Ecosystem is one of those buzzwords used without explanation, all the time. Some appear to use the term “ecosystem” to describe the range of partners a firm may have.

Others appear to use the word to describe third-party applications that interwork with, or are available to use, on a device or a network.

Finally, the classic, pre-digital and pre-internet “ecosystem” was a vertically-integrated end-to-end solution.

The term might be confused with platform. The issue there is that there are several different ways the term is used. In the computing business, a platform is a set of hardware or software upon which other third-party apps can run. So Windows has always been seen as a platform, as have the Intel line of processors.

In that sense, the internet is a platform for both communications and applications. But there is a new sense of the term that refers strictly to business model, not computing or communications infrastructure.

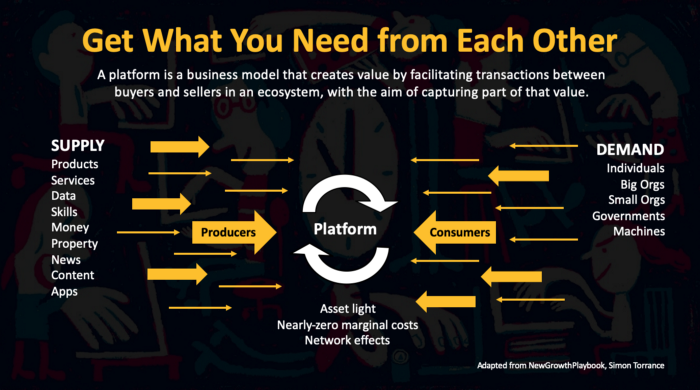

In the internet era a new meaning has emerged. A platform is a business model based on an entity that acts as an exchange, connecting buyers and sellers.

source: Simon Torrence

A platform business model essentially involves becoming an exchange or marketplace. A pipe model requires a firm to be a direct supplier of some essential input in the value chain.

A platform functions as a matchmaker, bringing buyers and sellers together, but classically not owning the products sold on the exchange. A pipe business creates and then sells a product directly to customers. Amazon is a platform; telcos and infrastructure suppliers are pipes.

Amazon is a platform. Etsy is a platform. Uber and Lyft are platforms. Airbnb is a platform. All connect buyers with sellers; sellers with sellers or buyers with buyers. None of those platforms “owns” the assets traded on the exchange.

It all boils down to “who makes the money” and “how” the money is made. Even when understood as a business-to-business marketplace, a bandwidth exchange, for example, a key principle is that buyer and seller transactions volume is how the platform makes money.

A true platform in the digital commerce sense does not own the actual products purchased using the platform, and makes money by a commission or fee for using the platform to complete a transaction. A ridesharing platform does not own the vehicles used by drivers. A short-term lodging platform does not own the rooms and properties available for rental. An e-commerce site does not own the products bought and sold using the platform.

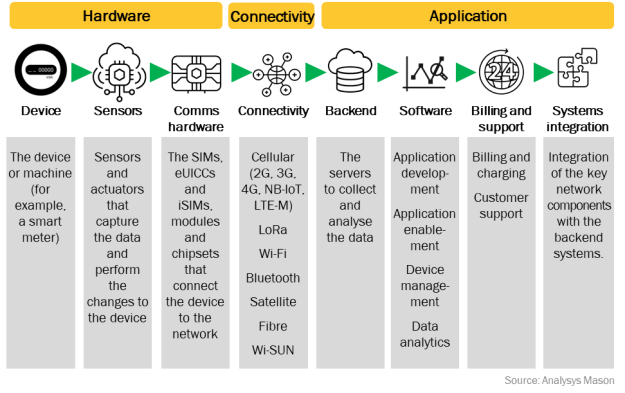

“Ecosystem” sometimes also seems to be used in the sense of value chain, a business model that describes the full range of activities needed to create a product or service.

source: Analysys Mason

Also, firms have for decades been moving towards products that combine physical goods with software; content with appliances; implements and experiences. Among the classic examples in the mobile device business is Apple bundling devices with content; device with app store; device with payment mechanisms; sales with support.

Almost by definition, ecosystems are loosely coupled. There might not be a direct business relationship between any two firms in an ecosystem. Ecosystem participants might come from distinct industries, geographies or roles. So digital ecosystems are quite complicated.

“A digital ecosystem is a complex network of stakeholders that connect online and interact digitally in ways that create value for all,” says Tata Consulting Services.

It is hard to organize an ecosystem. It is difficult to create a platform business model. It can be tough to develop a value chain. For most businesses, creating a simple role within a value chain is task enough.

Acting as a retailer of products to end user customers, for example, can be complex enough. Creating ecosystems or platforms is quite something else.