Verizon Wireless, AT&T, China Mobile and mobile providers in India have advantages over suppliers in many other markets, namely a huge internal market. Some would argue that is why AT&T and Verizon have done relatively better than many European providers over the past several years, in terms of internal revenue growth.

But even a large internal market might not be sufficient to keep a very-large telecom provider growing, indefinitely. So it is that the Wall Street Journal reports AT&T is considering acquiring a European operator. The United Kingdom, Germany or the Netherlands reportedly are seen as the most-viable markets.

Whether the move is simply opportunistic, or evidence that AT&T sees some clear limits to U.S. growth, is not so clear. Some might argue European telco assets currently are undervalued, so an acquisition would be a relatively attractive way to deploy capital and gain revenue.

To be sure, the move would be a bit of a change of strategy. Obviously, AT&T and SBC had been looking at international growth opportunities for at least a decade. But up to this point, no particular deal seemed to make so much sense.

On the other hand, one might argue that AT&T has taken a hard look at its growth prospects, and does not see sufficient revenue mass from any of the new sources it is working on, compared to the advantages of "growing by acquisition."

However much AT&T might be hopeful about the new bets it is placing in applications and services, it does not currently appear that any could represent incremental revenue large enough to move the needle for AT&T, in the near term.

Have we reached a point where even a firm the size of AT&T cannot grow fast enough in the U.S. market? Possibly. The other issue is simply regulator objection. The Federal Communications Commission essentially has told AT&T, by opposing AT&T's acquisition of T-Mobile USA, that it cannot grow larger in the U.S. market.

So, like it or not, the obvious corollary is that AT&T will deploy its capital, and try to grow, elsewhere.

Thursday, January 17, 2013

AT&T Considering Europe Market in a New Way?

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Tablets ARE PCs

With talk of a "post-PC" era, the role and understanding of tablets has become a key requirement not only for device manufacturers, which face significant potential disruption of their markets, but for application providers, access providers and others in the ecosystem.

In some ways, the tablet represents a clear new appliance category. In other ways, it also displaces the use of PCs. But there remains some uncertaintly about whether the tablet is a "mobile" device or is primarily an "untethered" device.

In truth, the tablet is a mix of both. Sometimes it will be used as a "mobile" device, carried by a user outside the home, used outside the home and on a mobile network connection. Most of the time, though, it is used inside the home or office in "untethered" mode.

That leads some to note, not without justification, that a tablet is simply the latest form factor for a PC. Some might say the tablet is why "netbook" demand has collapsed, for example.

In some ways, the tablet represents a clear new appliance category. In other ways, it also displaces the use of PCs. But there remains some uncertaintly about whether the tablet is a "mobile" device or is primarily an "untethered" device.

In truth, the tablet is a mix of both. Sometimes it will be used as a "mobile" device, carried by a user outside the home, used outside the home and on a mobile network connection. Most of the time, though, it is used inside the home or office in "untethered" mode.

That leads some to note, not without justification, that a tablet is simply the latest form factor for a PC. Some might say the tablet is why "netbook" demand has collapsed, for example.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Wednesday, January 16, 2013

Pan-EU Telco Infrastructure Talks Are Unlikely to Succeed

Will European telcos be able to create a unified fixed nework infrastructure across borders? Fitch Ratings doesn't think so.

The proposal, which presumably would have to be ratified and approved by the European Commission, would allow all the contestants to essentially create a continent-wide infrastructure company that would sell capacity and services to any retail operator in any of the participating countries.

If you think about it, this is a bigger version of the infrastructure sharing mobile operators have been doing: sharing towers and sometimes radio infrastructure in ways that lower costs for each of the retail providers.

Doubtless there are pragmatic difficulties, such as technology incompatibilities in some cases. But Fitch thinks the bigger problem simply will be EC regulator opposition to a move very likely seen as the precursor to more consolidation in the EC telecom markets.

Deutsche Telekom, Orange, Telecom Italia, Telefonica, Belgacom and KPN are among the carriers interested in such a cross-country infrastructure sharing plan. The sharing might not be seen as "consolidation" in the market by some. But regulators might not agree.

