It might be a bit of an experiment, but LightSquared is proposing a spectrum sharing plan as part of its effort to resurrect its business plan.

To avoid interference, LightSquared proposes to share spectrum that is currently set aside for weather balloons used by the federal government. In exchange, LightSquared said it would permanently relinquish its 10 MHz of spectrum that is directly adjacent to the frequencies used by GPS receivers.

LightSquared wants to combine the 5 MHz it uses for satellite service at 1670-1675 MHz with frequencies in the 1675-1680 MHz band.

FCC officials might want to approve the proposal just to see how it works, since there is some thinking wider sharing of spectrum might be possible in many other bands.

Tuesday, November 20, 2012

Spectrum Sharing Test?

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Will the U.S. Cable Industry Someday Have a Broadband Monopoly?

Is the market for high-speed broadband Internet destined to become a "new monopoly?" The question might seem silly to many observers who compete in the market.

Some simply point to the consistent strength of cable provided broadband in the net new customers area as evidence cable is winning the broadband access market share battle

It is hard to refute that notion, as consistent declines for telco-provided digital subscriber line services, despite gains by fiber-reinforced services provided by telcos, are a clear trend.

So U.S. cable operators are gaining share in the fixed network access market. Also, recent marketing agreements between Verizon and top U.S. cable operators give the impression that cable has abandoned any serious effort to build its own facilities-based mobile business, while Verizon likewise has decided that, where it cannot provider FiOS, it will rely on mobile broadband.

But that's only part of the story.

Mobile broadband is beginning to represent a bigger share of total broadband access, as well.

The number of active mobile broadband subscriptions reached nearly 1.2 billion by mid-2011, representing a 45 percent increase annually since 2007, with total mobile subscriptions topping five billion By the end of 2010, there were over twice as many mobile broadband as wireline broadband subscriptions, for example.

Over the longer term, fixed broadband access share might not matter as much, overall.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

"Internet as Platform" Still Challenges Telcos

True, some of the quiet has to do with industry coalescence around "IP Multimedia Subsystem" and "Rich Communications Suite" as the practical answers to the question of what the industry will do about next generation networks.

The notion of "platform" comes into play in that regard. You might argue that traditional telecom networks were, albeit limited at times, "platforms" in the current sense for applications. The analogy is imperfect, but industry suppliers of switches, routers, other operating software, billing, operations support systems and so forth were the equivalent of today's third party developers.

The fundamental issue is that the public Internet has usurped much, perhaps most of the role of next generation platform. Some might go further and argue that some devices, especially smart phones, now have become application platforms as well.

In a nutshell, that is the strategic problem for telecom, cable or other access networks. The Internet, and devices that use the Internet, actually have become the next generation network platforms of choice for most apps.

That doesn't mean cable, telco, satellite, fixed wireless or other networks cannot operate as platforms. But it does mean they now have limited utility in that regard.

The difference between the public Internet and use of IP on private networks remains important, not to mention the continuing interest national regulators everywhere have in their communications infrastructure.

But it is hard not to argue that the Internet now is the next generation network platform of choice, even if what we now call the public switched telephone network continues to operate, in parallel, as a platform as well.

That might seem obvious, but it was more contentious a decade or so ago, when debates about next generation networks tended to revolve around use of protocols such as asynchronous transfer mode or Internet Protocol.

There are business implications. Platforms have tended to standardize around a single dominant provider, such as Windows in PCs, Facebook in social, Google in search.

The more dominant the platform becomes, the more valuable it becomes and the harder it becomes to dislodge, as a network effect kicks in. Developers want to create for the platform "everybody uses."

And that illustrates the problem telcos and other access providers still have. The platform of choice increasingly has become the Internet. Developers who specialize in apps for the public network are far fewer in number than those who build Internet-compatible apps.

It is still true that the public Internet is distinct from the public switched telephone network. That will remain true even after the legacy PSTN is replaced by the next-generation IP network.

