The most important numbers in the global mobile service provider business are "three" and "four." The reason is that national communication regulators generally have held that four contestants is the minimum necessary to provide the benefits of competition for consumers.

But in most markets, over the next half decade, there is likely to be significant consolidation in the mobile business, with many markets moving from four providers to three suppliers. That will be a serious issue for most regulators.

Hutchison Whampoa Limited, for example, wants to buyTelefonica's 02 Ireland unit.

The acquisition would quadruple the market share of Hutchison's subsidiary, 3 Ireland, to 37.5 percent, behind market leader Vodafone.

The European Commission already has said it is concerned about a reduction of competition in Ireland, as the deal will cut the number of mobile phone operators from four to three. That was an issue Hutchison faced in its acquisition of Orange Austria in 2013 as well.

Whether four competitors actually works "better" for consumers than three competitors remains to be seen. There are any number of inputs that collectively represent better consumer outcomes.

Lower prices, innovative services and devices, higher speeds, more and better applications, many ways to buy and use, and more robust service all are parts of the value competition is supposed to deliver.

You might instinctively argue that four competitors leads to lower prices, and that likely is generally true, at least in the short term. What is less certain is the longevity of such price benefits, over the long term, if the smaller contestants cannot stay in business.

And that's the long term issue: capital intensive businesses might require high levels of investment on a continuous basis that a small competitor, competing on price, simply cannot afford to make. In that case, consumer benefit is less than it might otherwise be.

Many observers might point to the inter-modal competition between cable TV operators and telcos as an example of significant competition and consumer benefits even when there are only two providers in a capital-intensive business.

Others might counter that the history of intra-modal competition with just two providers, in the mobile business, suggests clearly sub-optimal benefits for consumers.

So the key question is how widely regulators and anti-trust officials will conclude that reasonable and effective levels of competition can be promoted if a mobile market is lead by three providers, instead of four.

Wednesday, October 30, 2013

4 or 3: the Most Important Number in the Mobile Business

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Intel Media Preparing to End Effort to Create Sreaming Service?

Intel Media has been trying to build a Web-based subscription TV service for several years, and originally had promised to launch late in 2013. But Intel seems not to have gotten traction with the content suppliers it would need to build a service analogous to cable TV.

Intel recently had said it was looking for partners, including Samsung, Amazon, Liberty Media, and Netflix, but a report suggests Intel Media has failed at that effort as well, and is exploring a sale of its assets to Verizon Communications, which already owns part of the Redbox Instant streaming service operated as a joint venture with Redbox.

Qualcomm earlier had launched a mobile video service called MediaFLO, but wound up closing the service and then selling the spectrum to AT&T after abandoning the effort.

MediaFLO did better than Intel, at least in terms of securing content rights. In the U.S. market, for example, MediaFLO offered a set of 14 basic channels:

Intel recently had said it was looking for partners, including Samsung, Amazon, Liberty Media, and Netflix, but a report suggests Intel Media has failed at that effort as well, and is exploring a sale of its assets to Verizon Communications, which already owns part of the Redbox Instant streaming service operated as a joint venture with Redbox.

Qualcomm earlier had launched a mobile video service called MediaFLO, but wound up closing the service and then selling the spectrum to AT&T after abandoning the effort.

MediaFLO did better than Intel, at least in terms of securing content rights. In the U.S. market, for example, MediaFLO offered a set of 14 basic channels:

- 2.FLO (6 am to 10 pm) — Original made-for-mobile reports and concerts

- Adult Swim (10 pm to 6 am)

- ABC Mobile

- CBS Mobile

- CNBC

- Comedy Central

- ESPN Mobile TV

- Fox Mobile

- Fox News Channel

- MTV Mobile

- MSNBC

- NBC 2Go — A mix of MSNBC, NBC, CNBC, and Bravo networks

- Disney Channel

- Nickelodeon

None of these failures is going to stop other entities from trying to create new streaming services. Sooner or later, a bigger crack than Netflix will appear in the dam.

