GfK Media now suggests that the number of U.S. households opting for over the air broadcast service is growing a bit faster.

"In 2012, we see homes with broadcast-only reception increase at a statistically significant level (two percent or more) for the first time in over five years," GfK Media says.

In fact, some 17.8 percent of TV homes report broadcast-only reception, compared with levels of 14 percent to 15 percent levels seen over the last five years.

That means that around 21 million homes rely only on over-the-air broadcast rather than a subscription TV service.

And broadcast-only levels are even higher among minority and lower-income homes, as well as with younger householders; all have seen an increase in broadcast-only reception in the past year, GfK Media says.

"Our data show that only one third of broadcast-only homes actually did cut the cord – they cancelled pay TV service at their current household - and only one sixth of those broadcast-only homes report some type of online service connected to their TV set," says Allan Fromen, GfK Media VP.

In other words, 66 percent of the new "broadcast only" users were not formerly cable, satellite or telco TV customers.

About a third of the new broadcast-only users formerly had a subscription TV service, and more than 70 percent of those consumers said cost-cutting was the reason they abandoned subscription TV service.

Tuesday, June 19, 2012

Cord Cutting, in the Form of Broadcast-Only Service, Is Growing

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Europe Mobile Operators Will Merge, Because Scale Matters

Economies of scale always are important in the global telecom business, which is one reason why firms tend to become bigger, and fewer, over time. A consolidation process has been underway in most regions and countries since at least 2001, but many believe Europe will be the focus of much activity in the years ahead, in large part because scale economies have not yet been maximized.

With the mobile market saturated, and average revenue per user dropping, scale is nearly always seen as one way to arrest the negative impact on service provider revenues. Simply, if organic growth is difficult, a service provider can buy growth by acquiring new customer bases and revenue streams outside the existing market.

Of course, volume alone does not "cure" declining average revenue per user problems. But greater scale allows service providers to operate more efficiently, wringing costs out of operations. On the other hand, one typical way of compensating for declining ARPU is to increase sales volume. Selling more units helps keep total revenue in line, even when ARPU is lower.

European mobile data use has so far failed to compensate for the sharp decline in mobile voice revenue, according to Wireless Intelligence research. A 2011 study found that mobile ARPU across the 27 European Union (EU27) countries had fallen by 20 percent over the last three years, dropping from EUR25 in 2007 to EUR20 in 2010 on average.

The drop was caused primarily by ongoing declines in the average per-minute price for voice calls, which dropped from EUR0.16 to EUR0.14 in the EU27 mobile markets over the period.

Over the past decade, smaller service providers have been buying other companies, and larger tier-one service providers have been making cross-border investments to boost scale.

But Yankee Group Research VP Declan Lonergan isn't so sure the consolidation process will proceed as much as some believe, though. "There will certainly be more sharing of networks, joint-procurement partnerships, and even acquisitions of fourth-placed operators by market leaders within individual markets," he says. "But it would be naive to think national regulators will stand by and watch all of the work they have done to foster competition during the past twenty years be swept away by a wave of consolidation."

Nor will the wave of consolidation necessarily reduce the amount of competition in national markets. Longergan believes "all European countries will still have at least three competing operators five years from now, along with at least two viable MVNOs."

With the mobile market saturated, and average revenue per user dropping, scale is nearly always seen as one way to arrest the negative impact on service provider revenues. Simply, if organic growth is difficult, a service provider can buy growth by acquiring new customer bases and revenue streams outside the existing market.

Of course, volume alone does not "cure" declining average revenue per user problems. But greater scale allows service providers to operate more efficiently, wringing costs out of operations. On the other hand, one typical way of compensating for declining ARPU is to increase sales volume. Selling more units helps keep total revenue in line, even when ARPU is lower.

European mobile data use has so far failed to compensate for the sharp decline in mobile voice revenue, according to Wireless Intelligence research. A 2011 study found that mobile ARPU across the 27 European Union (EU27) countries had fallen by 20 percent over the last three years, dropping from EUR25 in 2007 to EUR20 in 2010 on average.

The drop was caused primarily by ongoing declines in the average per-minute price for voice calls, which dropped from EUR0.16 to EUR0.14 in the EU27 mobile markets over the period.

Over the past decade, smaller service providers have been buying other companies, and larger tier-one service providers have been making cross-border investments to boost scale.

But Yankee Group Research VP Declan Lonergan isn't so sure the consolidation process will proceed as much as some believe, though. "There will certainly be more sharing of networks, joint-procurement partnerships, and even acquisitions of fourth-placed operators by market leaders within individual markets," he says. "But it would be naive to think national regulators will stand by and watch all of the work they have done to foster competition during the past twenty years be swept away by a wave of consolidation."

Nor will the wave of consolidation necessarily reduce the amount of competition in national markets. Longergan believes "all European countries will still have at least three competing operators five years from now, along with at least two viable MVNOs."

