Some already speculate about the impact of Covid-driven 5G deployment delays in Europe, which both Ericsson and Huawei have noted. Analysys Mason predicts a significant 3.4 percent dip in developed market telecom revenues in the immediate aftermath of the pandemic, resulting from business failures that--at least temporarily--reduce the customer base.

With the caveat that trends could be quite different from region to region, what is not so clear is how “permanent” the pandemic economic shutdowns will be, longer term, on infrastructure deployment by service providers, business or consumer spending on communications. Correlation is not causation. Not everything we observe, post-pandemic, will be caused by the pandemic. In other words, cyclical changes of a short-term nature and longer-term secular changes should not be confused.

The short-term impact is going to be clear enough, since policy makers created a deliberate recession. Recessions tend to depress growth, and also telecom spending growth by businesses and consumers. What remains to be explained, though, are the long-term effects, if any.

source: Analysys Mason

And while post-pandemic spending is likely to be depressed, a rebound to the underlying trend is almost certain to happen within two years, as was the case in the wake of the 2008 Great Recession. And some believe flat connectivity revenue growth, not contraction, is in store, even if economic growth falls fairly sharply.

source: IDC

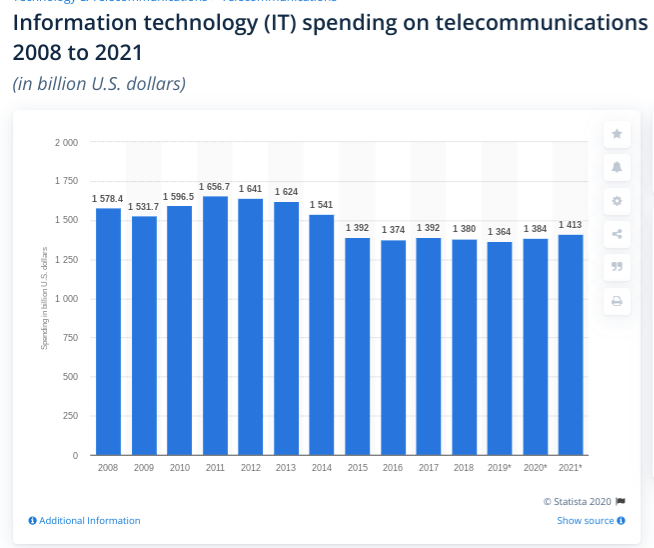

There is a long term decline or flattening trend at work for connectivity services that is hard to pin on any single recession, since spending in the aftermath of the Great Recession of 2008 actually recovered by 2010. Looking at global telecom spending, which is relatively flat, despite growth in developing markets, something else--or several trends--seem to be at work.

Internet-based product substitutes often allow users to reduce spending even as value increases. Competition is causing price declines for virtually all products. Open source and products that improve with Moore’s Law allow firms to reap value even when total cost is less. Virtualization of most processes also allows value to increase while the cost of solutions often decreases.

source: Statista

The issue is whether the effects of the Coronavirus pandemic will be transitory or permanent. If gross domestic product grows, that will drive higher IT spending, and presumably also higher enterprise connectivity spending.

Some would note that the longer-term trend for enterprise spending on information technology both tends to track GDP growth, but also has shifted to “newer” technologies, and away from legacy products.

It can be hard to quantify telecom spending that is buried in wider information technology forecasts, but IT spending tends to grow over time, and often at rates faster than GDP grows. Telecom spending tends to fall, over time, in real terms, though growing (globally) at about one-percent annual rates.

source: IDC

source: IDC

The impact of the Great Recession of 2008 was sharp, but relatively short, if it had effects at all, on productivity levels, research and development spending or gross domestic product. So the question is whether the same thing will happen in the wake of the pandemic. A return to the underlying trend might well be assumed.

source: Intereconomics

Some might note revenue trends in the aftermath of the Great Recession of 2008 that they would describe as “permanent.” So some might hypothesize that post-pandemic trends will similarly be long lived.

BT Global Services saw its revenue from businesses grew between 2005 and 2008 but suffered a long-term decline after 2008, Analysys Mason notes. Revenue from data services and managed network services increased in both 2009 and 2010, but at a slower rate than in the previous three years.

Orange saw revenue from enterprises become stable between 2005 and 2008 but began to fall steadily after 2008.

The rate of decline of business services revenue for AT&T and Verizon increased significantly after 2008. Both business services divisions served mainly large enterprises.

The issue, though, is whether those are long-term effects of the recession itself or are simply reflections of wider underlying changes in the business. We can note that consumer spending on connectivity, as a share of household spending, has been dropping for a decade since 2008. Yet few customers would likely argue the value they derive from the lessened spending is lower than it once was.

source: Scope, OECD

Business spending likewise has been computer-centric rather than telecom-centric for some time, though growth trends can be flattened in the wake of a major bubble burst or recession. Spending growth flattened in the wake of the Internet bubble crash of 2000.

source: Researchgate

In part, that reflects slower revenue growth, as business budgets set such spending on a “percentage of revenues” basis. Slower revenue growth also means slower IT spending growth. So temporary dips are expected. The issue is whether long-term trends also are created.

source: IMF

The value to be wrung from better technology also means less information technology spending is required to achieve a desired objective. Also, much spending is shifting from hardware and software to services, which are much harder to quantify, in terms of impact, value and productivity.

Enterprises might be spending less on connectivity services, long term, because the unit prices of connectivity services are dropping so much. Business customers might be substituting less-costly products for legacy products (IP telephony for traditional long distance calling or conferencing services).

Business demand for fixed network voice arguably continues to drop, much as consumer demand for such products began to drop about 2000.

The bottom line is that permanent trends specifically caused by the pandemic are going to be subtle and hard to quantify.