President Barack Obama is expected to soon nominate a former head of the largest U.S. cable TV and mobile trade organizations to be chairman of the Federal Communications Commission, WSJ.com reports.

Some policy advocates will decry Wheeler's nomination, but he is an acknowledged subject matter expert on both the cable and mobile industries. Others might say an FCC chairman intimately familiar with the funding of new entities should have views about innovation and regulation that could be helpful as the FCC grapples with how to adapt its regulation to a non-monopoly world where innovation can outrun regulatory understanding.

Tuesday, April 30, 2013

Obama to Name Tom Wheeler to Head FCC

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Mexico Telecom Deregulation is Coming

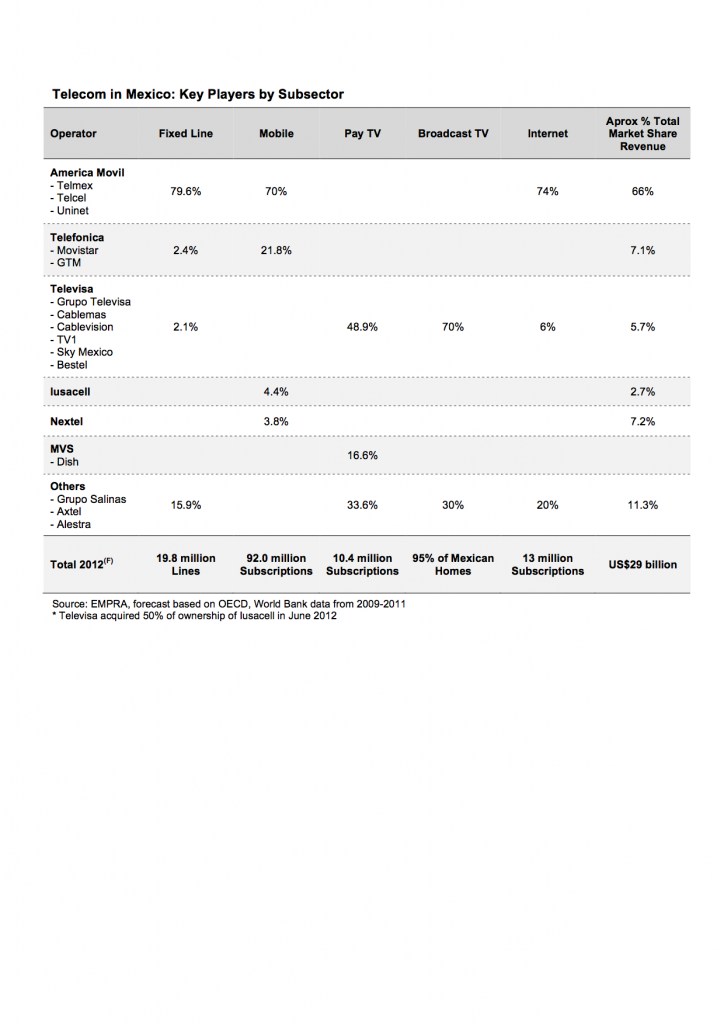

Mexico's telecom and TV markets are about to be disrupted, as the Mexican Senate has passed a bill to create a new communications and media regulator with the power to break up any firms with 50 percent or more market share in either the communications or TV broadcasting markets.

The legislation also ends the current limits on foreign investment in fixed network telephony and television. The law also creates a state-owned wholesale telecom network that would allow rival companies to bypass America Movil, which controls 75 percent of the country's fixed telephone lines and 70 percent of its mobile telephones and broadband accounts.

Televisa is the other target the new regulator will be looking at. Televisa, has around a 70 percent share of the TV market,

The new regulatory body, called the Federal Telecommunications Institute, is expected to be in operation by the end of 2013, with its first actions occurring in the first half of 2014.

Just how much impact the new law will have in promoting competition is not immediately clear, though it is anticipated the new regulator will impose asymmetric rules on contestants that will favor all the smaller competitors and handicap America Movil and Televisa in some way.

The ending of the 49 percent investment cap on foreign firms might, or might not, have too much impact. Telefonica is a possible buyer of some of the smaller providers, as it already has about 22 percent mobile market share.

But international investors have been able to own more than 49 percent of mobile operations in Mexico for some time, and few have shown any appetite to buy into the market on a wider scale.

