Of 10 consumer macro trends shaping the technology, media and service provider markets over the next 10 years, perhaps the most important is the shift to “value” as consumers reset expectations in response to sluggish global growth, analysts at Gartner now say.

“All 10 of these trends converge around questions of value, what consumers value enough to pay for, how consumers' values are changing, and how technology and service providers can respond to this to increase their sales and margins,” Gartner says.

Consumer technology markets are being redefined by consumer cuts of discretionary spending in the wake of successive financial and economic crises.

Still, consumers seem to put a higher value on media and communications products in times of recession as they cut back on more-expensive substitutes, Gartner argues.

In addition to more “recession-friendly” marketing messages, a greater range of "affordable" or value product options, more-strenuous customer engagement efforts, and improved customer experience efforts, will be required.

Over time, there has been a closing of the classic "digital divide" between the haves and have-nots in terms of access to basic technology products and services. At the same time, there has been an acceleration of product update, upgrade and replacement cycles.

Acceleration should in theory give consumers more spare time to do the things they want. In reality, they experience the reverse. Therefore, the most valuable product that service providers can deliver to consumers is extra time in the day to do things that they want or need to get done.

Products and services that help consumers fill their time more productively and/or pleasurably are the most compelling, Gartner argues.

Thursday, July 19, 2012

Consumer Values Have Changed, Gartner Says

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Wednesday, July 18, 2012

Global Telecom Industry Has Made a Historic Leap in Serving People in Developing Regions

A high-level study sponsored by Alcatel-Lucent and conducted by the ENPC (Ecole des Ponts ParisTech) illustrates an important and historic change in global communications, especially the decades-long effort to figure out how to provide communications to billions of human beings who had not previously “made a phone call,” much less “used the Internet.”

In recent years, the concern has shifted dramatically to mobile service for the “next billion” people, or Internet for the next billion people, where in the 1960s and 1970s the issue was providing “phone service” to the “next billion” users in developing countries.

What has gone somewhat unnoticed is the truly stunning progress, globally, in getting communications services to users in developing regions, where once policy makers struggled to anticipate how that could be done with legacy technology, namely fixed networks.

Without too much fanfare, the answers have emerged organically from use of mobile and Internet technologies.

With six billion mobile users globally in 2011, usage of mobile phones has become a truly planetary phenomenon, and has largely erased the “divide” between people in developed countries and people in developing countries, in terms of ability to use communications.

In recent years, the concern has shifted dramatically to mobile service for the “next billion” people, or Internet for the next billion people, where in the 1960s and 1970s the issue was providing “phone service” to the “next billion” users in developing countries.

What has gone somewhat unnoticed is the truly stunning progress, globally, in getting communications services to users in developing regions, where once policy makers struggled to anticipate how that could be done with legacy technology, namely fixed networks.

Without too much fanfare, the answers have emerged organically from use of mobile and Internet technologies.

With six billion mobile users globally in 2011, usage of mobile phones has become a truly planetary phenomenon, and has largely erased the “divide” between people in developed countries and people in developing countries, in terms of ability to use communications.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Call Volumes Fall, on Both Fixed and Mobile Networks in U.K.

Overall time spent using voice communications fell by five percent in 2011, Ofcom, the U.K. communications regulator, reports.

“This reflects a 10 percent fall in the volume of calls from landlines, and for the first time, ever, a fall in the volume of mobile calls by just over one percent, in 2011,” Ofcom says.

According to Ofcom, 96 percent users 16 to 24 are using some form of text based application on a daily basis to communicate with friends and family; with 90 percent using texts and nearly three quarters (73 percent) using social networking sites.

By comparison, talking on the phone is less popular among this younger age group, with 67 percent making mobile phone calls on a daily basis, and only 63 percent talking face to face.

“This reflects a 10 percent fall in the volume of calls from landlines, and for the first time, ever, a fall in the volume of mobile calls by just over one percent, in 2011,” Ofcom says.

According to Ofcom, 96 percent users 16 to 24 are using some form of text based application on a daily basis to communicate with friends and family; with 90 percent using texts and nearly three quarters (73 percent) using social networking sites.

