BlackBerry Limited announced its QNX Software Development Platform 7.0 (QNX SDP 7.0), a 64-bit operating system for the automotive industry and connected cars.

Wednesday, January 4, 2017

BlackBerry Announces New QNX OS for Connected Cars

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

AT&T Expects Gigabit Speed at Some Cell Sites in 2017

AT&T 5G Evolution plans for 2017 include an upgrade to 1 Gbps speeds on at least some cell sites on the 4G network. T-Mobile US and Sprint also are touting such speeds on their own 4G networks.

As always, such speeds are possible when carriers use more bandwidth and aggregate channels. AT&T currently is deploying three-way carrier aggregation in select areas, and plan to introduce four-way carrier aggregation as well as LTE-License Assisted Access (LAA) this year.

In the first half of 2017, AT&T also will conduct a trial in Austin where residential customers can stream DirecTV Now video service over a fixed wireless 5G connection.

AT&T says it also has activated its first 5G business customer trial, working with Intel and Ericsson using millimeter wave spectrum, significantly using unlicensed spectrum.

AT&T also announced plans to team up with Qualcomm Technologies and Ericsson for mobile and fixed wireless trials in the second half of 2017, using the 5G New Radio specification being developed by the industry technology standards group 3GPP.

Those trials will test both mobile and fixed wireless solutions operating in millimeter wave spectrum in the 28 Ghz and 39 Ghz bands.

AT&T lab trials already are achieving speeds up to 14 Gbps over a wireless connection. The company says, with latency less than 3 milliseconds.

Separately, AT&T says its fiber to the home network has been deployed to four million locations across 46 metros nationwide. More than 650,000 of these locations include apartments and condo units.

By mid-2019 AT&T plans to reach at least 12.5 million locations across 67 metro areas.

AT&T also is testing fixed wireless point-to-point millimeter wave and G.fast technologies, and expects to have deployed more than 400,000 active fixed wireless links by the end of 2017.

By the end of 2020, AT&T plans to reach 1.1 million rural locations using fixed wireless.

The company also is working on Project AirGig, an access platform that operates near, but not over, power lines.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

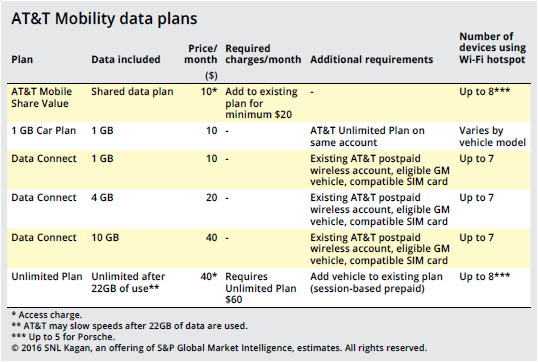

Connected Car Now a Material Revenue Contributor for AT&T and Verizon

The connected car business now is a material factor for AT&T and Verizon, with AT&T selling billions of accounts and Verizon booking more than $1 billion in annual revenue.

In some quarters, AT&T has been adding nearly a million net new connected car accounts, illustrating one of three potential revenue streams from the connected car business. In 2016, AT&T added more new connected car accounts than phone or tablet accounts.

source: S and P Global Intelligence

source: S and P Global Intelligence

In some quarters, AT&T has been adding nearly a million net new connected car accounts, illustrating one of three potential revenue streams from the connected car business. In 2016, AT&T added more new connected car accounts than phone or tablet accounts.

Aside from supplying the mobile connections, AT&T also hopes to sell data and marketing information to car makers, including location and usage information useful for fleet operators.

Also, temporary prepaid internet access accounts also are viewed as an opportunity for rental car fleets or other scenarios where the driver wants to enable internet access for a vehicle on a temporary basis.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Tuesday, January 3, 2017

T-Mobile US Launches IoT Plans

T-Mobile US launched two new low-cost Internet of Things (IoT) connection plans, including the access module. For applications that use a little data, customers can get up to 5MB of data per month for $20 per year per device in the first year and $6 per year per device afterwards.

For unlimited data at 64kbps, connections cost $25 per year per device. For a limited time, these customers get $5 off the first year for each device, T-Mobile US says.

With both T-Mobile IoT Access packs, T-Mobile will cover the cost of a Sequans Cat1 module, up to $16 per module.

Verizon and AT&T likewise have created service plans for unmanned aerial vehicle communications. AT&T’s “Machine Type Communication” prepaid plans, which target developers and businesses, include three tiers of data and text messages: 1 gigabyte of data valid for up to 1 year and 500 text messages for $25; 3 GB of data valid for up to 1 year and 1,000 text messages for $60; and 5 GB of data valid for up to 2 years and 1,500 text messages for $100.