The Internet has not actually become the "next generation telco network." But it is the bigger platform. And in those areas, such as mobility, where the network actually retains more relevance, the mediating role of the device now is usurping more of the actual value of the mobile platform.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Monday, November 19, 2012

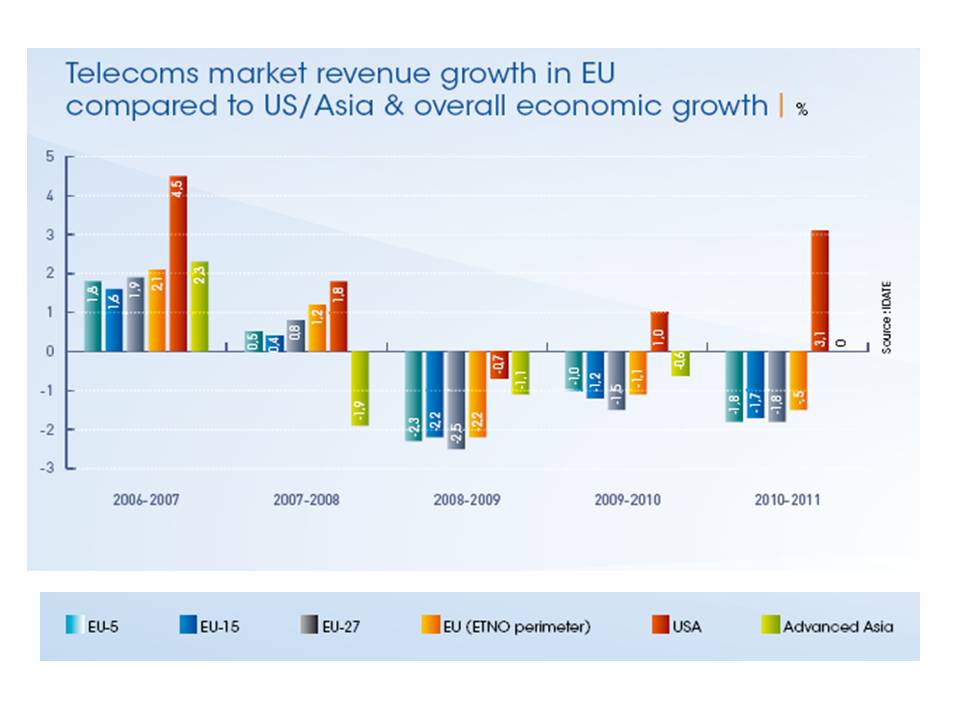

Global Telecom Revenue Grows Unevenly

Though the global telecommunications business is predicted by virtually all analysts to be growing, that is not necessarily the case in every region. Global telecom revenue is one thing. The fortunes of service providers in specific regions are another matter.

The European telecom service market decreased for the third year in a row, by 1.5 percent, the European Telecommunications Network Operators Association reports. You might blame a tough economy for the contraction, but ETNO points out that in the most-recent year, in a context of moderate economic recovery (+4.2 percent for current gross domestic product in the region), the lagging performance suggests structural changes, not just cyclical economic impact.

But some observers might argue that economic woes are having an impact. And some might predict more turmoil in 2013.

The decline in European fixed telephony revenues is accelerating (-8.3 percent in 2011 and –31 percent over the last five years), driven in part by a negative five percent growth of fixed lines in service. Since 2005, fixed line subscribership is down 22 percent. The bad news is that mobile revenues, long the driver of industry growth, also are declining (-0.6 percent)

Mobile voice revenues were down 4.7 percent in 2011 (–13.2 percent over the past three years), a decline driven by significant drops in some large countries: Spain (-8.3 percent),

France (-8.2 percent) and Germany (-7.1 percent).

Fixed network broadband revenue is the bright spot, as revenues were up 6.5 percent in 2011.

Mobile services, though, remain the bulk of telcos revenues, accounting for 52 percent of the total market (142.7 billion EUR in 2011).

The report also shows the divergence between European and the United States market, where it comes to revenue growth. Since 2006, U.S. service providers have done better than their European counterparts.

Precisely why that should be the case is not always so clear. One might argue that European markets are more competitive. One might argue European markets are more fragmented. One might argue that calling and texting tariffs have been higher, since there is more international roaming across Europe, compared to the continent-sized U.S. market.

