Tuesday, December 11, 2012

Netflix ISP Ranking Shows Modest Differences Between ISPs

Google Fiber is now the most consistently fast ISP in America for watching Netflix streamed content, according to Netflix. But keep it in perspective: Netflix streaming only happens so fast.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Is Sprint Moving to Take Over Clearwire?

Many observers were convinced Softbank would not have taken control of Sprint without a clear path to own Clearwire as well, and that might be the impetus for a Sprint bid to buy the remainder of Clearwire it does not already own. Reuters reports that Sprint is in talks with Intel Corp. and Comcast Corp. to buy out their stakes in Clearwire.

Intel and Comcast own a combined basis roughly 12.4 percent of Clearwire's total shares. Aside from plans Sprint might now have for a new assault on the U.S. mobile market, something most expect Softbank to attempt, the U.S. market is showing other signs of instability or attempted disruption.

There are growing signs that the U.S. mobile service provider market is unstable, in terms of market structure, and on the cusp of changes that could include a significant wave of provider restructuring, despite the failure of the AT&T bid to buy T-Mobile USA.

"What is clear for now, in our view, is that the current strategy, indeed the entire current business, isn't working," said Craig Moffett, an analyst at Sanford C. Bernstein. Moffett seems to be referring to the whole business operated by regional U.S. wireless carriers.

To be sure, Moffett has been saying that the U.S. mobile business is saturated since at least 2009.

Oddly enough, to some of us the new stresses resemble the earlier transition from dial-up Internet access to broadband access. In this case, the transition is from feature phone to smart phone business models.

In that earlier transition, many suppliers that had made a business of supplying dial-up access found they no longer could compete in the broadband business. Now, in mobile, it appears that the cost of supporting handset subsidies is pinching operating revenue, while the cost of building fourth generation networks likewise will hit earnings.

Of the "big four" U.S. mobile carriers, only T-Mobile USA seems to have experienced a subscriber loss.

In its second quarter of 2012, AT&T added 1.5 million net new customers. Verizon Wireless added 1.2 million net new subscribers. Sprint added postpaid net additions of 442,000 postpaid net additions. But T-Mobile USA, one the "big four" U.S. mobile service providers, lost 510,000 subscribers in the first quarter.

The immediate stress is heavy for the regional mobile providers, often using prepaid models.

Regional or prepaid service providers clearly have had a tougher 2012 than had been the case in the mid-2000s, for example. Leap hasn't been profitable since 2005, for example. MetroPCS profits dropped 63 percent during the first quarter of 2012.

A study undertaken by Tellabs suggests that mobile service provider profitability could become extremely challenging for some mobile operators within three years, with costs surpass revenues for many operators.

In North America that could happen by the fourth quarter of 2013 or as early as Q1 2013. Developed Asia Pacific service providers could see problems by the third quarter of 2014. In some cases this could happen as early as Q3 2013, Tellabs said.

Service providers in Western Europe could run into trouble by the first quarter of 2015. In some cases this could happen as early as the first quarter of 2014.

Vivendi's SFR mobile operation reportedly has been talking to Iliad (owner of Free Mobile) about a merger. SFR also apparently is in talks with French cable operator Numericable about a merger of SFR with Numericable as well, Reuters reports.

Those talks indicate that, after a period of relative stability, mobile market structure, in France and elsewhere, might be changing, because of market saturation and competition.

In many Western European markets there are four, and sometimes five facilities-based mobile service providers. That was sustainable in an earlier period where the mobile market was growing.

But the issue has been whether four to five contestants are "too many" suppliers for a stable market. In the United Kingdom, the formation of EE is another example, while in the U.S.market Sprint and T-Mobile USA are the contestants seen as inevitable parts of a future market consolidation.

With the recent mergers of T-Mobile USA and MetroPCS, and the purchase of Sprint by Softbank (assuming both transactions pass regulatory muster), there is once again an active discussion in many quarters about the future shape of the U.S. mobile service provider business.

What seems a safe observation, though, is that the number of successful mobile service providers will be few in number. The only question is “how few?” In many markets, there are four to five major providers, in terms of market share. But just how stable a market that is is questionable.