The proposal, which presumably would have to be ratified and approved by the European Commission, would allow all the contestants to essentially create a continent-wide infrastructure company that would sell capacity and services to any retail operator in any of the participating countries.

If you think about it, this is a bigger version of the infrastructure sharing mobile operators have been doing: sharing towers and sometimes radio infrastructure in ways that lower costs for each of the retail providers.

Doubtless there are pragmatic difficulties, such as technology incompatibilities in some cases. But Fitch thinks the bigger problem simply will be EC regulator opposition to a move very likely seen as the precursor to more consolidation in the EC telecom markets.

Deutsche Telekom, Orange, Telecom Italia, Telefonica, Belgacom and KPN are among the carriers interested in such a cross-country infrastructure sharing plan. The sharing might not be seen as "consolidation" in the market by some. But regulators might not agree.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Do Smart Phones and Tablet Change Demand for "Remote Management of Home" Services

Though consumers often indicate they will do something, and then do not, or say they will not do something, and then do, it is possible that widespread adoption of smart phones and tablets, plus more sophisticated and Web-accessible management tools, could change the perception of home security and remote monitoring services, a study by Strategy Analytics suggests. .

The survey of broadband households in France, Germany, Italy, the United Kingdom and United States found that more than 50 percent of broadband households without security are willing to pay for professionally monitored services, if combined with monitoring and control capabilities.

The key change there probably are the remote control features, not the security as such.

The study also revealed significant willingness to pay for remote healthcare and energy management services if the services are priced right. Potential adoption of smart home services is highest in the United States, United Kingdom, Germany and Italy and less so in France.

Remote healthcare services have the greatest potential in Italy if recurring fees are kept under $10 per month.

"The percentage of broadband households with both the interest in and willingness to pay for selected connected home solutions is higher than expected," said Bill Ablondi, Strategy Analytics director.

The study might suggest a combination of smart phone and tablet usage, plus easier to use Web tools, could be changing customer appetite for new home management services, such as controlling heating and cooling systems or other appliances within the home, for example.

Percentage of Broadband Households Willing to Pay for Selected Smart Home Capabilities in the US and Major Western European Countries

Source: Strategy Analytics, Inc.

The survey of broadband households in France, Germany, Italy, the United Kingdom and United States found that more than 50 percent of broadband households without security are willing to pay for professionally monitored services, if combined with monitoring and control capabilities.

The key change there probably are the remote control features, not the security as such.

The study also revealed significant willingness to pay for remote healthcare and energy management services if the services are priced right. Potential adoption of smart home services is highest in the United States, United Kingdom, Germany and Italy and less so in France.

Remote healthcare services have the greatest potential in Italy if recurring fees are kept under $10 per month.

"The percentage of broadband households with both the interest in and willingness to pay for selected connected home solutions is higher than expected," said Bill Ablondi, Strategy Analytics director.

The study might suggest a combination of smart phone and tablet usage, plus easier to use Web tools, could be changing customer appetite for new home management services, such as controlling heating and cooling systems or other appliances within the home, for example.

Percentage of Broadband Households Willing to Pay for Selected Smart Home Capabilities in the US and Major Western European Countries

| Percentage Willing to Pay | |

| Self-monitored Security | 55 percent |

| Professionally Monitored Security | 54 percent |

| Remote Monitoring and Control | 47 percent |

| Remote Healthcare Services | 32 percent |

| Remote Energy Management | 30 percent |

Source: Strategy Analytics, Inc.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Small Cell "As a Service?"

European service provider Colt is among service providers who believe a wholesale approach to small cell infrastructure makes sense. Virgin Business Media also is among service providers who believe creating a network of small cells and then selling use of that network to other mobile service providers, is a business opportunity.

There are any number of reasons why some mobile service providers might find the “buy rather than build” approach attractive. The cost of backhaul for a small cell will be a challenging exercise.

Whichever technology is used to backhaul small cells, it has to be cheap, "it has to be massively cheap," said Andy Sutton, Everything Everywhere principal architect, access transport. "We have a financial envelope for small cells and it's challenging."