Aereo, the local TV streaming service, launching in Denver on November 4, 2013, already serves nine U.S. markets. Another firm, FilmON, previously "Aerokiller," operates in Western U.S. states, primarily.

And Amazon, Apple and Google already offer video streaming content, if not perhaps on the scale of Netflix. And there is talk that Comcast might itself launch its own branded streaming service as well.

So far, no provider has been able to convince a critical mass of content owners to make their shows available to streaming services on the same basis as presently offered to cable TV, satellite TV and telco TV providers.

And that is to say nothing of new licensing models that might allow customized, individualized or a la carte purchase of single episodes, whole series or single channels.

Sooner or later, it will happen, though most assume it will take some time to reach that point.

It will likely take far greater disruption of the economics of today's subscription video revenues before content owners will be willing to start making changes that enable truly competitive streaming services. We aren't quite there, yet.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Tuesday, October 29, 2013

Google Photos, Hangouts Enhanced

Google Hangouts and Photos have been enhanced. Google Photos already has been automatically backing up photos taken on Android phones and syncing to Google Drive.

Google Hangouts and Photos have been enhanced. Google Photos already has been automatically backing up photos taken on Android phones and syncing to Google Drive. New are full size backups and background sync for Google+ on Apple iOS.

Google Photo now also recognizes and groups objects--over a thousand different objects at the moment--ranging from sunsets to snowmen, grouping them in user libraries.

Auto Enhance improves each photo added to Google , and users can dial the enhancements up or down. If users already processing your images elsewhere, they can choose to exempt an album entirely.

Auto Enhance improves each photo added to Google , and users can dial the enhancements up or down. If users already processing your images elsewhere, they can choose to exempt an album entirely.Google also has added editing apps. For editing on the go, use Snapseed and its new HDR (high dynamic range) Scape filter.

More sophisticated editing can be done using Analog Efex Pro, part of the Nik Collection ($149).

Hangouts for Android now supports location sharing and SMS. Users can send a map of their current location, send and receive text messages.

Broadcasters can now schedule Hangouts On Air, then promote them with a dedicated watch page. Once live, Control Room lets users moderate the conversation with eject and remote mute.

In both cases, the video calling experience is significantly improved, Google says. It's now full screen across mobile and desktop, and it fixes and enhances webcam lighting automatically.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

15 Percent of 3G/4G Tablet Owners Pay for Data Plan

About 30 percent of tablets come equipped with mobile network capability. About 15 percent of tablets presently have a mobile data plan.

That will grow. But between personal hotspots and home wi-fi, many do not need a separate data plan.

http://feedly.com/k/16IbGxR

shared via http://feedly.com

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Time Warner Cable Upgrading to 100 Mbps in Some Markets

Time Warner Cable, which upgraded its top Internet access tier in Kansas City, Mo. to 100 Mbps, is also upgrading customers in Lost Angeles to 100 Mbps.

Residential customers in Los Angeles who subscribe to the Ultimate 50 tier are being automatically upgraded to Ultimate 100 at no extra cost.

Ultimate 50 residential customers in New York City and Hawaii will be upgraded by year’s end.

By early 2014, all customers in these markets will have access to Ultimate 100, with more TWC markets to follow in 2015.

Credit Google Fiber with the new incentives for Time Warner Cable to upgrade speeds.

Residential customers in Los Angeles who subscribe to the Ultimate 50 tier are being automatically upgraded to Ultimate 100 at no extra cost.

Ultimate 50 residential customers in New York City and Hawaii will be upgraded by year’s end.

By early 2014, all customers in these markets will have access to Ultimate 100, with more TWC markets to follow in 2015.

Credit Google Fiber with the new incentives for Time Warner Cable to upgrade speeds.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

If There is a Spectrum Bubble, Does it Martter?

Spectrum is not the only cost input for a mobile service provider, nor is it the largest cost input. As a rule of thumb, operating expense might be in the range of 45 percent of revenue, while all network related capex might be in the range of eight percent of revenue. So spectrum acquisition costs are not a huge driver of overall costs, typically.

What really matters is revenue. Still, the cost of spectrum matters in an environment where service provider costs threaten to exceed revenues earned from such spectrum.

