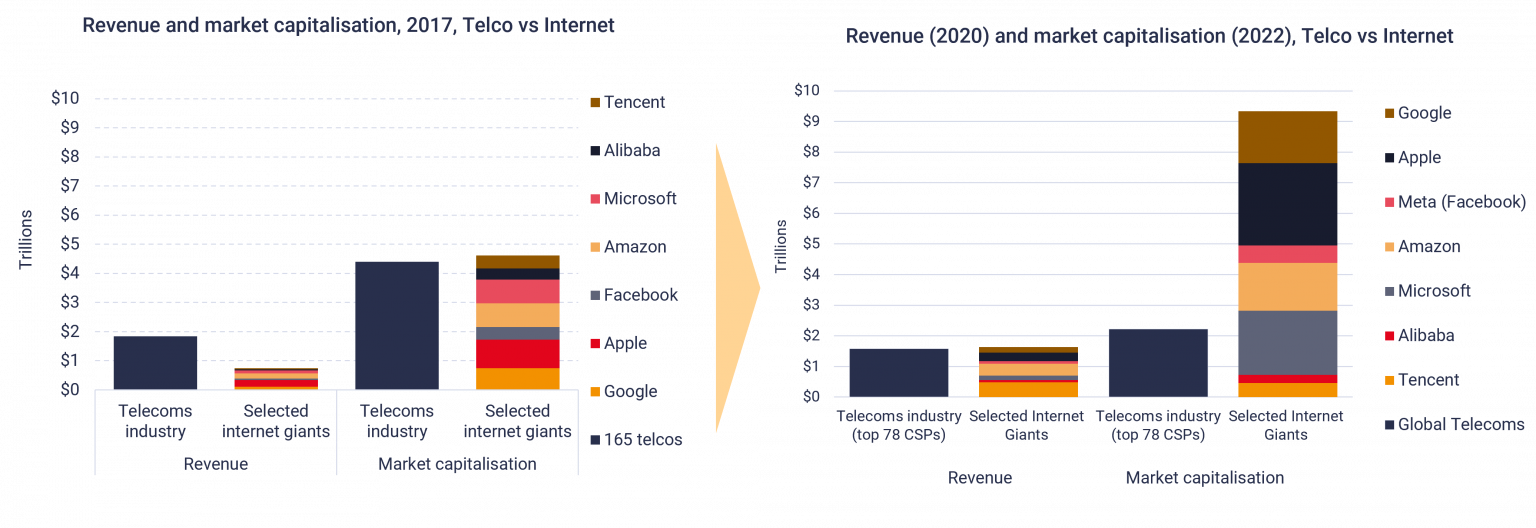

We have all repeatedly seen comparisons of equity value of hyperscale app providers compared to the value of connectivity providers, which show the valuation differential between them.

The comparison often is used to show a huge gap between the equity performance of telcos compared to hyperscale app providers, usually within the context of an argument that connectivity providers create value for others that should be shared with the access providers.

source: Statista

That is arguably not valid. Different industries often have different valuations. And those expectations are based on revenue growth. Hyperscalers grow fast, telcos do not. That is why the valuation differential exists.

Without internet access, hyperscalers would not exist. But that also is true of electricity, computer chips, computing devices and software.

source: Seeking Alpha

And hyperscale app providers most certainly are valued more highly than most other firms in most other industries.

Consider the industry price-to-earnings ratio. Software might have a trailing P/E ratio of 111, meaning the stock price is 111 times earnings. An energy company might be valued at nine to 10 times. The disparity also exists for the expected earnings (forward P/E).

source: Broker Chooser

The point is that some industries are valued more highly than others by investors, even when many of those industries use products supplied by other industries. Health care relies on telecommunications, real estate, energy and information technology, but all those industries are valued at higher average P/E ratios than “telecommunications.”

source

Telco executives argue that hyperscaler value is “based on” the use of access networks. But most products use railroads, water, electricity, airports and airplanes, trucks, wastewater systems, natural gas and other “utilities” including internet access.

Equity valuation has nothing to do with “who uses what and when” but only expected earnings growth.

source: STL Partners

Hypescaler revenue is expected to grow much faster than access provider revenue. But the internet economy includes some parts of most industries, all all use internet access to some extent.

The analogy might be to all industries and their use of electricity. Yes, electricity has high value. Yes, almost everybody and every organization uses electricity. But it is nonsensical to argue that therefore electrical energy providers “create economic value” that should be shared with the energy producers.