Charter Communications Inc is weighing a bid for Time Warner Cable that could occur before the end of 2013, Reuters reports. That move would have been entirely improbable a decade ago, when Time Warner Cable still was considered among the best-managed cable TV companies and Charter was debt-burdened and unprofitable.

Beyond the immediate performance issues, some believe structural changes lie ahead for the cable TV business, which might well be eclipsed or transformed by streaming delivery.

“Ultimately over the long term I think that the whole video product is eventually going to go to the Internet,” Cablevision Systems Corp. CEO James Dolan has said.

That doesn't mean cable TV companies will get out of the access business. Quite to the contrary, the revenue driver will shift to providing Internet access.

But the economics of the subscription video business could well change. And though the conventional wisdom among consumers is that prices will drop, that might not happen. In principle, the costs of building and operating an access network are included in current costs of video service.

But many other costs, including sales, marketing and fulfillment, would remain, if it altered form. If the costs of the network are mostly shifted to the voice and data services, cable operators would, in principle, have some room to alter pricing. But content acquisition costs would still be an issue.

It is not clear that content suppliers would willingly cut prices for their product, simply because the delivery method changed. Some might argue that content owners would prefer to deliver content direct to end users, but others would argue the content companies simply are not well set up to do so, as their current revenue models are "business to business," not "business to consumer."

That still suggests a vital role for distributors. Perhaps the bigger issues are whether current bundling methods would change, or at least be made available. Some might argue that the bigger innovation is not over the top delivery, but unbundled delivery (ability to buy a single TV episode or a TV series or a single channel on a subscription basis).

Monday, November 4, 2013

Time Warner Cable in Play?

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Android Surges to 81%b Global Market Share, and That is Not the Big Story

But some would say that is not the big story.

Rather, some would say, the important news is that Windows Phone has been shipped on more than 10 million smart phones globally in a single quarter.

That is the first time that has ever happened, and represents Microsoft Windows Phone doubling its market share to become the world's fastest growing smart phone operating system.

Microsoft has doubled its global smart phone market share from two percent to four percent in the past year.

Microsoft grew its smart phone shipments by 178 percent annually in the third quarter of 2013.

Global smart phone shipments reached 251 million units in the third quarter of 2013, Strategy Analystics says.

Global smart phone shipments grew 45 percent annually from 172.8 million units in the third quarter of 2012 to 251.4 million in the third quarter of 2013.

Android’s gain came mainly at the expense of BlackBerry, which saw its global smart phone share dip from four percent to one percent in the past year.

Microsoft’s growth is almost entirely due to Nokia and its steadily improving Lumia portfolio across Europe, Asia and the United States.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

OECD Mobile Broadband Users Paying 4% Less for Speeds Up 123%

Mobile Internet access users in the Organization for Economic Cooperation and Development areas are paying less for access to faster connections, the most recent mobile broadband price benchmarking results from Strategy Analytics shows.

Also, some 29 percent of all offerings include WiFi or public hotspot access.

The average monthly cost for a tablet user needing 2 GB per month has fallen four percent since the same period last year, to USD PPP 17.79, while average advertised speed for the same basket has risen by 123 percent, to 26 Mbps.

For a laptop user requiring 5 GB per month, the cost has fallen by nine percent, and currently averages USD PPP 25.24, while the speed has risen by 35 percent over the year, and now stands at just under 24 Mbps.

The data was generated by a survey of 3,549 SIM-only, modem, laptop and tablet plans from 107 mobile network operators in 34 OECD countries.

SIM-only plans account for around 25 percent of all plans covered as part of the survey, suggesting those accounts are used by consumers in addition to their primary service.

Some 51 percent of all plans have an advertised maximum download speed of 20 Mbps and above. About 31 percent of all plans are 4G Long Term Evolution tariffs, an increase of about three percent since June 2013.

Also, some 29 percent of all offerings include WiFi or public hotspot access.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

AT&T to Deploy 40,000 Small Cells as Part of Move to "Heterogeneous Network"

As part of Project VIP, AT&T’s network upgrade program, AT&T also plans to deploy more than 40,000 small cells by the end of 2015, creating a denser mobile network better able to handle data traffic demand in dense or urban areas.