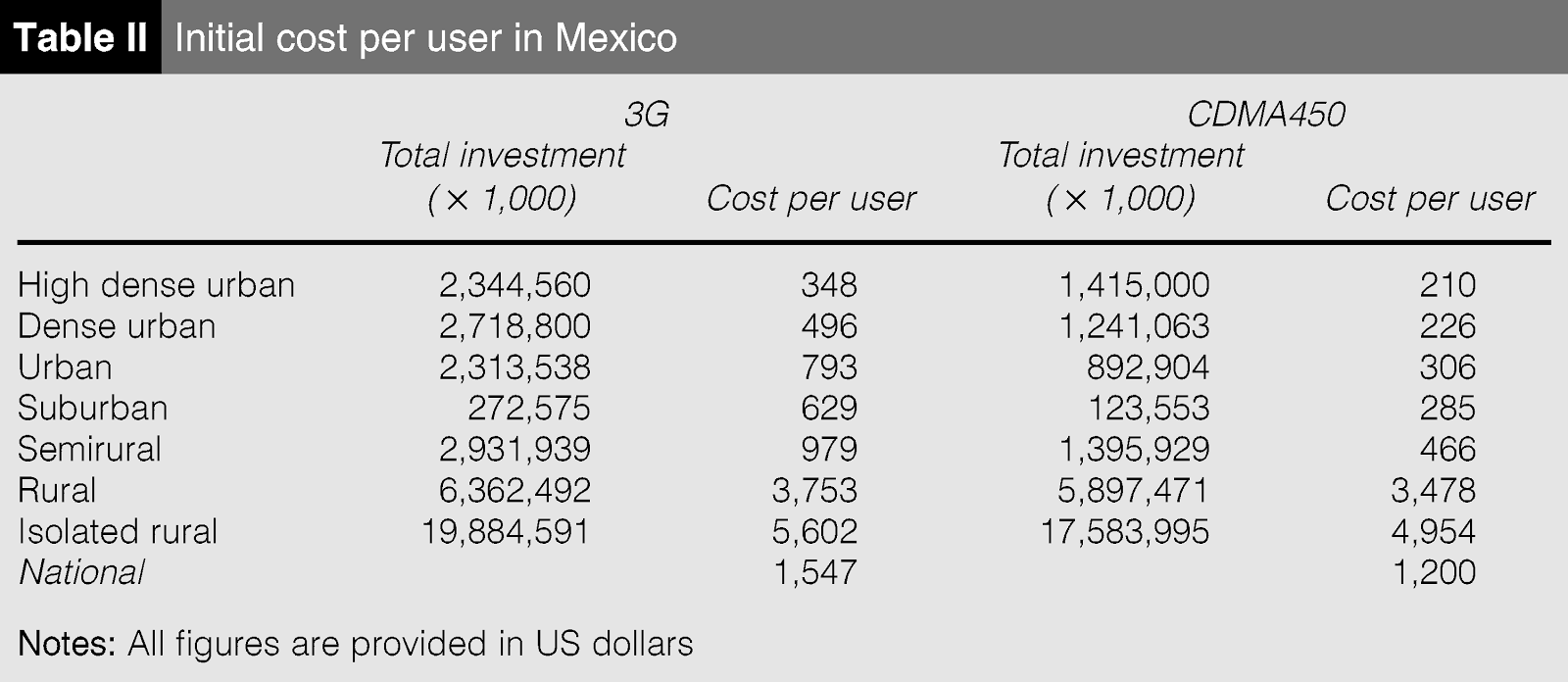

Depending on the country and the population density and terrain, a fully functioning 3G network, for example, might cost between several hundreds of dollars per customer, to a few thousands of dollars per customer.

Spectrum costs are a fraction of that. Assume a service provider has 20 MHz of spectrum in an area of three square miles, paid for whether all of the capacity is being used or not (spectrum reuse is necessary to avoid signal interference).

Assume people reached by signals from that one tower number cover three square miles, where the density is 600 persons per square mile. That implies a population of 5,400 people, each representing 20 MHz per pop. At prices of 10 cents per MHz pop, that works out to $2 per person, or $10,800 in spectrum costs in that area.

