At the moment, 5G fixed wireless is the clear contributor to new revenue sources earned by 5G networks. No other use case has produced the volume of new revenue.

Revenues from 5G fixed wireless, in the near term, will dwarf internet of things, private networks, network slicing and edge computing, for example. 5G fixed wireless might, in some markets, represent as much as eight percent of home broadband revenues, for example. None of the other sources is likely to hit as much as one percent of total revenues in the near term.

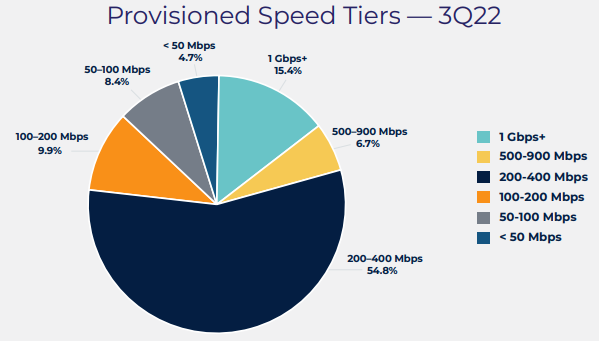

The center of gravity of demand for 5G fixed wireless is households In the U.S. market who will not buy speeds above 300 Mbps, or pay much more than $50 a month, at least in the early going. T-Mobile targets speeds up to 200 Mbps.

Verizon fixed wireless service plans also suggest that existing Verizon mobile customers are key targets. In the meantime, there is 4G fixed wireless, which will have to be aimed at a lower-speed portion of the market, albeit at about the same price points as 5G fixed wireless.

Up to this point, Verizon 4G fixed wireless, available in some rural areas, offers speeds between 25 Mbps and 50 Mbps. That might appeal to consumers unable to buy a comparable fixed network service.

By some estimates, U.S. home broadband generates $60 billion to more than $130 billion in annual revenues.

If 5G fixed wireless accounts and revenue grow as fast as some envision, $14 billion to $24 billion in fixed wireless home broadband revenue would be created in 2025.

5G Fixed Wireless Forecast |

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

Revenue $ M @99% growth rate | 389 | 774 | 1540 | 3066 | 6100 | 12,140 | 24,158 |

Revenue $ M @ 16% growth rate | 1.16 | 451 | 898 | 1787 | 3556 | 7077 | 14,082 |

source: IP Carrier estimate |

If the market is valued at $60 billion in 2021 and grows at four percent annually, then home broadband revenue could reach $73 billion by 2026.

|

| 2022 | 2023 | 2024 | 2025 | 2026 |

Home Broadband Revenue $B | 60 | 62 | 65 | 67 | 70 | 73 |

Growth Rate 4% |

|

|

|

|

|

|

Higher Revenue $B | 110 | 114 | 119 | 124 | 129 | 134 |

source: IP Carrier estimate |

If we use the higher revenue base and the lower growth rate, then 5G fixed wireless might represent about 10 percent of the installed base, which will seem more reasonable to many observers.

Assuming $50 per month in revenue, with no price increases at all by 2026, 5G fixed wireless still would amount to about $10.6 billion in annual revenue by 2026 or so. That would have 5G fixed wireless representing about 14 percent of home broadband revenue, assuming a total 2026 market of $73 billion.

If the home broadband market were $134 billion in 2026, then 5G fixed wireless would represent about eight percent of home broadband revenue.

Fixed wireless might be even more important elsewhere in global markets.

Critics are correct that 5G fixed wireless--at least in the medium term--has capacity limitations compared either to fiber-to-home or advanced hybrid fiber networks. But it also is true that the home broadband market has a value segment for whom fixed wireless seems to be in demand.

According to the latest data from Leichtman Research Group, during the third quarter of 2022, some 825,000 net new home broadband accounts were added in the U.S. market. But the two major fixed wireless service providers--T-Mobile and Verizon--added 920,000 net accounts during the quarter.

Fixed Wireless Services, Third Quarter 2022 |

Fixed Wireless Supplier | Total Accounts | Net Additions |

T-Mobile | 2,122,000 | 578,000 |

Verizon | 1,063,000 | 342,000 |

source: Leichtman Research Group

Total cable industry net adds were about 39,000, while telcos collectively lost about 136,000 fixed network accounts.

During the third quarter, about 22 percent of U.S. customers bought service at speeds of 200 Mbps or below. In other words, perhaps a fifth of the home broadband market is willing to buy service at speeds supported by fixed wireless.

source: Openvault

Predictably, supporters and detractors offer the expected defense of advantages and weaknesses. Cable operators note the bandwidth limitations. Verizon and T-Mobile point to the ease of installing and price advantages. In some cases fixed wireless might actually be faster than the other alternatives available from other local home broadband providers.

Critics do correctly note that fixed wireless home broadband is carefully marketed in areas where new 5G networks have spare capacity. That capacity will disappear as 5G adoption increases, the critics say.

But Verizon and T-Mobile might argue they have ways to boost capacity over time, as 5G networks are used more heavily and as bandwidth demand keeps increasing. Higher-capacity millimeter wave spectrum is the obvious early answer.

Longer term, Verizon and T-Mobile are likely to explore ways to add fiber to home coverage as well. For Verizon, that means finding new says to secure FTTH capacity outside its historic fixed network footprint. For T-Mobile, that means getting into FTTH for the first time.

Up to this point, T-Mobile has been focused on areas where there is less competition, such as rural markets.

Verizon’s geography is the roughly 80 percent of U.S. homes outside Verizon’s fixed network service territory, as well as its own mobile customer base, who are encouraged to bundle fixed wireless with existing mobile service.

The point is that the near-term market is substantial for both T-Mobile and Verizon in “out of region” geographies. For T-Mobile that is 100 percent of U.S. homes. For Verizon that is about 80 percent of U.S. homes.