As always is the case, pricing will be an issue as mobile operators and IoT specialists try to grab leadership in the IoT connections business. In some cases, narrowband IoT networks offer connections about an order of magnitude lower than mobile rates.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gigabit or 100 Mbps? Largest U.S. ISPs Make Different Choices

Why is Comcast, the largest U.S. internet service provider, pushing to make gigabit service available to all its customers, while Charter Communications, the second-largest ISP, only will sell 100 Mbps?

In each case, the decisions reflect strategic choices about what is required in their markets. Charter, the second-largest ISP, takes a minimalist approach at least in part because many of its systems are in rural areas where 100 Mbps is a top-of-the line service. Comcast, on the other hand, operates mostly in big-city markets where competition from other gigabit providers can be expected.

That does not mean those suppliers actually expect most consumers to buy their fastest service. In fact, they probably expect that most consumers will not do so. But those expectations also drive thinking about how much investment, and what type of investment, to make it their current generation access platforms.

That is true in other markets, as well.

In the United Kingdom, direct fiber connections on at least one access link remain a small fraction of total internet access connections is about two percent, according to U.K. government estimates. All-copper digital subscriber lines account for 44 percent or so of total connections; fiber-to-curb about 34 percent; and cable TV connections about 21 percent of total.

Speeds of Broadband Technologies as seen in December 2016

(ordered by median speed)

| |||||||

Provider

|

Ratio of tests

|

Down Speed of bottom 10%

Mbps

|

Median

Mbps

|

Mean

Mbps

|

Median Upload

Mbps

|

Mean Upload

Mbps

|

Down Speed of top 10%

Mbps

|

FTTH/FTTP

|

1%

|

16.7

|

49.1

|

72.6

|

16.3

|

32

|

160.1

|

Cable

|

20.6%

|

8.9

|

43.4

|

52.4

|

5.4

|

6.4

|

104.9

|

VDSL2/FTTC

|

33.9%

|

13.3

|

30.1

|

31.8

|

7.1

|

7.6

|

51.9

|

Mobile

|

N/A (*)

|

2.3

|

14.5

|

21.3

|

3.1

|

4.4

|

46

|

Fixed Wireless

|

0.14%

|

3.1

|

14.3

|

27.8 (**)

|

2.1

|

14.2 (**)

|

55.4

|

Satellite

|

0.04%

|

1.6

|

12.2

|

12.9

|

0.1

|

0.3

|

25.3

|

ADSL/ADSL2+

|

44.3%

|

1.1

|

5.5

|

6.8

|

0.6

|

0.6

|

14.8

|

(*) Mobile was not included in the proportion of tests as the assumption is the majority of the tests are people who have a fixed line option too.

(**) We advise caution on these two wireless mean speeds, as they appear skewed to due a small number of tests that are symmetric and in the 200 to 300 Mbps region, this may be people testing connected via Ethernet to a mast or as one or two fixed wireless providers suggest they provide Fibre to the Premises in a small part of their footprint.

| |||||||

In the United States, cable TV companies lead, in terms of speeds, for most consumers, even if independent providers and telcos support fiber-to-home networks. In the third quarter of 2016, cable operators had 63 percent of the installed base of fixed internet connections, and have added virtually all the net new accounts (more than 100 share of new accounts), as they have been for a few years.

That means that cable access platforms will use hybrid fiber coax (fiber plus copper), even if others (AT&T, Google Fiber, independent ISPs) deploy fiber to home networks. Cable operators use HFC because they can: gigabit speeds are possible on the standard hybrid networks. Telcos and independent ISPs must opt for FTTH to supply gigabit speeds.

Over the next couple of years, all of Comcast’s customers (Comcast is the largest U.S. ISP) will be able to buy gigabit service, and many of the other leading cable operators will be making that same move. For the moment, Charter Communications, the second biggest ISP, will hold top speeds to about 100 Mbps, across all its territories, though some customers (former Time Warner Cable customers) might be able to buy 300 Mbps.

In rural areas, fiber to home might not always be possible, but cable hybrid fiber coax networks might. That is important because the industry-standard DOCSIS 3.1 platform supports gigabit service on standard HFC cable networks.

The point is that decisions about “speed” vary, even between the largest and number-two U.S. ISPs. So do decisions about “minimum viable” access platforms.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Why 5G Will Have to Be Different

There are 5G skeptics who argue ISPs cannot afford it, or that other elements of the business model are questionable, mostly built around economies of scope and scale that might not develop, and certainly not by the 2020 time frame touted by backers in Korea, Japan and the United States. And some simply question whether most consumers actually will want to pay for it, much less need it.

Reliance on new millimeter wave spectrum also causes some concern, as signal propagation will be an issue. Use of small cells will require significantly-new backhaul infrastructure as well, while frequency-agile handsets might be pricey.