Cost is so important because small cells will have relatively low usage compared to a macrocell and there will be lots of sites to support. Compared with macrocells, small cells quite frequently will cover distances of about 50 square meters or 538 square feet. That's an area about 23 feet by 23 feet.

One way to look at matters is that this is an area smaller than the range of a consumer's home Wi-Fi router. In other cases service providers might need to support coverage of 2 kilometers down to 200 meters. Traditional backhaul might well make sense where a small cell covers an area of 2 kilometers radius.

It will be substantially more challenging for cells covering 200 meters or less. Cells covering areas smaller than that will be much more challenged, in terms of how much a service provider can afford to invest, in terms of radio and associated facilities, or the recurring cost of leased bandwidth.

Backhaul cost therefore becomes a key operating cost issue. A network services provider that owns lots of metro fiber, a cable operator or a telco might well be able to supply the affordable connections such small cells will require.

Entities that do not own such assets will find the cost of leasing backhaul, not to mention the costs of radios and site infrastructure, to be quite challenging as well.

For all those reasons, a well-developed wholesale small cell network could well make sense, especially for mobile service providers without extensive fixed network assets in an area.

Some will be unable to resist calling such services "small cell infrastructure as a service." Of course, historically, virtually all telecommunications offerings have been "services." So the term means almost nothing. The classic case of "communications as a product" are business phone systems.

Some speak of "communications as a service," which, when you think about it, is nonsensical. Communications always has been a service (with the exception of business phone systems). It is "communications as an app," or "communications as a feature," that is new.

In that sense, there is clear logic for small cell wholesale, in many cases. We just shouldn't get caught up in nonsensical nomenclature games.

There are any number of reasons why some mobile service providers might find the “buy rather than build” approach attractive. The cost of backhaul for a small cell will be a challenging exercise.

Whichever technology is used to backhaul small cells, it has to be cheap, "it has to be massively cheap," said Andy Sutton, Everything Everywhere principal architect, access transport. "We have a financial envelope for small cells and it's challenging."

Cost is so important because small cells will have relatively low usage compared to a macrocell and there will be lots of sites to support. Compared with macrocells, small cells quite frequently will cover distances of about 50 square meters or 538 square feet. That's an area about 23 feet by 23 feet.

One way to look at matters is that this is an area smaller than the range of a consumer's home Wi-Fi router. In other cases service providers might need to support coverage of 2 kilometers down to 200 meters. Traditional backhaul might well make sense where a small cell covers an area of 2 kilometers radius.

It will be substantially more challenging for cells covering 200 meters or less. Cells covering areas smaller than that will be much more challenged, in terms of how much a service provider can afford to invest, in terms of radio and associated facilities, or the recurring cost of leased bandwidth.

Backhaul cost therefore becomes a key operating cost issue. A network services provider that owns lots of metro fiber, a cable operator or a telco might well be able to supply the affordable connections such small cells will require.

Entities that do not own such assets will find the cost of leasing backhaul, not to mention the costs of radios and site infrastructure, to be quite challenging as well.

For all those reasons, a well-developed wholesale small cell network could well make sense, especially for mobile service providers without extensive fixed network assets in an area.

Some will be unable to resist calling such services "small cell infrastructure as a service." Of course, historically, virtually all telecommunications offerings have been "services." So the term means almost nothing. The classic case of "communications as a product" are business phone systems.

Some speak of "communications as a service," which, when you think about it, is nonsensical. Communications always has been a service (with the exception of business phone systems). It is "communications as an app," or "communications as a feature," that is new.

In that sense, there is clear logic for small cell wholesale, in many cases. We just shouldn't get caught up in nonsensical nomenclature games.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

U.S. Mobile Payments in 2017 Equally Split Between Retail an Remote Payments

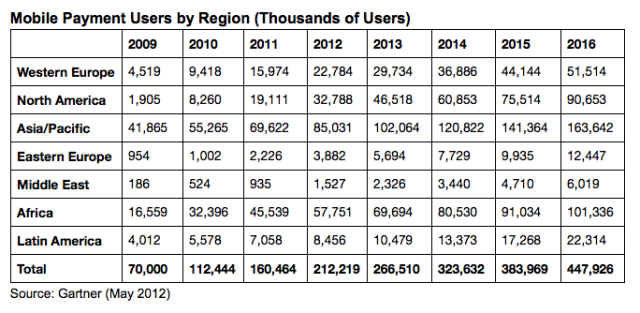

The volume of U.S. mobile payments will reach $90 billion in 2017, a 48 percent compound annual growth rate rom the $12.8 billion worth of mobile purchases in 2012, according to Forrester Research analyst Denée Carrington.

