Though the assertion is contested, European service providers say a fragmented market prevents European Union service providers from achieving economies of scale that would allow them to invest faster, and invest more, in Long Term Evolution and other advanced network platforms.

Though the assertion is contested, European service providers say a fragmented market prevents European Union service providers from achieving economies of scale that would allow them to invest faster, and invest more, in Long Term Evolution and other advanced network platforms.

In other words, regulators have to make a choice. They can continue to regulate in ways that promote competition by setting low wholesale rates, or they can regulate to promote investment by allowing widespread industry consolidation.

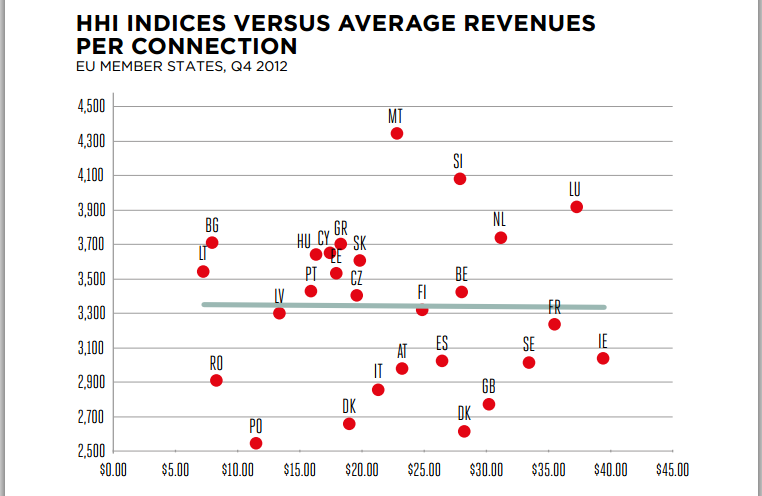

Addressing the argument that the markets require robust competition to promote lower prices and better services, the GSM Association argues “there is no statistically significant relationship between market concentration and prices.”

In other words, there is no direct relationship between the number of competitors in markets and the consumer benefits (lower prices, better and more varied services), the GSM Association argues.

At least in European Union countries, that might be explained by scale economics. The typical EU service provider is much smaller than an AT&T or Verizon Wireless, for example, denying EU service providers the ability to scale their operations in ways that enhance revenue and lower costs.

In fact, argues GSMA, the relationship between market concentration and consumer prices is inversely related. In other words, more-concentrated markets tend to have lower retail prices.

That is an argument also made by economists at Phoenix Center for Advanced Legal & Economic Public Policy Studies.

Also, GSMA argues, qualitative improvements (more features, same price; more bandwidth, same price) might also be said to more prevalent where contestants have the ability to invest more, because they earn more.

Also, GSMA argues, qualitative improvements (more features, same price; more bandwidth, same price) might also be said to more prevalent where contestants have the ability to invest more, because they earn more.

“Policies that sacrifice long-term dynamic efficiency for short-term gains in static efficiency (setting prices at or near short-term marginal costs) risk being pennywise and pound foolish,” GSMA argues.

In other words, in seeking the lowest-possible wholesale costs, to promote price competition, arguably also sacrifices service provider investment over the long term. That is why, GSMA argues, service provider investment in the EU tends to lag investment levels seen in the United States.

In markets characterized by network effects, such as communications, regulatory policies that limit firms’ ability to capture economies of scale and scope “may be particularly

pernicious,” GSMA says.

The reason is that limiting economies of scale (subscriber mass) and scope (ability to sell more products to the existing customer base) can mean service providers never can justify investing in capabilities to provide new services and features.

There also is no consistent relationship between market concentration and innovation, the GSM Association argues.

In dynamic markets such as mobile wireless, market concentration and performance are not inversely related, the association argues.