The Rule of Three holds nearly everywhere. While the percentage market share might vary, on an average, the top three mobile service providers control 93 percent of the market share in a given nation, irrespective of the regulatory framework.

Some might argue that scale effects account for the relatively small number of leading providers in many capital-intensive or consumer electronics businesses.

At some point, the access business can have only so many facilities-based providers before most companies cannot get enough customers to make a profit. Consolidation is the result.

The point is that mobile markets are heading for a period of greater instability and possible change than we have seen for some time.

Intel and Comcast own a combined basis roughly 12.4 percent of Clearwire's total shares. Aside from plans Sprint might now have for a new assault on the U.S. mobile market, something most expect Softbank to attempt, the U.S. market is showing other signs of instability or attempted disruption.

There are growing signs that the U.S. mobile service provider market is unstable, in terms of market structure, and on the cusp of changes that could include a significant wave of provider restructuring, despite the failure of the AT&T bid to buy T-Mobile USA.

"What is clear for now, in our view, is that the current strategy, indeed the entire current business, isn't working," said Craig Moffett, an analyst at Sanford C. Bernstein. Moffett seems to be referring to the whole business operated by regional U.S. wireless carriers.

To be sure, Moffett has been saying that the U.S. mobile business is saturated since at least 2009.

Oddly enough, to some of us the new stresses resemble the earlier transition from dial-up Internet access to broadband access. In this case, the transition is from feature phone to smart phone business models.

In that earlier transition, many suppliers that had made a business of supplying dial-up access found they no longer could compete in the broadband business. Now, in mobile, it appears that the cost of supporting handset subsidies is pinching operating revenue, while the cost of building fourth generation networks likewise will hit earnings.

Of the "big four" U.S. mobile carriers, only T-Mobile USA seems to have experienced a subscriber loss.

In its second quarter of 2012, AT&T added 1.5 million net new customers. Verizon Wireless added 1.2 million net new subscribers. Sprint added postpaid net additions of 442,000 postpaid net additions. But T-Mobile USA, one the "big four" U.S. mobile service providers, lost 510,000 subscribers in the first quarter.

The immediate stress is heavy for the regional mobile providers, often using prepaid models.

Regional or prepaid service providers clearly have had a tougher 2012 than had been the case in the mid-2000s, for example. Leap hasn't been profitable since 2005, for example. MetroPCS profits dropped 63 percent during the first quarter of 2012.

A study undertaken by Tellabs suggests that mobile service provider profitability could become extremely challenging for some mobile operators within three years, with costs surpass revenues for many operators.

In North America that could happen by the fourth quarter of 2013 or as early as Q1 2013. Developed Asia Pacific service providers could see problems by the third quarter of 2014. In some cases this could happen as early as Q3 2013, Tellabs said.

Service providers in Western Europe could run into trouble by the first quarter of 2015. In some cases this could happen as early as the first quarter of 2014.

Vivendi's SFR mobile operation reportedly has been talking to Iliad (owner of Free Mobile) about a merger. SFR also apparently is in talks with French cable operator Numericable about a merger of SFR with Numericable as well, Reuters reports.

Those talks indicate that, after a period of relative stability, mobile market structure, in France and elsewhere, might be changing, because of market saturation and competition.

In many Western European markets there are four, and sometimes five facilities-based mobile service providers. That was sustainable in an earlier period where the mobile market was growing.

But the issue has been whether four to five contestants are "too many" suppliers for a stable market. In the United Kingdom, the formation of EE is another example, while in the U.S.market Sprint and T-Mobile USA are the contestants seen as inevitable parts of a future market consolidation.

With the recent mergers of T-Mobile USA and MetroPCS, and the purchase of Sprint by Softbank (assuming both transactions pass regulatory muster), there is once again an active discussion in many quarters about the future shape of the U.S. mobile service provider business.

What seems a safe observation, though, is that the number of successful mobile service providers will be few in number. The only question is “how few?” In many markets, there are four to five major providers, in terms of market share. But just how stable a market that is is questionable.

The Rule of Three holds nearly everywhere. While the percentage market share might vary, on an average, the top three mobile service providers control 93 percent of the market share in a given nation, irrespective of the regulatory framework.

