Wednesday, May 30, 2012

Tim Cook Talks About Apple

Portions of Tim Cook, Apple CEO, talk at "AllThingsD" conference.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Skype Carries 100 Billion Minutes a Quarter

Cheap and free Internet calls have driven Skype usage in the first quarter of 2012, jumping 40 percent to 100 billion minutes of calls in the first quarter, up from the first quarter of 2011, according to Microsoft. Skype also has about 250 million registered users.

What isn't so clear is how much gross revenue Skype makes, though it is reasonable to guess it now is in the low single-digit billions per quarter. Skype never has made much in the way of profit, and that probably hasn't changed.

Skype illustrates a major issue for service providers, namely that new Internet-enabled products displace traditional usage, but do not come close to generating the same level of revenue or profit as the older services. Essentially, the legacy market essentially becomes an important feature or capability, but not a "business" in the same sense.

Mobile service providers now worry about the health of their messaging business, which in some markets is showing the same trend as was seen in the VoIP market: traffic shifts and revenue declines. As was the case with voice, the new messaging providers earn revenue that is an order of magnitude less than the legacy services they are displacing.

What isn't so clear is how much gross revenue Skype makes, though it is reasonable to guess it now is in the low single-digit billions per quarter. Skype never has made much in the way of profit, and that probably hasn't changed.

Skype illustrates a major issue for service providers, namely that new Internet-enabled products displace traditional usage, but do not come close to generating the same level of revenue or profit as the older services. Essentially, the legacy market essentially becomes an important feature or capability, but not a "business" in the same sense.

Mobile service providers now worry about the health of their messaging business, which in some markets is showing the same trend as was seen in the VoIP market: traffic shifts and revenue declines. As was the case with voice, the new messaging providers earn revenue that is an order of magnitude less than the legacy services they are displacing.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Tuesday, May 29, 2012

Amazon Will be a Mobile Service Provider in Japan

The cards will be usable on NTT Docomo’s LTE network. The news comes as Facebook is said to be considering building its own smart phone.

Facebook also is rumored to be looking at its own browser as well.

To be sure, the move is probably more aimed at helping Amazon sell mobile content than anything else.

But that alone shows that a new segment could open up in the mobile business, namely lots more entry by application providers into the mobile virtual network operator business, bur as specialized content providers, not traditional voice and data access providers.

Microsoft's recent investment in the new company that will own the Nook tablet and content business illustrates a couple of important strategic shifts now happening in the mobile device and application markets.

The biggest shift is the growing importance content, advertising and commerce operations are assuming for device and application suppliers.

Some believe the "Four Horsemen" of the Internet include Facebook, Apple, Google and Amazon. Others might say the list actually is "Five Horsemen" and include Microsoft. Either way, the notion is that handful of firms have the ability, at least in principle, to create and own a complete and walled-off ecosystem in which consumers use a single company’s hardware, operating system and storefront to search online, buy apps and purchase digital media and physical products.

If that proves to be true then a couple of predictions are easy to make. Facebook and Amazon will produce their own smart phones. Facebook might also have to produce a tablet. Apple will have to create a mobile payment service, as will Microsoft.

Google and Facebook will have to get more share of the e-commerce and mobile commerce transactions, and all will deepen the activities they now already support around mobile advertising, promotion and loyalty.

The rumor surfaced that Facebook is getting closer to releasing its own branded smart phone, an obvious attempt at owning a stack component (hardware) that’s currently missing from its line-up, is part of that trend.

“A smartphone would be a logical next step for Amazon,” ABI Research Analyst Aapo Markkanen says.

Traditionally, mobile phones simply were devices carriers had to provide to sell voice and messaging services.

These days, matters are more complex. In addition to communications, hot consumer devices frequently are used for content consumption. That means smart phones are more important to application providers as platforms for selling content and advertising.

Everyone expects a mobile device to handle voice and texting. Beyond that, more users expect the ability to consume content and conduct transactions. That changes the strategic importance of being a device manufacturer.

For mobile service providers, phones have been a sort of prop to produce revenue indirectly, in the form of service subscriptions. But that also now is increasingly true for application providers.

For Apple, which merchandises all sorts of content to sell devices, the tight bundling of content and commerce is a major reason it can sell so many devices. That also is true for some other mobile device manufacturers. But not for all.

For Google and Amazon, devices are a way to sell more advertising, content and merchandise. Microsoft has a slightly different take, as it always has preferred to sell operating systems to partners who make phones. But Microsoft has to succeed in mobile operating systems to profit from the device ecosystem that supports the advertising, commerce and content businesses.

Such thinking is not terribly new. Consumer electronics manufacturers have for decades understood that content was important for the devices business. Sony is probably the best example of that. Apple arguably was the first consumer devices firm to really achieve that integration, with its iPod and iTunes.

These days, gaining the ability to lock consumer into a particular content ecosystem is the reason producing devices matters.