By comparison, talking on the phone is less popular among this younger age group, with 67 percent making mobile phone calls on a daily basis, and only 63 percent talking face to face.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Is Cablevision Clearband or OMGFast the Opening Gambit of a Historic Move?

Cablevision apparently is selling a fixed wireless broadband Internet and telephone service in Florida, using the Clearband or OMGFast brand names, charging subscribers $29.95 monthly for a 50 Mbps Internet connection that competes with Comcast and Time Warner Cable, at least in the voice and broadband access areas.

Moreover, Cablevision also appears to own licenses in 45 total markets. Cablevision acquired MVDDS licenses in 45 markets in 2004, including New York, Los Angeles, Chicago, Philadelphia, San Francisco, Miami, Cleveland, Nashville, and Tampa-St. Petersburg.

Federal Communications Commission cross-ownership rules likely would require that Cablevision sell the New York license, or limit its broadband wireless service to parts of the market in which it doesn't market its Optimum digital cable, phone and Internet products to subscribers.

Cablevision, almost singularly among top U.S. cable operators, thus appears ready to break ranks in a major way with its other top U.S. cable operators in respecting an informal "we don't compete with each other" understanding.

It wouldn't be the first time. Cablevision in the past has backed satellite direct broadcasting efforts that would similarly have competed with cable operators around the United States.

It isn't clear what Cablevision might be thinking about operations elsewhere. But if Cablevision decides to "overbuild" in some or all of its other areas, it would be historic, marking the first time a top-10 U.S. cable operator has decided to compete with other cable operators in their franchise areas.

Moreover, Cablevision also appears to own licenses in 45 total markets. Cablevision acquired MVDDS licenses in 45 markets in 2004, including New York, Los Angeles, Chicago, Philadelphia, San Francisco, Miami, Cleveland, Nashville, and Tampa-St. Petersburg.

Federal Communications Commission cross-ownership rules likely would require that Cablevision sell the New York license, or limit its broadband wireless service to parts of the market in which it doesn't market its Optimum digital cable, phone and Internet products to subscribers.

Cablevision, almost singularly among top U.S. cable operators, thus appears ready to break ranks in a major way with its other top U.S. cable operators in respecting an informal "we don't compete with each other" understanding.

It wouldn't be the first time. Cablevision in the past has backed satellite direct broadcasting efforts that would similarly have competed with cable operators around the United States.

It isn't clear what Cablevision might be thinking about operations elsewhere. But if Cablevision decides to "overbuild" in some or all of its other areas, it would be historic, marking the first time a top-10 U.S. cable operator has decided to compete with other cable operators in their franchise areas.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

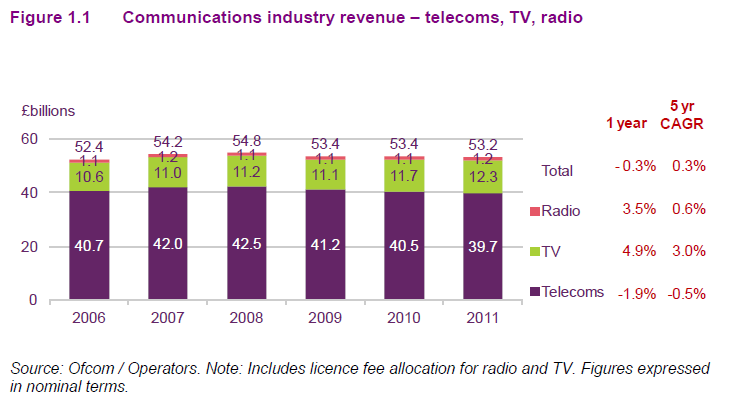

U.K. Service Provider Revenue Shows Need for New Lines of Business

Industry trends in the United Kingdom illustrate just how important new revenue sources already have become, in a business some of us expect will lose fully half its current revenue over about a decade’s time.You might argue that U.K. service provider revenue has been largely flat since about 2006, for example.

Total U.K. telecom service revenue declined for the third successive year in 2011, falling by £0.8 billion (1.9 percent) to £39.7 billion, Ofcom, the U.K. communications regulator, reports.

In large part, that might be because household spend on communication services fell from £110.50 in 2006 to £97.62 in 2011, representing a monthly decline of £12.88, or £154.56 per year. Average monthly household spend on telecoms services fell to £65.04 in 2011, a £3.02 a month (4.4 percent) fall in real terms.