Certainly, regulators have been squeezing revenue by mandating lower charges for cross-border roaming. Those lower tariffs of course will put pressure on gross revenue.

Moreover, Europe's share of the global telecoms market has been declining regularly over the recent years, from 31 percent in 2005 to just over 25 percent in 2011 as the gap between

global growth (+3.2 percent in 2011) and growth in Europe widens.

The European telecom service market decreased for the third year in a row, by 1.5 percent, the European Telecommunications Network Operators Association reports. You might blame a tough economy for the contraction, but ETNO points out that in the most-recent year, in a context of moderate economic recovery (+4.2 percent for current gross domestic product in the region), the lagging performance suggests structural changes, not just cyclical economic impact.

But some observers might argue that economic woes are having an impact. And some might predict more turmoil in 2013.

The decline in European fixed telephony revenues is accelerating (-8.3 percent in 2011 and –31 percent over the last five years), driven in part by a negative five percent growth of fixed lines in service. Since 2005, fixed line subscribership is down 22 percent. The bad news is that mobile revenues, long the driver of industry growth, also are declining (-0.6 percent)

Mobile voice revenues were down 4.7 percent in 2011 (–13.2 percent over the past three years), a decline driven by significant drops in some large countries: Spain (-8.3 percent),

France (-8.2 percent) and Germany (-7.1 percent).

Fixed network broadband revenue is the bright spot, as revenues were up 6.5 percent in 2011.

Mobile services, though, remain the bulk of telcos revenues, accounting for 52 percent of the total market (142.7 billion EUR in 2011).

The report also shows the divergence between European and the United States market, where it comes to revenue growth. Since 2006, U.S. service providers have done better than their European counterparts.

Precisely why that should be the case is not always so clear. One might argue that European markets are more competitive. One might argue European markets are more fragmented. One might argue that calling and texting tariffs have been higher, since there is more international roaming across Europe, compared to the continent-sized U.S. market.

Certainly, regulators have been squeezing revenue by mandating lower charges for cross-border roaming. Those lower tariffs of course will put pressure on gross revenue.

Moreover, Europe's share of the global telecoms market has been declining regularly over the recent years, from 31 percent in 2005 to just over 25 percent in 2011 as the gap between

global growth (+3.2 percent in 2011) and growth in Europe widens.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

4G, Better Devices Mean Mobile Video Is Set To Explode

But that's only part of the change. Faster mobile networks, especially 4G Long Term Evolution, mean better video experience. Larger screen devices, including smart phones and tablets, likewise make video experiences far better.

By some estimates, faster networks increase the likelihood that mobile users will watch a video on their smart phones.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Fighting "Dumb Pipe" Won't Work

Fixed network service providers are trying to swim upstream in struggling against the notion that they provide “dumb pipe” or “big pipe” access to the Internet. Ignore for the moment the unstated “low gross revenue or low gross margin” adjectives that often accompany the phrase “dumb pipe.”

The simple fact is that a fixed connection provides the lowest-cost access method for an untethered device. In the case of a public Wi-Fi hotspot, the incremental cost can be “zero.”

In the case of a branded service provider hotspot, the incremental cost also might be zero, though the precondition for such “no incremental charge” access is that the customer already buys a fixed or mobile Internet access service.

Likewise, a fixed connection, equipped with Wi-Fi, provides the lowest cost bandwidth for consuming entertainment video on a variety of devices.

There are, to be sure, other services and applications that fixed network providers supply. But it seems unlikely any amount of marketing is going to persuade end users that the primary value of a fixed broadband connection is “lowest cost bandwidth.”

That does not mean fixed service providers will not have other, and new services and applications to sell. But it is hard to deny the obvious end user understanding that a primary reason for using a fixed broadband connection is the sheer cost advantage, compared to a mobile bandwidth alternative.

