So many use cloud services because many cloud services are provided at no incremental charge to end users, or cost very little.

Monday, October 15, 2012

375 Million Use Consumer Cloud, 500 Million be End of 2012

Some 375 million consumer were using some form of cloud service earlier in 2012, while perhaps 500 million will be jumping to an estimated 625 million in 2013 and then doubling over the course of four years to reach 1.3 billion by 2017, according to IHS iSuppli.

So many use cloud services because many cloud services are provided at no incremental charge to end users, or cost very little.

So many use cloud services because many cloud services are provided at no incremental charge to end users, or cost very little.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Mobile and Cloud Will Change the Channel

Will the coming era of cloud-based apps and mobile access change the channel business? It seems impossible to believe otherwise.

As companies embrace anytime, anywhere communications--driven by the ubiquity of mobile devices--has the time finally come (yet again) to toss aside IP hardphones or even softphones? It’s a question at least some are asking.

“Once IP communications take over (if not already), the artifacts of telephony, including digit dialing and wired access will become obsolescent and will be replaced by a range of mobile IP-based communications tools,” says consultant Russell Bennett.

Consider the implications. If the mobile device becomes the object that uses broadband access, what happens to markets for fixed access? If the mobile displaces the desk phone, what happens to demand for hosted PBX services, SIP trunking or even fixed broadband?

To the extent that the typical channel partner, and the typical fixed network services provider, makes money selling fixed network voice and data, a shift to mobile will shift demand to mobile services, and away from fixed network services.

The shift to cloud computing, which is related to growing use of mobile devices and connections, doesn’t necessarily help channel partners or fixed network service providers, either. Consider the use of basic business productivity suites.

Once upon a time, business and consumer buyers purchased such products as “shrink wrapped” physical products, at retail outlets. These days, such purchases are not made, or are made online. In other words, distribution shifted from retail partners to online partners.

At the same time, average selling prices have dropped. In some cases, retail price now effectively is “zero,” when users use Google Docs, for example.

But, you might argue, there also are subscription-based business versions. Yes, that is true.

According to Cloud Sherpas, money can be made iin the cloud-based document suites business, despite the fact that no enterprise or smaller business pays very much for such apps. Business access to Google Apps costs $5 a month, or $50 a year.

But ask yourself whether a typical channel partner can make a living selling products priced at $50 a year.

In the channel partner business, the analogy is mobile-only business broadband and voice. You might argue that the channel partner only has to shift its products from fixed network to mobile product lines. But it isn’t that simple.

In some cases, business buyers will be able to “buy direct,” without a channel partner. In other cases, the retail prices might be low enough that there is little gross revenue or profit margin for any channel partner.

Sam Kumar, CEO of Denver competitive local exchange carrier Microtech-Tel, argues that CLECs no longer can compete with cable TV operators in the SMB business broadband access business. If the carrier cannot compete, then the carrier’s channel partners will have difficulty as well.

The obvious implication is that channel partners will have to shift product lines to cable high-speed Internet access, and away from incumbent telco or CLEC products.

A major disruption of the hosted PBX or premises phone system business is a bit further off. But if a business buyer can obtain enough of the same call management features from a mobile service, that a buyer would formerly have gotten from a hosted PBX solution, buying ultimately will shift. If the device to be supported is a mobile or a tablet, and if reasonable functionality can be provided, then purchasing should shift to “mobile direct” modes.

What should agencies do? Mobile product lines are a strategic necessity. Cable broadband is a tactical necessity.

In both the telecom and value added reseller businesses, it is harder to sustain revenue earned from traditional products, leading participants to search for better revenue models. Value added resellers generally are looking for recurring revenue streams, while telecom agents generally are looking for products other than recurring communications services.

Whether or not most agencies can diversify into pre-sale or post-sale products distinct from the residuals earned from selling carrier services is the big question.

The answers are not easy, but in all likelihood will revolve around the value telecom agents can add, either pre-sale or post-sale, for services other than the actual communications services. If you think about the traditional distinction between a “consultant” and an “agent,” you’ll get the idea.

The consultant does not represent service providers, does not earn any revenue from any communications services, but is paid for advice. In principle, that is what a commissioned telecom agent would have to learn to do, as well.

Peter Radzieski, owner of RAD-INFO, a consultancy, charges clients if what they want is information about who sells dark fiber, for example. He charges for the advice, whether or not a deal results (RAD-INFO works with about 65 service providers, so there sometimes is commission revenue involved).

He suggests that one way agencies could create post-sales revenue is by getting into the telecom expense managment business, for example, or managing mobile devices, or providing security services.

Another avenue is to “become the outsourced telecom department” for customers,” he says. In other cases an agency might be paid for integration activities. When a wide area network has to be created, it might be necessary to stitch together elements from a variety of suppliers. In those cases, an agency might be paid for integration tasks.

The point is that everything hinges on the “added value” beyond selling a circuit. As always is the case, management, integration, configuration, troubleshooting, monitoring, security and provisioning are some of the time-consuming tasks that a customer might essentially outsource to an agency capable of handling those chores.

But that’s the rub: an agency has to be able to provide those valuable services, credibly. The possible issue is that such services are time consuming. In principle, some agents might take a different tack and simply add on an incremental fee for some of the post-sale chores that inevitably arise around billing issues, for example.

The obvious downside is that a customer might then decide whether to buy direct from a carrier. Another possible avenue could be “white labeling” of carrier services, where the agency gets a wholesale price and then can sell at any retail price.

It won’t be easy to create pre-sale or post-sale revenue streams. But neither, given the difficult revenue model for selling pure communications services, does it seem likely agencies will be able to prosper, longer term, without those new revenue sources.

Will the coming era of cloud-based apps and mobile access change the channel business? It seems impossible to believe otherwise.

As companies embrace anytime, anywhere communications--driven by the ubiquity of mobile devices--has the time finally come (yet again) to toss aside IP hardphones or even softphones? It’s a question at least some are asking.