Project Velocity IP (or Project VIP) is a three year, $14 billion investment plan to enhance AT&T’s mobile and fixed network IP broadband networks.

Between 2007 and 2012, mobile data traffic on AT&T’s network has increased more than 30,000 percent, AT&T says.

AT&T furthermore is working on the next generation of small cell technology, such as multi-standard “metrocells” that will support 3G, 4G LTE and Wi-Fi air interfaces.

Most observers would agree that end user demand for mobile network capacity is going to grow exponentially over the next decade, while even Long Term Evolution provides only incremental bandwidth gains.

Many would suggest several simultaneous solutions must be embraced, ranging from new spectrum to better coding, more efficient air interfaces, new spectrum, shared spectrum, small cell and virtualized architectures and use of unlicensed spectrum and Wi-Fi. In all likelihood, all will play a part in creating new networks.

Mobile analyst Monica Paolini, Senza Fili Consulting principal, argues for an “all of the above” definition of “heterogeneous networks.” Paolini says all air interfaces (GSM, CDMA, UMTS, HSPA, HSPA+, 4G: LTE, LTE-Advanced and Wi-Fi will be parts of the heterogeneous network, though not all will be used by every network.

Radio architectures will include macrocells as well as small cells (pico, femto, Wi-Fi or personal area), as well as distributed antenna systems.

Heterogeneous networks will span Indoor and outdoor locations; public, enterprise and residential locations.

All of that explains why many observers now say a future “fifth generation network” will not be distinguished from 4G strictly by air interface, bandwidth or frequency, but by the integration of many different architectures, protocols, networks, air interfaces and network ownership patterns.

In essence, network access for end user devices will be assembled dynamically, which explains the interest in “self organizing networks” able to provide access to any available network, in real time, often using the best available network.

Paolini says most of the adaptation will be an overlay of sorts, with mobile service providers incorporating new small cells, carrier Wi-Fi or other techniques first in dense urban areas where data demand is greatest.

By definition, frequency planning and interference control issues will grow as smaller cells are activated. Also, by definition, call control, data access and handoff chores will become more complex as users move into and out of small cell coverage areas and across access networks.

“Different radio technologies manage interference differently, and so the same small-cell

location may work for an LTE-Advanced small cell with sophisticated interference

mitigation techniques and not for a 3G small cell,” says Paolini.

In fact, the limited ability to manage interference in 3G environments is often cited as a cause for mobile operators’ hesitance to deploy 3G small cells.

Also, for the first time, frequency planning and interference avoidance will have to account for cells that are separately vertically, not just horizontally. So floor location within a single building now matters.

Use of Wi-Fi networks owned by third parties is the best example of how mobile networks are becoming heterogeneous. But small cells represent a next step, as well. Radio sites supporting multiple air interfaces are another example.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

BlackBerry Cancels Sale Process, Will Remain Independent

In an unexpected development, BlackBerry, which had been seeking buyers, has abandoned its plan to sell itself. Until Nov. 4, 2013, talks had been proceeding with a Canadian investor group lead by Fairfax Financial Holdings.

Apparently, Fairfax Financial Holdings was unable to raise the money it needed to make the bid, and BlackBerry now will try to raise funds by selling bonds. But it appears Fairfax will be among the entities buying some of the new bonds.

At closing, John S. Chen will be appointed executive chairman of BlackBerry's Board of Directors. Prem Watsa, chairman and CEO of Fairfax, will be appointed lead director and chair of the compensation, nomination and governance committee. Current CEO Thorsten Heins and board member David Kerr will resign from the board.

Fairfax Financial Holdings Limited will acquire U.S. $250 million worth of the convertible bonds. The transaction is expected to be completed within the next two weeks.

The bonds are convertible into common shares of BlackBerry at a price of U.S. $10.00 per common share.

At closing, John S. Chen will be appointed executive chairman of BlackBerry's Board of Directors. Prem Watsa, chairman and CEO of Fairfax, will be appointed lead director and chair of the compensation, nomination and governance committee. Current CEO Thorsten Heins and board member David Kerr will resign from the board.

