Insight Research predicts that global telecommunications services revenue will grow from $2.1 trillion in 2012 to $2.7 trillion in 2017 at a combined average growth rate of 5.3 percent. For most people, that will seem reasonable, given the growth of wireless services globally.

Wireless subscriber growth, particularly in Asia and other emerging markets, will raise wireless revenues by 64 percent from current levels, while wireline revenues show only modest growth. And what growth occurs in the fixed network realm will happen in broadband services.

Wireless 3G and 4G broadband services are projected to grow at a compounded rate of 24 percent over the forecast period and wireline broadband services projected to grow at a 13 percent compounded rate over the same forecast horizon, the Insight Research predicts.

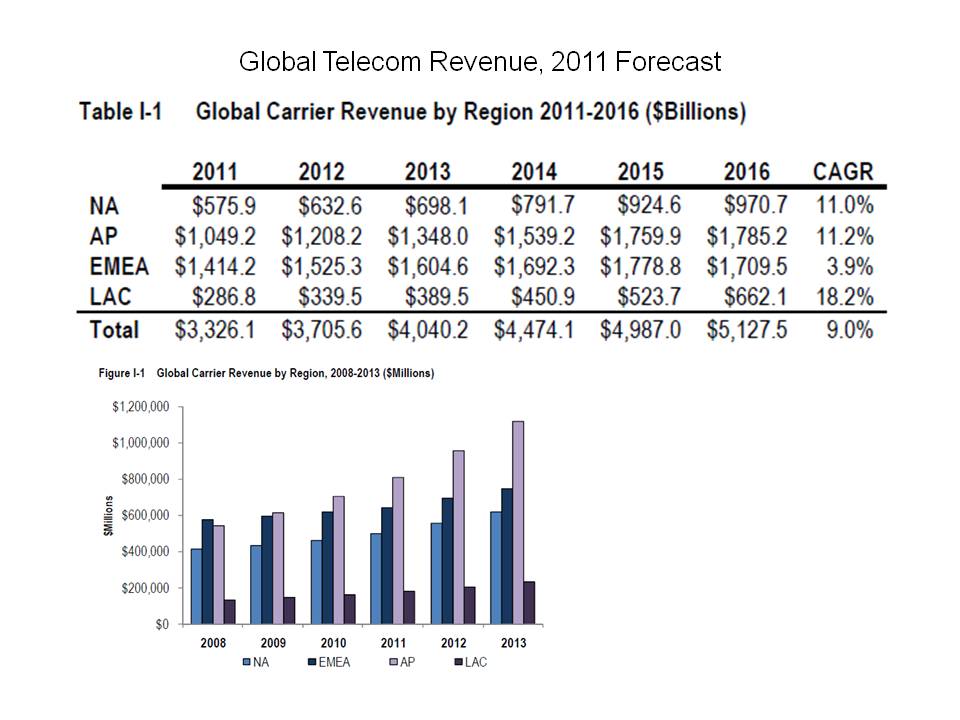

The most-surprising prediction, by far, is the forecast that, between 2011 and 2016, North American carrier revenue will rise from $287 billion to $662 billion, representing 11 percent compound annual revenue growth.

Granted, there is lots of activity in the U.S. and Canadian markets around mobile payments, mobile banking, advertising, commerce and machine-to-machine services. But not many think those initiatives will produce lots of revenue within the next five years.

So if an 11-percent compound revenue growth rate were to occur, it would have to be driven by the basic services people already buy. That rapid growth, on a compound basis, would lead to a doubling of industry revenue in five years. Unlike the global forecast, that will raise some eyebrows.For starters, since U.S. firms represent about 90 percent of North American revenue, that forecast has to be based on U.S. revenue growth. And since just a few U.S. firms control about 80 percent of all revenue, that forecast also assumes a few firms, necessarily including AT&T and Verizon Wireless, will find huge new markets, fast.That isn’t to discount what Sprint, T-Mobile USA, Comcast, Tme Warner Cable and others might be able to do. It’s just that a doubling of revenue in such a short time would require extraordinary growth, likely requiring an assumption that every North American customer will double the amount they are spending on communications services over the next five years. That is not “impossible,” but would be extraordinarily rare. Consider that revenue growth in Europe, a similar market in many respects, might grow at far-lower rates of perhaps four percent annually. Most rational observers would probably agree that North American growth rates of four percent a year for the next five years would be reasonable. Likewise, global carrier revenue is expected to achieve a nine percent compound annual growth rate from 2011 to 2016, growing to a total of $5.13 trillion, Insight Research says.  In terms of segment revenue, the latest forecast projects a 45 percent CAGR for global wireless broadband revenue, 14 percent for fixed-line broadband, about six percent growth for narrowband wireless services and negative three percent revenue change for fixed network narrowband services. One way to look at the structure of the global market is to note that, by 2016, wireless broadband will account for about 28 percent of all communications service revenue. Narrowband wireless services will account for 38 percent of global revenue. Altogether, wireless will represent 66 percent of total industry revenue.Fixed-line broadband will account for 11 percent of global revenue, while fixed-line narrowband services will represent 23 percent of total revenue. In aggregate, fixed line revenue will account for 34 percent of total service provider revenue, on a global basis.For some of us, the big surprise is the aggressive forecast for North American growth.

In terms of segment revenue, the latest forecast projects a 45 percent CAGR for global wireless broadband revenue, 14 percent for fixed-line broadband, about six percent growth for narrowband wireless services and negative three percent revenue change for fixed network narrowband services. One way to look at the structure of the global market is to note that, by 2016, wireless broadband will account for about 28 percent of all communications service revenue. Narrowband wireless services will account for 38 percent of global revenue. Altogether, wireless will represent 66 percent of total industry revenue.Fixed-line broadband will account for 11 percent of global revenue, while fixed-line narrowband services will represent 23 percent of total revenue. In aggregate, fixed line revenue will account for 34 percent of total service provider revenue, on a global basis.For some of us, the big surprise is the aggressive forecast for North American growth.