Mobile proximity payments (retail transactions) are currently the smallest category within mobile payments, but Carrington expects it to be the fastest growing category. Proximity payments will reach $41 billion by 2017, making up nearly half of all mobile payments in 2017.

Cross-border remittances using peer-to-peer networks either for bill payment or sending money to other people, will exceed $4 billion in remittance value over the next five years but will fail to achieve the scale of mobile proximity payments or mobile commerce, Carrington forecasts.

Mobile remote payments, which Forrester Research calls “mobile commerce,” represent 90 percent of the mobile payments category and will continue to be the most-dominant category, representing about $45 billion in transaction volume.

Analysts at Gartner in 2012 had a similar range of forecasts.

Mobile proximity payments (retail transactions) are currently the smallest category within mobile payments, but Carrington expects it to be the fastest growing category. Proximity payments will reach $41 billion by 2017, making up nearly half of all mobile payments in 2017.

Cross-border remittances using peer-to-peer networks either for bill payment or sending money to other people, will exceed $4 billion in remittance value over the next five years but will fail to achieve the scale of mobile proximity payments or mobile commerce, Carrington forecasts.

Mobile remote payments, which Forrester Research calls “mobile commerce,” represent 90 percent of the mobile payments category and will continue to be the most-dominant category, representing about $45 billion in transaction volume.

Analysts at Gartner in 2012 had a similar range of forecasts.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Tuesday, January 15, 2013

If E-Commerce is So Disruptive, How Come More Retailers Have Not Failed?

Apparently, attendance is up smartly at the National Retail Federation meeting this year, with about a 60 percent increase in attendance by retailers looking for technology to improve competitiveness in the face of online and mobile challenges.

But there is a lesson here. Firms such Amazon have been in business since 1994. Everybody seems aware of e-commerce. A growing amount of retail sales volume passes through Internet retailer channels. And yet, it is hard to point to major retailer disruption, in the form of firms going out of business.

“If e-business is so disruptive, how come nobody died?” Gartner analyst Mark Raskino recalls thinking, back in 2000. The answer might be, as it often seems to be, that big trends in complex ecosystems take some time to take root, and then hit an inflection point.

It is quite possible that U.S. retailers sense an inflection point coming, where mobile commerce or e-commerce will cease to be an irritant, and start to be extremely disruptive, dramatically reshaping revenue patterns.

If and when that happens, the feared wave of bankruptcies will happen. The fact that nothing quite unusual seems to have happened, on that score, is simply the period of ecosystem change that precedes the disruption, one might argue.

But there is a lesson here. Firms such Amazon have been in business since 1994. Everybody seems aware of e-commerce. A growing amount of retail sales volume passes through Internet retailer channels. And yet, it is hard to point to major retailer disruption, in the form of firms going out of business.

“If e-business is so disruptive, how come nobody died?” Gartner analyst Mark Raskino recalls thinking, back in 2000. The answer might be, as it often seems to be, that big trends in complex ecosystems take some time to take root, and then hit an inflection point.

It is quite possible that U.S. retailers sense an inflection point coming, where mobile commerce or e-commerce will cease to be an irritant, and start to be extremely disruptive, dramatically reshaping revenue patterns.

If and when that happens, the feared wave of bankruptcies will happen. The fact that nothing quite unusual seems to have happened, on that score, is simply the period of ecosystem change that precedes the disruption, one might argue.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Subscribe to:

Comments (Atom)

On the Use and Misuse of Principles, Theorems and Concepts

When financial commentators compile lists of "potential black swans," they misunderstand the concept. As explained by Taleb Nasim ...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...