Saturday, December 8, 2018

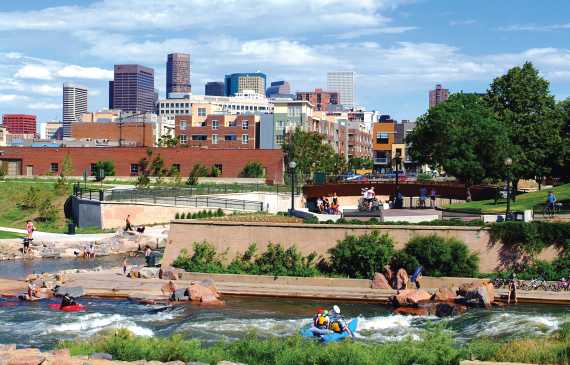

Denver, 1863 and Now

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Without Subsidies, Tough or No Business Model for Internet Access in Rural Areas

It often is easy to forget the low density of most places in the United States, defined as places where there are fewer than 15 locations (business and residential) per road mile, according to Steve Parsons, Parsons Applied Economics president and James Stegeman, CostQuest Associates president.

Such places cover nearly 86 percent of the area of the lower 48 U.S. states and most of Alaska. Those 86 percent of areas contain 12 percent of U.S. locations.

The implications for building any sort of cabled communications network are stark. In such areas it can cost $17,400 per location to build a cabled communications network using standard telecom industry platforms.

If half the locations actually buy service, the network cost per customer is as much as $34,800.

Beyond the capital investment are the ongoing costs to operate the business. The bottom line is that, in rural areas, there is no sustainable business case without subsidies.

Capital investment per customer location, for conduit and poles, is approximately 5.6 times higher in rural areas as in suburban areas, the consultants say. For fiber optic cable, the capital investment is approximately 4.2 times higher in rural areas as in suburban areas.

The other issue is that across the U.S. west, there are many areas that are not populated (shown in grey). Areas shown in green (metro areas) are where terrestrial cabled networks have the lowest costs. Areas in yellow are medium cost, while areas shown in orange have high costs. Areas in red have very high cost.

Such realities are why TV white spaces, unlicensed and shared spectrum, low earth orbit satellite constellations and 5G are viewed as possible solutions for rural internet access and other services.

There are, of course, possible business implications for existing service providers (cable, telco, satellite, fixed wireless) in rural areas.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Friday, December 7, 2018

$773 Billion in 2018 IoT Spending on Hardware, Software, Services

Global spending on Internet of Things sensors, software and services will reach $772.5 billion in 2018, an increase of 14.6 percent over the $674 billion that will be spent in 2017, Gartner predicts.

IoT hardware will be the largest technology category in 2018 with $239 billion going largely toward modules and sensors along with some spending on infrastructure and security.

Software will be the fastest growing technology segment with a five-year CAGR of 16.1 percent. Services spending will also grow at a faster rate than overall spending with a CAGR of 15.1 percent and will nearly equal hardware spending by the end of the forecast.

"By 2021, more than 55 percent of spending on IoT projects will be for software and services,” said Carrie MacGillivray, IDC VP.

Global IoT spending will grow at a 14.4 percent compound annual growth rate through 2021, Gartner predicts.

Asia/Pacific (excluding Japan) will be the geographic region with the most IoT spending in 2018 ($312 billion) followed by North America (the United States and Canada) at $203 billion and Europe, the Middle East, and Africa (EMEA) at $171 billion.

China will be the country with the largest IoT spending total in 2018 ($209 billion), driven by investments from manufacturing, utilities, and government.

IoT spending in the United States will total $194 billion in 2018, led by manufacturing, transportation, and the consumer segment.

Japan ($68 billion) and Korea ($29 billion) will be the third and fourth largest countries in 2018, with IoT spending largely driven by the manufacturing industry.

Latin America will deliver the fastest overall growth in IoT spending with a five-year CAGR of 28.3 percent.

The industries that are expected to spend the most on IoT solutions in 2018 are manufacturing ($189 billion), transportation ($85 billion), and utilities ($73 billion). IoT spending among manufacturers will be largely focused on solutions that support manufacturing operations and production asset management, IDC said.

In transportation, two thirds of IoT spending will go toward freight monitoring, followed by fleet management. IoT spending in the utilities industry will be dominated by smart grids for electricity, gas, and water.

Cross-Industry IoT spending, which represent use cases common to all industries, such as connected vehicles and smart buildings, will be nearly $92 billion in 2018 and rank among the top areas of spending.