There has been lots of speculation about whether Apple, for example, might want to become a virtual mobile service provider as well. It is getting harder to ignore the speculation.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

New Chromebooks Coming June 15, 2012

Samsung has just announced a new Chromebook and the first Chromebox.

Samsung has just announced a new Chromebook and the first Chromebox. The newest Chromebook is a fast and portable laptop for everyday users, but most people don't use one.

Google seems to be focusing its adoption efforts on several verticals, including schools, retailers, call centers and airlines.

These focus areas probably build on areas where Google has had success so far.

Google says more than 500 schools have used these devices. Retailers such as Dillards are planning to deploy Chromeboxes in more than half of its US stores, while others such as Kaplan are moving their New York-based call center to Chromeboxes.

Chromebooks will be available online June 15, 2012, in the United States, United Kingdom, France, Germany, Netherlands, Italy and Spain. More countries will follow in the coming months. In the U.S., Chromebooks will be available from Amazon and Best Buy and internationally from leading retailers.

The new Chromebook and Chromebox, based on Intel Core processors, are nearly three times as fast as the first-generation Chromebooks. The new Chromebook boots in less than seven seconds and resumes instantly.

The new versions also have a new user interface said to make it easier to find and launch apps, and use alongside browser or other apps. Commonly-used apps can be pinned to the screen for quick access, with multiple windows displayed side-by-side.

Since most of my "PC" usage is for content creation, I never use a tablet as a "replacement" for a notebook. I also travel quite a lot and use cloud apps on a number of machines. The Chromebook is the device always packed in my backpack.

As a "cloud" device, you can't do much without a Wi-Fi connection. That means on airplanes I just do something else (that's when the tablet gets used, mostly for reading, for example). The only "offline" format I have found troublesome are PDFs. But then I find PDFs annoying on all my machines.

You might still have trouble finding anybody you know using a Chromebook on a regular basis, though.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

66% of U.K. SMBs Have Adopted Cloud Services, or Plan to

The ability to work in a more mobile and flexible way was identified in an IBM study as the number one reason for small and mid-size businesses to use cloud-based apps. IBM says the survey shows interest has moved from cost savings to more-strategic advantages.

About two thirds of the senior managers surveyed had either already implemented cloud services or intended to in the future, with 45 percent of U.K. businesses looking to do so within the next two years.

The increased ability for employees to work with greater mobility and flexibility was identified as the most popular reason to move to cloud services (39 percent of respondents), with cost efficiencies named as the second most popular reason (33 percent of respondents).

About two thirds of the senior managers surveyed had either already implemented cloud services or intended to in the future, with 45 percent of U.K. businesses looking to do so within the next two years.

The increased ability for employees to work with greater mobility and flexibility was identified as the most popular reason to move to cloud services (39 percent of respondents), with cost efficiencies named as the second most popular reason (33 percent of respondents).

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Multiple Fixed Networks "Make No Sense"

Multiple networks make no sense, TM Forum’s Founder and Chairman, Keith Willetts argues in “Unzipping the Digital World.” In some markets, including Singapore, Australia, Malaysia and New Zealand, that is the way regulators have decided to use as the framework for fixed network broadband services.

He shares his views in this video interview.

He shares his views in this video interview.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