Retail revenues increased by £0.1 billion to £31.0 billion during the year, despite a £0.2 billion increase in fixed internet revenues. Neither of those changes is particularly large in magnitude, but the key figure is the increase in fixed network Internet revenues, since broadband access has been the most-recent “new service” added to fixed network menus.

A similar rise in corporate data service revenues and a £0.1 billion increase in retail revenues from mobile voice and data services were offset by a £0.5 billion fall in fixed network calling and access revenues.

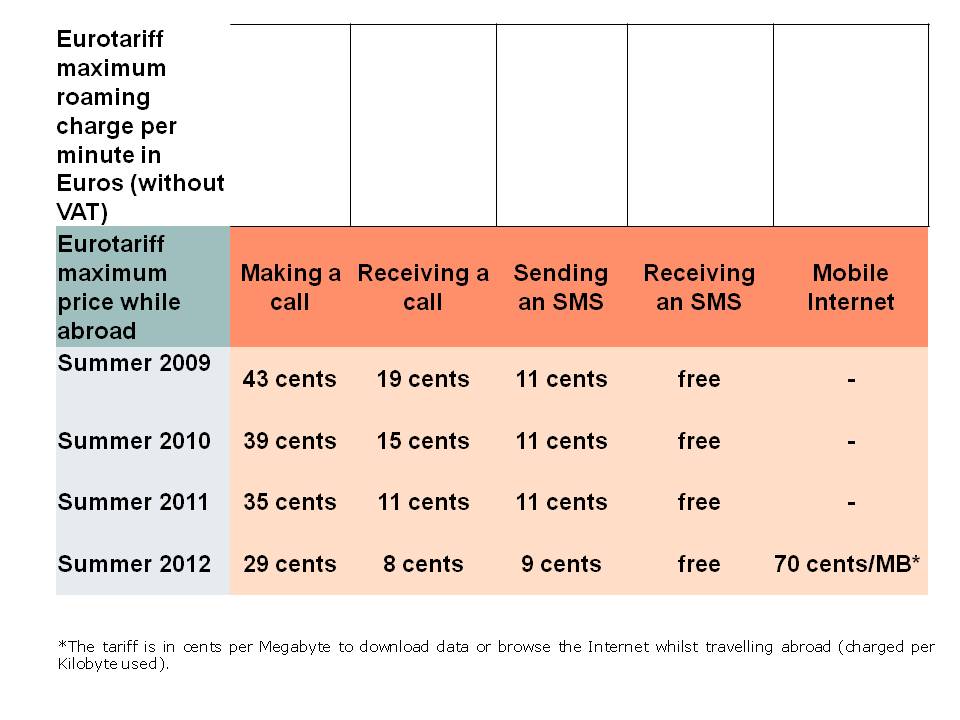

Much of the shortfall came from the wholesale segment, as revenues fell by £0.9 billion (8.9 percent) in 2011. That illustrates the near-term impact regulatory changes can have. The European Commission, for example, recently has mandated reductions in wholesale roaming charges for mobile services.

Total U.K. telecom service revenue declined for the third successive year in 2011, falling by £0.8 billion (1.9 percent) to £39.7 billion, Ofcom, the U.K. communications regulator, reports.

In large part, that might be because household spend on communication services fell from £110.50 in 2006 to £97.62 in 2011, representing a monthly decline of £12.88, or £154.56 per year. Average monthly household spend on telecoms services fell to £65.04 in 2011, a £3.02 a month (4.4 percent) fall in real terms.

Retail revenues increased by £0.1 billion to £31.0 billion during the year, despite a £0.2 billion increase in fixed internet revenues. Neither of those changes is particularly large in magnitude, but the key figure is the increase in fixed network Internet revenues, since broadband access has been the most-recent “new service” added to fixed network menus.

A similar rise in corporate data service revenues and a £0.1 billion increase in retail revenues from mobile voice and data services were offset by a £0.5 billion fall in fixed network calling and access revenues.