Some might argue that scale effects account for the relatively small number of leading providers in many capital-intensive or consumer electronics businesses.

At some point, the access business can have only so many facilities-based providers before most companies cannot get enough customers to make a profit. Consolidation is the result.

The point is that mobile markets are heading for a period of greater instability and possible change than we have seen for some time.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

How 4G LTE Might TransformiThe Mobile Ecosystem

Will Long Term Evolution 4G transformthe mobile ecosystem? Possibly, Business Insider says. In fact, mobile service providers hope that will happen, much as 3G was thought to be the foundation for new applications user experiences and revenue streams.

Of course, the 3G experience also suggests that it sometimes can take quite a while for those new applications, experiences and revenue streams to materialize. So what does Business Insider think could happen?

LTE is about ten times faster than 3G wireless connections. In fact, many consumers have found LTE faster than their home broadband connections, Business Insider argues. That might lead more users to evaluate substituting LTE for a fixed broadband connection. So there could be changes affecting service providers.

LTE might encourage application developers to create, and people to use, video-based or video-enhanced applications.

These categories most notably include video sharing, video chat, augmented reality, games, and apps.

Both consumers and app developers might therefore find that 4G creates the foundation for qualitatively different experiences, not just "faster" experiences.

Advertisers might find that LTE creates more engagement and more monetization opportunities. That might mean more advertising, and more immersive experiences, more often and in new locations. Google, Facebook and others are betting big that will happen.

On the other hand, some circumspection is probably in order. Mobile service providers were initially convinced that 3G likewise would create massive new revenue streams, apps and experiences, and for quite some time, none of that happened.

Only with the emergence of mobile email did lead applications of value to lots of people finally emerge. That was followed by mobile Internet access as a lead value. Most observers think video will play a key role in underpinning 4G-unique experiences. Others think the "personal hotspot" could emerge as a major new app as well.

Of course, the 3G experience also suggests that it sometimes can take quite a while for those new applications, experiences and revenue streams to materialize. So what does Business Insider think could happen?

LTE is about ten times faster than 3G wireless connections. In fact, many consumers have found LTE faster than their home broadband connections, Business Insider argues. That might lead more users to evaluate substituting LTE for a fixed broadband connection. So there could be changes affecting service providers.

LTE might encourage application developers to create, and people to use, video-based or video-enhanced applications.

These categories most notably include video sharing, video chat, augmented reality, games, and apps.

Both consumers and app developers might therefore find that 4G creates the foundation for qualitatively different experiences, not just "faster" experiences.

Advertisers might find that LTE creates more engagement and more monetization opportunities. That might mean more advertising, and more immersive experiences, more often and in new locations. Google, Facebook and others are betting big that will happen.

On the other hand, some circumspection is probably in order. Mobile service providers were initially convinced that 3G likewise would create massive new revenue streams, apps and experiences, and for quite some time, none of that happened.

Only with the emergence of mobile email did lead applications of value to lots of people finally emerge. That was followed by mobile Internet access as a lead value. Most observers think video will play a key role in underpinning 4G-unique experiences. Others think the "personal hotspot" could emerge as a major new app as well.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

News Consumption Shifting to Mobile Devices

Over a third of respondents report getting news daily on the tablet and the smart phone, putting it on par with other activities such as email and playing games on tablets and behind only email on smart phones.

None of that should come as a surprise, given the dominant role of content consumption on tablets, and the growing role of content consumption on smart phones.

Fully 43 percent of male tablet owners consume news daily on their device versus 32 percent of female tablet owners. The gap is nearly identical on smartphones (41 percent compared with 30 percent among women).

As you might guess, younger users are heavier users. On the tablet, male news users under 50 are more likely than female news users under 50 (and both genders over 50) to check news more than once a day.

Nearly half of male tablet news users under 50 (48 percent) get news on their tablet multiple times during the day compared to 33 percent of women under 50 and 31 percent of men and women 50 and over.

Male news users under 50 are more avid readers of in-depth news articles on the tablet. Fully 84 percent do so at least sometimes, compared to 70 percent of women under 50 and 65 percent of both genders over 50.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Computing Goes Mobile, Untethered, Content Oriented

Debates about whether tablets will displace personal computers are nearly pointless. Tablets clearly are driving sales of computing appliances as much as are smart phones.