“Once IP communications take over (if not already), the artifacts of telephony, including digit dialing and wired access will become obsolescent and will be replaced by a range of mobile IP-based communications tools,” says consultant Russell Bennett.

Consider the implications. If the mobile device becomes the object that uses broadband access, what happens to markets for fixed access? If the mobile displaces the desk phone, what happens to demand for hosted PBX services, SIP trunking or even fixed broadband?

To the extent that the typical channel partner, and the typical fixed network services provider, makes money selling fixed network voice and data, a shift to mobile will shift demand to mobile services, and away from fixed network services.

The shift to cloud computing, which is related to growing use of mobile devices and connections, doesn’t necessarily help channel partners or fixed network service providers, either. Consider the use of basic business productivity suites.

Once upon a time, business and consumer buyers purchased such products as “shrink wrapped” physical products, at retail outlets. These days, such purchases are not made, or are made online. In other words, distribution shifted from retail partners to online partners.

At the same time, average selling prices have dropped. In some cases, retail price now effectively is “zero,” when users use Google Docs, for example.

But, you might argue, there also are subscription-based business versions. Yes, that is true.

According to Cloud Sherpas, money can be made iin the cloud-based document suites business, despite the fact that no enterprise or smaller business pays very much for such apps. Business access to Google Apps costs $5 a month, or $50 a year.

But ask yourself whether a typical channel partner can make a living selling products priced at $50 a year.

In the channel partner business, the analogy is mobile-only business broadband and voice. You might argue that the channel partner only has to shift its products from fixed network to mobile product lines. But it isn’t that simple.

In some cases, business buyers will be able to “buy direct,” without a channel partner. In other cases, the retail prices might be low enough that there is little gross revenue or profit margin for any channel partner.

Sam Kumar, CEO of Denver competitive local exchange carrier Microtech-Tel, argues that CLECs no longer can compete with cable TV operators in the SMB business broadband access business. If the carrier cannot compete, then the carrier’s channel partners will have difficulty as well.

The obvious implication is that channel partners will have to shift product lines to cable high-speed Internet access, and away from incumbent telco or CLEC products.

A major disruption of the hosted PBX or premises phone system business is a bit further off. But if a business buyer can obtain enough of the same call management features from a mobile service, that a buyer would formerly have gotten from a hosted PBX solution, buying ultimately will shift. If the device to be supported is a mobile or a tablet, and if reasonable functionality can be provided, then purchasing should shift to “mobile direct” modes.

What should agencies do? Mobile product lines are a strategic necessity. Cable broadband is a tactical necessity.

Mobile, in a real sense, is inseparable from cloud computing. The reason is simply that mobile devices increasingly provide value as "computers." And the thing about cloud computing is that it means new applications can be launched immediately, upgraded immediately or changed immediately, without little overhead.

In both the telecom and value added reseller businesses, it is harder to sustain revenue earned from traditional products, leading participants to search for better revenue models. Value added resellers generally are looking for recurring revenue streams, while telecom agents generally are looking for products other than recurring communications services.

Whether or not most agencies can diversify into pre-sale or post-sale products distinct from the residuals earned from selling carrier services is the big question.

The answers are not easy, but in all likelihood will revolve around the value telecom agents can add, either pre-sale or post-sale, for services other than the actual communications services. If you think about the traditional distinction between a “consultant” and an “agent,” you’ll get the idea.

The consultant does not represent service providers, does not earn any revenue from any communications services, but is paid for advice. In principle, that is what a commissioned telecom agent would have to learn to do, as well.

Peter Radzieski, owner of RAD-INFO, a consultancy, charges clients if what they want is information about who sells dark fiber, for example. He charges for the advice, whether or not a deal results (RAD-INFO works with about 65 service providers, so there sometimes is commission revenue involved).

He suggests that one way agencies could create post-sales revenue is by getting into the telecom expense managment business, for example, or managing mobile devices, or providing security services.

Another avenue is to “become the outsourced telecom department” for customers,” he says. In other cases an agency might be paid for integration activities. When a wide area network has to be created, it might be necessary to stitch together elements from a variety of suppliers. In those cases, an agency might be paid for integration tasks.

The point is that everything hinges on the “added value” beyond selling a circuit. As always is the case, management, integration, configuration, troubleshooting, monitoring, security and provisioning are some of the time-consuming tasks that a customer might essentially outsource to an agency capable of handling those chores.

But that’s the rub: an agency has to be able to provide those valuable services, credibly. The possible issue is that such services are time consuming. In principle, some agents might take a different tack and simply add on an incremental fee for some of the post-sale chores that inevitably arise around billing issues, for example.

The obvious downside is that a customer might then decide whether to buy direct from a carrier. Another possible avenue could be “white labeling” of carrier services, where the agency gets a wholesale price and then can sell at any retail price.

It won’t be easy to create pre-sale or post-sale revenue streams. But neither, given the difficult revenue model for selling pure communications services, does it seem likely agencies will be able to prosper, longer term, without those new revenue sources.

As companies embrace anytime, anywhere communications--driven by the ubiquity of mobile devices--has the time finally come (yet again) to toss aside IP hardphones or even softphones? It’s a question at least some are asking.

“Once IP communications take over (if not already), the artifacts of telephony, including digit dialing and wired access will become obsolescent and will be replaced by a range of mobile IP-based communications tools,” says consultant Russell Bennett.

Consider the implications. If the mobile device becomes the object that uses broadband access, what happens to markets for fixed access? If the mobile displaces the desk phone, what happens to demand for hosted PBX services, SIP trunking or even fixed broadband?

To the extent that the typical channel partner, and the typical fixed network services provider, makes money selling fixed network voice and data, a shift to mobile will shift demand to mobile services, and away from fixed network services.

The shift to cloud computing, which is related to growing use of mobile devices and connections, doesn’t necessarily help channel partners or fixed network service providers, either. Consider the use of basic business productivity suites.

