Tuesday, September 9, 2014

Phablet Sales Surprise: Will Apple Embrace Phablets?

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

"Mobile Payments A Failure"

For mobile payments to succeed, there has to be "something broken" about the business model or experience, for customers, retailers or bankers and processing networks.

It's hard to make the argument that paying using a debit card or credit card is flawed in some significant way, causing customer or retailer pain.

“It’s my opinion that the swipe isn’t especially broken,” said Josh Silverman American Express consumer products president. Silverman likely was being generous.

“On wallets generally, we have had wallets in the market for quite some time, and there has been fairly limited adoption of those wallets," he said.

"I think ‘fairly limited’ is generous" as a way to describe market success for many mobile wallet efforts, Silverman said.

And that is a problem Apple will confront if and when it launches its own mobile wallet effort. To be sure, up to this point, Apple seemingly has focused more on redesigning the retail experience by redesigning the payments process.

The way people can buy products in Apple stores illustrates the "no-register" approach to the retail experience.

To be sure, one can make many arguments about the other ways mobile payments and mobile wallets might affect retailing. Those angles range from personalization to promotions and marketing, loyalty, logistics and inventory implications.

These days, less seems to be claimed about how mobile payments speeds up checkout processes or lowers retailer costs.

And that is the issue Apple will confront, as have all others. The retail payments system fundamentally is not broken. And it is hard to sell a solution to a non-problem.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Saturday, September 6, 2014

"Internet for Everyone?" Android One Helps

The point is that formerly-formidable challenges have been successfully met. There is at this point little reason to believe that the new challenge--Internet for everyone--will not also be met.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Friday, September 5, 2014

Global Mobile Service Revenue Will Begin Declining in 2019

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Will Apple Drive Inflection Point for Proximity Payments Business?

The point is that Apple’s entry might help. But just how much, remains to be seen.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

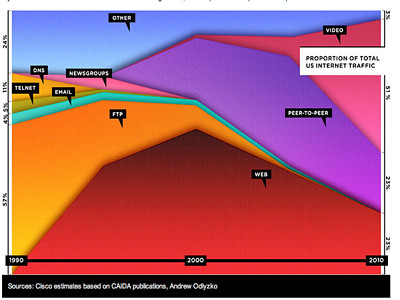

Internet was a Communications Network; Now it Mostly is a Distribution Network

Is the Internet a communications or content distribution network?

Is the Internet a communications or content distribution network?That's a rhetorical question, but an important question, nevertheless, since governments often regulate "communications" networks differently than they do "content delivery networks" (the generic function, not the business of CDNs).

Even traditional language "any to any" speaks more to the original communications function than the ways most of the Internet actually is used as a content acquisition medium these days.

The Named Data Networking project hopes to evolve the Internet's fundamental protocols in ways that acknowledge the key change by adding more security. But there is an equally-important change: the shift in Internet purposes from communication to content delivery.

"Recent growth in e-commerce, digital media, social networking, and smartphone applications has resulted in the Internet primarily being used as a distribution network for content," the NDN project says.

Aside from the matter of security and protocols, that shift to content delivery could have important business and regulatory implications.

One often hears it said that regulators should not allow the "Internet to become cable TV," That typically occurs in the context of discussions about network neutrality.

The notion is that the Internet should not become a media business.

The problem is that the Internet has become the enabler for precisely those developments.

Many current and future battles will occur, around that change. The Internet originally was a narrowband communications network. Now it is a broadband media consumption network.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

By 2018, 1/2 of All Internet Users Will Live in Asia

But China and India represent the majority of those users. For example, of perhaps about a billion Internet users in Asia, China represents 591 million, while India represents 213 million, about 80 percent of the total, according to Statista.

Japan represents about 10 percent, Indonesia about seven percent, South Korea about four percent, as does the Philippines. Bangladesh and Vietnam are closing on about four percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Wednesday, September 3, 2014

Must ISPs "Upgrade or Die?"

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Tuesday, September 2, 2014

Connected Car: Built in Versus Docking

According to the AutoTECHCAST findings, nearly two-thirds of car owners (65%) say they want built-in connectivity, compared to slightly more than one third (35%) who prefer brought-in connectivity using their smart phone.

That reminds me of the days of dedicated "car phones." Maybe it will be different this time around. But why isn't it simpler to dock a smartphone?

More than half of car owners say they are less likely to buy a vehicle that uses a data plan/carrier different from their own, and 31 percent say they are "much less likely" to purchase the vehicle.

That's crazy. Just make it easy to dock a smartphone or other. On nectar device.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Boost Mobile (Sprint) Counters T-Mobile US Prepaid Promotion

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Thailand Incumbent Telcos Face Revenue Shortfall

New Thailand Information and Telecommunications Minister Pornchai Rujiprapa said his priority will be finding new revenue for his two state telcos, CAT Telecom and TOT Corporation, which are facing a cash crunch.

Nearly everywhere, it seems, Telco revenue models are threatened.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Goldens in Golden

There's just something fun about the historical 2,000 to 3,000 mostly Golden Retrievers in one place, at one time, as they were Feb. 7,...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...