Possibly two new TV networks are expected to launch as a result of the changes. But there seems more uncertainty about market entry in the telecom business.

Observers might expect one of those new networks to be launched by Carlos Slim, who controls America Movil. Basically, Slim probably will use the new regulatory framework to diversify into television, even if America Movil

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

OTT App Traffic Now Higher than Text Messaging

Over the top messaging now is costing mobile service providers in Spain about €341 million annually. Text messaging revenues in Spain have declined from €1.1 billion (US$1.4 billion) in 2007 to €758.5 million in 2011 (US$991.8 million), says Pamela Clark-Dickson, Informa Telecoms analyst.

Significant losses also have occurred in other markets such as the Netherlands and South Korea.

Region

|

P2P Messaging Traffic (In Billion)

| ||||||||

2010

|

2011

|

2012

|

2013F

|

2014F

|

2015F

|

2016F

|

2017F

| ||

Worldwide

|

P2P SMS

|

5,812

|

6,546

|

6,623

|

6,687

|

6,654

|

6,522

|

6,304

|

5,931

|

OTT Messaging

|

1,494

|

3,840

|

6,774

|

10,452

|

14,970

|

20,437

|

26,359

|

32,141

| |

source:Portio Research

Daily OTT messaging traffic has already overtaken daily P2P SMS traffic in terms of volume, with an average of 19.1 billion OTT messages sent per day in 2012, compared with an average of 17.6 billion person-to-person SMS messages.

By the end of 2013, Informa estimates that 41 billion OTT messages will be sent every day, compared with an average of 19.5 billion P2P SMS messages.

Still, text messaging users vastly outnumber users of OTT apps. There were about 3.5 billion SMS users in 2012, compared with about 586.3 million users of OTT messaging.

Each OTT user sent an average of 32.6 OTT messages a day, compared with just five SMS messages per day per P2P SMS user, meaning that OTT-messaging users are sending more than six times as many messages as P2P SMS users do, says Clark-Dickson.

Still, Informa forecasts that global SMS revenues and traffic will continue to increase through 2016. Other analysts likewise predict the overall percentage of OTT messaging will continue to grow, compared to text messaging. Free is an attractive price point.  Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Monday, April 29, 2013

What Openreach Fiber to Home Prices Suggest About Infrastructure Cost

“Cost” is not “retail price,” but new fiber-on-demand retail prices from Openreach shed at least some light on the costs of a 330 Mbps fiber to premises network.

Openreach requires a fixed installation fee of £500. But most of the connection fee is variable, and is based on distance.

Openreach estimates more than half of premises (55 percent) will incur a distance based charge of between £200 and £1000. Virtually all other premises will face a charge of between £1,400 and £3,500.

It is hazardous to compare costs or retail prices between countries, but the Openreach retail prices translate to U.S. prices of $775 for the fixed install cost. Some 55 percent of locations also would have to pay between $310 and $1551 to get a fiber to home connection, which suggests a gigabit connection might cost somewhat more.

The other 45 percent of locations can expect to pay between $2171 and $5428 to get a fiber to home connection.

So for 55 percent of potential locations, costs might range from $1085 to $2326 to get a 300 Mbps fiber to home connection.

For 45 percent of connections, users might expect to pay between $2946 and $6203. Those are difficult numbers for a consumer connection.

Essentially, were “cost equal to price,” the standard monthly recurring cost of £38 a month ($59 a month) implies breakeven between 18 months to 39 months for 55 percent of locations.

Breakeven might take 50 months to 105 months. But cost is not equal to price.

Assume a designed 40 percent profit margin, suggesting actual breakeven costs for 55 percent of locations might range between $651 in revenue (11 months) to $1396 in revenue (24 months).

In 45 percent of instances, breakeven might occur at revenue between $1768 (30 months) and $3722 (63 months).

Of course, those estimates only describe simple payback on invested capital, with no accouting for the costs of borrowed money, and no profit until after the breakeven point is reached.

But those figures might roughly be in line with what other fiber to home projects might cost in North America, if a $70 monthly recurring cost is assumed.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gigabit Networks Will Destabilize the ISP Market

There are times in the global communications business when stability is the main trend. The first 125 years of telecom history were such times of fundamental stability.

But there are other times when instability and change are the main trends. That might have been said to be the case when global privatization and deregulation happened in the 1980s and 1990s. And instability now is growing with the maturation of voice and the rise of Internet access and mobility as anchor services.

