Ask yourself whether it is especially helpful for all your digital devices to use a similar look and feel. How important is it that your PC, your tablet, your smart phone and possibly other devices have a similar user interface? Microsoft is about to find out, it appears, with the launch of Microsoft 8.

Making radical changes to Windows poses a risk for Microsoft as enterprises and other large organizations prefer to reduce technology risk by deploying mature, stable, well-supported products, Gartner argues.

Windows Vista, for example, never gained significant success in corporate environments, and its lack of success can be glimpsed in the market share statistics. Gartner estimates that just eight percent of PCs run by Gartner clients ran Vista at its peak.

The bottom line is that IT leaders are questioning whether Windows 8 will suffer a similar fate, Gartner argues.

"Microsoft's approach is very different from Apple's and Google's, where phones and tablets have much more commonality than PCs and tablets," Gartner says. The new "Metro-style" user interface, which includes large buttons for touch and eliminates the ability to boot to the familiar Windows Desktop and have a traditional Windows start menu, is probably the most controversial decision Microsoft has made in Windows 8, Gartner says.

The result is an operating system that looks appropriate on new form factors of PC hardware including tablets, hybrids and convertibles, but has people questioning its appropriateness for traditional desktop and notebook machines, which comprise the majority of the existing PC market, Gartner notes.

Monday, September 24, 2012

Should all Internet Device User Interfaces be the Same?

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Telecom Italia Network Sale?

Telecom Italia SpA should sell its fixed-lined network, said Marco Fossati, whose family’s Findim Group SA owns about five percent of the company.

“This opportunity should not be wasted as the right conditions may be now, in the next two or three months, or never.”

To be sure, the interests of major shareholders and end users or Telecom Italia do not always line up in the same way. Telecom Italia, like other European telcos, needs to reduce its debt load and make investments in newer lines of business.

One can argue that what is good for Telecom Italia as an asset, and what is good for Italy, Italian consumers or Telecom Italia as a going concern, can be different.

In a larger sense, there is a small but growing divergence of opinion among tier one service providers about the value of network asset ownership.

In some cases, service providers have concluded that they can live with a future as non-facilities-based providers, or have traded their facilities ownership for other opportunities. That is the case in Australia, New Zealand, Singapore and Malaysia, for example.

In a broader range of cases service providers have concluded they can do so out of region, while continuing to operate as facilities-based providers in region. Increasingly, there is understanding that specific elements of the network can safely be outsourced or shared.

Telecom Italia might ultimately look for some way to bring in other investors, which would raise liquidity, while retaining management control of the network, though.

“This opportunity should not be wasted as the right conditions may be now, in the next two or three months, or never.”

To be sure, the interests of major shareholders and end users or Telecom Italia do not always line up in the same way. Telecom Italia, like other European telcos, needs to reduce its debt load and make investments in newer lines of business.

One can argue that what is good for Telecom Italia as an asset, and what is good for Italy, Italian consumers or Telecom Italia as a going concern, can be different.

In a larger sense, there is a small but growing divergence of opinion among tier one service providers about the value of network asset ownership.

In some cases, service providers have concluded that they can live with a future as non-facilities-based providers, or have traded their facilities ownership for other opportunities. That is the case in Australia, New Zealand, Singapore and Malaysia, for example.

In a broader range of cases service providers have concluded they can do so out of region, while continuing to operate as facilities-based providers in region. Increasingly, there is understanding that specific elements of the network can safely be outsourced or shared.

Telecom Italia might ultimately look for some way to bring in other investors, which would raise liquidity, while retaining management control of the network, though.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

TeliaSonera backs off plan to charge for VoIP

Swedish telecommunications company TeliaSonera has reversed an earlier decision to implement an additional fee plan for its customers who want to use over the top VoIP services, choosing instead to simply raise mobile data plan rates across the board.

TeliaSonera first announced plans to charge for use of over the top mobile VoIP apps in February 2012, A plan similar to one it had already implemented in Spain.

There, subscribers pay EUR6 a month for 100 megabytes worth of VoIP calls, equivalent to between five and 10 hours of talk time.

