Verizon’s rationale for acquiring Frontier Communications, at a cost of $20 billion, is partly strategic, partly tactical. Verizon and most other telcos face growth issues, and Frontier adds fixed network footprint, existing fiber access and other revenues, plant and equipment.

Consider how Verizon’s fixed network compares with major competitors.

ISP | Total Fixed Network Homes, Small Businesses Passed |

AT&T | ~70 million |

Comcast | ~60 million |

Charter | ~50 million |

Verizon | ~36 million |

Verizon has the smallest fixed network footprint, so all other things being equal, the smallest share of the total home broadband market nationwide. If home broadband becomes the next big battleground for AT&T and Verizon revenue growth (on the assumption mobility market share is being taken by cable companies and T-Mobile from Verizon and At&T), then Verizon has to do something about its footprint, as it simply does not have enough ability to compete for customers across most of the Untied States for home broadband using fixed network platforms.

And though Frontier’s customer base and geographies are heavily rural and suburban, compared to Verizon, that is characteristic of most “at scale” telco assets that might be acquisition targets for Verizon.

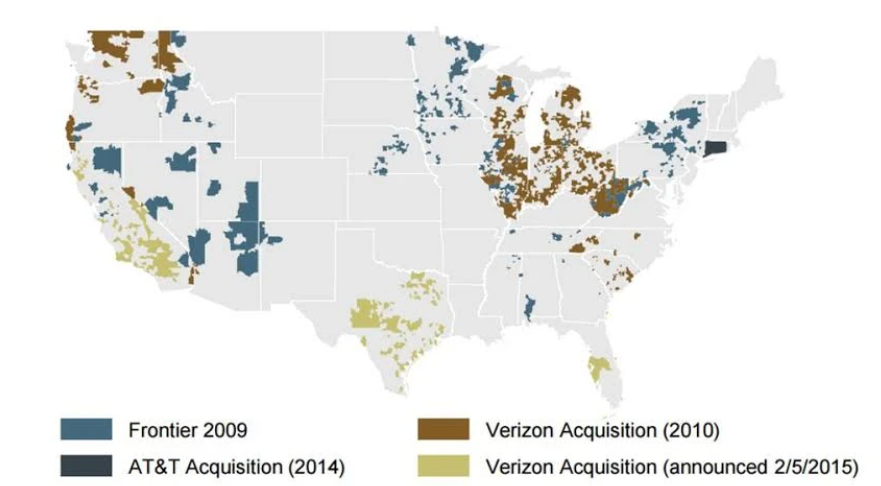

Oddly enough, Verizon sold many of the assets it now plans to reacquire. In 2010, for example, Frontier Communications purchased rural operations in 27 states from Verizon, including more than seven million local access lines and 4.8 million customer lines.

Those assets were located in Arizona, California, Idaho, Illinois, Indiana, Michigan, Nevada, North Carolina, Ohio, Oregon, South Carolina, Washington, Wisconsin and West Virginia, shown in the map below as brown areas.

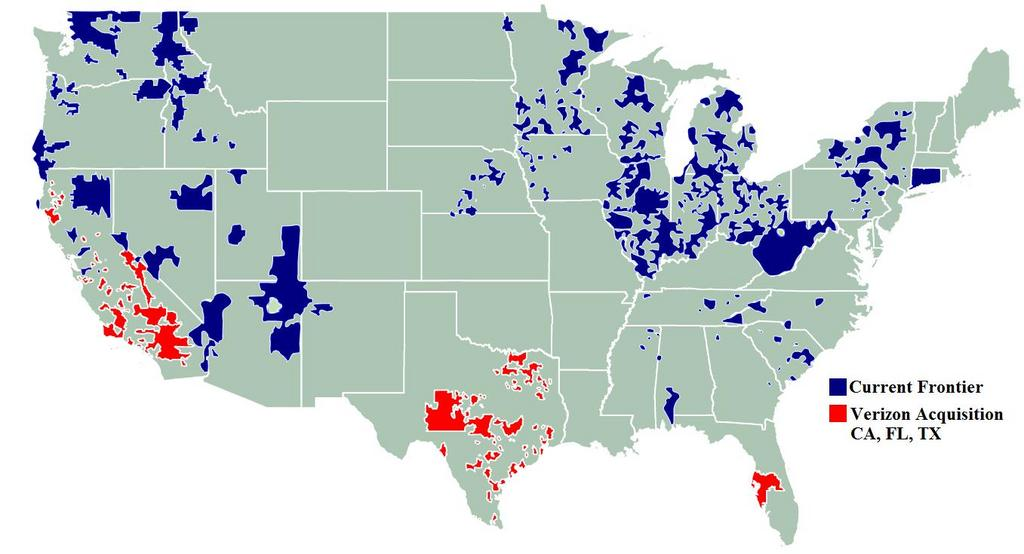

Then in 2015, Verizon sold additional assets in three states (California, Texas, Florida) to Frontier. Those assets included 3.7 million voice connections; 2.2 million broadband internet access customers, including about 1.6 million fiber optic access accounts and approximately 1.2 million video entertainment customers.

source: Verizon, Tampa Bay Business Journal

Now Verizon is buying back the bulk of those assets. There are a couple of notable angles. First, Verizon back in the first decade of the 21st century was raising cash and shedding rural assets that did not fit well with its FiOS fiber-to-home strategy. In the intervening years, Frontier has rebuilt millions of those lines with FTTH platforms.

