For more than two decades, U.S. cable operators have won the market share battle with telcos (net new additions) as well as the installed base battle (percentage of total customers). That appears poised to change, with telcos now believed to be possible installed base gainers.

To accomplish that, telcos also would likely have to win the market share (net new additions) battle. We haven’t seen that in two decades (some might argue telcos never have won the market share battles) but it seems possible for the first time.

So what has changed? Several things, probably. Some important tier-two telcos that had been capital constrained have now restricted to the point where they can afford to invest in new fiber-to-home facilities where they had not been able to, in the past.

Tier-one suppliers also arguably have altered options. Verizon, which had largely halted FTTH deployments because of the business model, now sees different returns as a result of fiber deployment to support its 5G small cell deployments. One byproduct is a denser optical transport network that can change the incremental cost to provide FTTH.

But market share or installed base can change in other ways directly related to that denser fiber transport footprint. In some cases, 5G fixed wireless can allow Verizon to gain share without full FTTH. If the issue is “bandwidth to the home” or “gigabit to the home,” then 5G fixed wireless might work, irrespective of the platform.

AT&T has been deleveraging, and is the telco with the most room to upgrade its access networks to FTTH.

source: Standard & Poors

Lumen Technologies, on the other hand, recently divested itself of about half its total consumer access lines, to concentrate on its denser metro areas.

It might seem paradoxical that perceptions of return from FTTH investment are higher than once was the case when three mass market services--each with high adoption--were possible with FTTH. With the decline of voice and linear video entertainment revenues, the fixed network business case for consumer services largely rests on internet access.

Logically that should create a worse business case, as revenue mostly must come from a single lead application. But other parts of the revenue and cost model also are changing. Third party sources of funding sometimes are more lucrative (either from joint builds or bigger government subsidies).

Divesting linear video reduces revenue, but also cost. Harvesting voice while concentrating on internet service provider operations might in some cases lead to lower operating costs.

Also, though telcos failed to halt the slide in broadband market share over the last two decades, the growing need for more-symmetrical bandwidth now offers telcos a possible marketplace advantage over cable operators.

Also, telcos increasingly are building models that rely on broadband for nearly all the financial return from a new FTTH build, based on steadily-improving efficiencies. Telcos with 5G backhaul networks now can leverage those other fiber transport investments to support consumer home broadband investments.

Expectations about installed base share also help the new payback models. Where telcos once might have held only 30 percent share of the installed base, they now can reasonably expect to eventually take 50 percent share of the installed base, which changes the financial return.

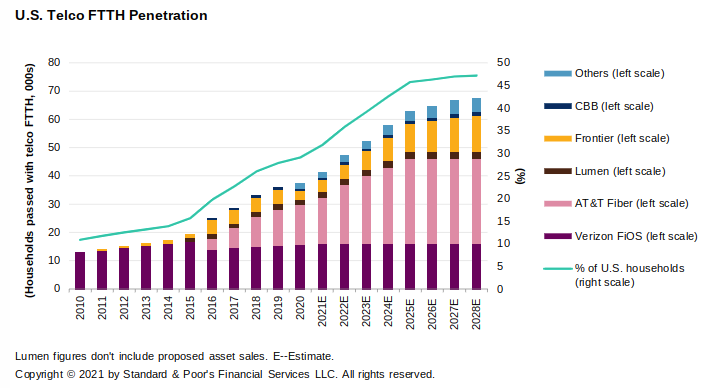

Up to this point the U.S. FTTH footprint has been rather modest. All together, telco FTTH probably today passes only about 29 percent of U.S. homes. That percentage will grow closer to half of all U.S. homes over the next five years or so.

That still leaves telcos with a problem: they wil be able to sell FTTH-based gigabit services to only half of U.S. homes. What to do about the rest is the logic behind 5G fixed wireless.

In 2021, for example, Comcast, the biggest U.S. cable operator, faced an FTTH competitor in less than 30 percent of its footprint. That obviously limits the amount of total share loss Comcast is exposed to, as cable trounces digital subscriber line platforms in performance. DSL simply is not competitive with cable modem service.

Then there are the strategic issues. Absent the upgrades to FTTH, can a fixed network service provider reasonably expect to remain in business? Increasingly, the answer is “no.” To the extent that internet access is the paramount driver of fixed network revenue, then FTTH either is installed or the telco faces bankruptcy.

The argument then is not so much “we will make more money” as it is “we get to stay in business.”