Once upon a time, business and consumer buyers purchased such products as “shrink wrapped” physical products, at retail outlets. These days, such purchases are not made, or are made online. In other words, distribution shifted from retail partners to online partners.

At the same time, average selling prices have dropped. In some cases, retail price now effectively is “zero,” when users use Google Docs, for example.

But, you might argue, there also are subscription-based business versions. Yes, that is true.

According to Cloud Sherpas, money can be made iin the cloud-based document suites business, despite the fact that no enterprise or smaller business pays very much for such apps. Business access to Google Apps costs $5 a month, or $50 a year.

But ask yourself whether a typical channel partner can make a living selling products priced at $50 a year.

In the channel partner business, the analogy is mobile-only business broadband and voice. You might argue that the channel partner only has to shift its products from fixed network to mobile product lines. But it isn’t that simple.

In some cases, business buyers will be able to “buy direct,” without a channel partner. In other cases, the retail prices might be low enough that there is little gross revenue or profit margin for any channel partner.

Sam Kumar, CEO of Denver competitive local exchange carrier Microtech-Tel, argues that CLECs no longer can compete with cable TV operators in the SMB business broadband access business. If the carrier cannot compete, then the carrier’s channel partners will have difficulty as well.

The obvious implication is that channel partners will have to shift product lines to cable high-speed Internet access, and away from incumbent telco or CLEC products.

A major disruption of the hosted PBX or premises phone system business is a bit further off. But if a business buyer can obtain enough of the same call management features from a mobile service, that a buyer would formerly have gotten from a hosted PBX solution, buying ultimately will shift. If the device to be supported is a mobile or a tablet, and if reasonable functionality can be provided, then purchasing should shift to “mobile direct” modes.

What should agencies do? Mobile product lines are a strategic necessity. Cable broadband is a tactical necessity.

In both the telecom and value added reseller businesses, it is harder to sustain revenue earned from traditional products, leading participants to search for better revenue models. Value added resellers generally are looking for recurring revenue streams, while telecom agents generally are looking for products other than recurring communications services.

Whether or not most agencies can diversify into pre-sale or post-sale products distinct from the residuals earned from selling carrier services is the big question.

The answers are not easy, but in all likelihood will revolve around the value telecom agents can add, either pre-sale or post-sale, for services other than the actual communications services. If you think about the traditional distinction between a “consultant” and an “agent,” you’ll get the idea.

The consultant does not represent service providers, does not earn any revenue from any communications services, but is paid for advice. In principle, that is what a commissioned telecom agent would have to learn to do, as well.

Peter Radzieski, owner of RAD-INFO, a consultancy, charges clients if what they want is information about who sells dark fiber, for example. He charges for the advice, whether or not a deal results (RAD-INFO works with about 65 service providers, so there sometimes is commission revenue involved).

He suggests that one way agencies could create post-sales revenue is by getting into the telecom expense managment business, for example, or managing mobile devices, or providing security services.

Another avenue is to “become the outsourced telecom department” for customers,” he says. In other cases an agency might be paid for integration activities. When a wide area network has to be created, it might be necessary to stitch together elements from a variety of suppliers. In those cases, an agency might be paid for integration tasks.

The point is that everything hinges on the “added value” beyond selling a circuit. As always is the case, management, integration, configuration, troubleshooting, monitoring, security and provisioning are some of the time-consuming tasks that a customer might essentially outsource to an agency capable of handling those chores.

But that’s the rub: an agency has to be able to provide those valuable services, credibly. The possible issue is that such services are time consuming. In principle, some agents might take a different tack and simply add on an incremental fee for some of the post-sale chores that inevitably arise around billing issues, for example.

The obvious downside is that a customer might then decide whether to buy direct from a carrier. Another possible avenue could be “white labeling” of carrier services, where the agency gets a wholesale price and then can sell at any retail price.

It won’t be easy to create pre-sale or post-sale revenue streams. But neither, given the difficult revenue model for selling pure communications services, does it seem likely agencies will be able to prosper, longer term, without those new revenue sources.

Will the coming era of cloud-based apps and mobile access change the channel business? It seems impossible to believe otherwise.

As companies embrace anytime, anywhere communications--driven by the ubiquity of mobile devices--has the time finally come (yet again) to toss aside IP hardphones or even softphones? It’s a question at least some are asking.

“Once IP communications take over (if not already), the artifacts of telephony, including digit dialing and wired access will become obsolescent and will be replaced by a range of mobile IP-based communications tools,” says consultant Russell Bennett.

Consider the implications. If the mobile device becomes the object that uses broadband access, what happens to markets for fixed access? If the mobile displaces the desk phone, what happens to demand for hosted PBX services, SIP trunking or even fixed broadband?

To the extent that the typical channel partner, and the typical fixed network services provider, makes money selling fixed network voice and data, a shift to mobile will shift demand to mobile services, and away from fixed network services.

The shift to cloud computing, which is related to growing use of mobile devices and connections, doesn’t necessarily help channel partners or fixed network service providers, either. Consider the use of basic business productivity suites.

Once upon a time, business and consumer buyers purchased such products as “shrink wrapped” physical products, at retail outlets. These days, such purchases are not made, or are made online. In other words, distribution shifted from retail partners to online partners.

At the same time, average selling prices have dropped. In some cases, retail price now effectively is “zero,” when users use Google Docs, for example.

But, you might argue, there also are subscription-based business versions. Yes, that is true.

According to Cloud Sherpas, money can be made iin the cloud-based document suites business, despite the fact that no enterprise or smaller business pays very much for such apps. Business access to Google Apps costs $5 a month, or $50 a year.

But ask yourself whether a typical channel partner can make a living selling products priced at $50 a year.

In the channel partner business, the analogy is mobile-only business broadband and voice. You might argue that the channel partner only has to shift its products from fixed network to mobile product lines. But it isn’t that simple.

In some cases, business buyers will be able to “buy direct,” without a channel partner. In other cases, the retail prices might be low enough that there is little gross revenue or profit margin for any channel partner.