At 33 percent market share, implying 1782 paying customers, the cost per customer is about $6 per customer. Even paying interest on such an investment is a small part of the total cost of providing service.

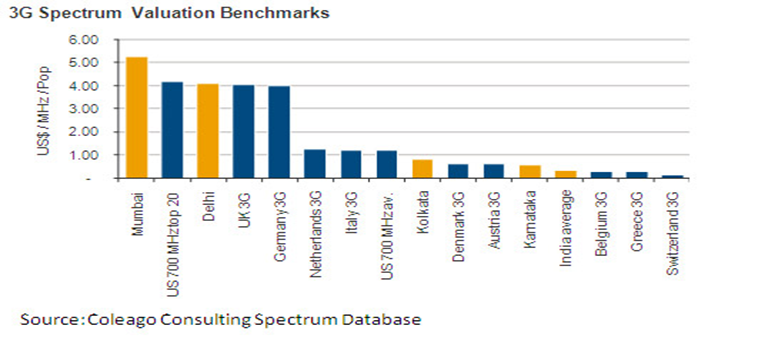

But you can see the sensitivity to price per MHz pop. At $1 a Mhz pop, the spectrum would represent $108,000 in spectrum costs, or $61 per customer. At $4 per MHz pop, spectrum costs would represent $244 per customer.

Amortized over 10 years, with monthly revenue of $50, that still is not unworkable, at reasonable market share. But as with any fixed cost, market share really matters. At 16 percent share, spectrum cost grows to about $488 per customer.

If revenue earned from the leading services sold by mobile service providers is dropping, and if market share is fragmented, the cost impact of spectrum acquisition is magnified.

In that sense, revenue per MHz pop, though not a metric anybody uses, likewise will drop. In the end, that is the key issue: revenue per MHz pop, not cost of spectrum per MHz pop, at a high level.

Whether Long Term Evolution 4G auctions will become a spectrum bubble is anybody’s guess, at the moment. But industry observers with long memories will recall that vast overbidding nearly bankrupted leading European mobile service providers when 3G auctions were held.

There are some signs of price inflation in the Netherlands, Ireland, Taiwan, in Austria and in the Czech Republic, for example. In Taiwan, bid prices were about three times what regulators set as the minimum price. The Czech Republic suspended its auction when prices grew too quickly.

The U.K. 4G spectrum auctions generally are considered reasonable, compared to Czech prices before the auction suspension. The May 2013 U.K. auction raised around EUR0.18/MHz/pop. The Czech auction had reached EUR0.25/MHz/pop, about 30 percent higher than the actual U.K. prices.

MHz per pop is a way of measuring capacity per person, and cost per megahertz per pop is a way of measuring spectrum cost, per unit of capacity, per person.

Even that pales in comparison to 3G auction prices in some markets, where past prices have been measured in tenths of cents or cents. In some cases, Western European 3G prices were measured in dollars.

Of course, the “right price” for spectrum hinges on any number of business and market factors. The value of Clearwire spectrum provides a recent example.

Some recent 700-MHz spectrum in the U.S. market has sold for dollars per MHz pop, a “high” price by world standards. But that spectrum also has coverage and wall-penetrating advantages bidders believed justified the price.

Whether spectrum was acquired at prices “too high” can be determined only after the capacity is put into service and revenue generated by that spectrum can be assessed. Prices of dollars per MHz pop might be quite reasonable if the new spectrum allows a service provider to gain customers, raise profit margins or gross revenue, cut churn or create uniqueness.

In other words, 3G prices were an order of magnitude to two orders of magnitude above spectrum prices paid before, or after. To be sure, the value of spectrum generally is affected by the actual frequencies: lower frequencies are more valuable than higher frequencies.

That is a function of signal propagation, not bandwidth potential. Signals at lower frequencies attenuate less, and hence travel further, with better ability to penetrate walls. On the other hand, signals at higher frequencies are capable of providing much more bandwidth, using any specific coding technique.

