Governmental policies designed to foster a particular industry are not unusual in East Asia or elsewhere, so it is not too surprising that artificial intelligence (AI) now is the target for China, as the State Council has set a goal of becoming a “global innovation center” for AI by 2030.

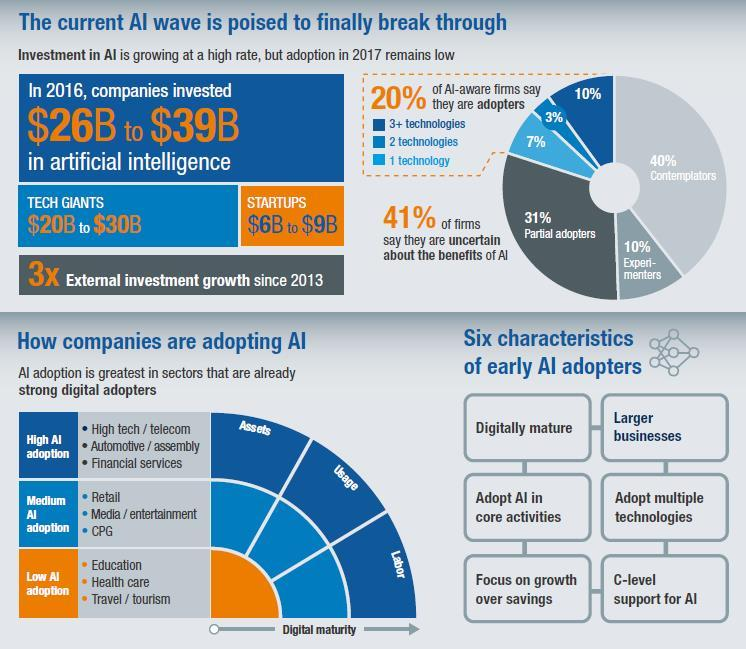

Though it remains unclear how much business impact might eventually be derived, some early adopters already find AI contributes.

source: McKinsey

source: McKinsey

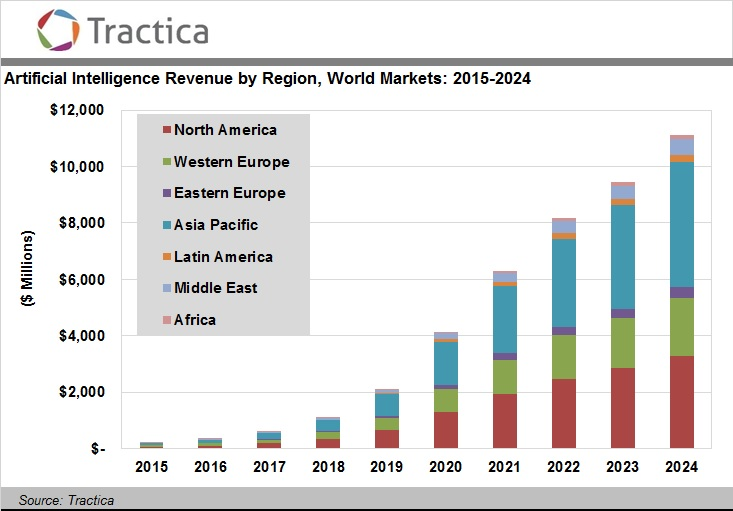

The value of artificial intelligence industries should surpass 1 trillion yuan ($147.80 billion) by that point, the State Council says. That is an ambitious goal, given some current projections of total market size by 2024, if only AI software and systems are counted.

But the State Council forecast clearly includes the value of all economic output driven by AI, not just the value of AI itself. That is akin to valuing the impact of e-commerce by adding up the retail value of all products and goods moved through that channel. You can get big numbers pretty quickly.

By 2020, almost every new software product and service will incorporate artificial intelligence features, Gartner predicts.

Though it remains unclear how much business impact might eventually be derived, some early adopters already find AI contributes.

Amazon uses robotics to automate “picking and packing” activities in its warehouses, McKinsey notes. The “click to ship” cycle time, which ranged from 60 to 75 minutes with humans, fell to 15 minutes after applying robotics, while inventory capacity increased by 50 percent. Operating costs fell an estimated 20 percent, McKinsey argues.

Netflix uses AI to personalize recommendations. Netflix found that customers, on average, give up 90 seconds after searching for a movie. By improving search results, Netflix projects that they have avoided canceled subscriptions that would reduce its revenue by $1 billion annually.

Baidu and Google spent between $20 billion to $30 billion on AI in 2016, McKinsey says.

Healthcare, financial services, and professional services are seeing the greatest increase in their profit margins as a result of AI adoption, McKinsey argues.

The McKinsey Global Institute Study on Artificial Intelligence, The Next Digital Frontier also estimates that total annual external investment in AI at between $8 billion to $12 billion in 2016, with machine learning attracting nearly 60 percent of that investment.

Robotics and speech recognition are two of the most popular investment areas.