Sam Kumar, CEO of Denver competitive local exchange carrier Microtech-Tel, argues that CLECs no longer can compete with cable TV operators in the SMB business broadband access business. If the carrier cannot compete, then the carrier’s channel partners will have difficulty as well.

The obvious implication is that channel partners will have to shift product lines to cable high-speed Internet access, and away from incumbent telco or CLEC products.

A major disruption of the hosted PBX or premises phone system business is a bit further off. But if a business buyer can obtain enough of the same call management features from a mobile service, that a buyer would formerly have gotten from a hosted PBX solution, buying ultimately will shift. If the device to be supported is a mobile or a tablet, and if reasonable functionality can be provided, then purchasing should shift to “mobile direct” modes.

What should agencies do? Mobile product lines are a strategic necessity. Cable broadband is a tactical necessity.

Mobile, in a real sense, is inseparable from cloud computing. The reason is simply that mobile devices increasingly provide value as "computers." And the thing about cloud computing is that it means new applications can be launched immediately, upgraded immediately or changed immediately, without little overhead.

In both the telecom and value added reseller businesses, it is harder to sustain revenue earned from traditional products, leading participants to search for better revenue models. Value added resellers generally are looking for recurring revenue streams, while telecom agents generally are looking for products other than recurring communications services.

Whether or not most agencies can diversify into pre-sale or post-sale products distinct from the residuals earned from selling carrier services is the big question.

The answers are not easy, but in all likelihood will revolve around the value telecom agents can add, either pre-sale or post-sale, for services other than the actual communications services. If you think about the traditional distinction between a “consultant” and an “agent,” you’ll get the idea.

The consultant does not represent service providers, does not earn any revenue from any communications services, but is paid for advice. In principle, that is what a commissioned telecom agent would have to learn to do, as well.

Peter Radzieski, owner of RAD-INFO, a consultancy, charges clients if what they want is information about who sells dark fiber, for example. He charges for the advice, whether or not a deal results (RAD-INFO works with about 65 service providers, so there sometimes is commission revenue involved).

He suggests that one way agencies could create post-sales revenue is by getting into the telecom expense managment business, for example, or managing mobile devices, or providing security services.

Another avenue is to “become the outsourced telecom department” for customers,” he says. In other cases an agency might be paid for integration activities. When a wide area network has to be created, it might be necessary to stitch together elements from a variety of suppliers. In those cases, an agency might be paid for integration tasks.

The point is that everything hinges on the “added value” beyond selling a circuit. As always is the case, management, integration, configuration, troubleshooting, monitoring, security and provisioning are some of the time-consuming tasks that a customer might essentially outsource to an agency capable of handling those chores.

But that’s the rub: an agency has to be able to provide those valuable services, credibly. The possible issue is that such services are time consuming. In principle, some agents might take a different tack and simply add on an incremental fee for some of the post-sale chores that inevitably arise around billing issues, for example.

The obvious downside is that a customer might then decide whether to buy direct from a carrier. Another possible avenue could be “white labeling” of carrier services, where the agency gets a wholesale price and then can sell at any retail price.

It won’t be easy to create pre-sale or post-sale revenue streams. But neither, given the difficult revenue model for selling pure communications services, does it seem likely agencies will be able to prosper, longer term, without those new revenue sources.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

You Can't Turn Off the PSTN Without Answering Some Basic Questions

The Federal Communications Commission has a Technology Advisory Committee (TAC) that is supposed to recommend ways the Federal Communications Commission can help prepare for the day when the PSTN is "turned off." Like many other committees, the day to day work doesn’t get much attention.

Among the issues is setting a date for terminating the PSTN is ensuring there is virtually universal broadband service everywhere, since the IP alternatives will require broadband. There are lots of other issues, to be sure.

But many of the issues will involve the framework for handling “carrier of last resort issues” and how common carrier regulation is applied. In a market expected to feature multiple ubiquitous networks, should historic common carrier regulations be extended to other providers, or should less restrictive frameworks be used?

Beyond that, there are other issues, such as the financial backdrop against which regulations are applied. Universal service funding mechanisms, and high cost support, in turn tend to hinge on the amount of social surplus generated by the industry as a whole.

Once upon a time, high gross revenues and high profit margins made possible a fundning of USF from business customer services. Over the last few decades, that has changed, and funding has come to rely on per-line consumer funding, from both fixed network and mobile network services.

And there is not as much surplus as there once was. In fact, over time, all the mechanisms will likely have to rely on taxes of mobile customer services, rather than shrinking fixed network revenues.

In fact, one might plausibly argue that, in the future, taxes on broadband and mobile services will be the dominant funding sources, not fixed network voice services. On the surface, those might not be seen as issues.

You would be hard pressed to find a single quarter in any recent year when the likes of AT&T and Verizon Communications did not show steady revenue growth and relatively stable earnings, with the ability to pay dividends. That isn't to say all providers are in the same condition. From time to time, many providers have faced some distress.

But Craig Moffett, Bernstein Research analyst, has been a notable “bear” on business prospects for the large mobile service providers. He now calculates that AT&T and Verizon Wireless are not even earning a return above their cost of capital.

In other words, AT&T and Verizon now are already losing money, investing in networks and services that do not earn back the cost of the borrowed money driving the investments. But most of the problem comes from the wireline businesses, he argues.

AT&T and Verizon executives would disagree, of course. In part, Verizon argues, returns have been depressed recently because of heavy investment, both in the FiOS program and wireless upgrades, but the revenue impact of the sluggish economy. Over the long term, those issues will recede, Verizon argues.

The current discussion within the European Community about the investment impact of “net neutrality” rules is not a new debate. In the wake of the passage of the Telecommunications Act of 1996, dominant U.S. fixed-line providers argued, successfully, that mandatory wholesale rules, providing deeply-discounted rates for wholesale customers, would severely discourage investment in optical facilities. And, in fact, Verizon's FiOS effort did not get into high gear until after the Federal Communications Commission approved such rules.

