging revenues have fallen by six percent to about €171 million in the third quarter of 2012.

As some would note, text messaging represents nearly 100 percent operating profit for mobile operators, so losing volume in such a high-margin revenue stream is a particular problem.

The reason for the declines is substitution by users of IP-based messaging for text messaging.

According to asymco, 97 percent of Spanish smart phone users have Whatsapp installed, allowing users to send free instant messages to other users.

That is cannibalizing text messaging. Use of SMS was down about 30 percent in the third quarter of 2012, for example.

Globally SMS traffic is still rising, but Informa Telecoms & Media forecasts that mobile operators will still generate a total of US$722.7 billion in revenues from SMS between 2011 and 2016.

But text messaging share of global mobile messaging traffic will fall, from this point forward, analysts suggest.

By some estimates, we are close to the point where over the top message volume should exceed that of text messaging.

In the U.S. market, for example, text messaging revenues and volume fell for the first time ever in the third quarter of 2012.

The only surprising fact is that text messaging revenue has fallen, even in the U.S. market, which has been relatively more protected from such losses, to this point.

After peaking at the end of 2008 at about €450/quarter, Spanish text messaging revenues have fallen by six percent to about €171 million in the third quarter of 2012.

As some would note, text messaging represents nearly 100 percent operating profit for mobile operators, so losing volume in such a high-margin revenue stream is a particular problem.

The reason for the declines is substitution by users of IP-based messaging for text messaging.

According to asymco, 97 percent of Spanish smart phone users have Whatsapp installed, allowing users to send free instant messages to other users.

That is cannibalizing text messaging. Use of SMS was down about 30 percent in the third quarter of 2012, for example.

Globally SMS traffic is still rising, but Informa Telecoms & Media forecasts that mobile operators will still generate a total of US$722.7 billion in revenues from SMS between 2011 and 2016.

But text messaging share of global mobile messaging traffic will fall, from this point forward, analysts suggest.

By some estimates, we are close to the point where over the top message volume should exceed that of text messaging.

In the U.S. market, for example, text messaging revenues and volume fell for the first time ever in the third quarter of 2012.

The only surprising fact is that text messaging revenue has fallen, even in the U.S. market, which has been relatively more protected from such losses, to this point.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Saturday, February 9, 2013

What Long Run Mobile Broadband Growth Rate?

In 2012, global bandwidth growth slowed to about 40 percent, from about 70 percent annual growth in 2008. But keep that in perspective. Growth rates always slow when any organism, business or trend reaches an adult stage, garners a much larger installed base or achieves high penetration. In other words, there is a “law of large numbers” at work.

And that seems the case for Internet bandwidth growth as well. While the pace of growth is slowing, international Internet bandwidth continues to grow rapidly, more than doubling between 2010 and 2012, to 77 Tbps, according to TeleGeography.

Average international Internet traffic grew 35 percent in 2012, down from 39 percent in 2011, and peak traffic grew 33 percent, well below the 57 percent increase recorded in 2011, TeleGeography says.

International Internet traffic and capacity growth rates are declining due to slowing broadband subscriber growth in mature markets, and the expansion of content delivery networks (CDNs) and local caching technologies, which reduce the need for new long-haul capacity by storing popular content closer to the end-users.

Some think the same sort of trend ultimately will characterize mobile broadband bandwidth growth rates as well, In fact, there is little reason to doubt that future trend, given historical precedents.

In March 2011, for example, AT&T projected that data bandwidth growth would be on the order of eight to 10 times over then-current levels between the end of 2010 and the end of 2015.

That forecast appears to be based on an expectation that volumes would roughly double in 2011 and then increase by a further 65 percent in 2012.

Instead, AT&T seems to be seeing something like 40 percent annual growth. To be sure, 40 percent annual growth is significant. It means bandwidth consumption doubles about every two to three years.

Cisco estimates mobile broadband grew about 70 percent in 2012, and will grow at a compound annual growth rate of 66 percent from 2012 to 2017.