The desktop PC market has for some time been shrinking, compared to the notebook part of the PC market, but even notebook sales probably will be displaced to a large extent by tablets and smart phones, as well, IDC says.

Those changes speak to changes in the ways people use computing appliances, as much as anything. As it turns out, most people do not require a PC, as much as they used to, to work or play. At work, most applications involve either light communications activities (email, messaging) and consuming content of various types, rather than creating it.

In other words, more people most of the time, read or view documents, presentations and videos, rather than needing to create them. Tablets and smart phones work passably well for such activities.

The desktop PC market has for some time been shrinking, compared to the notebook part of the PC market, but even notebook sales probably will be displaced to a large extent by tablets and smart phones, as well, IDC says.

Those changes speak to changes in the ways people use computing appliances, as much as anything. As it turns out, most people do not require a PC, as much as they used to, to work or play. At work, most applications involve either light communications activities (email, messaging) and consuming content of various types, rather than creating it.

In other words, more people most of the time, read or view documents, presentations and videos, rather than needing to create them. Tablets and smart phones work passably well for such activities.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

If Apple Does Sell an "Internet TV," How Much Would You Pay for It?

A survey conducted by AlphaWise and Morgan Stanley suggests at least some consumers are willing to pay a 20-percent premium for a hypothetical "Apple TV," compared to other standard TVs.

The survey found that 11 percent of respondents said they would be "extremely interested" in purchasing a so-called "iTV" from Apple, while 36 percent said they are "somewhat interested."

Some 46 percent of respondents said they are willing to pay over $1,000, while 10 percent are willing to pay over $2,000.

On average, respondents said they would pay $1,060 for an "iTV," which is a 20 percent premium over the $884 paid for the current average television set. Respondents ages 18 to 29 showed the most willingness to invest in an Apple television, indicating they would pay a 32 percent premium for such a device.

With the caveat that consumers often say they will do things they actually do not, the survey suggests Apple continues to have a "cachet" for many consumers.

The survey polled 1,568 heads of U.S. households regarding the "smart TV" market and found that just 18 percent of homes have a smart TV, while 13 percent of respondents said they didn't know whether their TV is considered "smart," the study found.

The poll also shows that those who own smart TVs connected to the Internet actually spend less time accessing Internet content through their TV than those who do not own a smart TV. That presumably suggests an "ease of use" problem that Apple likes to solve.

The question is whether the TV interface is a big enough irritant to convince lots of consumers to buy an appliance that promises much-better ease of use. The reason is that "content" is a huge part of the TV experience, and unless Apple can dramatically change that part of the end user interaction, the benefits might not be so large as Apple might hope.

It might be one thing to ease navigation between "broadcast" or "linear" TV and online sources, or to make "finding" interesting online content easier. It might not be so easy to revolutionize the TV experience if Apple cannot change the way Hollywood licenses programs.

If a hypothetical Apple TV or iTV enables viewing and purchase of single TV shows, at reasonable prices, that would be a huge deal. But Hollywood is unlikely to license content on such terms, at least not now.

For that reason, some of us are not so sure Apple can transform the TV experience as much as it changed music consumption or the mobile phone experience or PC interface.

The survey found that 11 percent of respondents said they would be "extremely interested" in purchasing a so-called "iTV" from Apple, while 36 percent said they are "somewhat interested."

Some 46 percent of respondents said they are willing to pay over $1,000, while 10 percent are willing to pay over $2,000.

On average, respondents said they would pay $1,060 for an "iTV," which is a 20 percent premium over the $884 paid for the current average television set. Respondents ages 18 to 29 showed the most willingness to invest in an Apple television, indicating they would pay a 32 percent premium for such a device.

With the caveat that consumers often say they will do things they actually do not, the survey suggests Apple continues to have a "cachet" for many consumers.

The survey polled 1,568 heads of U.S. households regarding the "smart TV" market and found that just 18 percent of homes have a smart TV, while 13 percent of respondents said they didn't know whether their TV is considered "smart," the study found.