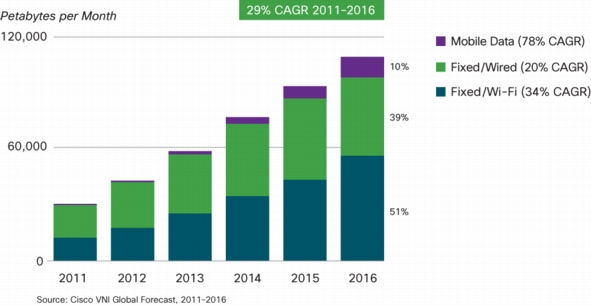

Traffic from wireless and untethered devices will exceed traffic from wired devices by 2016, Cisco forecasts, even though, up to this point, fixed connections have represented perhaps 90 percent of all bandwidth consumed by end users. It is perhaps a shocking prediction, but has to be put into context.

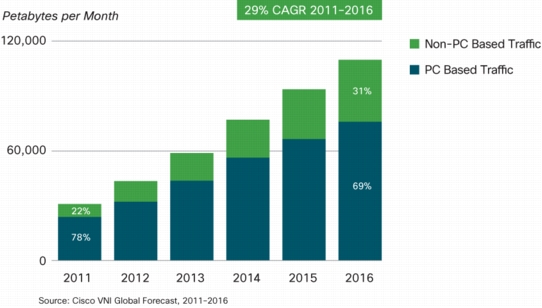

In 2016, wired devices will account for 39 percent of IP traffic, while Wi-Fi and mobile devices will account for 61 percent of IP traffic. In 2011, wired devices accounted for the majority of IP traffic at 55 percent, Cisco says. That is a huge change, driven in part by a shift of Internet consumption away from “PCs,” the traditional driver of Internet traffic.

At the end of 2011, 78 percent of IP traffic and 94 percent of consumer Internet traffic originated from PCs. By 2016, 31 percent of IP traffic and 19 percent of consumer Internet traffic will originate from non-PC devices such as smart phones and tablets, gaming consoles and Internet-connected TVs.

Globally, mobile data traffic will increase 18-fold between 2011 and 2016, Cisco says. Mobile data traffic will grow at a compound annual growth rate (CAGR) of 78 percent between 2011 and 2016, reaching 10.8 exabytes per month by 2016.

Also, global mobile data traffic will grow three times faster than fixed IP traffic from 2011 to 2016.

Global mobile data traffic was two percent of total IP traffic in 2011, and will be 10 percent of total IP traffic in 2016.

One of the key observations is the difference between tethered Wi-Fi and mobile access. If 61 percent of all traffic is created by untethered and mobile devices, while 10 percent of demand is driven by mobile devices, then it is fairly obvious that Wi-Fi-based use of the fixed networks could represent half of all bandwidth demand.

In other words,untethered devices--including mobile devices in Wi-Fi mode--become the key drivers of overall Internet demand.

The simple fact is that a fixed connection provides the lowest-cost access method for an untethered device. In the case of a public Wi-Fi hotspot, the incremental cost can be “zero.”

In the case of a branded service provider hotspot, the incremental cost also might be zero, though the precondition for such “no incremental charge” access is that the customer already buys a fixed or mobile Internet access service.

Likewise, a fixed connection, equipped with Wi-Fi, provides the lowest cost bandwidth for consuming entertainment video on a variety of devices.

There are, to be sure, other services and applications that fixed network providers supply. But it seems unlikely any amount of marketing is going to persuade end users that the primary value of a fixed broadband connection is “lowest cost bandwidth.”

That does not mean fixed service providers will not have other, and new services and applications to sell. But it is hard to deny the obvious end user understanding that a primary reason for using a fixed broadband connection is the sheer cost advantage, compared to a mobile bandwidth alternative.

Traffic from wireless and untethered devices will exceed traffic from wired devices by 2016, Cisco forecasts, even though, up to this point, fixed connections have represented perhaps 90 percent of all bandwidth consumed by end users. It is perhaps a shocking prediction, but has to be put into context.

