It is easy enough to find stories expressing worry about the “slow” pace of 5G adoption or even the business model. To be sure, there have been business model concerns since 3G, based in large part on the cost of acquiring spectrum.

Like it or not, data bandwidth--and lots of it--is the driver of the modern mobile business. And that means additional spectrum has to be acquired, like it or not. Fundamentally, it is the same business model issue as fiber to the home represents: service providers would rather not invest the huge amounts of new capex, but it is a necessity to stay in business.

5G also is an example of the adoption curve for virtually all new innovations, which are adopted in a “S curve” fashion. As far as new use cases, those will take some time to develop, as well, in part because Martec's Law operates. Technology changes faster than organizations change.

In many cases, the issue is less “where is the new incremental revenue” and more “we get to stay in business.” The investment is fundamentally strategic rather than driven by a simple analysis of the cost versus financial return.

So slow early adoption should not come as a surprise.

Ultimately, without the FTTH upgrade, a fixed network services provider will be driven out of business by competitors able to supply gigabit per second speeds and large usage allowances.

In the early days of any next-generation mobile network coverage always will be uneven, and taht means customer uptake will be uneven. It always takes time--especially in bigger countries--to deploy the network nationally.

In the case of 5G, the use of low band, mid band and high band spectrum is a new wrinkle, as potential speed boosts vary dramatically depending on which bands are available. Low band bandwidth is not going to vary much from 4G. Mid band will be faster and high band will be comparable to fixed network performance in some cases.

In the U.S. market, mid band spectrum has been limited for all but one of the leading providers, while high band deployments also have been limited. So speed increases have been correspondingly low, compared to 4G.

Also, very next-generation mobile network requires new devices. So it is not surprising at all that consumers say they have not yet already “bought 5G.” They need to buy new phones. In fact, it would be surprising if only 35 percent of U.S. customers actually own phones that are only capable of 4G network access, at this point, as reported in a survey by Speedcheck.org.

Other surveys might suggest more than 60 percent of U.S. consumers to 75 percent of customers do not yet own 5G-capable devices. But that will change over time, as people replace existing devices.

Other obvious barriers to adoption are “no 5G service in my area.”

source: Speedcheck.org

None of those issues are terribly worrisome or even new. We are early in the deployment of full national 5G networks by all the leading service providers and the device replacement cycle takes about three years, on average (half earlier, half later).

For many of us, battery life drives the replacement cycle, and that is closer to two years. At least one survey found that battery life is more important than 5G, for example.

Every next-generation mobile network requires new devices. So it is not surprising at all that consumers say they have not yet already “bought 5G.” They need to buy new phones. In fact, it would be surprising if only 35 percent of U.S. customers actually own phones that are only capable of 4G network access, at this point, as reported in a survey by Speedcheck.org.

Other surveys might suggest more than 60 percent of U.S. consumers to 75 percent of customers do not yet own 5G-capable devices. But that will change over time, as people replace existing devices.

None of those issues are terribly worrisome or even new. We are early in the deployment of full national 5G networks by all the leading service providers and the device replacement cycle takes about three years, on average (half earlier, half later).

For many of us, battery life drives the replacement cycle, and that is closer to two years. At least one survey found that battery life is more important than 5G, for example.

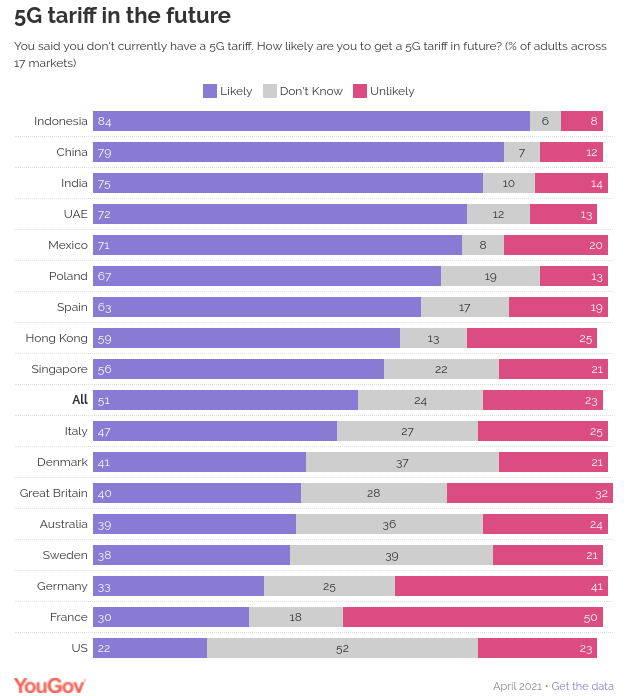

Still, 5G is inevitable. Most consumers will switch.

source: YouGov

5G arguably is being adopted faster than was 4G. It just seems “slow” because the networks still are being built.