Some might argue growing instability is what we will see over the next decade. Consider only the impact of symmetrical gigabit Internet access service. Quantitative change is not the only issue. Qualitative competitive implications will exist for contestants using different network topologies and access media.

Consider cable operator frequency plans and use of hybrid fiber coax, for example. Executives typically argue that HFC can be upgraded incrementally to support future bandwidths of that sort.

To support gigabit networks, it is argued, fiber is simply extended deeper in the access network, decreasing serving area size by about an order of magnitude, creating the same sorts of advantages mobile operators gain by using a fixed amount of spectrum in a cellular configuration.

Though the least disruptive, such an upgrade might feature per-user peak bandwidth of 100 Mbps, still an order of magnitude slower than Google Fiber’s 1 Gbps, symmetrical. Some say only the high-split and new top-split frequency plans, all featuring more fiber, will support gigabit speeds.

But some might suggest it would be easier to overlay some sort of fiber to home capability than to dramatically change frequency plans now commonly used by U.S. cable operators to support symmetrical gigabit Internet access services. At least so far, most cable executives deem that too expensive an approach.

Though three different frequency plans (low split, mid-split, high split) have been available for decades, virtually all cable operators use the low split plan. Basically, that means frequencies up to 54 MHz are reserved for return signals, while all the rest of the bandwidth up to about 850 MHz is used to support downstream communications and services.

But even traditional “mid-split or high-split networks are not symmetrical. The mid-split frequency plan increases return bandwidth up to about 85 MegaHertz. The high-split network increases return bandwidth to about 200 MHz. The new top-split network offers support for gigabit speeds gigabit speeds.

For cable operators, as for others using radio frequency networks, the challenge symmetrical gigabit services pose is not simply quantitative (more) but qualitative (equal split networks are needed).

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Wi-Fi as Substitute for Mobile Networks: Internet Access is the Difference

Wireless networking is at an inflection point where it can completely replace wired networking everywhere but the data center," said Robert J. Pera, Ubiquiti Networks CEO.

Allowing for a bit of hyperbole, we are probably once again at a point where observers are going to speculate about whether Wi-Fi networks can compete with or displace mobile networks. That debate is not as robust as it once was.

It might not be too early to suggest that such displacement does not make as much sense for voice networking or messaging as for Internet access, where use of fixed access by mobile devices primarily for Internet access is a rather common occurrence.

In fact, Cisco has speculated about the growing relevance of Wi-Fi for several years, in particular because the ways people use the Internet on mobile devices makes Wi-Fi a preferred and normal access method, something that is not quite so true for voice and messaging communications.

Cisco has predicted that Wi-Fi IP traffic will represent 46 percent of all IP traffic in 2015, while mobile IP (using the mobile network) will account for about eight percent of total traffic.

As early as 2010, more than 55 percent of all global public Wi-Fi hotspots offered free access to users.

Also, mobile service providers are starting to embrace Wi-Fi as a meaningful part of their overall network access plans, shifting traffic to Wi-Fi to protect bandwidth needed for fully mobile activities.

In fact, Cisco estimates only 16 percent to 20 percent of mobile device Internet access operations actually happen when people are "on the go" or "out and about." Fully 80 percent of the time, mobile devices are used in the home, in the office or some other indoor location where Wi-Fi will suffice for Internet operations.

Perhaps oddly, mobile remains the foundation for "always connected" voice, messaging and apps, while Wi-Fi increasingly supports extended Internet sessions and media consumption.

Mobile's value remains its "always connected" feature, but Wi-Fi access increasingly handles most of the place-based "mostly connected" Internet requirements.

One feature of Ubiquiti's UniFi 3.0 software is "Zero Hand-Off Roaming." As the name implies, the feature allows users on UniFi networks to roam seamlessly from access point to access point, as is a key feature of mobile networks.

But some ISPs in the future might give much more attention to whether an Internet-access-optimized network is viable and sustainable, compared to full mobile networks. As mobile service providers provide their own Wi-Fi networks, or contract to use other big Wi-Fi networks, might the reverse happen?

Might big Wi-Fi network operators buy roaming on mobile networks, for the times when Wi-Fi users really want fully mobile Internet access? And, if so, does that make Wi-Fi a full substitute for "mobile networks?"

as early as 2010, hugely significant percentages of total device access used the fixed network (Wi-Fi) rather than the mobile network, Analysys Mason has argued.

