"Assets" and "value" are not the same thing. The former can be shown on financial statements; the latter not so much. And an argument might be made that mobile operator asset value is becoming more driven by spectrum licenses and troves than other network-related physical assets.

By some measures, the capital investment in spectrum of the largest three U.S mobile operators ranges from 30 percent to nearly half of the committed capital investment of those firms. Also, as the growing involvement of infrastructure investment in telco access networks continually grows, we must ask new questions about the value of the actual access networks and assets.

Infrastructure investors are playing a bigger role in access network capital investment, often for the same reason they invest in airports, seaports and other forms of long-lived infrastructure. They see “moats” and stable, long-term demand with predictable cash flows.

As did other investors of 30 to 40 years ago, connectivity infrastructure and the cash flows built on it are seen as relatively stable sources of free cash flow bolstered by their relative scarcity. It started with cell towers but increasingly is moving towards optical fiber access networks, small cell network providers and data center infrastructure.

All of that raises new questions about where value lies in the connectivity business. To use the obvious analogy, money can be made operating a seaport or airport as money is to be made moving goods from manufacturers to end users and retail buyers.

The best connectivity industry examples are wholesale access platforms, where one entity owns the infrastructure and retail service providers all use the one infrastructure.

The business choice between facilities-based versus leased network access is an issue in other contexts as well. At scale, the former tends to offer better economics than the latter. That is why the leading mobile service providers in almost-all markets own their own networks.

At lower volumes, and especially “outside” the core geography, leased access typically offers better economics.

Hybrid models seem to be developing, though, where the access infrastructure is partly owned by a service provider and an infrastructure investor. The advantage is lower capital investment by the service provider, at the cost of shared revenues and profit.

Monetization opportunities will often depend on the ability to sell infrastructure access to multiple buyers, where traditionally a network has been virtually exclusively for the use of the network owner or its wholesale customers. As data centers arguably do best when they are “carrier neutral,” access assets might in some cases also benefit from multi-customer business models.

Indoor coverage by small cell networks provides an example. It will make sense for all mobile operators to take advantage of an indoor coverage network, for example.

It is not yet clear just how far changes in the physical platform could evolve. It might be fair to say that if value tends to migrate elsewhere in the ecosystem or value stack, away from the “access” function, such moves create new possibilities.

As networks increasingly are virtualized, it is conceivable that a new division of labor could develop in some markets, with asset owners providing physical facilities and other participants providing the service enablement or services.

As we presently see with wholesale-only infrastructure, one entity might provide the access functions, while all retail service or app providers pay to use that infrastructure. Though this might always make more sense for fixed networks, even mobile networks might eventually consider such a pattern, if capital intensity were to increase for future very-dense networks.

As we have already seen, perhaps a consortia of mobile operators might join together to create and own the physical plant. The odds of such developments increase with potential infrastructure intensity and cost.

As the U.S. spectrum auction of 3.4-GHz spectrum nears an end, $22 billion already has been bid on those assets, with an average price per MegaHertz per person of about 65 cents. Some will argue that directly increases capital investment by the winning entities. Others will agree, but enumerate those investments separately from other mobile operator capex.

How much capital investment mobile operators invest each year depends on how one counts such investments. Often, physical plant and spectrum investments are tallied separately.

Consider a CTIA report on U.S. mobile industry capital investment. Between 2016 and 2020, for example, “capex” is said to range from $25 billion to $30 billion per year.