The problem is that VoIP "is likely to replace traditional phone calls," according to TeliaSonera Chief Executive Lars Nyberg. "Eventually, all voice calls will be made over IP."

"If all our customers suddenly decided to switch over to VoIP, and we charged them only for the data traffic usage, we would lose about 70 percent of our revenue," Nyberg said.

That's an obvious observation, as all service providers ultimately will face the diminution of the traditional voice calling revenue stream, at current levels of gross revenue and profit margin. The issue is how to transition to "data access" revenue models most elegantly.

Lots of observers would note that charging extra for use of some apps is not elegant. In this case, TeliaSonera probably has chosen the better approach, namely simply matching value to pricing.

TeliaSonera first announced plans to charge for use of over the top mobile VoIP apps in February 2012, A plan similar to one it had already implemented in Spain.

There, subscribers pay EUR6 a month for 100 megabytes worth of VoIP calls, equivalent to between five and 10 hours of talk time.

The problem is that VoIP "is likely to replace traditional phone calls," according to TeliaSonera Chief Executive Lars Nyberg. "Eventually, all voice calls will be made over IP."

"If all our customers suddenly decided to switch over to VoIP, and we charged them only for the data traffic usage, we would lose about 70 percent of our revenue," Nyberg said.

That's an obvious observation, as all service providers ultimately will face the diminution of the traditional voice calling revenue stream, at current levels of gross revenue and profit margin. The issue is how to transition to "data access" revenue models most elegantly.

Lots of observers would note that charging extra for use of some apps is not elegant. In this case, TeliaSonera probably has chosen the better approach, namely simply matching value to pricing.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

More Smart Phone Users in Latin America than Developed Regions by 2017?

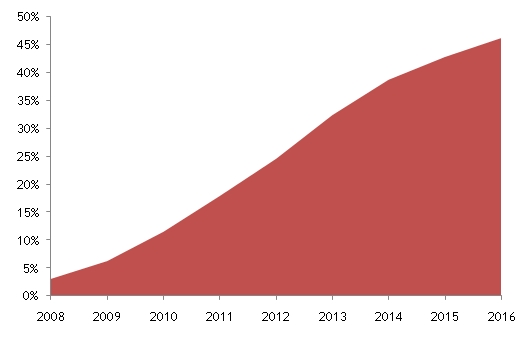

Telefónica has 208 million customers in Latin America, of which 173 million are mobile. Some would argue that in the next five years the region will surpass established markets by number of smart phones and their IP traffic will be multiplied by seven, with an annual growth rate of 49 percent.

In fact, Brazil has more smart phone users than Germany or France do. In fact, with about 27 million and 23 million smart phone users respectively, Brazil and Mexico both have more smart phone users than Australia has people (Australia’s population is around 22 million).

Google's Mobile Planet also revealed that Argentina has 24 percent smart phone penetration.

These numbers defy the common perception that these large Latin American markets are far behind the rest of the world in smart phone adoption, Google argues. They in fact already possess larger absolute numbers of smartphone users than many other countries, and above-average usage patterns in many areas, Google says.

Some 65 percent of Mexican smart phone users search on their phones every day, compared to 57 percent in the U.S. market.

Some 90 percent of Argentine smart phone users use their phones to access social networks, compared to 63 percent in Japan, and 29 percent of Brazilian smartphone users have changed their minds about a purchase while in a store due to research conducted on their phone, compared to 15 percent in Canada.

Latin America’s smart phone sales picked up in 2010 when smart phone sales in the region grew 117 percent and total handset sales grew 17 percent.

In 2011 smartphone sales were predicted to represent 17.9 percent of total handset sales and will continue to be the fastest growing category, increasing at a compound annual growth rate of 30 percent in the next five years, compared with a seven percent CAGR for overall handset sales during the same period.

By 2016, Pyramid Research expects smart phone sales to account for roughly 46 percent of total handset sales in the region.

Others might point to China as the driver of growth in emerging markets. Research firm Ovum says emerging markets in 2011 accounted for 160 million of 450 million smartphones sold worldwide. China accounted for about 66 percent of smartphones sold in developing markets, Ovum says.

