Data revenue will grow to 65 percent of total U.S. wireless service revenue as voice declines to 35 percent in 2016, according to Hugues de la Vergne, principal research analyst at Gartner.

What might not yet be so clear is how the industry will get to that point, but different retail packaging likely will play a key role, even as more users adopt smart phones that almost automatically boost data revenue because devices have most value when an Internet connection is available, all the time.

But nobody yet can be sure whether shared data plans offered by AT&T and Verizon Wireless will work as planned, namely lifting overall revenues while creating a usage-based data revenue model, while encouraging users to add tablets to their accounts for mobile broadband access.

But some think the entire industry eventually will move in that direction, as was the case with some earlier packaging innovations, including the mobile industry's abolition of domestic long distance with AT&T's Digital One Rate, or the adoption of family plans for domestic voice and texting.

As the number of devices with mobile network modems increases, consumers and small businesses in the U.S. will demand matching multi-device data rate plans, according to Gartner.

The disagreement about adoption probably will not be decided, one way or the other, for some time. The reason is that the current structure of the shared data plans does not offer significantly better economics for users, compared to what they already can buy.

There are some marginal advantages and inducements to add tablet devices, for example, but the price advantage might not be so obvious to most users, or valuable.

But Gartner believes multi-device rate plans will be a key driving factor in the expansion of U.S. data revenue from $81.4 billion in 2011 to $151.9 billion in 2016.

One could get a rather robust argument at the moment about the importance of new shared data plans launched by Verizon Wireless and AT&T. Those two carriers clearly believe consumers want such plans, and also believe that the plans will boost revenue.

Others are not so sure, or might even think the plans are unnecessary or less advantageous to consumers than more traditional plans.

Tuesday, July 24, 2012

How Important are Shared Data Plans?

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

U.K. Customers of Three Increase Data Consumption 100% in 12 Months

In about a year's time, smart phone customers of U.K. mobile service provider Three have doubled their "average" data consumption to 1.1 Gbytes a month, Three says.

That rate of increase is faster than for the U.K. audience as a whole, as Ofcom reports the overall volume of mobile data consumed in the United Kingdom has doubled in the 18 months to January 2012.

By way of comparison, according to Nielsen’s June 2012 analysis of U.S. mobile phone bills for 65,000 lines, smart phone owners, especially those with iPhones and Android devices, were consuming about 435 Mbytes a month in 2011, roughly the same as in the United Kingdom.

T-Mobile USA, meanwhile, reports that its users consumer about 760 Mbytes a month.

Ofcom estimates that the average U.K. consumer now spends ninety minutes per week using a mobile to access the Internet, largely replacing their use of PCs and laptops for watching video clips and sending messages.

Those of you with an engineering bent will realize what that means. Nothing stresses an access network like video.

Since mobile networks are more "bandwidth challenged" than the fixed networks, when users switch video viewing preferences to mobile access modes, mobile networks experience the "worst of all worlds" (the media type with the greatest bandwidth requirement is consumed on the networks with the least available bandwidth).

And one might well expect consumption to keep climbing, as more users adopt smart phones, come to rely on mobile access to the Internet and as fourth generation networks are built, since faster access drives higher data consumption.

A year ago, average consumption was about 450 megabytes. As you would expect, the growth has happened because of smart phone user behavior. About 95 percent of Three smart phone customers use data on a daily basis.

About 42 percent of respondents surveyed by Ofcom agree with the statement “my phone is more important to me for accessing the Internet than any other device."

Levels of agreement with this statement are highest among those aged 16 to 24 (51 percent) and 25 to 44 (48 percent). Levels of agreement have also increased over time, with 42 percent net agreement in 2012, compared to 33 percent net agreement in 2011.

Ofcom reports that mobile broadband (data dongles or cards) now are used by about 13 percent of U.K. mobile users, while smart phone adoption grew from 27 percent in 2011 to 39 percent of U.K. adults, representing 43% of mobile phone users.

Some 66 percent of U.K. users 16 to 24 and 60 percent of those aged 25 to 34 have a

smart phone,

That rate of increase is faster than for the U.K. audience as a whole, as Ofcom reports the overall volume of mobile data consumed in the United Kingdom has doubled in the 18 months to January 2012.

By way of comparison, according to Nielsen’s June 2012 analysis of U.S. mobile phone bills for 65,000 lines, smart phone owners, especially those with iPhones and Android devices, were consuming about 435 Mbytes a month in 2011, roughly the same as in the United Kingdom.

T-Mobile USA, meanwhile, reports that its users consumer about 760 Mbytes a month.