Proportion of mobile network traffic that is generated indoors, by region

Ironically, just as 4G is starting to narrow the gap between mobile broadband and fixed broadband, users--perhaps reacting to the higher cost of mobile broadband--have been using Wi-Fi as a substitute for mobile access.

That works because most “mobile device” Internet access happens at home, with a significant percentage at other locations where it is possible to default ot Wi-Fi access.

Allowing for a bit of hyperbole, we are probably once again at a point where observers are going to speculate about whether Wi-Fi networks can compete with or displace mobile networks. That debate is not as robust as it once was.

It might not be too early to suggest that such displacement does not make as much sense for voice networking or messaging as for Internet access, where use of fixed access by mobile devices primarily for Internet access is a rather common occurrence.

In fact, Cisco has speculated about the growing relevance of Wi-Fi for several years, in particular because the ways people use the Internet on mobile devices makes Wi-Fi a preferred and normal access method, something that is not quite so true for voice and messaging communications.

Cisco has predicted that Wi-Fi IP traffic will represent 46 percent of all IP traffic in 2015, while mobile IP (using the mobile network) will account for about eight percent of total traffic.

As early as 2010, more than 55 percent of all global public Wi-Fi hotspots offered free access to users.

Also, mobile service providers are starting to embrace Wi-Fi as a meaningful part of their overall network access plans, shifting traffic to Wi-Fi to protect bandwidth needed for fully mobile activities.

In fact, Cisco estimates only 16 percent to 20 percent of mobile device Internet access operations actually happen when people are "on the go" or "out and about." Fully 80 percent of the time, mobile devices are used in the home, in the office or some other indoor location where Wi-Fi will suffice for Internet operations.

Perhaps oddly, mobile remains the foundation for "always connected" voice, messaging and apps, while Wi-Fi increasingly supports extended Internet sessions and media consumption.

Mobile's value remains its "always connected" feature, but Wi-Fi access increasingly handles most of the place-based "mostly connected" Internet requirements.

One feature of Ubiquiti's UniFi 3.0 software is "Zero Hand-Off Roaming." As the name implies, the feature allows users on UniFi networks to roam seamlessly from access point to access point, as is a key feature of mobile networks.

But some ISPs in the future might give much more attention to whether an Internet-access-optimized network is viable and sustainable, compared to full mobile networks. As mobile service providers provide their own Wi-Fi networks, or contract to use other big Wi-Fi networks, might the reverse happen?

Might big Wi-Fi network operators buy roaming on mobile networks, for the times when Wi-Fi users really want fully mobile Internet access? And, if so, does that make Wi-Fi a full substitute for "mobile networks?"

as early as 2010, hugely significant percentages of total device access used the fixed network (Wi-Fi) rather than the mobile network, Analysys Mason has argued.

Proportion of mobile network traffic that is generated indoors, by region

Ironically, just as 4G is starting to narrow the gap between mobile broadband and fixed broadband, users--perhaps reacting to the higher cost of mobile broadband--have been using Wi-Fi as a substitute for mobile access.

That works because most “mobile device” Internet access happens at home, with a significant percentage at other locations where it is possible to default ot Wi-Fi access.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Vermont Telephone Sells $35-A-Month Gigabit Internet Access

Though the offer does not have many implications for other Internet service providers not able to get $5371 per home in free money, Vermont Telephone has begun selling 1-Gbps Internet access for $35 a month.

Vermont Telephone serves 17,500 homes, and has gotten $94 million in "broadband stimulus" funds (about $5371 per home) to upgrade its network. It's interesting, but not an example of sustainable nationwide gigabit access precisely because it is built on huge subsidies.

The really important developments are any new ways ISPs can build networks delivering gigabit speeds, without subsidies, with clear and sustainable revenue models.

Vermont Telephone serves 17,500 homes, and has gotten $94 million in "broadband stimulus" funds (about $5371 per home) to upgrade its network. It's interesting, but not an example of sustainable nationwide gigabit access precisely because it is built on huge subsidies.

The really important developments are any new ways ISPs can build networks delivering gigabit speeds, without subsidies, with clear and sustainable revenue models.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Subscribe to:

Comments (Atom)

On the Use and Misuse of Principles, Theorems and Concepts

When financial commentators compile lists of "potential black swans," they misunderstand the concept. As explained by Taleb Nasim ...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...