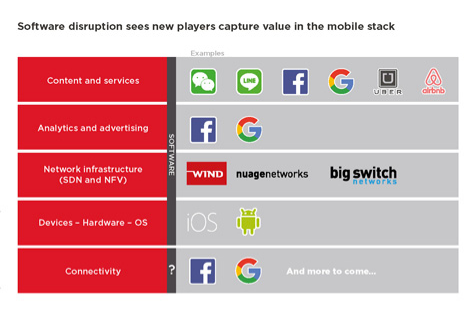

It is fairly easy to illustrate the shift in value generation within the internet ecosystem. The phrase “dumb pipe” nicely encapsulates the broad problem, which is that, in the internet era, network access--while essential--is not where most of the value and revenue is being created.

In technology terms, that is by design. The whole point of internet protocol, in the early days, was to protect information and content transmitted across networks from the impact of network disruptions.

The whole point of internet protocol as “the” next-generation network platform of choice is that it offers a low-cost way to deliver information, content and services of any type over a single integrated network.

But internet protocol also logically separates ownership of networks from control of applications that use the networks. That is why voice over IP, over the top messaging and video services have been disruptive. IP allows third parties to create apps and services that provide the value of carrier apps. And, in many cases, those third parties have business models not built on earning direct revenue from providing those features.

In the past monopoly era, telcos created and owned content, services devices, infrastructure and actual service revenue. These days, all that is disaggregated.

And even connectivity no longer is a “monopoly” of network service providers.

In other words, it is hard to sell a product or feature many other suppliers will happlily give away for free. That raises the “dumb pipe” notion, referring to the process whereby traditional network service providers become suppliers of relatively low-value internet access, but not necessarily the applications, products and services that all other entities create and deliver over those access networks.

That is why equity valuations of big internet app companies are growing so much faster than the valuations of “telcos.”

Longer term, revenue growth is highest for suppliers of apps, content and services delivered over public IP networks (we used to call them “telcos”). Granted, service provider revenue still is growing in Asia, Africa, and parts of Latin America, as more humans buy mobile services and use data access.

But the long-term trend is that once nearly every human uses mobile devices and internet access, revenue opportunities will slow.

So unless you really believe your retail telecom services business can thrive on the strength of internet access revenues, supplemented by some amount of voice or messaging revenue, a move elsewhere within the internet ecosystem is required.

Incremental revenue growth (and profit margins) will migrate up the stack over the next decade, and probably forever.

The caveat is that not every segment of the telecom industry sells to end users (enterprise, smaller business or consumers), and not every segment relies so much on access or transport services. But the classic "telco" serving retail customers really has to worry about surviving on the strength of access revenues increasingly tied to internet access.

The caveat is that not every segment of the telecom industry sells to end users (enterprise, smaller business or consumers), and not every segment relies so much on access or transport services. But the classic "telco" serving retail customers really has to worry about surviving on the strength of access revenues increasingly tied to internet access.

That value “problem” explains why many tier-one service providers are looking for ways to create new value by moving “up the stack” and becoming application providers (again), not as partners but as equity owners.