For every public policy decision, there are winners and losers. That is no different for proposals to tax a few hyperscalers to support home broadband networks. ISPs would gain; app providers would lose. Ultimately, so would users of internet-delivered apps and services.

Communications policy almost always is based on precedent and prior conceptions. All this might be relevant when thinking about how public networks are funded, especially not that regulators are looking at unprecedented funding mechanisms, such as levying fees on third parties that are not “customers” of connectivity providers.

It’s a bit like taxing appliance makers whose products create demand for electricity. Today, the electrical networks are common carriers, all the devices are private and the cost of using electricity is borne by the actual end user customers.

But some regulators want to essentially tax device manufacturers for the amount of electricity use they generate.

There are simpler solutions, such as charging customers on a usage basis, based on their consumption. That would have a possible added benefit of not disturbing the data communications regulatory framework.

And that matters, at least for observers who care about freedom of expression. Data networks have always separated the movement of data from the content of data. Devices and software do not require the permission of the data infra owner to traverse the network, once access rights are paid for.

The important point is that all networks now are computer networks.

To be clear, some will argue that changes in how networks are built (architecture, media, protocols) do not matter. It is the function that matters, not the media. If a network is used for broadcast TV or radio, that is the crucial distinction, not whether broadcasting uses analog or digital modulation; particular protocols or radios.

If a network is a public communications carrier, the types of switches, routers, cables, protocols and software used to operate that business do not matter. What is regulated is the function.

The function of a public network is to allow paying customers to communicate with each other. Each account is an active node on the network, and pays to become a node (a customer and user of the network).

Service providers are allowed to set policies that include usage volume and payment for other features. In principle, a connectivity provider may charge some customers more than others based on usage.

But one element is quite different in the internet era. Connectivity providers have customers, but generally do not own the applications that customers use their networks to interact with. There is no business relationship between the access provider and all the other application providers--as app providers. Every app provider is a customer of a local access provider or many access providers.

Operators of different domains can charge each other for use of each others’ networks by other networks, which is where the intercarrier settlements function plays. And volume does matter, in that regard.

The point is that it is the networks who settle up on any discontinuities in traffic exchange. Arbitrage always is possible whenever traffic flows are unequal, and where rules are written in ways that create an arbitrage opportunity. The classic example is a call center, which features lots of inbound traffic, compared to outbound.

So some might liken video streaming services to a form of arbitrage, in that video streaming creates highly unequal traffic flows: little outgoing traffic and lots incoming, for the consumer of streaming content.

But that also depends on where the servers delivering the content are located. In principle, traffic flows might well balance out--between connectivity domains-- if streaming customers and server sites are distributed evenly.

Historically, big networks and small networks also have different dynamics. When the media type is voice, for example, bigger networks will get more inbound traffic from smaller networks, while smaller networks should generate more outbound traffic to the larger networks.

For streaming and other content, traffic flows on public networks might largely balance, since the biggest content firms build and operate their own private networks to handle the large amount of traffic within any single data center and between data centers. Actual distribution to retail customers (home broadband users of streaming video, for example) likewise is conditioned by the existence of server farms entirely located within a single domain (servers and users are all on one service provider’s network).

The point is that inter-domain traffic flows, and any compensation that different domains might “owe” each other, is a complicated matter, and arguably should apply only to domains and their traffic exchange.

In other words, one might argue that traditional inter-carrier settlements, traffic peering and transit are sufficient to accommodate unequal traffic flows between the domains.

In other words, the argument that internet service providers make that a few hyperscale app providers are sending much more traffic than they are receiving “should” or “could” be settled between the access provider domains, as always has been done.

If the argument goes beyond that, into notions of broadband cost recovery, then we arguably are dealing with something different. Going beyond inter-carrier settlements, such notions add a new idea, that traffic sources (content providers and streaming services) should pay for traffic demand generated by their traffic sinks (users and subscribers of streaming services).

This is a new concept that conceptually is not required. If ISPs claim they cannot afford to build and operate their own access networks, they are free to change charging mechanisms for their own customers. Customers who use more can pay more. It’s simpler, arguably more fair and does not require new layers of business arrangements that conflict with the “permissionless” model.

Data networks (wide area and local area) all are essentially considered private, even when using some public network resources. Data networks using public network resources pay whatever the prevailing tariffs are, and that is that. Entities using data networks do not contribute, beyond that, to the building and operating of the public underlying networks.

Public transport and access providers might argue that they cannot raise prices, or if they did, would simply drive customers to build their own private networks for WAN transport.

That obviously would not happen often in the access function. Local networks are expensive. But there already exists a mechanism for networks to deal with unequal traffic flows between access domains.

So there is a clash here between private data networking and public communications models. What is new is that, in the past, the applications supported by the network were entirely owned by the network services provider.

Now, the assumption is that almost none of the applications used by any ISP’s customers are owned by the ISP itself. So the business model has to be built on an ISP’s own data access customer payments. Application revenue largely does not factor into the business model.

But that is the way private computer networks work. Cost is incurred to create the network. Revenue might be created when public network access and transport is required. But all those payments are made by an ISP’s local customers, even when the ISP bundles in access to other ISP domains required to construct the private network.

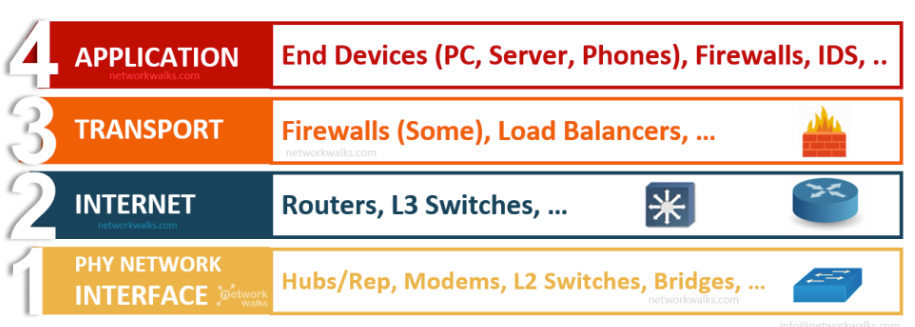

“Permissionless” development and operation now is foundational for software design and computing networks. All networks now are computing networks, and all now rely on functional layers.

The whole design allows changes and innovation at each functional layer without disturbing all the functions of the other layers. What we sometimes forget is that below the physical layer is layer 0, the networks of cables that create the physical pathways to carry data.

Of course, any connectivity network must operate at several layers: physical, data link and network. By the “transport” layer functions tend to be embedded in edge devices.

source: Comparitech

To be sure, connectivity networks--especially access networks that sell home broadband and other connectivity services to businesses--must operate at many layers, including the modems used to support broadband access.

So some might add, in addition to a “layer zero” network of cables, a layer eight for software and applications that run on networks.

source: NetworkWalks

Local area networks typically are less complex, but still use the layers architecture. The difference is that LANs (Wi-Fi, Ethernet or other) primarily rely on layers one to three of the model.

source: Electricalfundablog

“Permissionless” access and transport have sparked enormous innovation. That should remain the case. Additional taxes, which means higher costs, will not help that process. Other networks charge for usage. Public IP networks could do the same. Settlement policies between access domains already exist. And, to be clear, app domains can create facilities that do not cross access domains, if they choose.

So ISPs can charge for usage if they choose. Unlimited usage could be a higher price. Lower amounts of usage can still be sold in tiers. Problem essentially solved.