Much of the shortfall came from the wholesale segment, as revenues fell by £0.9 billion (8.9 percent) in 2011. That illustrates the near-term impact regulatory changes can have. The European Commission, for example, recently has mandated reductions in wholesale roaming charges for mobile services.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gmail by Text Message in Ghana, Nigeria, Kenya

Gmail SMS works on any phone, even the most basic ones which only support voice and SMS.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

AT&T to Offer Family Mobile Data Plans in August 2012

AT&T is introducing family mobile data plans, as expected, starting in late August 2012. As Verizon Wireless already has done, AT&T is executing a bit of a historic shift in retail packaging.

Where once it was voice and texting services that were offered on a usage basis, now under both Verizon Wireless and AT&T plans, both domestic texting and voice services are unlimited and usage insensitive.

Instead, it is mobile broadband that becomes the primary usage-sensitive service, using the same “bucket of use” concept long used for voice and text messaging services.

That shift reflects the historic shift of revenue opportunities within the mobile and fixed network businesses. For starters, there now are growing numbers of over the top voice and messaging options that do not require purchase of a “voice” or “texting” plan from a service provider. That means voice and messaging revenue is going to decline, over time.

Also, as consumers shift their communications patterns from voice to text and other Internet mechanisms, actual consumption of voice is declining. Overall time spent using voice communications, for example, fell by five percent in 2011, Ofcom, the U.K. communications regulator, reports. “This reflects a 10 percent fall in the volume of calls from landlines, and for the first time ever, a fall in the volume of mobile calls (by just over one percent, in 2011.”

In other words, for the first time ever, fewer phone calls are being made on both fixed and mobile phones, Ofcom reports.

At the same time, where usage of voice is flat to declining, usage of bandwidth is climbing as much as 50 percent a year.

Under such circumstances, capital investment increasingly is dictated by broadband products, not voice or messaging, so revenue recognition also must shift to match the drivers of capital investment, as well.

As was the case for family plans for voice and data, the new plans will, over time, lead to accounts adding more revenue-generating devices. For the new Verizon and AT&T plans, that will mean more data devices to be added to plans, especially tablets. But the new plans also will encourage users to convert to smart phones as well.

The actual revenue impact will be hard to discern, at first, as the plans are constructed in ways that make them revenue neutral, for the most part. Only over time, as more mobile broadband cards and tablets get connected will the changes in data revenues be clearly seen.

Where once it was voice and texting services that were offered on a usage basis, now under both Verizon Wireless and AT&T plans, both domestic texting and voice services are unlimited and usage insensitive.

Instead, it is mobile broadband that becomes the primary usage-sensitive service, using the same “bucket of use” concept long used for voice and text messaging services.

That shift reflects the historic shift of revenue opportunities within the mobile and fixed network businesses. For starters, there now are growing numbers of over the top voice and messaging options that do not require purchase of a “voice” or “texting” plan from a service provider. That means voice and messaging revenue is going to decline, over time.

Also, as consumers shift their communications patterns from voice to text and other Internet mechanisms, actual consumption of voice is declining. Overall time spent using voice communications, for example, fell by five percent in 2011, Ofcom, the U.K. communications regulator, reports. “This reflects a 10 percent fall in the volume of calls from landlines, and for the first time ever, a fall in the volume of mobile calls (by just over one percent, in 2011.”

In other words, for the first time ever, fewer phone calls are being made on both fixed and mobile phones, Ofcom reports.

At the same time, where usage of voice is flat to declining, usage of bandwidth is climbing as much as 50 percent a year.

Under such circumstances, capital investment increasingly is dictated by broadband products, not voice or messaging, so revenue recognition also must shift to match the drivers of capital investment, as well.

As was the case for family plans for voice and data, the new plans will, over time, lead to accounts adding more revenue-generating devices. For the new Verizon and AT&T plans, that will mean more data devices to be added to plans, especially tablets. But the new plans also will encourage users to convert to smart phones as well.

The actual revenue impact will be hard to discern, at first, as the plans are constructed in ways that make them revenue neutral, for the most part. Only over time, as more mobile broadband cards and tablets get connected will the changes in data revenues be clearly seen.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Subscribe to:

Posts (Atom)

DIY and Licensed GenAI Patterns Will Continue

As always with software, firms are going to opt for a mix of "do it yourself" owned technology and licensed third party offerings....

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...