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Monday, June 18, 2012

Verizon Boosts FiOS Speeds

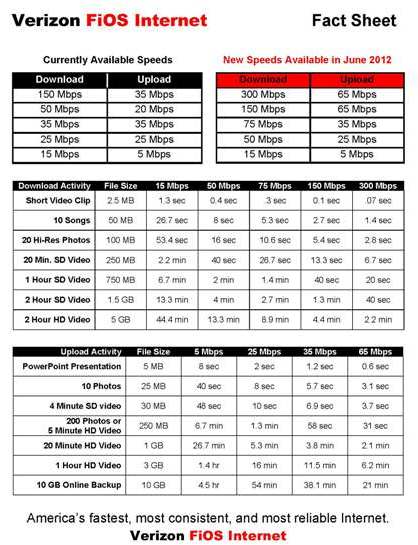

The majority of existing Verizon FiOS customers will pay $10 to $15 more per month to double or triple their Internet speed, under new service plans Verizon has announced.

The new speeds, available in a range of double- and triple-play bundles, plus stand-alone service, feature tiers with download/upload speeds of 50/25, 75/35, 150/65 and 300/65 megabits per second, Verizon says.

Three of those speeds 75/35, 150/65 and 300/65 -- are twice as fast as those previously offered, Verizon notes. In addition, Verizon will continue to offer its entry-level speed of 15/5 Mbps.

The two highest downstream speed offers, of 150 Mbps and 300 Mbps, as well as the new 65 Mbps upstream speed, are said by Verizon to be the fastest, mass scale U.S. residential Internet speeds available in the market.

Existing FiOS customers can upgrade to the new bundles and enjoy the faster speeds anytime, with no upgrade fee.

The latest upgrades are simply more evidence that, despite criticism, Internet service providers continue to upgrade speeds for U.S. consumers.

The new speeds, available in a range of double- and triple-play bundles, plus stand-alone service, feature tiers with download/upload speeds of 50/25, 75/35, 150/65 and 300/65 megabits per second, Verizon says.

Three of those speeds 75/35, 150/65 and 300/65 -- are twice as fast as those previously offered, Verizon notes. In addition, Verizon will continue to offer its entry-level speed of 15/5 Mbps.

The two highest downstream speed offers, of 150 Mbps and 300 Mbps, as well as the new 65 Mbps upstream speed, are said by Verizon to be the fastest, mass scale U.S. residential Internet speeds available in the market.

Existing FiOS customers can upgrade to the new bundles and enjoy the faster speeds anytime, with no upgrade fee.

The latest upgrades are simply more evidence that, despite criticism, Internet service providers continue to upgrade speeds for U.S. consumers.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

For LTE, Spectrum Matters

It's a bit faster than T-Mobile's HSPA 21, and it's about 25 times as fast as Sprint's 3G network.

But it doesn't quite match AT&T's and Verizon's LTE speeds in cities where they have more spectrum, PCMag.com says.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

No Surprise: Mobile Voice Volume Growth Has Gone Negative

People have been talking less, texting more, for some time.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

No Surprise: Tablet Users Prefer Ad-Supported Free Apps

Nobody who is familiar with consumer media behavior will be at all surprised by a new study commissioned by the Online Publishers Association that has found 54 percent of tablet users prefer free, ad-supported apps over paid ones, up from 40 percent a year ago.

Consumers often say they "hate" or "dislike" ads. But given a choice between ad-supported, no incremental cost content, supported by ads, or paying for that same content, people will tend to prefer the ad-supported versions.

The study also found 19 percent of users prefer to pay more for apps with no ads, down from 30 percent in the 2011 survey. You might say that as use of apps has grown, people are exhibiting the same sentiments they typically do, when confronted with ad supported or "for fee" content.

Consumers often say they "hate" or "dislike" ads. But given a choice between ad-supported, no incremental cost content, supported by ads, or paying for that same content, people will tend to prefer the ad-supported versions.

The study also found 19 percent of users prefer to pay more for apps with no ads, down from 30 percent in the 2011 survey. You might say that as use of apps has grown, people are exhibiting the same sentiments they typically do, when confronted with ad supported or "for fee" content.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Who Dies First, Nokia or RIM?

Both Research in Motion and Nokia now are mobile device suppliers in trouble. But some would argue Nokia is more likely to survive than RIM.

One of the most important things playing into Nokia’s favor is its partnership with Microsoft. Microsoft has been trying, largely without success, to make a big market share move in the mobile device market, and is betting heavily on Nokia to help it.

For that reason, some think Nokia is more likely to survive than Research in Motion.

One of the most important things playing into Nokia’s favor is its partnership with Microsoft. Microsoft has been trying, largely without success, to make a big market share move in the mobile device market, and is betting heavily on Nokia to help it.

For that reason, some think Nokia is more likely to survive than Research in Motion.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Subscribe to:

Comments (Atom)

AI Music Revenue Models Will lean on Business-to-Business Use Cases

Automation seemingly always tends to redefine job functions and value, and artificial intelligence is unlikely to be different. Past automa...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...