In 2016, wired devices will account for 39 percent of IP traffic, while Wi-Fi and mobile devices will account for 61 percent of IP traffic. In 2011, wired devices accounted for the majority of IP traffic at 55 percent, Cisco says. That is a huge change, driven in part by a shift of Internet consumption away from “PCs,” the traditional driver of Internet traffic.

At the end of 2011, 78 percent of IP traffic and 94 percent of consumer Internet traffic originated from PCs. By 2016, 31 percent of IP traffic and 19 percent of consumer Internet traffic will originate from non-PC devices such as smart phones and tablets, gaming consoles and Internet-connected TVs.

Globally, mobile data traffic will increase 18-fold between 2011 and 2016, Cisco says. Mobile data traffic will grow at a compound annual growth rate (CAGR) of 78 percent between 2011 and 2016, reaching 10.8 exabytes per month by 2016.

Also, global mobile data traffic will grow three times faster than fixed IP traffic from 2011 to 2016.

Global mobile data traffic was two percent of total IP traffic in 2011, and will be 10 percent of total IP traffic in 2016.

One of the key observations is the difference between tethered Wi-Fi and mobile access. If 61 percent of all traffic is created by untethered and mobile devices, while 10 percent of demand is driven by mobile devices, then it is fairly obvious that Wi-Fi-based use of the fixed networks could represent half of all bandwidth demand.

In other words,untethered devices--including mobile devices in Wi-Fi mode--become the key drivers of overall Internet demand.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

What Will Dish Network Do if FCC Approves LTE Plan?

The Federal Communications Commission is close to approving the request by Dish Network to use its mobile satellite spectrum to build a terrestrial Long Term Evolution network. That would seem to be welcome news for Dish, but there is a catch, Wall Street Journal reports.

To prevent interference, the agency is likely to bar Dish from using some portion of its bandwidth, a move that Dish CEO Charlie Ergen has said "would be a game changer for us," making his bet to enter the wireless industry "increasingly risky."

Basically, the limits on use of some spectrum at the high end of the frequency range would reduce uplink bandwidth about 25 percent. Dish also argues other relatively typical sources of link degradation would reduce bandwidth another 25 percent.

So, if approved, the issue is whether the stated objections really would cause Dish to abandon its plans, modify those plans or proceed after making the strongest argument it could to use all the spectrum.

Given the FCC's handling of interference issues posed by Lightsquared, Dish Network has to have known all along that some sort of guard band would be required. On the other hand, many carriers operate asymmetrical networks with more bandwidth provided downstream than upstream. How big a marketing issue Dish might have, with less upstream capacity, is unclear.

Also, to the extent that the key innovation would be a mobile video service, which would be highly biased to downstream bandwidth, asymmetry might not be a killer issue.

To prevent interference, the agency is likely to bar Dish from using some portion of its bandwidth, a move that Dish CEO Charlie Ergen has said "would be a game changer for us," making his bet to enter the wireless industry "increasingly risky."

Basically, the limits on use of some spectrum at the high end of the frequency range would reduce uplink bandwidth about 25 percent. Dish also argues other relatively typical sources of link degradation would reduce bandwidth another 25 percent.

So, if approved, the issue is whether the stated objections really would cause Dish to abandon its plans, modify those plans or proceed after making the strongest argument it could to use all the spectrum.

Given the FCC's handling of interference issues posed by Lightsquared, Dish Network has to have known all along that some sort of guard band would be required. On the other hand, many carriers operate asymmetrical networks with more bandwidth provided downstream than upstream. How big a marketing issue Dish might have, with less upstream capacity, is unclear.

Also, to the extent that the key innovation would be a mobile video service, which would be highly biased to downstream bandwidth, asymmetry might not be a killer issue.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Gary Kim has been a digital infra analyst and journalist for more than 30 years, covering the business impact of technology, pre- and post-internet. He sees a similar evolution coming with AI. General-purpose technologies do not come along very often, but when they do, they change life, economies and industries.

Subscribe to:

Posts (Atom)

Zoom Wants to Become a "Digital Twin Equipped With Your Institutional Knowledge"

Perplexity and OpenAI hope to use artificial intelligence to challenge Google for search leadership. So Zoom says it will use AI to challen...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...