Spectrum prices are going to quite important in the 5G era, for fundamental reasons related to changing mobile business models. Higher network investment and limited revenue upside are among the key issues.

The next generation of 5G networks will cost more than 3G and 4G networks did, in part because they will use small cells. That will have dramatic cost implications for the simple reason that shrinking cell site radius by 50 percent quadruples the number of cells required.

That reduction of cell radius has been going on for some time, as higher-frequency signals have been put into use.

“One study found that the cost (capex) of coverage at 3500 MHz using presently available technologies (not 5G) was roughly 6.7 times as great as the cost of coverage at 700 MHz,” says Bruegel contributor Scott Marcus. That cost differential comes primarily from the greater number of cell sites required at higher frequencies.

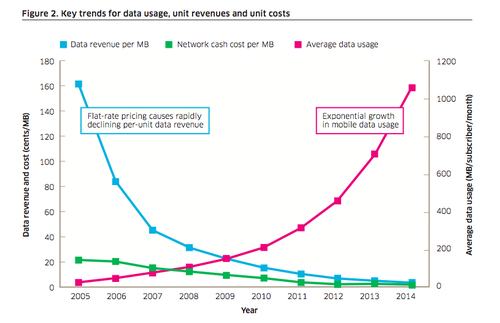

At the same time, revenue upside is more questionable than has been the case in the past. One reason is that services humans will pay for (to use their smartphones and other personal devices) are more limited, as every major revenue source (voice, texting, internet access) is saturated, reaching saturation or going to reach saturation.

That means the higher capital investment is not clearly matched by proven incremental revenue upside that will pay for the new networks.

In many advanced countries, subscriber penetration is well above 100 percent and average revenue per account is not increasing.

Against this background, the ability of operators to monetize the growth in demand for mobile data, for example through fixed-mobile convergence or new value-added services linked to the Internet of Things, is uncertain.

Also, big changes in spectrum supply are coming, for a combination of reasons including a shift to small cell architectures, huge amounts of new spectrum in the millimeter regions, spectrum sharing and additional unlicensed spectrum, better radios and even the ability to create larger channels, which itself increases effective utilization of any available spectrum.

Normal economic realities suggest that vastly increased supply of a desired good should lead to lower prices. That suggests spectrum prices must decrease.

High spectrum costs always have been a barrier to market entry in the mobile industry. Indeed, some would argue that mobile business models are built on spectrum scarcity.

The corollary is that releasing more spectrum, at lower prices, spurs competition and innovation.

A study by NERA Economic Consulting, sponsored by the GSMA, argues that high spectrum prices have lead to lower-quality networks, reduced take-up of mobile data services, reduced incentives for investment, higher consumer prices and lost consumer welfare with a purchasing power of US$250 billion across a group of countries where spectrum was priced above the global median.

“Where governments adopt policies that extract excessive financial value from the mobile sector in the form of high fees for spectrum, a significant share of this burden is passed onto customers through higher prices for mobile and lower quality data services,” NERA says.

“In summary, the current outlook is for reduced spectrum scarcity but uncertain scope for operators to generate revenues from mobile networks,” NERA notes. “This implies that prices paid for spectrum should fall, especially as future releases are increasingly focused on higher frequency bands.”

“Countries that try to resist this trend, either by restricting spectrum availability or overpricing newly released spectrum, are likely to see large amounts of spectrum go unallocated,” NERA warns.

source: GSMA