Edge computing possibly can grow to generate a minimum of $1 billion in annual new revenues for some tier-one service providers. The same might be said for service-provider-delivered and operated private networks, internet of things services or virtual private networks.

But none of those services seem capable of driving the next big wave of revenue growth for connectivity providers, as their total revenue contribution does not seem capable of driving 80 percent of total revenue growth or representing half of the total installed base of revenue.

In other words, it does not appear that edge computing, IoT, private networks or network slicing can rival the revenue magnitude of voice, texting, video subscriptions, home broadband or mobile subscription revenue.

It is not clear whether any of those new revenue streams will be as important as MPLS or SD-WAN, dedicated internet access or Ethernet transport services, for example. All of those can be created by enterprises directly, on a do-it-yourself basis, from the network edge.

The point is that even when some new innovations are substantial generators of revenue and activity, it is not automatically connectivity providers who benefit, in terms of direct revenue.

One rule of thumb I use for determining whether any proposed new line of business makes sense for tier-one connectivity providers is whether the new line has potential to produce a minimum of $1 billion in annual revenues for a single provider in some definable time span (five years for a specific product.

By that rule of thumb, tier-one service providers might be able to create edge computing revenue streams that amount to as much as $1 billion in annual revenue for some service providers. But most will fail to achieve that level of return in the next five to seven years.

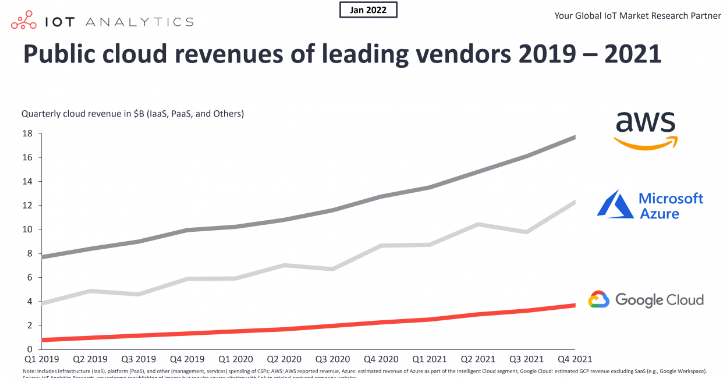

That is not to say "computing at the edge" will be a small business. Indeed, it is likely to account for a growing part of public cloud computing revenues, eventually. And that is a big global business, already representing more than $400 billion in annual revenues, including both public cloud revenues as well as infrastructure spending to support cloud computing; the value of business applications and associated consulting and services to implement cloud computing.

The leading public cloud computing hyperscalers themselves represent about $72 billion or more in annual revenues already. All the rest of the revenue in the ecosystem comes from sales of software, hardware and services to enable cloud computing, both public and private.

source: IoT Analytics

It is likely a reasonable assumption that most public edge computing revenue is eventually earned by the same firms leading public cloud computing as a service.

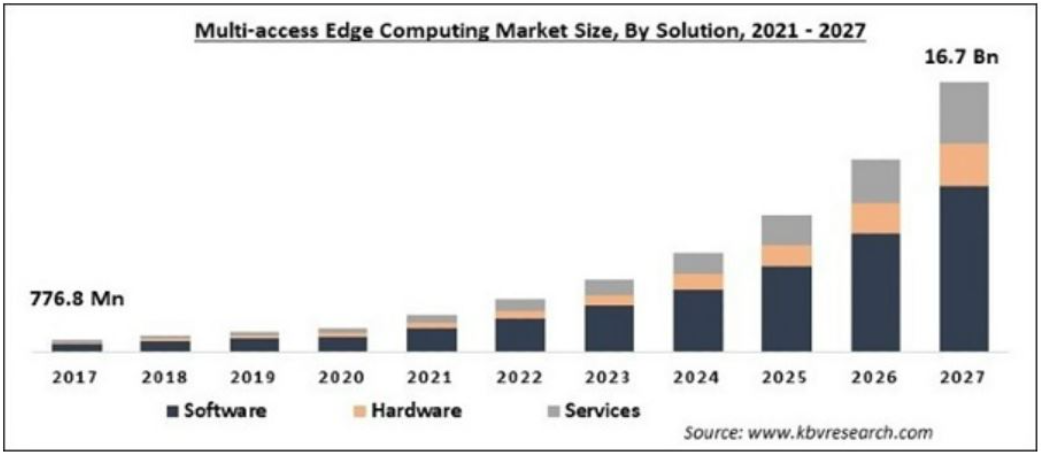

Perhaps service provider revenues from edge computing could reach at least $20 billion, in about five years. By that standard, multi-access edge computing barely qualifies as "something worth pursuing," at least for tier-one connectivity service providers.

In other words, MEC is within the category of products that offers reasonable hope of payback, but is not yet in the category of “big winners” that add at least $100 billion to $200 billion in global service provider revenues.

In other words, MEC is not “mobile phone service; home broadband. Perhaps it will be as big as MPLS or SD-WAN. For tier-one connectivity providers, perhaps MEC is more important than business voice (unified communications as a service).

source: STL, KBV Research

As with many other products, including Wi-Fi, SD-WAN, MPLS, 4G or 5G private networks, local area networks in general and enterprise voice services, most of the money is earned by suppliers of software (business functionality) and hardware platforms, not end-user-facing services.

The reason is that such solutions can be implemented on a do-it-yourself basis, directly by enterprises and system integrators, without needing to buy anything from tier-one connectivity providers but bandwidth or capacity.

So one reason why I believe that other new connectivity services enabled by 5G likely do not have the potential to substantially move the industry to the next major revenue model is that none of those innovations are very likely to produce much more than perhaps one percent of total service revenues for the typical tier-one service provider.

The opportunity for big public connectivity providers lies in use cases related to the wide area network rather than the domain of indoor and private networks. That is why the local area networks industry has always been dominated by infra providers (hardware platforms) and users who build and own their own networks (both enterprise and consumer).

And most of the proposed “new revenue sources” for 5G are oriented towards private networks, such as private enterprise local area networks. Many of the other proposed revenue generators can be done by enterprises on a DIY basis (edge computing, internet of things). Some WAN network services--such as network slicing--attack problems that can be solved with DIY solutions.

Edge computing is a solution for some problems network slicing is said to solve, for example.

None of the new 5G services--or new services in aggregate-- is believed capable of replacing half of all current mobile operator revenues, for example. And that would be the definition of a “new service” that transforms the industry.

All of which suggests there is something else, yet to be discovered, that eventually drives industry revenue forward once mobility and home broadband have saturated. So far, nobody has a plausible candidate for that new service.

Edge computing might be helpful. So might network slicing, private networks or internet of things. But not even all of them together are a solution for industry revenue drivers once home broadband and mobile service begin to decline as producers of at least half of industry revenues.

It already seems clear that others in the edge computing ecosystem--including digital infra providers and hyperscale cloud computing as a service suppliers--will profit most from edge computing.