Also, with fixed network growth stagnant, acquiring Frontier now provides a way to boost Verizon’s own revenue growth.

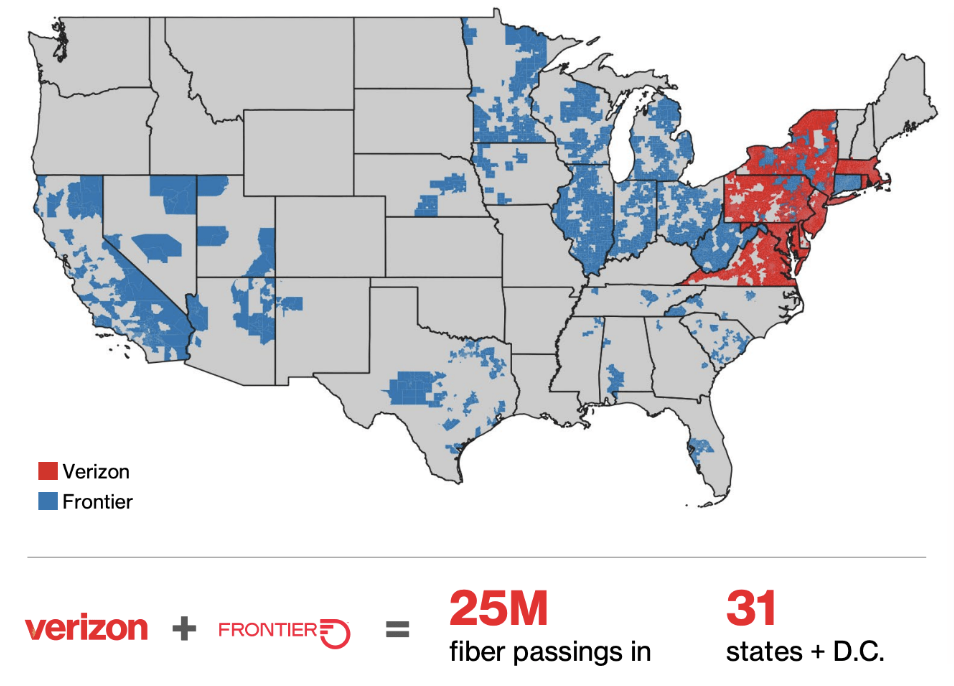

For example, the acquisition adds around 7.2 million additional and already-in-place fiber passings. Verizon already has 18 million fiber passings,increasing the fiber footprint to reach nearly 25 million homes and small businesses. In other words, the acquisition increases current fiber passings by about 29 percent.

There also are some millions of additional copper passings that might never be upgraded to fiber, but can generate revenue (copper internet access or voice or alarm services, for example). Today, Frontier generates about 44 percent of its total revenue from copper access facilities, some of which will eventually be upgraded to fiber, but perhaps not all.

Frontier already has plans to add some three million more fiber passes by about 2026, for example, bringing its total fiber passings up to about 10 million.

That suggests Frontier’s total network might pass 16 million to 17 million homes and small businesses. But assume Verizon’s primary interest is about 10 million new fiber passings.

Frontier has estimated its cost per passing for those locations as between $1000 and $1100. Assume Verizon can also achieve that. Assume the full value of the Frontier acquisition ($20 billion) was instead spent on building new fiber plant outside of region, at a blended cost of #1050 per passing.

That implies Verizon might be able to build perhaps 20 million new FTTH passings as an alternative, assuming all other costs (permits, pole leases or conduit access) were not material. But those costs exist, and might represent about 25 percent higher costs.

So adjust the cost per passing for outside-of-region builds to a range of $1300 to $1400. Use a blended average of $1350. Under those circumstances, Verizon might hope to build less than 15 million locations.

And in that scenario Verizon would not acquire the existing cash flow or other property. So one might broadly say the alternative is spending $20 billion to build up to 15 million new fiber passings over time, versus acquiring 10 million fiber passings in about a year, plus the revenue from seven million passings (with take rates around 40 percent of passings).

Critics will say Verizon could do something else with $20 billion, to be sure, including not spending the money and not increasing its debt. But some of those same critics will decry Verizon’s lack of revenue growth as well.

But Verizon also sees economies of scale, creating projected cost synergies of around $500 million annually by the third year. The acquisition is expected to be accretive to Verizon’s revenue, EBITDA and cash flow shortly after closing, if adding to Verizon’s debt load.

Even if the majority of Verizon revenue is generated by mobility services, fixed network services still contribute a quarter or so of total revenues, and also are part of the cost structure for mobility services. To garner a higher share of moderate- to high-speed home broadband (perhaps in the 300 Mbps to 500 Mbps range for “moderate speed” and gigabit and multi-gigabit services as “high speed”), Verizon has to increase its footprint nationwide or regionally, outside its current fixed network footprint.

One might make the argument that Verizon should not bother expanding its fixed network footprint, but home broadband is a relative growth area (at least in terms of growing market share). The ability to take market share from the leading cable TV firms (using fixed wireless for lower speed and fiber for higher speed accounts) clearly exists, but only if Verizon can acquire or build additional footprint outside its present core region.

And while it is possible for Verizon to cherry pick its “do it yourself” home broadband footprint outside of region, that approach does not offer immediate scale. Assuming all else works out, it might take Verizon five years to add an additional seven million or so FTTH passings outside of the current region.

There is a value to revenue Verizon can add from day one, rather than building gradually over five years.