But there is one area where supporters and skeptics do agree, and that is that if and when 5G emerges as a sustainable platform, it will be because big new revenue streams and applications have emerged, as well. Virtually all agree that will, or could happen, because of the internet of things and machine-to-machine applications.

In other words, should 5G prove sustainable, it will be because new and vital enterprise apps have developed, although new fixed wireless services in the consumer segment might prove to be quite helpful, for the business case.

There are clear signs that such new thinking already is driving capital investment decisions. Consider the way Verizon is deploying new optical fiber in Boston. In the past, FiOS has either an “either, or” proposition: either full residential deployment or not.

Now, Verizon architects seem to have shifted to a network that uses dense fiber trunks suitable for supporting macro and small cells, and then extends the distribution network from there. In some ways, that One Fiber network is a mirror image of the network cable operators want to deploy to support their eventual W--Fi-first mobile networks.

Some leading cable operators, with a heritage serving the consumer segment, are building dense public Wi-Fi networks on the back of their consumer internet access services, essentially trying to create an enterprise service on the backs of a consumer service.

Verizon is taking the other tack, essentially building an enterprise network (macro and small cell backhaul) that helps create a new IoT capability, and that in turn lowers the cost of creating a consumer capability (fiber to the home). It already is clear that tier-one service provider fixed network revenues are driven by the enterprise segment, not consumers.

Many would argue that the XO Communications acquisition is part of that overall direction, as XO contributes a fiber-rich enterprise customer network. And, as always is the case, having direct fiber access to any anchor tenant lowers the cost of reaching the next set of customers.

Somewhat ironically, “lots more fiber” to support enterprise apps and IoT makes high-bandwidth services for consumers more feasible. But the new framework is “bandwidth to the customer,” not always “fiber to the customer.” One Fiber definitely is “fiber to the tower” or “fiber to the cell site.” I

In many cases One Fiber might also mean “fiber to the business.” Once that is done, the economics of supplying gigabit to the small business or residential customer are a lot easier. In some cases that might mean full fiber-to-home deployment. In other cases, fixed wireless might be the solution.

The point is that the legitimate concerns about the 5G business model are related to enterprise services, enterprise networks and fiber deployment strategy in a way that has not been true for earlier mobile network generations. In that sense, and others, 5G is different.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Monday, January 2, 2017

Why Both 100-Mbps and Gigabit "Top Speeds" Make Sense

Decisions about internet access speeds always are a mix of supply and demand drivers, as suppliers invest in capabilities they believe potential customers will buy, at specific price points, at levels that are sustainable long term.

That is why the second-largest U.S. internet service provider--Charter Communications--sells 100 Mbps connections as its top offer, while Comcast and other cable companies are rolling out gigabit connections.

Charter could upgrade to a gigabit, but clearly believes the market will pay for 100 Mbps. If so, then investing in more-expensive gigabit connections does not make business sense.

Comcast and others (AT&T, many independent ISPs and other cable companies) think upgrades to a gigabit are required for competitive reasons (headline speeds and marketing), even if they believe most consumers will not choose to buy such services.

The key observation is that nobody actually has found that most consumers are willing to buy gigabit connections when they also have a choice of 100-Mbps up to 300-Mbps choices that cost less.

In other words, investing in gigabit platforms almost always--so far--involves a determination that most consumers will not buy that product, and instead will opt for a lower-speed--though still fast--connection.

So why supply gigabit services? The answer is because “our competitors do so.”

Comcast primarily operates in major urban markets, where competition is more robust, and where it faces Google Fiber offering gigabit services. That is true for AT&T and CenturyLink as well. Even if only 10 percent of customers actually choose to pay for gigabit services, that still sets market expectations, and no leader wants to face the marketing claim that “it is not the leader” in speeds.

Customer demographics also can play a role. Charter historically has operated in smaller markets, where competition is less robust, though the new Time Warner Cable assets primarily are in larger urban areas.

Comcast, on the other hand, mostly operates big-city networks, where it faces competition from other ISPs presently, or soon, to offer gigabit speeds.

So gigabit headline speeds matter, in big markets, even if suppliers realize most consumers will not buy them, yet. Google Fiber, and some other gigabit providers, also have found demand for gigabit connections less robust than they had hoped. EPB reports that about eight percent of its internet access customers buy the gigabit service, for example. Google Fiber might have wound up getting 10 percent or less take rates for its gigabit service, priced at $70 a month.

Under such conditions, a range of decisions, ranging from “top speeds of 100 Mbps” to “top speeds of a gigabit” or even 2 Gbps, make business sense. Demand matters when supply is considered.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Subscribe to:

Posts (Atom)

Meta Quantifies AI Monetization

Though we might still note that artificial intelligence benefits often are somewhat indirect or hard to measure, Meta joins the ranks of fir...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...