Ofcom estimates that the average U.K. consumer now spends ninety minutes per week using a mobile to access the Internet, largely replacing their use of PCs and laptops for watching video clips and sending messages.

Those of you with an engineering bent will realize what that means. Nothing stresses an access network like video.

Since mobile networks are more "bandwidth challenged" than the fixed networks, when users switch video viewing preferences to mobile access modes, mobile networks experience the "worst of all worlds" (the media type with the greatest bandwidth requirement is consumed on the networks with the least available bandwidth).

And one might well expect consumption to keep climbing, as more users adopt smart phones, come to rely on mobile access to the Internet and as fourth generation networks are built, since faster access drives higher data consumption.

A year ago, average consumption was about 450 megabytes. As you would expect, the growth has happened because of smart phone user behavior. About 95 percent of Three smart phone customers use data on a daily basis.

About 42 percent of respondents surveyed by Ofcom agree with the statement “my phone is more important to me for accessing the Internet than any other device."

Levels of agreement with this statement are highest among those aged 16 to 24 (51 percent) and 25 to 44 (48 percent). Levels of agreement have also increased over time, with 42 percent net agreement in 2012, compared to 33 percent net agreement in 2011.

Ofcom reports that mobile broadband (data dongles or cards) now are used by about 13 percent of U.K. mobile users, while smart phone adoption grew from 27 percent in 2011 to 39 percent of U.K. adults, representing 43% of mobile phone users.

Some 66 percent of U.K. users 16 to 24 and 60 percent of those aged 25 to 34 have a

smart phone,

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Monday, July 23, 2012

ATM and Frame Relay Gone by 2015

“By 2015, ATM and frame relay will virtually vanish, while private leased lines will be around a bit longer,” says Michael Howard, co-founder and principal analyst of Infonetics Research.

In large part, that is because replacement services such as Ethernet and IP VPNs are taking the place of frame relay and ATM. “Despite some slowdown in Europe in 2011 and 2012, we see solid growth ahead for both IP MPLS VPNs and Ethernet services, together topping $81 billion worldwide by 2016,” Howard says.

Global Ethernet and MPLS IP VPN service revenue grew a combined 13 percent in 2011 to just over $50 billion, fueled by surging data traffic, cloud services, and cost-cutting initiatives, Infonetics says.

In large part, that is because replacement services such as Ethernet and IP VPNs are taking the place of frame relay and ATM. “Despite some slowdown in Europe in 2011 and 2012, we see solid growth ahead for both IP MPLS VPNs and Ethernet services, together topping $81 billion worldwide by 2016,” Howard says.

Global Ethernet and MPLS IP VPN service revenue grew a combined 13 percent in 2011 to just over $50 billion, fueled by surging data traffic, cloud services, and cost-cutting initiatives, Infonetics says.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Mobile Money Already is a Major Revenue Driver for Safaricom

If you want an indication of how big a deal mobile money services could be for some mobile service providers, consider that M-Pesa, operated by Safaricom, now accounts for 13.3 percent of Safaricom’s total revenue.

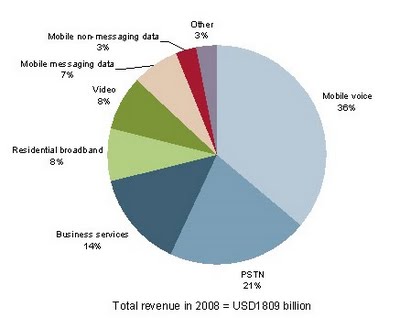

To give you some idea of how important that is, consider that, in 2008, business services accounted for about 14 percent of global service provider revenues. In other words, as a percentage of revenue, what Safaricom is making from mobile money services is as significant as business services were, in 2008.

For Safaricom, mobile money already is more significant than mobile messaging revenues were in 2008, more important than video services, more important than mobile broadband.

On the other hand, mobile service providers will have very-different opportunities in developing markets, than in developed markets. A simple way of putting matters would be to say that, in developing markets, where the mobile device and mobile service provider provide the functional equivalent of a banking service, the obvious value is “access” to banking.

In developed regions, where banking is well developed, that will not be the case. Instead, mobile service providers will have to create more complex new services, and the role of third party partners will be crucial. Some might even argue that, ultimately, mobile service providers will have to create applications that are highly integrated with core banking functions, for example.

In developed regions, “applications” are the value, and that will require rather more complex infrastructure and relationships.

In developing regions, the demand is for low-cost, low-speed, and infrequent transfers of money, often of small amounts.

In developed regions, the demand if for high speed, higher value transactions that might occur more frequently as well.

To give you some idea of how important that is, consider that, in 2008, business services accounted for about 14 percent of global service provider revenues. In other words, as a percentage of revenue, what Safaricom is making from mobile money services is as significant as business services were, in 2008.