Latin America smartphone sales as percentage of total handset sales, 2008–2016

In fact, Brazil has more smart phone users than Germany or France do. In fact, with about 27 million and 23 million smart phone users respectively, Brazil and Mexico both have more smart phone users than Australia has people (Australia’s population is around 22 million).

Google's Mobile Planet also revealed that Argentina has 24 percent smart phone penetration.

These numbers defy the common perception that these large Latin American markets are far behind the rest of the world in smart phone adoption, Google argues. They in fact already possess larger absolute numbers of smartphone users than many other countries, and above-average usage patterns in many areas, Google says.

Some 65 percent of Mexican smart phone users search on their phones every day, compared to 57 percent in the U.S. market.

Some 90 percent of Argentine smart phone users use their phones to access social networks, compared to 63 percent in Japan, and 29 percent of Brazilian smartphone users have changed their minds about a purchase while in a store due to research conducted on their phone, compared to 15 percent in Canada.

Latin America’s smart phone sales picked up in 2010 when smart phone sales in the region grew 117 percent and total handset sales grew 17 percent.

In 2011 smartphone sales were predicted to represent 17.9 percent of total handset sales and will continue to be the fastest growing category, increasing at a compound annual growth rate of 30 percent in the next five years, compared with a seven percent CAGR for overall handset sales during the same period.

By 2016, Pyramid Research expects smart phone sales to account for roughly 46 percent of total handset sales in the region.

Others might point to China as the driver of growth in emerging markets. Research firm Ovum says emerging markets in 2011 accounted for 160 million of 450 million smartphones sold worldwide. China accounted for about 66 percent of smartphones sold in developing markets, Ovum says.

Latin America smartphone sales as percentage of total handset sales, 2008–2016

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Bango, Facebook Use Carrier Billing for Virtual Goods

Carrier billing is not new. It has been available since about 1983, as was made necessary by the breakup of the former monopoly AT&T into separately-owned and independent long distance and local businesses. Basically, local service providers needed a way to allow long distance carriers to bill local telephone service customers for their long distance calling.

As a byproduct, carrier billing has been available to other third parties, and primarily has been used to support third party sales of content or virtual goods such as ringtones, songs and more recently, mobile apps or in-app products.

Bango says it now is providing Facebook carrier billing services in Germany, the United Kingdom and United States, and will be expanded to other countries during the remainder of 2012.

Bango now provides Facebook users the ability to easily purchase digital content without the use of premium text messaging services or credit cards. Instead, purchases appear on the mobile customer phone bills.

As a byproduct, carrier billing has been available to other third parties, and primarily has been used to support third party sales of content or virtual goods such as ringtones, songs and more recently, mobile apps or in-app products.

Bango says it now is providing Facebook carrier billing services in Germany, the United Kingdom and United States, and will be expanded to other countries during the remainder of 2012.

Bango now provides Facebook users the ability to easily purchase digital content without the use of premium text messaging services or credit cards. Instead, purchases appear on the mobile customer phone bills.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Has BlackBerry Subscriber Base Gone into Decline?

A decade after Research In Motion Ltd. introduced its first smartphone, the tribe of BlackBerry users has stopped growing stopped growing. The bigger question is whether something worse than that has happened over the last quarter, namely an actual decline in the user base.

Some would point that although it has faced huge challenges, Research in Motion has until recently been able to show sales growth, albeit at rates that do not match those of Apple iOS, Samsung or other Android devices.

In August, 2011 RIM had 70 million BlackBerry subscribers worldwide, and in June 2012 reported 78 million users globally.

Some analysts now believe the total number of BlackBerry users is now declining, or about to start declining. This contrasts with first weekend sales of the new Apple iPhone 5 of perhaps five million units. And some analysts appear to be disappointed at that sales level, which is more than for the similar first weekend of any other version of the iPhone, but less than some had anticipated based on pre-order activity.

Some would point that although it has faced huge challenges, Research in Motion has until recently been able to show sales growth, albeit at rates that do not match those of Apple iOS, Samsung or other Android devices.

In August, 2011 RIM had 70 million BlackBerry subscribers worldwide, and in June 2012 reported 78 million users globally.