Among the issues is setting a date for terminating the PSTN is ensuring there is virtually universal broadband service everywhere, since the IP alternatives will require broadband. There are lots of other issues, to be sure.

But many of the issues will involve the framework for handling “carrier of last resort issues” and how common carrier regulation is applied. In a market expected to feature multiple ubiquitous networks, should historic common carrier regulations be extended to other providers, or should less restrictive frameworks be used?

Beyond that, there are other issues, such as the financial backdrop against which regulations are applied. Universal service funding mechanisms, and high cost support, in turn tend to hinge on the amount of social surplus generated by the industry as a whole.

Once upon a time, high gross revenues and high profit margins made possible a fundning of USF from business customer services. Over the last few decades, that has changed, and funding has come to rely on per-line consumer funding, from both fixed network and mobile network services.

And there is not as much surplus as there once was. In fact, over time, all the mechanisms will likely have to rely on taxes of mobile customer services, rather than shrinking fixed network revenues.

In fact, one might plausibly argue that, in the future, taxes on broadband and mobile services will be the dominant funding sources, not fixed network voice services. On the surface, those might not be seen as issues.

You would be hard pressed to find a single quarter in any recent year when the likes of AT&T and Verizon Communications did not show steady revenue growth and relatively stable earnings, with the ability to pay dividends. That isn't to say all providers are in the same condition. From time to time, many providers have faced some distress.

But Craig Moffett, Bernstein Research analyst, has been a notable “bear” on business prospects for the large mobile service providers. He now calculates that AT&T and Verizon Wireless are not even earning a return above their cost of capital.

In other words, AT&T and Verizon now are already losing money, investing in networks and services that do not earn back the cost of the borrowed money driving the investments. But most of the problem comes from the wireline businesses, he argues.

AT&T and Verizon executives would disagree, of course. In part, Verizon argues, returns have been depressed recently because of heavy investment, both in the FiOS program and wireless upgrades, but the revenue impact of the sluggish economy. Over the long term, those issues will recede, Verizon argues.

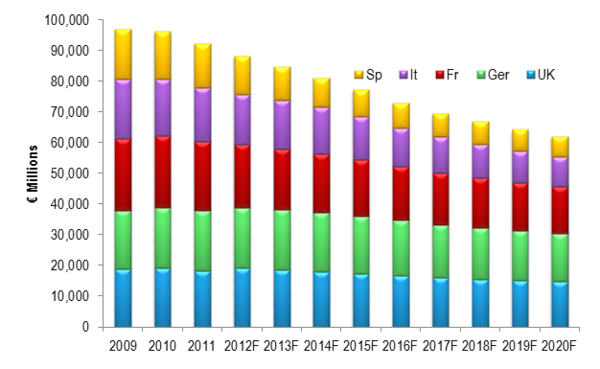

One might argue that recent developments in the global telecom business suggest growing strains at the very least, non-viability of some business models, in some markets, and serious strain in others.

One might infer from the "wholesale only" broadband access models used in Singapore, Australia and New Zealand, that facilities-based "very high speed access" is not a business most providers can afford to be in.

Instead, networks providing that access, are a functional monopoly, too expensive for more than one provide to attempt.

In Europe, the European Commission seems seriously concerned that European facilities-based broadband providers might not be able to afford the next round of upgrades, and seem to be considering policies that would boost the financial return from new and massive investments.

Does anybody anymore seriously think global growth will be lead by anything other mobile services?

At some level, whether formally stated or not, the profitability of fixed networks will be an issue in future discussions of how to shut off the old PSTN. The current discussion within the European Community about the investment impact of “net neutrality” rules is not a new debate. In the wake of the passage of the Telecommunications Act of 1996, dominant U.S. fixed-line providers argued, successfully, that mandatory wholesale rules, providing deeply-discounted rates for wholesale customers, would severely discourage investment in optical facilities. And, in fact, Verizon's FiOS effort did not get into high gear until after the Federal Communications Commission approved such rules.

These days, the EC discussion revolves to a great extent around the impact “network neutrality” rules could have on incentives for broadband investment. Specifically, operators argue that restriction of services to “best effort only,” without the ability to create differentiated service plans involving quality of service measures, will be a significant disincentive to the high rates of investment EC officials would prefer to see.

Some will say the carriers are bluffing about requiring some path to revenue when investing in 100-Mbps or 1-Gbps access facilities. Some of us would disagree. The alternative is to invest in mobile facilities and applications instead.

In fact, some recent global estimates of market share suggest telcos globally are losing the consumer market share battle to cable companies. In fact, looking just at triple-play accounts, it appears cable operators have roughly 66 percent market share. In other words, telcos arguably are losing the market share battle in the consumer market.

The point is pretty simple. If it appears telcos are losing ground in the consumer market, but dominating and growing the mobile market, and if revenue potential in fixed line network services appears to be waning, at some point it will be a wise executive indeed who decides mobility is really where resources and effort ought to be placed.

Placing obstacles to a profitable return on massive new investments does not seem calculated to encourage operators to invest substantially more in fixed access networks.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

10-Gbps Wireless Access in 25 Years?

Observers disagree about how much bandwidth people will need, and how much will be available for sale, in various markets in the future. But some observers think the typical U.S. end user will have a breath-taking amount of access bandwidth.

Mobile devices will have the power of a supercomputer, argues Donald Newell, AMD Server CTO. To be more precise, a then-current smart phone will have more processing power than today’s servers, Newell argues. That isn’t even the most-surprising prediction. More startling, in all likelihood, is the notion that a typical wireless consumer will have access to 10 Gbps.

Cisco thinks terabytes is a reasonable expectation for U.S. consumers, in a couple of decades. Cisco's Dave Evans, Chief Futurist, thinks at-home consumers will have access to Evans says multi-terabit Internet connections.. "I could have an 8-terabit per second connection to my home," he says. "That's more connectivity to my home than most countries have."

As a result, the core networks will operate at petabit per second speeds, about 10 to the 15th power, about three orders of magnitude bigger than terabit networking," Evans says.