Consumer IoT spending will reach $62 billion in 2018, making it the fourth largest industry segment. The leading consumer use cases will be related to the smart home, including home automation, security, and smart appliances.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

U.S. SD-WAN Managed Service Revenue $282 Million in 2018

U.S. managed SD-WAN revenue will reach $282 million in 2018, according to Vertical Systems Group. The big takeaway is not the present volume of service provider sales, but the projected growth of SD-WAN as a replacement for legacy wide area networking choices.

In principle, SD-WAN services could take a growing share of MPLS and other networking services.

Service providers actively selling Managed SD-WAN services in the U.S. include Aryaka, AT&T, CenturyLink, Cogent, Comcast, Fusion Connect, GTT, Hughes, Masergy, MetTel, Sprint, Verizon, Windstream and Zayo.

Other network operators throughout the world offer or plan to offer Managed SD-WAN Services in the U.S. market, Vertical Systems says.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Thursday, December 6, 2018

AWS Launches Edge Computing Service

Mobile and fixed network connectivity service providers believe edge computing is an opportunity for them to leverage their real estate and connectivity assets.

But it was only a matter of time before today’s cloud computing giants began to show their migration path to edge computing. AWS seems to have gotten there first.

AWS Outposts enables native AWS services, infrastructure, and operating models at “virtually any data center, co-location space, or on-premises facility,” AWS says. “You can use the same APIs, the same tools, the same hardware, and the same functionality across on-premises and the cloud to deliver a truly consistent hybrid experience.”

The obvious applications are enterprise-driven use cases where low latency is a paramount concern, or where local data processing is essential for the use case. Industrial internet of things, high-definition video or security, for example.

AWS Outposts come in two variants, the first being VMware Cloud on AWS Outposts, which allows customers to use the existing VMware control plane and application programming interfaces.

The AWS-native variant of AWS Outposts allows customers to use the same APIs and control plane used to run in the AWS cloud, but on-premises.

AWS Outposts infrastructure is fully managed, maintained, and supported by AWS to deliver access to the latest AWS services, the company says.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Wednesday, December 5, 2018

Mobile, Internet, P2P Apps and Elderly Care

“Aging in place,” allowing the elderly to remain in their homes even after they require caregivers, could well reduce the cost of living at home, compared to care in an assisted-living situation.

At least according to one study, mobile, peer-to-peer and other apps can allow the elderly to remain in their homes, saving more than half the amount required to live in an assisted living home.

That speaks to the value of mobile and internet apps, if not directly to the business opportunities available to connectivity suppliers.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Disposable Income is the Great Constraint on Telecom Revenue Growth

Australian households spend about 3.5 percent of disposable income on fixed and mobile communications services, which points to a major constraint on the connectivity services business: consumers will only spend so much on communications services.

As a percentage of total household income, households spend perhaps 2.5 percent of what they earn on communications, assuming discretionary income is 70 percent of total income.

As a percentage of total household income, households spend perhaps 2.5 percent of what they earn on communications, assuming discretionary income is 70 percent of total income.

Even if mobile subscription growth globally has achieved what once seemed nearly impossible when the only tools we had were fixed networks, long term, telecom industry revenue itself only tends to grow in line with growth of gross national income.

And that means telecom really is a slow-growth industry, not a growth segment of the economy. That also means industry profitability sits on a bit of a knife edge, under conditions where every legacy service is declining, and where substitute products increasingly are available to businesses and consumers.

In the global wide area network segment of the business, for example, enterprises now directly own and operate their own private WANs, carrying a huge share of global traffic. Depending on route, private networks now carry between 20 percent to 70 percent of all traffic on global wide area network routes.

One way of describing that reality is that a business once monopolized by telecom carriers now is driven and lead by enterprises that build and operate their own networks. In that sense, in the global capacity business, relegation to “dumb pipe” status is only the second-biggest business problem service providers now face.

It is the fact that big enterprises can build and operate their own networks, removing most of the potential demand from the market, that is the number-one trend.

Likewise, consumers and households are only going to spend so much of their own incomes on communication or entertainment services, no matter how good.

According to the Australian Bureau of Communications and Arts Research, household spend on mobile and fixed network communications runs about 3.5 percent of of disposable income.

Of course, all other things are not equal. There is more growth lying ahead in Africa and Asia than in North America and Europe, for example. Eventually, as markets saturate, the correlation with GDP becomes more pronounced.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Subscribe to:

Posts (Atom)

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

Who gets to use spectrum, and concerns about interference from other users, now appears to be an issue for Google’s Project Loon in India. ...