While Android smartphone usage within the enterprise nearly doubled during the second quarter of 2012, iOS continues to be the dominant smartphone platform, led primarily by the iPhone 4S, a Good Technology study suggests.

On average, the two most recently released iPhones and iPads drove the majority of activations between April 1 and June 30, 2012. The iPhone 4S was the top device, driving nearly twice as many activations as any other smartphone, with 30.8 percent of activations for the quarter.

Corporate use of Android smart phones nearly doubled quarter over quarter, capturing 36.9 percent of total activations, led by the popular Samsung Galaxy SII, which ranked fifth in “Top 10” devices this quarter at 4.6 percent.

Other “Top 10” Android devices include Samsung’s Galaxy SII and the Motorola Droid Razr which claimed the fifth and sixth spots. Both of these Android smartphones outpaced the original iPad and iPhone 3S, which ranked seventh and eighth, down slightly from their respective fifth and sixth place spots last quarter.

Additionally, while tablet adoption by the enterprise continued to grow—dominated by the iPad, which accounted for 94.5 percent overall tablet activations— smart phone usage still outnumbered tablet usage by three to one, accounting for 73 percent of total mobile device activations.

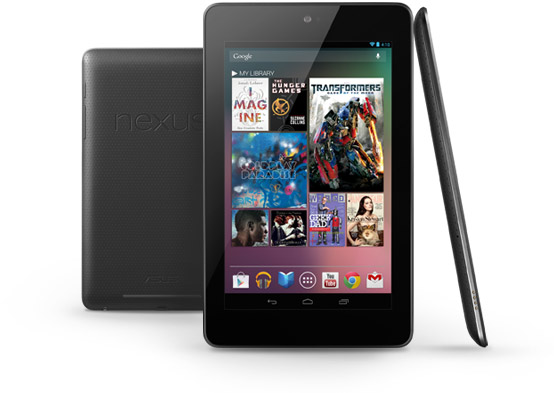

Android saw another increase in this category for the quarter, as Android tablets captured 5.5 percent of total tablet activations, up from 2.7 percent last quarter.