Phones will have more than a terabyte of local memory," adds Mark Lewis, chief strategy officer at EMC, who predicts that all of our digital information will be backed up over the cloud. "If I lose my phone, I can pick up a new one, enter my code word, and it will re-identify me and push all of my information out to my new device."

For wireless networks, typical speeds will be as high as 10 gigabits per second, as fast as the fastest optical core networks today, some would argue.

Bandwidth increases on that order of magnitude, at least in the wireless arena, will require more than spectrum allocation. It will require continued significant advances in signal coding and compression, with some likely changes in network architecture as well. Additional spectrum will help, but it is hard to see typical mobile users getting 10 Gbps without robust new developments in coding.

If not, using today’s technology, cell sites would be so small they would be virtually indistinguishable from a fixed connection, in which cases “mobility” would not be possible.

But 25-year horizons are not meaningful, and predictions for what the world will be like that far out almost always are incorrect. One might find more success betting against today’s 25-year predictions instead.

That is not to say Moore’s Law is repealed, or that users will stop demanding more bandwidth. It’s just that linear projections almost always are wrong, over the long term.

On a relatively immediate basis, though, some projections that can seem outlandish are directionally valid enough to support rational business planning. Netflix, for example, has supported its business by mailing DVDs to customers. It began doing so because there was at one point no way to support delivery over the Internet, even though its very name suggests that possibility.

Netflix CEO Reed Hastings claims that back when even cable modems and digital subscriber line were not available, “we took out our spreadsheets and we figured we’d get 14 Mbps to the home by 2012, which turns out is about what we will get.”

“If you drag it out to 2021, we will all have a gigabit to the home,” Hastings argues.

Still, Netflix took the rational route and did not build its revenue model on bandwidth that wasn’t available; it built on what was feasible at the time. Lots of application service providers based their businesses on inadequate bandwidth and server infrastructure in the early 2000s, and most failed because of those assumptions.

Now, lots of providers are about to make a business out of cloud computing, which is the same concept, but in an infrastructure environment that has changed dramatically.

Timing might not be everything, but it is close. For that reason, no rational executive can build a business today based on expectations of 10 Gbps consumer mobile connections. But the direction is clear enough.

Mobile devices will have the power of a supercomputer, argues Donald Newell, AMD Server CTO. To be more precise, a then-current smart phone will have more processing power than today’s servers, Newell argues. That isn’t even the most-surprising prediction. More startling, in all likelihood, is the notion that a typical wireless consumer will have access to 10 Gbps.

Cisco thinks terabytes is a reasonable expectation for U.S. consumers, in a couple of decades. Cisco's Dave Evans, Chief Futurist, thinks at-home consumers will have access to Evans says multi-terabit Internet connections.. "I could have an 8-terabit per second connection to my home," he says. "That's more connectivity to my home than most countries have."

As a result, the core networks will operate at petabit per second speeds, about 10 to the 15th power, about three orders of magnitude bigger than terabit networking," Evans says.

Phones will have more than a terabyte of local memory," adds Mark Lewis, chief strategy officer at EMC, who predicts that all of our digital information will be backed up over the cloud. "If I lose my phone, I can pick up a new one, enter my code word, and it will re-identify me and push all of my information out to my new device."

For wireless networks, typical speeds will be as high as 10 gigabits per second, as fast as the fastest optical core networks today, some would argue.

Bandwidth increases on that order of magnitude, at least in the wireless arena, will require more than spectrum allocation. It will require continued significant advances in signal coding and compression, with some likely changes in network architecture as well. Additional spectrum will help, but it is hard to see typical mobile users getting 10 Gbps without robust new developments in coding.

If not, using today’s technology, cell sites would be so small they would be virtually indistinguishable from a fixed connection, in which cases “mobility” would not be possible.

But 25-year horizons are not meaningful, and predictions for what the world will be like that far out almost always are incorrect. One might find more success betting against today’s 25-year predictions instead.

That is not to say Moore’s Law is repealed, or that users will stop demanding more bandwidth. It’s just that linear projections almost always are wrong, over the long term.

On a relatively immediate basis, though, some projections that can seem outlandish are directionally valid enough to support rational business planning. Netflix, for example, has supported its business by mailing DVDs to customers. It began doing so because there was at one point no way to support delivery over the Internet, even though its very name suggests that possibility.

Netflix CEO Reed Hastings claims that back when even cable modems and digital subscriber line were not available, “we took out our spreadsheets and we figured we’d get 14 Mbps to the home by 2012, which turns out is about what we will get.”

“If you drag it out to 2021, we will all have a gigabit to the home,” Hastings argues.

Still, Netflix took the rational route and did not build its revenue model on bandwidth that wasn’t available; it built on what was feasible at the time. Lots of application service providers based their businesses on inadequate bandwidth and server infrastructure in the early 2000s, and most failed because of those assumptions.

Now, lots of providers are about to make a business out of cloud computing, which is the same concept, but in an infrastructure environment that has changed dramatically.

Timing might not be everything, but it is close. For that reason, no rational executive can build a business today based on expectations of 10 Gbps consumer mobile connections. But the direction is clear enough.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Most Businesses Adopting IP Telephony Still Choose Phone Systems