Those moves suggest either that the board became sharply divided about BlackBerry strategy, and not simply that the Fairfax Financial Holdings bid was deemed insufficient. In that case, the board would likely have solicited additional bids.

Others might suggest that the inability to raise funds for the $4.7 billion bid simply suggests there is not support among investors for that type of a deal.

Yet others might argue that the bond deal is a stopgap measure, and that a future sale, though not for the $4.7 billion purchase price, still is envisioned.

Other potential buyers were said to include Cerberus Capital Management, Qualcomm, Lenovo and BlackBerry co-founders Mike Lazaridis and Doug Fregin.

The move is a blow to BlackBerry bankers J.P. Morgan Chase & Co. and Perella Weinberg Partners, which were retained to manage the sale process. The bankers reportedly had spoken to Facebook, and had sought indications of interest from other firms including Microsoft, LinkedIn and Oracle.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Sunday, November 3, 2013

0.07 Percent of Startups Reach $1 Billion Valuations?

To be sure, the survey only studied software-based startups started since 2003.

Takeaway: it’s really hard, and highly unlikely, to build or invest in a billion dollar company.

The odds of creating a $1 billion valuation company is "somewhere between catching a foul ball at an MLB game and being struck by lightning in one’s lifetime."

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

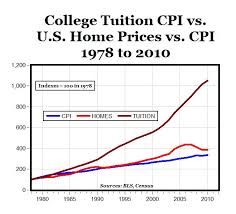

Tech Sector Is In A Bubble

"We're in a new tech bubble, heading for a crash, just like the dot com bust of 1999," some now argue. After two bubble burses in the first decade of the 21st century (Internet in 2000, housing in 2008), we might be headed for the first bubble burst of the second decade of the 21st century.

So the question is "what will it mean for the telecom industry?" At the very least, a significant deflation of equity values, which will mean less ability for firms to make acquisitions, raise capital for network investment and otherwise invest in their operations, right at the point that Long Term Evolution network builds are underway.

That could delay network modernization for a few years, and slow down consumer demand as well.

The best case scenario is that the tech bubble remains just that: a tech bubble that does not disrupt other market segments too adversely.

The best case scenario is that the tech bubble remains just that: a tech bubble that does not disrupt other market segments too adversely.

The worse case scenario is that other sectors facing bubble conditions burst synchronously. U.S.farmland is among the sectors ripe for a major crash, for example.

Some speculate that a massive default wave on student loans could set up the next financial bubble.

To be sure, most would argue that telecom is relatively immune from bubbles. But telecom is not fully immune.

The problem with bubbles is that one never knows one is in a bubble until it is over.

So the question is "what will it mean for the telecom industry?" At the very least, a significant deflation of equity values, which will mean less ability for firms to make acquisitions, raise capital for network investment and otherwise invest in their operations, right at the point that Long Term Evolution network builds are underway.

That could delay network modernization for a few years, and slow down consumer demand as well.

The worse case scenario is that other sectors facing bubble conditions burst synchronously. U.S.farmland is among the sectors ripe for a major crash, for example.

Some speculate that a massive default wave on student loans could set up the next financial bubble.

To be sure, most would argue that telecom is relatively immune from bubbles. But telecom is not fully immune.

The problem with bubbles is that one never knows one is in a bubble until it is over.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Gary Kim was cited as a global "Power Mobile Influencer" by Forbes, ranked second in the world for coverage of the mobile business, and as a "top 10" telecom analyst. He is a member of Mensa, the international organization for people with IQs in the top two percent.

Subscribe to:

Comments (Atom)

On the Use and Misuse of Principles, Theorems and Concepts

When financial commentators compile lists of "potential black swans," they misunderstand the concept. As explained by Taleb Nasim ...

-

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which s...

-

It really is surprising how often a Pareto distribution--the “80/20 rule--appears in business life, or in life, generally. Basically, the...

-

One recurring issue with forecasts of multi-access edge computing is that it is easier to make predictions about cost than revenue and infra...