For Safaricom, mobile money already is more significant than mobile messaging revenues were in 2008, more important than video services, more important than mobile broadband.

On the other hand, mobile service providers will have very-different opportunities in developing markets, than in developed markets. A simple way of putting matters would be to say that, in developing markets, where the mobile device and mobile service provider provide the functional equivalent of a banking service, the obvious value is “access” to banking.

In developed regions, where banking is well developed, that will not be the case. Instead, mobile service providers will have to create more complex new services, and the role of third party partners will be crucial. Some might even argue that, ultimately, mobile service providers will have to create applications that are highly integrated with core banking functions, for example.

In developed regions, “applications” are the value, and that will require rather more complex infrastructure and relationships.

In developing regions, the demand is for low-cost, low-speed, and infrequent transfers of money, often of small amounts.

In developed regions, the demand if for high speed, higher value transactions that might occur more frequently as well.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Broadband "Progress" Is Hard to Measure, These Days

According to Organization for Economic Cooperation and Development statistics, there were 314.9 million fixed network broadband connections in use in the OECD countries in December 2011, for example.

There also were 667.4 million wireless broadband connections in use at the same time, for a total of 982.3 million broadband connections. That means 68 percent of all broadband connections in the OECD region are wireless.

That has obvious implications for service providers, investors, end users and regulators alike, as it means any effort to measure broadband subscribers, access speeds and prices is much more complicated than it once was.

As tablets show a historic shift in what people are doing, and want to do, using “computing” devices, so people are showing historic new patterns in terms of how they want to consume Internet applications and content.

Though the trend is most clear in developing regions, where a mobile device is the primary way people use Internet apps, it increasingly is the case that a “small screen” smart phone or feature phone is the way many people are choosing to use the Internet.

In China, for example, there now are fewer fixed broadband subscribers, compared to last year. Internet users reached 530 million over the past six months, but the broadband subscriber base actually shrank as mobile became the most popular way for users to get online for the first time, a report by the Chinese government suggests.

Of those Internet users, some 380 million were fixed broadband users, down from 396 million in December 2011, and 388 million were mobile internet users, up from 356 million.

Instead of growing, as you might expect, fixed broadband accounts actually declined, as users apparently decided to spend their money on mobile broadband, rather than fixed broadband.

The point is that, though it is useful to measure how fixed network access bandwidth, usage or prices are developing, that does not offer a full picture of how people are using broadband, since two thirds of broadband connections in the OECD are of the mobile variety.

For example, though it is noteworthy that the Federal Communications Commission reports “striking across-the-board-improvements” in U.S. broadband access services in its July 2012 “Measuring Broadband America Report,” that describes improvements in connections that represent only about a third of total paid connections.

The study is important, as it suggests fixed network ISPs are doing much better, in a few key areas.

Five ISPs now routinely deliver nearly one hundred percent or greater of the speed advertised to the consumer even during time periods when bandwidth demand is at its peak, the report says.

In the August 2011 Report, only two ISPs met this level of performance. In 2011, the average ISP delivered 87 percent of advertised download speed during peak usage periods; in 2012, that jumped to 96 percent, the report says. .

Performance also is more uniform, across providers. The 2011 study showed wide variances between top performers and bottom performers in meeting advertised speeds.

On average, customers subscribed to faster speed tiers in 2012 than in 2011. This is a result of both upgrades by ISPs to their network as well as some migration of consumers to higher speed services.

During the testing period for the August 2011 Report, the average speed tier was 11.1 Megabits per second. In the latest report, speed increased to 14.3 Mbps, an almost 30 percent increase in just one year.

The actual increase in experienced speed by consumers was even greater than the increase in advertised speed. End user experienced speeds rose from 10.6 Mbps to 14.6 Mbps, an improvement of about 38 percent over the one year period.

The report expresses optimism that the U.S. market is moving toward the goal of equipping at least 100 million homes with actual download speeds of at least 50 Mbps by 2015, and 100 Mbps by 2020.

The August 2011 Report showed that the ISPs included in the Report were, on average, delivering 87 percent of advertised speeds during the peak consumer usage hours of weekdays from 7:00 pm to 11:00 pm local time.

The July 2012 Report finds that ISP performance has improved overall, with ISPs delivering on average 96 percent of advertised speeds during peak intervals, and with five ISPs routinely meeting or exceeding advertised rates.

On average, during peak periods, DSL-based services delivered download speeds that were 84 percent of advertised speeds, cable-based services delivered 99 percent of advertised speeds, and fiber-to-the-home services delivered 117 percent of advertised speeds.