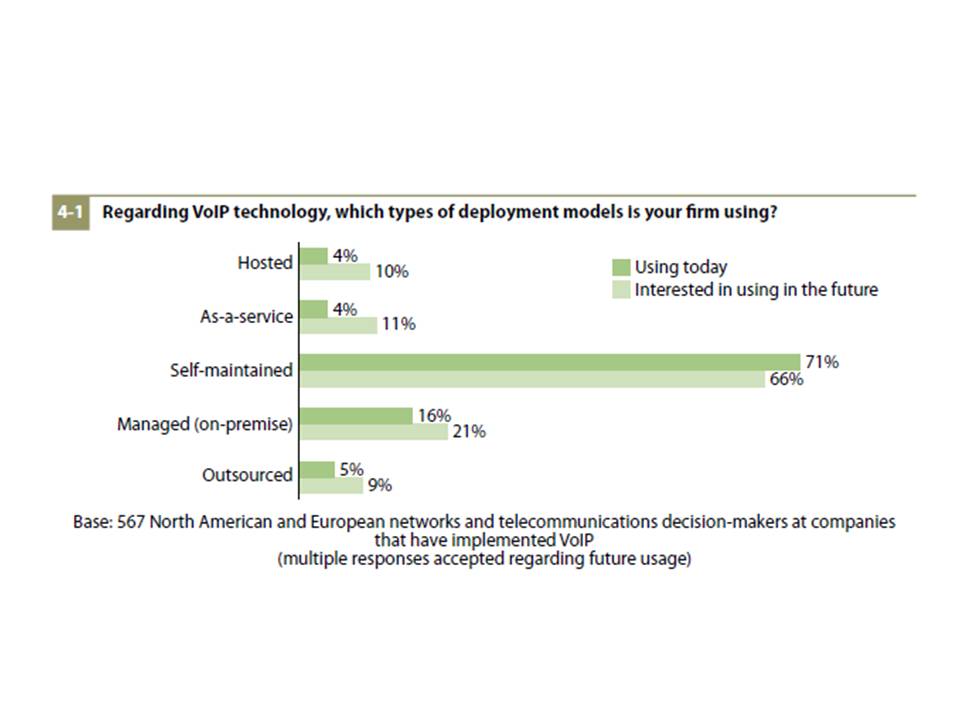

A recent Forrester Research survey of 567 enterprise and smaller business users that already have adopted IP telephony shows that most buyers so far have chosen premises-based solutions.

Just four percent of respondents say they have adopted a "hosted" IP telephony service. Another four percent reported they had adopted a "telephony as a service solution. About five percent said their IP telephony solution was outsourced. Taking all three as a group, just 13 percent of IP telephony solutions were hosted, cloud-based or outsourced.

That might make a great deal of sense. The economics of IP telephony tend to suggest that small users can benefit from hosted or cloud-based solutions, while enterprises often can justify owning their own solutions.

The study lends credence to the cable operator strategy of targeting businesses with 20 or fewer employees, as those are the venues where the economics of buying a service are best, compared to buying a premises-based solution.

About 71 percent said their IP telephony solutions were self maintained, while 16 percent said they owned their solution, but that it also was managed by a third party.

Respondents were more likely to use hosted web conferencing solutions. Some 18 percent reported they use a hosted solution, 25 percent said they used a "conferencing as a service," nine percent said their solution was on premises, but managed, and seven percent used an outsourced solution of some sort. About 40 percent of respondents said they maintained their own solution.

Forrester Research defines an enterprise as any entity with 1,000 or more employees, while a small or medium business is defined as an entity with 20 to 999 employees.

Just four percent of respondents say they have adopted a "hosted" IP telephony service. Another four percent reported they had adopted a "telephony as a service solution. About five percent said their IP telephony solution was outsourced. Taking all three as a group, just 13 percent of IP telephony solutions were hosted, cloud-based or outsourced.

That might make a great deal of sense. The economics of IP telephony tend to suggest that small users can benefit from hosted or cloud-based solutions, while enterprises often can justify owning their own solutions.

The study lends credence to the cable operator strategy of targeting businesses with 20 or fewer employees, as those are the venues where the economics of buying a service are best, compared to buying a premises-based solution.

About 71 percent said their IP telephony solutions were self maintained, while 16 percent said they owned their solution, but that it also was managed by a third party.

Respondents were more likely to use hosted web conferencing solutions. Some 18 percent reported they use a hosted solution, 25 percent said they used a "conferencing as a service," nine percent said their solution was on premises, but managed, and seven percent used an outsourced solution of some sort. About 40 percent of respondents said they maintained their own solution.

Forrester Research defines an enterprise as any entity with 1,000 or more employees, while a small or medium business is defined as an entity with 20 to 999 employees.

Still, others argue that digital voice will be the fastest-growing U.S. industry in the next five years, and that mostly means voice services provided by cable companies, not Skype or Google Voice, according to a new report from IBISWorld. Cable companies are expected to gain 65 percent of all the revenue in the digital voice space until 2016.

About 80 percent of the revenue will come from consumers and very-small businesses, while enterprises account for about 20 percent of the revenue, the report suggests. But mobility services are a wild card. Although cable-delivered VoIP dominates the landscape today, tomorrow's growth might come from non-cable providers and mobile VoIP, IBIS predicts.

About 80 percent of the revenue will come from consumers and very-small businesses, while enterprises account for about 20 percent of the revenue, the report suggests. But mobility services are a wild card. Although cable-delivered VoIP dominates the landscape today, tomorrow's growth might come from non-cable providers and mobile VoIP, IBIS predicts.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

"Line Extensions" Will Drive At Least 1/2 of Telco New Revenues

About half of revenue growth over the next three years will come from new lines of business, telco executives believe. But most of that opportunity still consists of line extensions built on current capabilities, according to STL Partners

Existing core services might provide upside up to about nine percent, STL Partners reports. Vertical industry services have potential to provide as much as 10 percent of revenue growth.

Infrastructure services (wholesale services, essentially) might provide eight percent of growth. Allowing third parties to embed communications features into their apps might drive 10 percent of growth. Providing other services to third party app providers could represent as much as 12 percent of revenue growth over the next three years.

Telcos providing their own "over the top" apps might provide five percent of revenue growth.

The takeaway is not so much that half of potential new revenue will come from new lines of business, but more that each opportunity builds logically from what service providers already provide.

Existing core services might provide upside up to about nine percent, STL Partners reports. Vertical industry services have potential to provide as much as 10 percent of revenue growth.

Infrastructure services (wholesale services, essentially) might provide eight percent of growth. Allowing third parties to embed communications features into their apps might drive 10 percent of growth. Providing other services to third party app providers could represent as much as 12 percent of revenue growth over the next three years.