Some believe Wi-Fi offload will slow the rate of mobile broadband growth. On the other hand, even such offloading, at high rates of perhaps 80 percent, would slow the rate of growth by about 50 percent.

And that seems the case for Internet bandwidth growth as well. While the pace of growth is slowing, international Internet bandwidth continues to grow rapidly, more than doubling between 2010 and 2012, to 77 Tbps, according to TeleGeography.

Average international Internet traffic grew 35 percent in 2012, down from 39 percent in 2011, and peak traffic grew 33 percent, well below the 57 percent increase recorded in 2011, TeleGeography says.

International Internet traffic and capacity growth rates are declining due to slowing broadband subscriber growth in mature markets, and the expansion of content delivery networks (CDNs) and local caching technologies, which reduce the need for new long-haul capacity by storing popular content closer to the end-users.

Some think the same sort of trend ultimately will characterize mobile broadband bandwidth growth rates as well, In fact, there is little reason to doubt that future trend, given historical precedents.

In March 2011, for example, AT&T projected that data bandwidth growth would be on the order of eight to 10 times over then-current levels between the end of 2010 and the end of 2015.

That forecast appears to be based on an expectation that volumes would roughly double in 2011 and then increase by a further 65 percent in 2012.

Instead, AT&T seems to be seeing something like 40 percent annual growth. To be sure, 40 percent annual growth is significant. It means bandwidth consumption doubles about every two to three years.

Cisco estimates mobile broadband grew about 70 percent in 2012, and will grow at a compound annual growth rate of 66 percent from 2012 to 2017.

Some believe Wi-Fi offload will slow the rate of mobile broadband growth. On the other hand, even such offloading, at high rates of perhaps 80 percent, would slow the rate of growth by about 50 percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Utilities Look to "Field Area Networks"

Add “field area network” (FAN) to the list of acronyms we use to describe communications networks of various functions and coverage areas, ranging from wide area network to metropolitan area network to local area network.

By 2020, annual global shipments of wireless communications nodes to support FANs will reach 14.3 million units, according to Pike Research.

The market for private utility FANs--which generally will be private networks--will be led by North America, which represented about 82 percent of world shipments in 2012.

That share will decline steadily to 2020, but North America will still account for 44 percent of world shipments by 2020.

The fastest growth in the decade will come in Latin America, where shipments will increase at a compound annual growth rate (CAGR) of 48 percent.

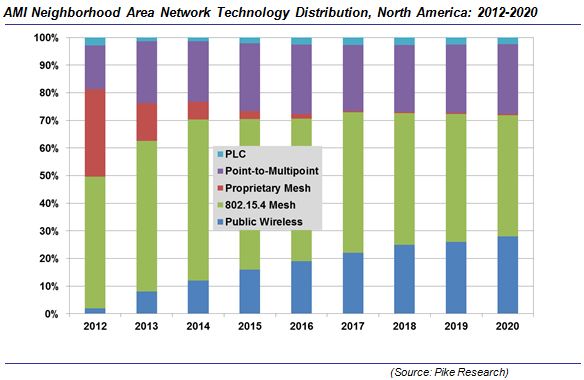

FANs will use a variety of wireless networks, ranging from radio frequency mesh and Wi-Fi to WiMAX or LTE technology.

A FAN is a network used to connect various devices located in a utility’s “field” of operations, which can include smart meters, concentrators, distribution assets, control and protection equipment, and substation equipment, according to Pike Research.

Some field area networks will use the 802.15.4 standard for fixed terrestrial radio networks. Others might use Long Term Evolution, Some also predict systems using the 802.15.4 standard, with point-to-multipoint fixed wireless, will dominate the networks used to support FANs.

But LTE networks operated by leading mobile companies could be a growing factor in the FAN market.

ABB, GE, S&C and Eaton are some of the established firms selling systems for the field communications market.