The poll also shows that those who own smart TVs connected to the Internet actually spend less time accessing Internet content through their TV than those who do not own a smart TV. That presumably suggests an "ease of use" problem that Apple likes to solve.

The question is whether the TV interface is a big enough irritant to convince lots of consumers to buy an appliance that promises much-better ease of use. The reason is that "content" is a huge part of the TV experience, and unless Apple can dramatically change that part of the end user interaction, the benefits might not be so large as Apple might hope.

It might be one thing to ease navigation between "broadcast" or "linear" TV and online sources, or to make "finding" interesting online content easier. It might not be so easy to revolutionize the TV experience if Apple cannot change the way Hollywood licenses programs.

If a hypothetical Apple TV or iTV enables viewing and purchase of single TV shows, at reasonable prices, that would be a huge deal. But Hollywood is unlikely to license content on such terms, at least not now.

For that reason, some of us are not so sure Apple can transform the TV experience as much as it changed music consumption or the mobile phone experience or PC interface.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Will Data Demand Keep Growing at 60% a Year?

Forecasting the future is a tough business, at least in part because people respond to changes in incentives, which in turn reshapes their behavior in non-linear ways. Many of you who follow trends in bandwidth are familiar with a basic rule suggesting that bandwidth consumption grows about 60 percent a year, globally or in most market segments.

It therefore is logical to assume continued growth at about that magnitude. But that might not be a safe assumption. One might assume that later users are less heavy consumers of data than the early adopters.

Retail pricing is shifting in ways that provide clear incentives for users to make choices about which networks they use when connecting to the Internet.

And service providers also have new incentives to encourage offloading of data demand. Wi-Fi is more prevalent, all the time, and service providers have a vested interest in convincing their own customers to use Wi-Fi when possible, in part to relieve strain on mobile networks, and in part to provide a better end user experience.

To be sure, the percentage of data-using devices also is growing steadily, adding more users. So any attempt to predict future usage has multiple moving inputs.

So it is reasonable to ask whether smart phone consumers are making significant changes in behavior that could slow the rate of mobile broadband data consumption. Given trends that show substantial use of Wi-Fi connections in place of mobile network access, that is a possibility.

A recent study by NPD Connected Intelligence, for example, tracking usage on 1,200 smart phones, shows a mixed pattern. Android users on the Verizon, AT&T and Sprint networks seem to have decreased their use of mobile data networks between April 2012 and October 2012, while T-Mobile USA Android users seem to have increased usage.

Apple iPhone users on all of the networks except AT&T seem to have increased usage.

Fierce Wireless notes that the iPhone sample is small, so the results might be an anomaly.

But at least a couple explanations could explain the data. It is conceivable that users are learning to economize by shifting to Wi-Fi access whenever possible. And even where mobile network usage is growing, it is possible the greater consumption is less than it would have been had users not begun shifting access to Wi-Fi.

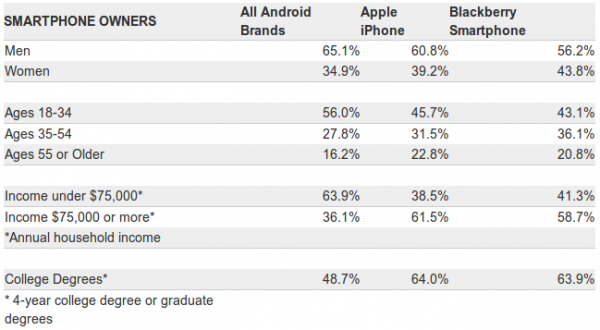

It is conceivable that new Android users are more budget conscious. And it remains possible that the demographics of Android and iPhone users are different in some material way. A number of surveys have shown that Apple iPhone users are, in fact, wealthier than Android users.

Other studies suggesting iPhone spend more than Android users likewise might be related to differences in disposable income. That pattern was upheld, some studies suggest, on Black Friday of 2012 and also Cyber Monday of 2012.

The NPD data is a snapshot in time, and one ought to be circumspect about what it really means. Nor are consumer preferences, demographics, disposable income or device type the only key variables.