Still, prices for 3G spectrum awarded in more recent auctions also was measured in the dollars per MHz pop. The 3G auctions in India provide a recent example.

Also, some spectrum, licensed for backhaul applications rather than end user services, generally costs less than spectrum enabling actual end user services.

For example, 3.5 GHz spectrum intended to support fixed wireless access applications, rather than mobile applications, often was sold at prices an order of magnitude less than spectrum for mobile apps.

3.5 GHz Spectrum Band Pricing Examples

Country

|

Band

|

Price of 10 MHz

|

Per MHz-PoP

|

Italy

|

3.5 GHz

|

€ 10,793,651

|

€ 0.0189

|

Germany

|

3.5 GHz

|

€ 4,325,397

|

€ 0.0053

|

UK

|

3.5 GHz

|

£1,750,000

|

£ 0.0030

|

UK

|

3.8 GHz

|

£744,048

|

£ 0.0012

|

Netherlands

|

3.5 GHz

|

€ 500,000

|

€ 0.0030

|

Switzerland

|

3.5 GHz

|

CHF 1,416,667

|

CHF 0.0178

|

Canada

|

3.5 GHz

|

$2,877,402

|

$ 0.0049

|

On the other hand, 2.5 GHz spectrum made recently available in many European countries (and Canada in 2004 and 2005) cost more than 3.5 GHz spectrum, but they are much lower than prices fetched in the 800 MHz spectrum band (which range between € 0.5 – € 0.8 per MHz-PoP in most countries).

2.5 GHz Spectrum Band Pricing Examples

Country

|

Band

|

Price of 10 MHz

|

Per MHz-PoP

|

Sweden

|

2.5 GHz FDD

|

€ 14,867,475

|

€ 0.159

|

France

|

2.5 GHz FDD

|

€ 66,866,394

|

€ 0.106

|

Italy

|

2.5 GHz FDD

|

€ 35,996,667

|

€ 0.059

|

Belgium

|

2.5 GHz FDD

|

€ 5,025,455

|

€ 0.046

|

Belgium

|

2.5 GHz TDD

|

€ 5,002,222

|

€ 0.045

|

Italy

|

2.5 GHz TDD

|

€ 24,678,367

|

€ 0.041

|

Sweden

|

2.5 GHz TDD

|

€ 3,416,868

|

€ 0.037

|

Spain

|

2.5 GHz FDD

|

€ 12,334,753

|

€ 0.027

|

Germany

|

2.5 GHz FDD

|

€ 18,412,643

|

€ 0.023

|

Germany

|

2.5 GHz TDD

|

€ 17,303,600

|

€ 0.021

|

Netherlands

|

2.5 GHz FDD

|

€ 2,627,000

|

€ 0.0012

|

Canada WCS

|

2.3 GHz WCS

|

$ 6,136,598

|

$ 0.018

|

Looking at spectrum pricing in the higher spectrum bands, 2.5 GHz assets typically sell at a discount of up to 92 percent that of 800 MHz spectrum, while 3.5 GHz spectrum sells at around 82 percent discount to that of 2.5 GHz.

3.x GHz Spectrum Band Pricing Examples

Country

|

Band

|

Price of 10 MHz

|

Per MHz-PoP

|

Italy

|

3.5 GHz

|

€ 10,793,651

|

€ 0.0189

|

Germany

|

3.5 GHz

|

€ 4,325,397

|

€ 0.0053

|

UK

|

3.5 GHz

|

£1,750,000

|

£ 0.0030

|

UK

|

3.8 GHz

|

£744,048

|

£ 0.0012

|

Netherlands

|

3.5 GHz

|

€ 500,000

|

€ 0.0030

|

Switzerland

|

3.5 GHz

|

CHF 1,416,667

|

CHF 0.0178

|

Canada

|

3.5 GHz

|

$2,877,402

|

$ 0.0049

|

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Subscribe to:

Comments (Atom)

On the Use and Misuse of Principles, Theorems and Concepts

When financial commentators compile lists of "potential black swans," they misunderstand the concept. As explained by Taleb Nasim ...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...