OTT Destroys Voice, Text Business, Isn't Just Share Shifting

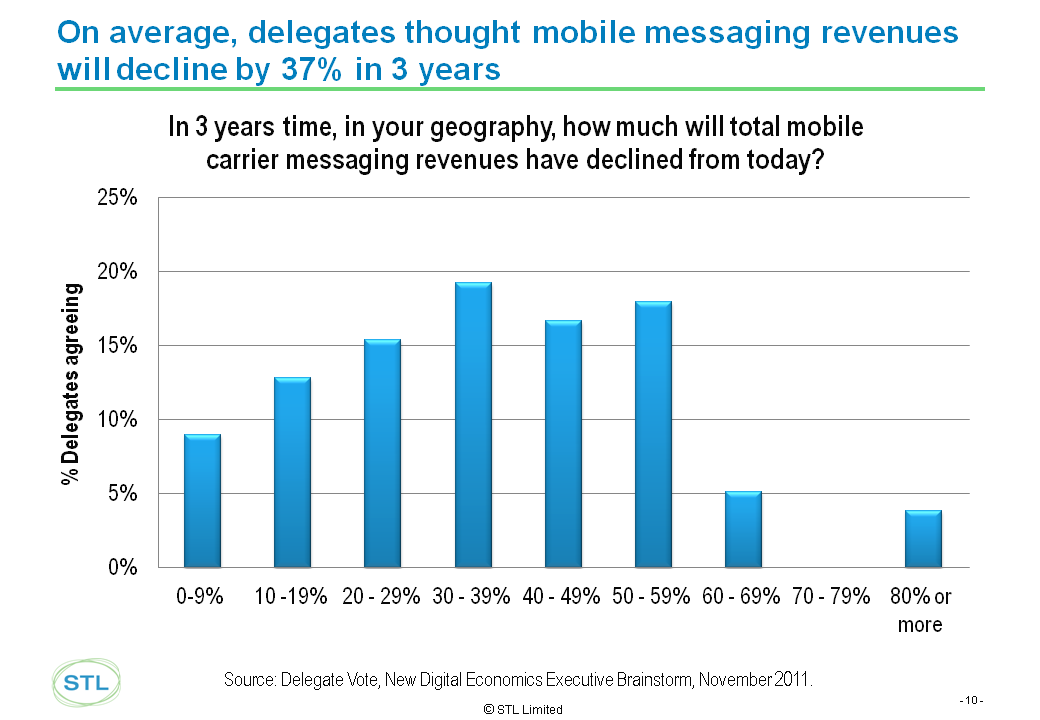

Mobile operators’ SMS revenues may be under pressure from mobile messaging apps such as WhatsApp, iMessage and others. The only real issue is where, when and how much over the top apps will reduce mobile service provider revenue.

To be sure, Informa Telecoms & Media still forecasts that mobile operators will still generate a total of $722.7 billion in revenues from text messaging revenues between 2011 and 2016.

Third-party providers of over the top (OTT) messaging services will earn about $8.7 billion in 2016. That disparity in revenue illustrates the issue.

The big problem is not that OTT providers take so much revenue from mobile service providers, so much as OTT messaging essentially destroys the existing business, rather than shifting share to new contestants.

Text messaging revenue could decline 40 percent over the next three or four years in the European and Middle East markets, many executives predict. About 84 percent of respondents to a Telco 2.0 survey thought the main reason for such declines was the expected price reductions mobile service providers would adopt to compete with OTT services and apps.

In many ways, that is precisely what service providers have encountered when facing over the top voice apps. The OTT providers do not so much take revenue away from incumbent service providers as destroy the market.

Informa Telecoms & Media estimates that every 10 percentage points increase in smart phone penetration could cost Western European operators $1.19 billion in voice and messaging revenues and $306 million for their Eastern European counterparts.

In 2010, for example, mobile operators made on average only $13.21 per user per year from mobile VoIP services.

In other words, VoIP turns out not to be such a great product for incumbent service providers.

In fact, some might argue there is almost no way incumbent service providers can avoid losing both voice and messaging revenue to over-the-top applications, no matter what they do.

Mobile service providers lost an estimated $13.9 billion in text messaging revenue in 2011, as subscribers turned to outside social messaging apps, according to researcher Ovum.

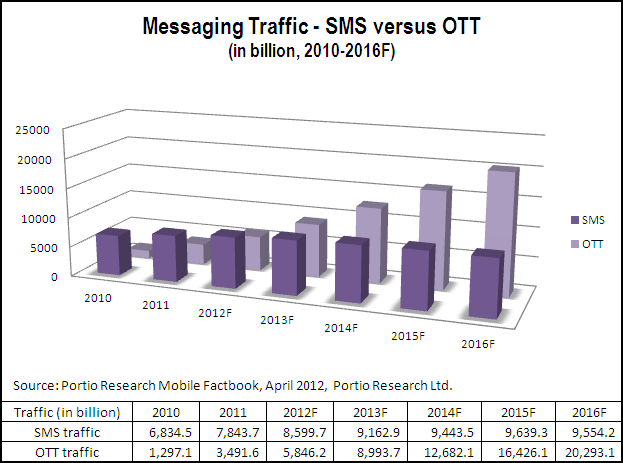

Globally, Informa forecasts that SMS traffic will total 9.4 trillion messages by 2016, up from 5.9 trillion messages in 2011. However, SMS’s share of global mobile messaging traffic will fall from 64.1 percent in 2011, to 42.1 percent in 2016. Traffic is not revenue, though.

At the same time, global mobile instant messaging traffic will increase from 1.6 trillion messages in 2011 to 7.7 trillion messages in 2016, doubling its share of global messaging traffic from 17.1 percent in 2011 to 34.6 percent in 2016.

“There will not be a uniform decline in mobile operators’ SMS traffic and revenues as a result of the adoption and use of over-the-top messaging services,” says Pamela Clark-Dickson, senior analyst, Mobile Content and Applications, at Informa.

Text messaging traffic on the KPN Netherlands network shows the impact of changing use of text messaging and OTT apps. SMS traffic has been declining since the third quarter of 2010, it appears, after hitting a plateau in early 2010.

While Informa is forecasting either slowing growth or even a small decline in person-to-person SMS revenues in some developed regions and countries, total global SMS revenues will increase at a compound annual growth rate of three percent over the next five years.

Western Europe will generate the highest amount of SMS revenues globally between 2011 and 2016, totalling $174.1 billion, followed by Asia Pacific Developing, where SMS revenues will total $173.8 billion between 2011 and 2016.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Subscribe to:

Posts (Atom)

More Computation, Not Data Center Energy Consumption is the Real Issue

Many observers raise key concerns about power consumption of data centers in the era of artificial intelligence. According to a study by t...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

Who gets to use spectrum, and concerns about interference from other users, now appears to be an issue for Google’s Project Loon in India. ...