Some of the service providers might be deliberately creating greater incentives for users to switch to Wi-Fi, in some cases allowing users to default to Wi-Fi automatically, which would increase use of the Wi-Fi access method.

With mobile service providers having clear financial incentives to shift users to Wi-Fi, and with a greater move to use of small cell access (especially when those small cells also feature Wi-Fi access), it seems reasonable to assume at least a possibility that smart phone mobile network bandwidth consumption might not grow as fast as some have predicted.

That will have key implications for any number of other elements of business strategy, such as new spectrum policies, the value of new spectrum, the amount of undersea cables that must be built, and the lit capacity on those cables.

How fast to deploy Long Term Evolution will be an issue in many markets, especially where 3G might meet demand in the near term. And service providers might have to rethink the pace of infrastructure upgrades, at least in terms of network elements that can handle higher speeds and more capacity.

It bears watching.

Solid Lines represent Android data. Dashed Lines with square markers represent iOS/iPhone data.

It therefore is logical to assume continued growth at about that magnitude. But that might not be a safe assumption. One might assume that later users are less heavy consumers of data than the early adopters.

Retail pricing is shifting in ways that provide clear incentives for users to make choices about which networks they use when connecting to the Internet.

And service providers also have new incentives to encourage offloading of data demand. Wi-Fi is more prevalent, all the time, and service providers have a vested interest in convincing their own customers to use Wi-Fi when possible, in part to relieve strain on mobile networks, and in part to provide a better end user experience.

To be sure, the percentage of data-using devices also is growing steadily, adding more users. So any attempt to predict future usage has multiple moving inputs.

So it is reasonable to ask whether smart phone consumers are making significant changes in behavior that could slow the rate of mobile broadband data consumption. Given trends that show substantial use of Wi-Fi connections in place of mobile network access, that is a possibility.

A recent study by NPD Connected Intelligence, for example, tracking usage on 1,200 smart phones, shows a mixed pattern. Android users on the Verizon, AT&T and Sprint networks seem to have decreased their use of mobile data networks between April 2012 and October 2012, while T-Mobile USA Android users seem to have increased usage.

Apple iPhone users on all of the networks except AT&T seem to have increased usage.

Fierce Wireless notes that the iPhone sample is small, so the results might be an anomaly.

But at least a couple explanations could explain the data. It is conceivable that users are learning to economize by shifting to Wi-Fi access whenever possible. And even where mobile network usage is growing, it is possible the greater consumption is less than it would have been had users not begun shifting access to Wi-Fi.

It is conceivable that new Android users are more budget conscious. And it remains possible that the demographics of Android and iPhone users are different in some material way. A number of surveys have shown that Apple iPhone users are, in fact, wealthier than Android users.

Other studies suggesting iPhone spend more than Android users likewise might be related to differences in disposable income. That pattern was upheld, some studies suggest, on Black Friday of 2012 and also Cyber Monday of 2012.

The NPD data is a snapshot in time, and one ought to be circumspect about what it really means. Nor are consumer preferences, demographics, disposable income or device type the only key variables.

Some of the service providers might be deliberately creating greater incentives for users to switch to Wi-Fi, in some cases allowing users to default to Wi-Fi automatically, which would increase use of the Wi-Fi access method.

With mobile service providers having clear financial incentives to shift users to Wi-Fi, and with a greater move to use of small cell access (especially when those small cells also feature Wi-Fi access), it seems reasonable to assume at least a possibility that smart phone mobile network bandwidth consumption might not grow as fast as some have predicted.

That will have key implications for any number of other elements of business strategy, such as new spectrum policies, the value of new spectrum, the amount of undersea cables that must be built, and the lit capacity on those cables.

How fast to deploy Long Term Evolution will be an issue in many markets, especially where 3G might meet demand in the near term. And service providers might have to rethink the pace of infrastructure upgrades, at least in terms of network elements that can handle higher speeds and more capacity.

It bears watching.

Solid Lines represent Android data. Dashed Lines with square markers represent iOS/iPhone data.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Subscribe to:

Posts (Atom)

Younger Home Broadband Buyers are Less Loyal, Generate Lower ARPU

Sometimes researchers have to do studies that have an expected outcome, even if what the new research does is simply confirm an expected pat...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...