source: CTIA

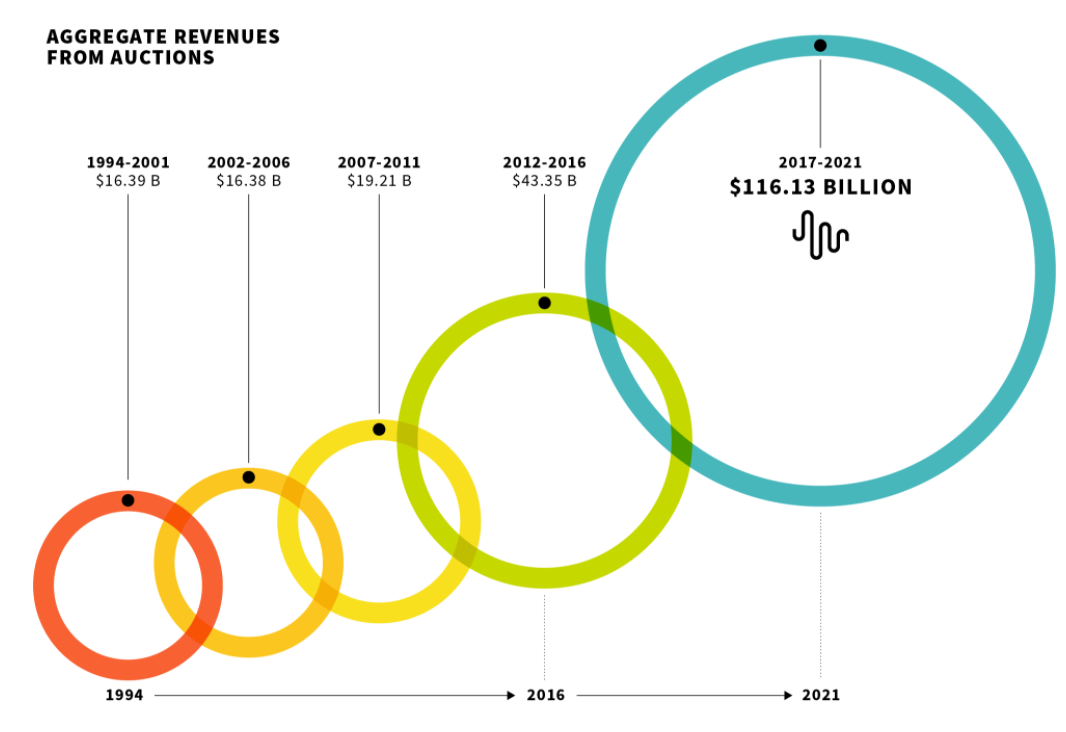

Spending for spectrum licenses ranges is tracked separately, it appears, as it appears spectrum license spending has accelerated since 1994.

Prior to 1994, spectrum license spending might have been tracked by decade. Between 1994 and 2001 CTIA used an eight-year interval. Since 2002 CTIA uses a five-year interval.

That indicates a quickening of the tempo of license acquisitions; more competition for licenses as well as bigger spectrum allotments (more frequent auctions; more licensees; more capacity per auction).

source: CTIA

It appears CTIA, for purposes of tracking capital investment, does not include spectrum purchases in its chart on U.S. mobile industry “capital investment.” CTIA shows cumulative “capex” between 2016 and 2020 as a cumulative $138.5 billion total.

CTIA also shows spectrum licenses paid for in the 2017 to 2021 period as $116 billion. So obviously, spectrum license spending, though “capex” for accounting purposes, is separated from spending on spectrum licenses, which also is categorized as “capex” by accountants.

Standard and Poors includes spectrum licenses in the “capex” category, for example.

So actual mobile capex often is portrayed as higher or lower, depending on the assumptions. “Network capex” often is separately portrayed from “spectrum capex.” Both have grown.

CTIA also says cumulative capex including 2001 to 2020 is $601 billion, an average of about $30 billion per year. That tends to correlate to separate tracking of network capex and spectrum license capex. At the same time, cumulative spectrum license fees are said to represent a cumulative $200 billion in spending.

Spectrum licenses represent perhaps 25 to 35 percent of mobile operator assets in the United States and perhaps 10 percent to 20 percent of assets for other mobile operators globally.

Overall, some might argue that total capex is rising. This chart from Standard and Poors Market Intelligence shows U.S. mobile operator capex (Just the three largest facilities-based providers) rising over time. As S&P includes spectrum spending in capex totals, that suggests spectrum spending is rising.

source: Standard and Poors

But secondary transactions also happen. Including those investments, U.S. mobile operators have cumulatively spent about $601 billion in capital investment since 1994, according to the CTIA.

Spectrum license purchases since 1994 have amounted to at least $211.5 billion, not including the cost of spectrum licenses that have traded hands in the form of direct purchases or company acquisitions and mergers.

Assume that about half of all spectrum originally acquired at auction then is resold on secondary markets, primarily as firms with those licenses are acquired by other firms. That would imply an additional $106 billion that mobile operators have spent on spectrum assets.

source: CTIA

If so, then spectrum represents about $317.5 billion in spectrum capex, or roughly 53 percent of total capex.

The larger point is that the value of access network assets might be changing. Such assets are viewed as desirable investments by private equity and institutional investors. At the same time, a greater share of access network plant might be viewed by telcos as not providing sustainable business advantage, or at least not enough value to consider 100-percent ownership of such assets.

At the same time, if capital investment intensity continues to rise, there will be greater business logic to considering partial divestment of access network plant.

That might well raise new questions about the value of structural separation--not as imposed by regulators--but as business choises made by the telcos themselves. It is conceivable that market participans themselves might revalue access infrastructure in ways that lead to more structural separation, as a way of managing capex while maintaining value.