Will linear TV eventually move to non-linear formats? Many believe it will. Significantly, for mobile service providers, one might also argue that the shift to non-linear television formats is especially suited for mobile delivery.

If consumer demand shifts to non-linear modes, then existing consumer behavior suggests mobile delivery will be key.

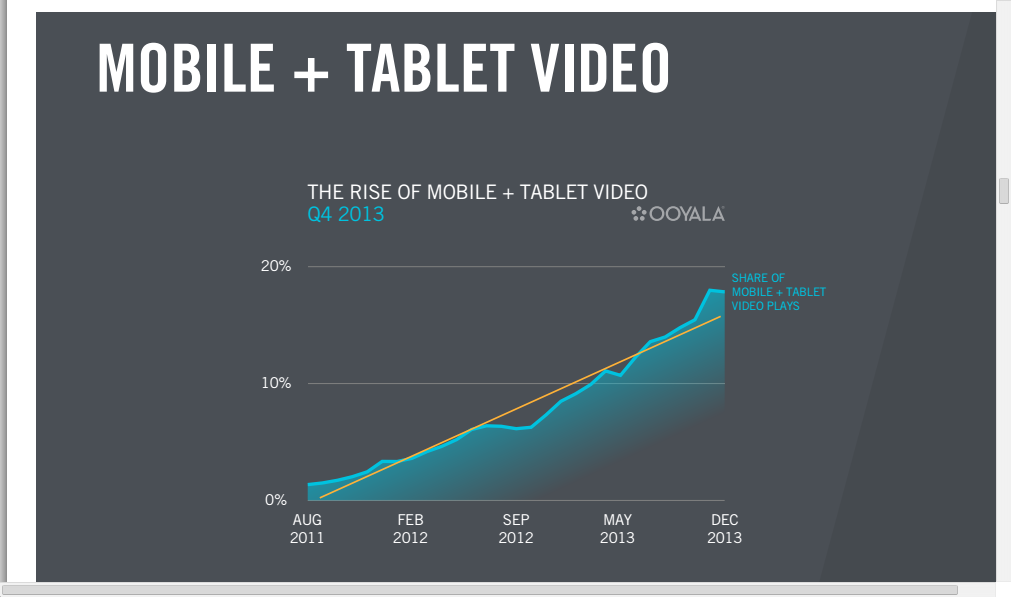

Mobile video consumption is growing so fast, it could make up half of all online video consumption by 2016, according to Ooyala.

Year over year, share of time spent watching videos on tablets and mobile devices has increased 719 percent since the fourth quarter of 2011, and 160 percent year-over-year since the fourth quarter of 2012.

Separately, Ofcom, the United Kingdom regulator, has found that 69 percent of tablet owners watch video on their devices. Some 32 percent of tablet owners reported watching U.K. or international news, 27 percent sports news and 19 percent local news.

About 29 percent reported watching TV shows, Ofcom reports.

On smartphones, 28 percent watching U.K. and international news, 25 percent watch sports news and 21 percent watch regional or local news.

That should provide AT&T, Verizon and other mobile service providers with reason to believe they eventually will be able to grow new revenue streams directly related to mobile video entertainment, but also be in position to protect themselves against potential losses in the linear video entertainment business.

The point is that those behaviors suggest existing demand for tablet and mobile phone live TV.

Where once mobile viewing was mostly of short-form video, now long-form content viewing also is growing. About 53 percent of global user mobile viewing time was of video longer than 30 minutes length.

Tablet users spent 35 percent of their mobile viewing time watching video longer than 30 minutes, says Ooyala.

Mobile viewers spent 31 percent of their viewing time engaged with content longer than an hour in length. Tablet viewers spend 19 percent of untethered viewing time watching content at least an hour in length.

Significantly, for would-be suppliers of mobile live TV programming, mobile viewers watched an average of more than 42 minutes of live video per play streamed over the top on connected TVs, and nearly 35 minutes per play on PCs.

That is significant as it shows existing demand for live TV, not just pre-recorded material such as movies or short videos.

Based on average time per play, live streaming video consumption is nearly two times greater than video on demand on tablets. That is another way of noting demand for live TV, as opposed to pre-recorded video.

“Viewers are especially engaged with live sports on mobile, watching three times more live

sports video than video on demand,” Ooyala says.

Arecent Ooyala survey of online video publishers and broadcasters found 99 percent rating the ability to deliver video to mobile and tablet devices as “critical” or “important.”