By 2020, annual global shipments of wireless communications nodes to support FANs will reach 14.3 million units, according to Pike Research.

The market for private utility FANs--which generally will be private networks--will be led by North America, which represented about 82 percent of world shipments in 2012.

That share will decline steadily to 2020, but North America will still account for 44 percent of world shipments by 2020.

The fastest growth in the decade will come in Latin America, where shipments will increase at a compound annual growth rate (CAGR) of 48 percent.

FANs will use a variety of wireless networks, ranging from radio frequency mesh and Wi-Fi to WiMAX or LTE technology.

A FAN is a network used to connect various devices located in a utility’s “field” of operations, which can include smart meters, concentrators, distribution assets, control and protection equipment, and substation equipment, according to Pike Research.

Some field area networks will use the 802.15.4 standard for fixed terrestrial radio networks. Others might use Long Term Evolution, Some also predict systems using the 802.15.4 standard, with point-to-multipoint fixed wireless, will dominate the networks used to support FANs.

But LTE networks operated by leading mobile companies could be a growing factor in the FAN market.

ABB, GE, S&C and Eaton are some of the established firms selling systems for the field communications market.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Friday, February 8, 2013

Google Nexus 1 to Control Satellite, XBox Kincet Next, Seriously

A standard issue Nexus One smart phone will be controlling a new satellite to be launched by the end of February 2012. Granted, it is a "nano satellite" just 30 cm long and weighing 4.3 kg.

Still, using a consumer smart phone as a satellite controller is novel.

A Strand-2 satellite is under development. For that generation of satellites, two cubesats will use the motion-sensing technology in Microsoft's XBox Kinect devices to locate each other in space and dock together.

Still, using a consumer smart phone as a satellite controller is novel.

A Strand-2 satellite is under development. For that generation of satellites, two cubesats will use the motion-sensing technology in Microsoft's XBox Kinect devices to locate each other in space and dock together.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Huawei, ZTE, Lenovo Among Top 5 Smart Phone Suppliers in 4Q 2012

Huawei, ZTE and Lenovo ranked among the top-five suppliers of smart phones in the fourth quarter of 2012. You might expect Samsung and Apple to top the list, and they do.

In the fourth quarter of 2012, Samsung provided 63 percent of smart phone shipments while Apple had 48 percent. Huawei shipped about 11.5 percent of all smart phones globally in the fourth quarter of 2012, while ZTE shipped 10 percent. Lenovo shipped about 9.5 percent of smart phones in the quarter.

For some of us, the surprise continues to be that BlackBerry and Nokia do not appear among the top five. We sometimes become myopic and assume that Nokia and BlackBerry are fighting Samsung and Apple. In one sense, that is true. Nokia and BlackBerry will have to fight for a spot among the “high end” providers in the market.

In a larger sense, it appears the situation is that Nokia and BlackBerry have to catch Huawei, ZTE and Lenovo, all of which seem to be gobbling up the low end that Nokia once dominated.

In the fourth quarter of 2012, Samsung provided 63 percent of smart phone shipments while Apple had 48 percent. Huawei shipped about 11.5 percent of all smart phones globally in the fourth quarter of 2012, while ZTE shipped 10 percent. Lenovo shipped about 9.5 percent of smart phones in the quarter.

For some of us, the surprise continues to be that BlackBerry and Nokia do not appear among the top five. We sometimes become myopic and assume that Nokia and BlackBerry are fighting Samsung and Apple. In one sense, that is true. Nokia and BlackBerry will have to fight for a spot among the “high end” providers in the market.

In a larger sense, it appears the situation is that Nokia and BlackBerry have to catch Huawei, ZTE and Lenovo, all of which seem to be gobbling up the low end that Nokia once dominated.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Subscribe to:

Comments (Atom)

On the Use and Misuse of Principles, Theorems and Concepts

When financial commentators compile lists of "potential black swans," they misunderstand the concept. As explained by Taleb Nasim ...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...