Telcos providing their own "over the top" apps might provide five percent of revenue growth.

The takeaway is not so much that half of potential new revenue will come from new lines of business, but more that each opportunity builds logically from what service providers already provide.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Just 4 Basic Business Models for Tier-One Service Providers

Just four fundamental business models lie ahead for global communications service providers, say researchers at Booz & Company. Half the models essentially are wholesale in orientation; one requires global operations and one is the traditional model, but with operators moving further up the value chain.

The "Network Guarantor" model has network infrastructure providers operating in a wholesale mode, providing other retail providers network services.

The "Business Enabler" is a mixed model, including both retail broadband services as well as wholesale broadband, managed services, transaction and billing support, and platforms such as hosting and cloud computing.

The "Experience Creator" is closest to the current retail model used by most service providers globally. Experience creators will look to move up the telecom value chain and provide end-users, both consumers and business customers, with the ubiquitous connectivity they demand, with targeted applications, fresh content, and a distinctive experience, and with the ability to create and distribute their own content.

The "Global Multimarketer" model is a retail model, but requires global operations and scale beyond a single nation. Already, more than 75 percent of telecom subscribers in regions such as Europe and the Middle East are owned by global operators,” Booz & Co. says.

There are challenges for service providers in all four scenarios. The "wholesale only, Network Guarantor" model offers a trade off. There is less sales, marketing and customer service cost, since the products are wholesale, sold only to retailers, not to actual end users. On the other hand, gross revenues likely are smaller, and profit margins also will tend to be lower than is typical for retail operations.

To the extent that executives are worried about being reduced to the role of "low margin dumb pipe providers," this model guarantees it. In this scenario, service providers supply connectivity and other network services to all other retail entities, who have the actual relationship with end users. Also, companies that want to "own the customer relationship" will find this model unattractive, since it abdicates that role.

The "Business Enabler" model has a mix of advanages and disadvantages. It r. etains the retail role, implying both higher sales, marketing and customer support costs, but also higher gross revenue potential and higher margins for those retail services. But this model also includes sale of infrastructure services to third parties, on a wholesale basis.

That means there is inherently a possibility of channel conflict, as the service provider essentially competes with its wholesale customers in the retail market.

The Experience Creator model is the closest to today's model, where a service provider sells retail services to end users. It offers the least dramatic changes to the current model, but arguably also offers the smallest chance of dramatic changes in overhead and operating costs.

Also, to the extent that there is risk in moving into new roles within the application space, there is the danger of failure. This model virtually requires a more-active role in content and applications delivery, a terrain not historically favorable for telcos.

The Global Multimarketer role is most logical for larger, well-capitalized firms with some ability to leverage a strong brand in additional markets. This strategy probably is not viable for small national firms with weak brand name assets and small market capitalization. This strategy also is likely to prove attractive only for firms with the ability to provide mobile services.

In many ways the Global Multimarketer and Experience Creator models are mutually exclusive. Operators too small to operate globally are likely confined to their internal national markets. Likewise, the Experience Creator and Network Guarantor models are mutually exclusive. Only the Business Enabler strategy might be used by large and small service providers operating locally or globally.

The "Network Guarantor" model has network infrastructure providers operating in a wholesale mode, providing other retail providers network services.

The "Business Enabler" is a mixed model, including both retail broadband services as well as wholesale broadband, managed services, transaction and billing support, and platforms such as hosting and cloud computing.

The "Experience Creator" is closest to the current retail model used by most service providers globally. Experience creators will look to move up the telecom value chain and provide end-users, both consumers and business customers, with the ubiquitous connectivity they demand, with targeted applications, fresh content, and a distinctive experience, and with the ability to create and distribute their own content.

The "Global Multimarketer" model is a retail model, but requires global operations and scale beyond a single nation. Already, more than 75 percent of telecom subscribers in regions such as Europe and the Middle East are owned by global operators,” Booz & Co. says.

There are challenges for service providers in all four scenarios. The "wholesale only, Network Guarantor" model offers a trade off. There is less sales, marketing and customer service cost, since the products are wholesale, sold only to retailers, not to actual end users. On the other hand, gross revenues likely are smaller, and profit margins also will tend to be lower than is typical for retail operations.

To the extent that executives are worried about being reduced to the role of "low margin dumb pipe providers," this model guarantees it. In this scenario, service providers supply connectivity and other network services to all other retail entities, who have the actual relationship with end users. Also, companies that want to "own the customer relationship" will find this model unattractive, since it abdicates that role.

The "Business Enabler" model has a mix of advanages and disadvantages. It r. etains the retail role, implying both higher sales, marketing and customer support costs, but also higher gross revenue potential and higher margins for those retail services. But this model also includes sale of infrastructure services to third parties, on a wholesale basis.

That means there is inherently a possibility of channel conflict, as the service provider essentially competes with its wholesale customers in the retail market.

The Experience Creator model is the closest to today's model, where a service provider sells retail services to end users. It offers the least dramatic changes to the current model, but arguably also offers the smallest chance of dramatic changes in overhead and operating costs.

Also, to the extent that there is risk in moving into new roles within the application space, there is the danger of failure. This model virtually requires a more-active role in content and applications delivery, a terrain not historically favorable for telcos.

The Global Multimarketer role is most logical for larger, well-capitalized firms with some ability to leverage a strong brand in additional markets. This strategy probably is not viable for small national firms with weak brand name assets and small market capitalization. This strategy also is likely to prove attractive only for firms with the ability to provide mobile services.

In many ways the Global Multimarketer and Experience Creator models are mutually exclusive. Operators too small to operate globally are likely confined to their internal national markets. Likewise, the Experience Creator and Network Guarantor models are mutually exclusive. Only the Business Enabler strategy might be used by large and small service providers operating locally or globally.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Subscribe to:

Posts (Atom)

Directv-Dish Merger Fails

Directv’’s termination of its deal to merge with EchoStar, apparently because EchoStar bondholders did not approve, means EchoStar continue...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...