Some analysts now believe the total number of BlackBerry users is now declining, or about to start declining. This contrasts with first weekend sales of the new Apple iPhone 5 of perhaps five million units. And some analysts appear to be disappointed at that sales level, which is more than for the similar first weekend of any other version of the iPhone, but less than some had anticipated based on pre-order activity.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

U.S. "Falling Behind" Rest of World in Spectrum Auctions?

One has to be skeptical at times about claims that a specific country is "falling behind" on some measure of communications intensity.

That might apply, in some ways, to claims the United States "has quickly fallen behind the world" in auctioning off spectrum that can be used to support wireless communications.

It is argued that Germany and Spain have auctioned about 50 percent more spectrum for broadband than the United States has. It is said that France has auctioned about 40 percent percent more spctrum, while Italy and Japan have auctioned 30 percent more spectrum.

"Specifically, the U.S. has auctioned about 410 MHz, Germany about 615 MHz, Spain about 600 MHz, France about 560 MHz, Italy roughly 510 MHz, Japan an estimated 500 MHz, and the United Kingdom preparing to auction about 600 MHz, Precursor principal Scott Cleland says.

Some skeptics will argue that one would expect Cleland to take that view, as one virtually always will find Cleland taking positions that are "against" Google and "for" telcos. And there is little doubt that mobile service providers virtually always seem to be looking for more spectrum as they add more customers.

The new reality is that each of those new customers are starting to consume network bandwidth at unprecedented rates, compared to past usage of narrowband voice and messaging apps.

That isn't to deny that more spectrum will be needed, in most countries, as mobile broadband adoption increases. Nor are U.S. regulators unmindful of the need to clear unused former TV broadcast spectrum for mobile use. So the "auction gap," like many other past "gaps," will close over time.

Also, what isn't immediately so obvious is what other spectrum assets already exist that can be "re-purposed," as U.S. mobile service providers are decommissioning older 2G or iDEN spectrum for new use by fourth generation networks.

And then there is spectrum Clearwire already has deemed surplus, the potential Dish Network, LightSquared and Nextwave spectrum, for example.

Long term, most service providers will need more physical spectrum. What isn't so clear is that there really is a spectrum auction gap that means anything terribly important at the moment.

That might apply, in some ways, to claims the United States "has quickly fallen behind the world" in auctioning off spectrum that can be used to support wireless communications.

It is argued that Germany and Spain have auctioned about 50 percent more spectrum for broadband than the United States has. It is said that France has auctioned about 40 percent percent more spctrum, while Italy and Japan have auctioned 30 percent more spectrum.

"Specifically, the U.S. has auctioned about 410 MHz, Germany about 615 MHz, Spain about 600 MHz, France about 560 MHz, Italy roughly 510 MHz, Japan an estimated 500 MHz, and the United Kingdom preparing to auction about 600 MHz, Precursor principal Scott Cleland says.

Some skeptics will argue that one would expect Cleland to take that view, as one virtually always will find Cleland taking positions that are "against" Google and "for" telcos. And there is little doubt that mobile service providers virtually always seem to be looking for more spectrum as they add more customers.

The new reality is that each of those new customers are starting to consume network bandwidth at unprecedented rates, compared to past usage of narrowband voice and messaging apps.

That isn't to deny that more spectrum will be needed, in most countries, as mobile broadband adoption increases. Nor are U.S. regulators unmindful of the need to clear unused former TV broadcast spectrum for mobile use. So the "auction gap," like many other past "gaps," will close over time.

Also, what isn't immediately so obvious is what other spectrum assets already exist that can be "re-purposed," as U.S. mobile service providers are decommissioning older 2G or iDEN spectrum for new use by fourth generation networks.

And then there is spectrum Clearwire already has deemed surplus, the potential Dish Network, LightSquared and Nextwave spectrum, for example.

Long term, most service providers will need more physical spectrum. What isn't so clear is that there really is a spectrum auction gap that means anything terribly important at the moment.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Subscribe to:

Comments (Atom)

On the Use and Misuse of Principles, Theorems and Concepts

When financial commentators compile lists of "potential black swans," they misunderstand the concept. As explained by Taleb Nasim ...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...