This compared with 2011 results showing performance levels of 82 percent for DSL, 93 percent for cable, and 114 percent for fiber.

Peak period speeds decreased from 24-hour average speeds by 0.8 percent for fiber-to-the-home services, 3.4 percent for DSL-based services and 4.1 percent for cable-based services. This compared with 0.4 percent for fiber services, 5.5 percent for DSL services and 7.3 percent for cable services in 2011.

Average peak period download speeds varied from a high of 120 percent of advertised speed to a low of 77 percent of advertised speed. This is a dramatic improvement from last year where these numbers ranged from a high of 114 percent to a low of 54 percent.

In 2011, on average, ISPs had a six percent decrease in delivered versus advertised download speed between their 24 hour average and their peak period average. In 2012, average performance improved, and there was only a three percent decrease in performance between 24 hour and peak averages.

All of that is good news for end users. But those improvements reflect changes to about a third of all U.S. broadband connections. And it remains very hard to measure “value” in the broadband access business.

Raw speed is a good thing. But if raw speed were the only consideration, people wouldn’t pay for and use mobile broadband. Nor is any measurement of fixed network broadband access the full story, in any nation within the OECD, or arguably outside the OECD, as well.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Is "Wi-Fi-Only" Really a Tablet Shortcoming?

For some observers, a tablet that supports only Wi-Fi connections is defective. Maybe not. At least so far, the overwhelming percentage of tablet usage occurs at home, with the balance of usage at public hot spots or at work.

If 88 percent of tablet use occurs in a living room, where Wi-Fi is assumed to be present, there are only 12 percent of other locations where a tablet might conceivably be used, and one might argue that a smart phone will suffice for most of those use cases.

Some 24 percent of tablet users say they likewise use tablets at work, where Wi-Fi reasonably also can be presumed to be available.

The point is that the hope mobile service providers have of more consumers adopting mobile broadband for their tablets remains largely an expectation.

Of course, some will argue that the current usage pattern is shaped by the fact that most people have purchased devices without native mobile network support. What people cannot do, they do not do.

But that seems to ignore the more obvious conclusion, which is that tablets get used mostly in situations where Wi-Fi is available. In that case, lack of direct mobile connectivity is not such a big problem. For users who normally carry a smart phone with personal hotspot service, there is virtually no problem at all.

If 88 percent of tablet use occurs in a living room, where Wi-Fi is assumed to be present, there are only 12 percent of other locations where a tablet might conceivably be used, and one might argue that a smart phone will suffice for most of those use cases.

Some 24 percent of tablet users say they likewise use tablets at work, where Wi-Fi reasonably also can be presumed to be available.

The point is that the hope mobile service providers have of more consumers adopting mobile broadband for their tablets remains largely an expectation.

Of course, some will argue that the current usage pattern is shaped by the fact that most people have purchased devices without native mobile network support. What people cannot do, they do not do.

But that seems to ignore the more obvious conclusion, which is that tablets get used mostly in situations where Wi-Fi is available. In that case, lack of direct mobile connectivity is not such a big problem. For users who normally carry a smart phone with personal hotspot service, there is virtually no problem at all.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Wireless Now Leads Global Broadband Growth

The focus of global broadband adoption now has shifted to the wireless domain, a dstudy suggests. Wireless broadband subscriptions showed growth of over 13 percent in the last six months and Korea (100.6) and Sweden (98.0) have wireless penetration above or near 100 percent.

The global number of wireless broadband subscriptions in OECD countries totals 667 million, up from 590 million in June 2011, according to the Organization for Economic Cooperation and Development (OECD).

Switzerland tops for the first time the Organization for Economic Cooperation and Development (OECD) fixed broadband rankings for fixed broadband "density," with 39.9 subscribers per 100 inhabitants, followed closely by the Netherlands (39.1) and Denmark (37.9). The OECD average is 25.6, according to new OECD statistics.

Fixed wired broadband subscriptions reached 314 million in the OECD area at the end of 2011, although growth slowed to 1.8 percent in the second half of 2011, the study suggests.

OECD Fixed (wired) broadband subscriptions per 100 inhabitants, by technology, December 2011

The overall share of DSL subscriptions continues to decrease (55.8 percent), to the benefit of cable (30 percent) and, especially, fibre-to-the-home subscriptions that now represent 13.7 percent of the total number of fixed broadband subscriptions.

Data and charts for the December 2011 broadband statistics are available here.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Subscribe to:

Posts (Atom)

Have LLMs Hit an Improvement Wall, or Not?

Some might argue it is way too early to worry about a slowdown in large language model performance improvement rates . But some already voic...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...